(“Amaroq” or the “Corporation” or the “Company”)

Q1 2024 Financial Results

TORONTO, ONTARIO – 14 May 2024 - Amaroq Minerals

Ltd. (AIM, TSXV, NASDAQ Iceland: AMRQ), an independent mine

development company with a substantial land package of gold and

strategic mineral assets in Southern Greenland, presents its Q1

2024 financials. A conference call for analysts and investors will

be held today at 16:00 BST (15:00 GMT, 11:00 EST), details of which

can be found further down in this announcement. All dollar amounts

are expressed in Canadian dollars unless otherwise noted.

Eldur Olafsson, CEO of Amaroq,

commented:

“During the quarter we successfully completed a

fundraise to accelerate mining at Nalunaq, whilst continuing to

invest in our wider gold and strategic minerals portfolio in South

Greenland. I would like to thank all participating shareholders for

their strong support shown in this financing.

"I have been on site at Nalunaq now for some

weeks, participating across all workstreams, and am highly

encouraged by how operations are progressing. It has been excellent

to be working alongside around 80 people from the Amaroq mining,

engineering and site teams, in addition to our contractors Thyssen

Schachtbau, Halyard, HK Transport, Scott Steel and Arctic

Unlimited. With our new General Manager Jaco Duvenhage hired to

oversee all operations at Nalunaq, we are seeing good progress on

all fronts, and I would like to thank the team for their hard work.

The experience gained this winter, in our first year of year-round

operations, has been invaluable to improving our understanding and

planning for developing future projects in South Greenland.

Construction works over this period were completed despite pack ice

conditions, thanks to the foresight of the team who ensured that

all the required equipment was mobilised to site ahead of time. In

addition, at the end of March, the successful first underground

mining blast at Nalunaq was initiated at the 720m level, which was

a key milestone.

"I look forward to providing the market with a

more complete update on Nalunaq operations at our Capital Markets

event on 13 June, where we will present visuals of the progress

made to date and providing guidance on the cost to complete as well

as the expected date of first gold production. In addition, we will

present our plan for resource growth at Nalunaq, along with details

of our expanded drilling programme at the Stendalen copper-nickel

discovery."Finally, progress on new growth opportunities within

South Greenland, including Strategic Minerals, Hydro and Servicing

are progressing well and we look forward to providing an update to

the market in due course, during or before the Capital Markets

Day.”

Q1 2024 Corporate

Highlights

- Amaroq group liquidity of $96.31

million consisting of cash balances, undrawn revolving credit

facilities, undrawn revolving credit overrun facility less trade

payables ($52.42 million as at December 31, 2023).

- Gold business working capital of

$78.2 million that includes prepaid contractors on the Nalunaq

project of $17.47 million as of March 31, 2024 ($37.6 million as at

December 31, 2023 including prepaid contractors on the Nalunaq

project of $18.68 million)

- The Gardaq Joint Venture that

comprises the Strategic Minerals business has available liquidity

of $17.0 million ($18.7 million as at December 31, 2023) on a 100%

basis.

- In February 2024 the Company

completed a Fundraising, raising net proceeds of approximately

$74.52 million, to accelerate mining of the Target Block at the

Nalunaq mine to maintain the processing plant’s current nameplate

capacity of 300 tonnes of ore processed per day in 2025 and for the

extension of the process plant to include a flotation circuit and

dry-stack tailings facility.

- The Company intends to provide an

update on the Nalunaq project at a Capital Markets event to be held

in Iceland on 13 June 2024

- The Company increased the amount

placed in escrow from $0.68 million as at December 31, 2023 to

$5.70 million as at March 31, 2024 as a pre-requisite for mining

and construction permits.

- Post-period, Jaco Duvenhage was

appointed as Nalunaq General Manager to oversee the operation

Q1 2024 Operational

Highlights

- Permitting:

The public consultation for the Environmental Impact Assessment

(EIA) and Social Impact Assessment (SIA) for Nalunaq closed on 1st

March 2024

- Contracting and

Procurement: After the re-scoping of the work, 81% of the

key contracts for the processing plant were concluded and

procurement was 81% complete at the end of Q1. The last major

contract for structural, mechanical, piping and processing plant

equipment installation was awarded to Scott Steel Erectors in early

April

- Engineering:

Process plant detailed design and engineering was 86% complete at

the end of Q1 based on the updated project scope

- Construction:

Processing plant pad construction is 95% complete, Precast

foundations received and on site, foundation excavations completed,

all plinths installed up to crusher area. Erection of processing

plant steel structure is in progress. Overall processing plant

construction is 24% complete

- Mining: Mine

rehabilitation was completed in mid-March, and the successful first

underground blast at Nalunaq was initiated on March 30, 2024.

Development work continues, with Rehabilitation of 570L access

commenced to establish underground diamond drill location for

drilling-off the Target Block extension. Mine equipment, including

the second development drill and two ST-7 scoops, are on route to

Greenland and awaiting delivery to site as per schedule

- Exploration:

The Company has been busy finalising interpretation and preparing

for a busy 2024 field season to include a targeted Mineral Resource

growth plans at Nalunaq and Copper-Nickel-Cobalt drilling at

Stendalen among other project development programmes

Nalunaq Project KPIs

- 60,372 total hours worked

during Q1 2024

- Daily average of 55 people

working on site at Nalunaq in Q1 2024

- Zero Lost Time Injuries in Q1

2024

- Ratio of Greenlandic personnel

at Nalunaq standing at 53% in Q1 2024

Outlook

- Following the announcement that

Jaco Crouse would step down as Chief Financial Officer and as a

Director of the Company with effect from 3 June 2024, the

recruitment process to appoint a new CFO is well advanced. The

Company will update the market in due course

- All engineering for the process

plant will be completed during quarter two and the procurement

packages will be issued to the market for these.

- Post period, activities at

Nalunaq continue to progress well, with 80 people now present on

site. Construction of the processing plant structure is underway

and expected to complete in June 2024. Management intends to

provide a further update on the Nalunaq Project at a Capital

Markets Day in Iceland, to take place on 13 June 2024

Exploration activities

overview

Gold projects:

- Nalunaq

- Additional 75 vein

intersections from historical core drilling have been selected

using core photography and will be assessed and sampled during Q2

2024

- A Resource development

exploration programme has been developed to work alongside

continued underground rehabilitation and development

activities

- Nanoq

- Further desk-based modelling from

the ALS Goldspot interpretation has allowed the Company to produce

detailed resource drilling plans that can be progressed in

2024/25

- Vagar Ridge

- The Corporation has progressed with

the construction of a robust geological and mineralization model to

inform future exploration at Vagar as well as designing future

exploration options

Strategic Minerals:

- Sava Copper Belt

(Sava/North Sava)

- Amaroq has continued to assess the

results from the 2023 field season alongside recognised subject

matter experts in porphyry mineralisation as the Company develops

its 2024 exploration programmes

- Stendalen

- Geophysical data reviewed points to

the likely feeder zone and other sulphide accumulation areas. 2024

exploration drilling plans have been developed

- Kobberminebugt:

- High resolution geophysical data

(MT) has been received and inverted for the Kobberminebugt licence

and is currently being reviewed ahead of the development of a 2024

field programme

- Nunarsuit

- High resolution geophysical data

(Magnetics, Gravity and Radiometics) has been received for the

western sections of the licence and is currently being reviewed

ahead of the development of a 2024 field programme

- Regional

Exploration

- The Company has continued its desk

based regional exploration programmes developing further targets to

be assessed as part of the 2024 field programmes

Details of conference

call

A conference call for analysts and investors

will be held today at 16:00 BST (15:00 GMT, 11:00 EST), including a

management presentation and Q&A session.

To join the meeting, please register at the

below link:

https://us06web.zoom.us/webinar/register/WN_nfp5J0EwQy6ZI6VB522KOg

Notice of Iceland Capital Markets

Day

The Company intends to hold a Capital

Markets Day in Iceland on 13 June 2024, during which Management

will provide an update on the Nalunaq Project.

Details of registration and remote access

will be provided in advance of the session.

Amaroq Financial

Results

The following selected financial data is extracted from the

Financial Statements for the three months ended March 31, 2024.

Financial Results

|

|

Three months ended March 31 |

|

|

2024$ |

2023$ |

|

Exploration and evaluation expenses |

875,213 |

1,181,653 |

|

General and administrative |

3,959,226 |

2,577,035 |

|

Share of 3-month loss of an equity-accounted joint arrangement |

646,432 |

- |

|

Unrealized loss on derivative liability |

4,300,213 |

- |

|

Net loss and comprehensive loss |

9,217,515 |

3,376,893 |

|

Basic and diluted loss per common share |

(0.03) |

(0.01) |

Financial Position

|

|

As at March 31 |

As at December 31 |

|

|

2024$ |

2023$ |

|

Cash on hand |

65,086,851 |

21,014,633 |

|

Total assets |

179,887,713 |

106,953,183 |

|

Total current liabilities (before convertible notes liability) |

7,371,146 |

6,354,185 |

|

Total current liabilities (including convertible notes

liability) |

48,922,487 |

42,097,312 |

|

Shareholders’ equity |

130,283,503 |

64,278,637 |

|

Working capital-gold business (before convertible notes

liability) |

78,210,475 |

37,614,068 |

|

Working capital-gold business (after convertible notes

liability) |

36,659,134 |

1,870,941 |

|

Gold business liquidity (excludes $17.0 and $18.7M ring-fenced for

strategic mineral exploration as of March 31, 2024 and Dec 31,

2023) |

96,303,850 |

52,419,243 |

Ends

Enquiries: Amaroq Minerals

Ltd. Eldur Olafsson, Executive Director and

CEO eo@amaroqminerals.com Eddie

Wyvill, Corporate Development+44 (0)7713

126727 ew@amaroqminerals.com Stifel

Nicolaus Europe Limited (Nominated Adviser and

Broker) Callum Stewart Varun

Talwar Simon Mensley Ashton

Clanfield +44 (0) 20 7710

7600 Panmure Gordon (UK) Limited

(Joint Broker) Hugh Rich Dougie

Mcleod +44 (0) 20 7886

2500 Camarco (Financial

PR) Billy Clegg Elfie

Kent Charlie Dingwall +44 (0) 20 3757

4980

For Company updates: Follow

@Amaroq_minerals on Twitter Follow Amaroq Minerals Inc.

on LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business objectives

are the identification, acquisition, exploration, and development

of gold and strategic metal properties in Greenland. The Company's

principal asset is a 100% interest in the Nalunaq Project, a

development stage property with an exploitation license including

the previously operating Nalunaq gold mine. The Corporation has a

portfolio of gold and strategic metal assets in Southern Greenland

covering the two known gold belts in the region. Amaroq Minerals is

incorporated under the Canada Business Corporations Act and wholly

owns Nalunaq A/S, incorporated under the Greenland Public Companies

Act.

Certain statements in this release constitute

"forward-looking statements" or "forward-looking information"

within the meaning of applicable securities laws. Such statements

and information involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or

achievements of the company, its projects, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information. Such statements can be identified by the

use of words such as "may", "would", "could", "will", "intend",

"expect", "believe", "plan", "anticipate", "estimate", "scheduled",

"forecast", "predict" and other similar terminology, or state that

certain actions, events or results "may", "could", "would", "might"

or "will" be taken, occur or be achieved. These statements reflect

the Company's current expectations regarding future events,

performance and results and speak only as of the date of this

release.

Forward-looking statements and information

involve significant risks and uncertainties, should not be read as

guarantees of future performance or results and will not

necessarily be accurate indicators of whether or not such results

will be achieved. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements or information, including, but not limited to: material

adverse changes, unexpected changes in laws, rules or regulations,

or their enforcement by applicable authorities; the failure of

parties to contracts with the company to perform as agreed; social

or labour unrest; changes in commodity prices; and the failure of

exploration, refurbishment, development or mining programs or

studies to deliver anticipated results or results that would

justify and support continued exploration, studies, development or

operations.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Glossary

|

Ag |

silver |

|

Au |

gold |

|

Bt |

Billion tonnes |

|

Cu |

copper |

|

g |

grams |

|

g/t |

grams per tonne |

|

km |

kilometers |

|

Koz |

thousand ounces |

|

m |

meters |

|

Mo |

molybdenum |

|

MRE |

Mineral Resource Estimate |

|

MT |

Magnetotelluric data |

|

Nb |

niobium |

|

Ni |

nickel |

|

oz |

ounces |

|

REE |

Rare Earth Elements |

|

t |

tonnes |

|

Ti |

Titanium |

|

t/m3 |

tonne per cubic meter |

|

U |

uranium |

|

USD/ozAu |

US Dollar per ounce of gold |

|

V |

Vanadium |

|

Zn |

zinc |

Inside Information

This announcement contains inside information

for the purposes of Article 7 of the UK version of

Regulation (EU) No. 596/2014 on Market Abuse ("UK MAR"), as it

forms part of UK domestic law by virtue of

the European Union (Withdrawal) Act 2018, and Regulation

(EU) No. 596/2014 on Market Abuse ("EU MAR").

Qualified Person Statement

The technical information presented in this

press release has been approved by James Gilbertson CGeol, VP

Exploration for Amaroq Minerals and a Chartered Geologist with the

Geological Society of London, and as such a Qualified Person as

defined by NI 43-101.

Amaroq Minerals

Ltd.

UNAUDITED

CONDENSED INTERIM

CONSOLIDATED FINANCIAL

STATEMENTSFor the three months ended March 31,

2024

The attached financial statements have been

prepared by Management of Amaroq Minerals Ltd. and have not been

reviewed by the auditor

|

|

|

|

|

|

|

|

As at March 31, |

As at December 31, |

|

|

Notes |

2024 |

2023 |

|

|

|

$ |

$ |

|

ASSETS |

|

|

|

|

Current assets |

|

|

|

| Cash |

|

65,086,851 |

21,014,633 |

| Due from a related

party |

3,12 |

- |

3,521,938 |

| Sales tax

receivable |

|

144,108 |

69,756 |

| Prepaid expenses and

others |

|

17,469,706 |

18,681,568 |

|

Inventory |

|

2,880,956 |

680,358 |

|

Total current

assets |

|

85,581,621 |

43,968,253 |

|

Non-current assets |

|

|

|

| Deposit |

|

27,944 |

27,944 |

|

| Escrow account for

environmental rehabilitation |

|

5,697,903 |

598,939 |

|

| Financial Asset -

Related Party |

3,12 |

4,200,379 |

- |

| Investment in equity

accounted joint arrangement |

3 |

22,846,379 |

23,492,811 |

|

| Mineral

properties |

4 |

48,683 |

48,821 |

|

| Right of use

asset |

7 |

715,898 |

574,856 |

|

|

Capital assets |

5 |

60,768,906 |

38,241,559 |

|

|

Total non-current

assets |

|

94,306,092 |

62,984,930 |

|

TOTAL ASSETS |

|

179,887,713 |

106,953,183 |

|

LIABILITIES AND

EQUITY |

|

|

|

|

Current liabilities |

|

|

|

| Accounts payable and

accrued liabilities |

|

7,258,359 |

6,273,979 |

| Convertible

notes |

6 |

41,551,341 |

35,743,127 |

|

Lease liabilities – current portion |

7 |

112,787 |

80,206 |

|

Total current

liabilities |

|

48,922,487 |

42,097,312 |

|

Non-current liabilities |

|

|

|

|

Lease liabilities |

7 |

681,723 |

577,234 |

|

Total non-current

liabilities |

|

681,723 |

577,234 |

|

Total liabilities |

|

49,604,210 |

42,674,546 |

|

Equity |

|

|

|

| Capital stock |

|

206,698,546 |

132,117,971 |

| Contributed

surplus |

|

7,367,374 |

6,725,568 |

| Accumulated other

comprehensive loss |

|

(36,772) |

(36,772) |

|

Deficit |

|

(83,745,645) |

(74,528,130) |

|

Total equity |

|

130,283,503 |

64,278,637 |

|

TOTAL LIABILITIES

AND EQUITY |

|

179,887,713 |

106,953,183 |

|

|

|

|

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

|

|

|

Three months ended March

31, |

|

|

Notes |

2024 |

2023 |

|

|

|

$ |

$ |

|

Expenses |

|

|

|

| Exploration and

evaluation expenses |

9 |

875,213 |

1,181,653 |

|

| General and

administrative |

10 |

3,959,226 |

2,577,035 |

|

| Loss on disposal

of capital assets |

|

- |

37,791 |

|

|

Foreign exchange loss (gain) |

|

79,509 |

(197,004) |

|

|

Operating loss |

|

4,913,948 |

3,599,475 |

|

|

Other expenses

(income) |

|

|

|

|

| Interest

income |

|

(15,326) |

(231,319) |

|

| Gardaq management

income and allocated cost |

|

(636,326) |

- |

|

| Share of net

losses of joint arrangement |

3 |

646,432 |

- |

|

| Unrealized loss

on derivative liability |

6 |

4,300,213 |

- |

|

|

Finance costs |

11 |

8,574 |

8,737 |

|

|

Net loss and

comprehensive loss |

|

(9,217,515) |

(3,376,893) |

|

|

Weighted average number of common shares outstanding - basic and

diluted |

|

290,574,484 |

263,203,347 |

|

Basic and diluted loss per common share |

|

(0.03) |

(0.01) |

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

Amaroq Minerals

Ltd.Consolidated

Statements of

Changes in

Equity(Unaudited, in Canadian Dollars)

|

Number of

commonshares outstanding |

Capital Stock |

Contributed surplus |

Accumulated other

comprehensiveloss |

Deficit |

Total Equity |

|

|

|

|

$ |

$ |

$ |

$ |

$ |

|

Balance at

January 1,

2023 |

|

263,073,022 |

131,708,387 |

5,250,865 |

(36,772) |

(73,694,617) |

63,227,863 |

| Net loss and

comprehensive loss |

|

- |

- |

- |

- |

(3,376,893) |

(3,376,893) |

| Options

exercised |

|

208,275 |

128,758 |

(150,000) |

- |

- |

(21,242) |

|

Stock-based compensation |

8 |

- |

- |

451,014 |

- |

- |

451,014 |

|

Balance at March

31, 2023 |

|

263,281,297 |

131,837,145 |

5,551,879 |

(36,772) |

(77,071,510) |

60,280,742 |

|

|

|

|

|

|

|

|

|

|

Balance at

January 1,

2024 |

|

263,670,051 |

132,117,971 |

6,725,568 |

(36,772) |

(74,528,130) |

64,278,637 |

| Net loss and

comprehensive loss |

|

- |

- |

- |

- |

(9,217,515) |

(9,217,515) |

| Share issuance

under a fundraising |

|

62,724,758 |

75,574,600 |

- |

- |

- |

75,574,600 |

| Share issuance

costs |

|

- |

(1,047,098) |

- |

- |

- |

(1,047,098) |

| Options exercised

- net |

|

60,637 |

53,073 |

(70,500) |

- |

- |

(17,427) |

|

Stock-based compensation |

8 |

- |

- |

712,306 |

- |

- |

712,306 |

|

Balance at March

31, 2024 |

|

326,455,446 |

206,698,546 |

7,367,374 |

(36,772) |

(83,745,645) |

130,283,503 |

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

|

|

|

|

|

|

Notes |

Three months ended March

31, |

|

|

|

2024 |

2023 |

|

|

|

$ |

$ |

|

Operating activities |

|

|

|

| Net loss for the

period |

|

(9,217,515) |

(3,376,893) |

| Adjustments

for: |

|

|

|

|

Depreciation |

5 |

172,763 |

180,008 |

|

Amortisation of ROU asset |

7 |

19,997 |

19,777 |

|

Stock-based compensation |

8 |

712,306 |

451,014 |

|

Unrealized loss on derivative liability |

6 |

4,300,213 |

- |

|

Loss on disposal of capital assets |

5 |

- |

37,791 |

|

Share of net losses of joint arrangement |

3 |

646,432 |

- |

|

Gardaq management income and allocated cost |

3,12 |

(636,326) |

|

|

Other expenses |

|

- |

8,737 |

|

Foreign exchange |

|

(195,812) |

(216,560) |

|

|

|

(4,197,942) |

(2,896,126) |

| Changes in

non-cash working capital items: |

|

|

|

|

Sales tax receivable |

|

(74,352) |

16,076 |

|

Prepaid expenses and others |

|

(988,735) |

(515,244) |

|

Trade and other payables |

|

955,992 |

(127,977) |

|

|

|

(107,095) |

(627,145) |

|

Cash flow used

in operating

activities |

|

(4,305,037) |

(3,523,271) |

|

Investing activities |

|

|

|

|

Transfer to escrow account for environmental rehabilitation |

|

(5,066,194) |

- |

| Construction in

progress and acquisition of capital assets |

5 |

(21,476,951) |

- |

|

Prepayment for acquisition of ROU asset |

|

(5,825) |

- |

|

Cash flow used

in investing

activities |

|

(26,548,970) |

- |

|

Financing activities |

|

|

|

| Share

issuance |

|

75,574,600 |

|

| Share issuance

costs |

|

(1,047,098) |

|

| Principal

repayment – lease liabilities |

7 |

(18,145) |

(26,474) |

|

Cash flow from

financing activities |

|

74,509,357 |

(26,474) |

|

Net change in cash before effects of exchange rate changes on cash

during the period |

|

43,655,350 |

(3,549,745) |

|

Effects of exchange rate changes on cash |

|

416,868 |

196,583 |

|

Net change in cash during the period |

|

44,072,218 |

(3,353,162) |

|

Cash, beginning of period |

|

21,014,633 |

50,137,569 |

|

Cash, end of

period |

|

65,086,851 |

46,784,407 |

|

Supplemental cash

flow information |

|

|

|

| Borrowing costs

capitalised to capital assets (note 5) |

|

1,223,021 |

- |

| Interest

received |

|

15,327 |

231,319 |

| ROU assets

acquired through lease |

|

155,214 |

- |

The accompanying notes are an integral part of these unaudited

condensed interim consolidated financial statements.

1. NATURE

OF OPERATIONS,

BASIS OF

PRESENTATION

Amaroq Minerals Ltd. (the “Corporation”) was

incorporated on February 22, 2017 under the Canada Business

Corporations Act. The Corporation’s head office is situated at

3400, One First Canadian Place, P.O. Box 130, Toronto, Ontario, M5X

1A4, Canada. The Corporation operates in one industry segment,

being the acquisition, exploration and development of mineral

properties. It owns interests in properties located in Greenland.

The Corporation’s financial year ends on December 31. Since July

2017, the Corporation’s shares are listed on the TSX Venture

Exchange (the “TSX-V”), since July 2020, the Corporation’s shares

are also listed on the AIM market of the London Stock Exchange

(“AIM”) and from November 1, 2022, on Nasdaq First North Growth

Market Iceland which were transferred on

September 21, 2023 on Nasdaq Main Market Iceland

(“Nasdaq”) under the AMRQ ticker.

These unaudited condensed interim consolidated

financial statements for the three months ended

March 31, 2024 (“Financial Statements”) were approved by

the Board of Directors on May 14, 2024

1.1 Basis

of presentation

and consolidation

The Financial Statements include the accounts of

the Corporation and those of its 100% owned subsidiary

Nalunaq A/S, company incorporated under the Greenland Public

Companies Act. The Financial Statements also include the

Corporation’s 51% equity pick-up of Gardaq A/S, a joint venture

with GCAM LP (Note 3).

The Financial Statements have been prepared in

accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board

(“IASB”) including International Accounting Standard (“IAS”) 34,

Interim Financial Reporting. The Financial Statements have been

prepared under the historical cost convention.

The Financial Statements should be read in

conjunction with the annual financial statements for the year ended

December 31, 2023, which have been prepared in accordance with IFRS

as issued by the IASB. The accounting policies, methods of

computation and presentation applied in these Financial Statements

are consistent with those of the previous financial year ended

December 31, 2023.

2. CRITICAL

ACCOUNTING JUDGMENTS

AND ASSUMPTIONS

The preparation of the Financial Statements

requires Management to make judgments and form assumptions that

affect the reported amounts of assets and liabilities at the date

of the Financial Statements and reported amounts of expenses during

the reporting period. On an ongoing basis, Management evaluates its

judgments in relation to assets, liabilities and expenses.

Management uses past experience and various other factors it

believes to be reasonable under the given circumstances as the

basis for its judgments. Actual outcomes may differ from these

estimates under different assumptions and conditions.

In preparing the Financial Statements, the

significant judgements made by Management in applying the

Corporation accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the

Corporation’s audited annual financial statements for the year

ended December 31, 2023.

3. INVESTMENT

IN AN ASSOCIATE OR JOINT VENTURE CORPORATION

|

|

As at

March 31, 2024 |

As at March 31,

2023 |

|

|

$ |

$ |

| Balance at

beginning of period |

23,492,811 |

- |

| Share of joint

venture’s net losses- for 3 months ended March 31 |

(646,432) |

- |

|

Balance at end of period |

22,846,379 |

- |

|

Original Investment

in Gardaq ApS |

7,422 |

- |

|

Transfer of

non-gold strategic minerals licences at cost |

36,896 |

- |

|

Investment at

conversion of Gardaq ApS to Gardaq A/S |

55,344 |

- |

|

Gain on FV

recognition of equity accounted investment in joint venture |

31,285,536 |

- |

|

Investment retained

at fair value- 51% share |

31,385,198 |

- |

|

Share of joint venture’s cumulative net losses |

(8,538,819) |

- |

|

Balance at end of period |

22,846,379 |

- |

The following tables summarize the unaudited

financial information of Gardaq A/S as of March 31, 2024.

|

|

As at March

31, 2024 |

|

|

$ |

| Cash and cash

equivalent |

17,002,319 |

|

Prepaid expenses and other |

815,896 |

|

Total current assets |

17,818,215 |

|

Mineral property |

92,240 |

|

Total Assets |

17,910,455 |

|

Accounts payable and accrued liabilities |

205,922 |

|

Financial Liability - Related Party |

4,200,379 |

|

Capital stock |

30,246,937 |

|

Deficit |

(16,742,783) |

|

Total equity |

13,504,154 |

|

Total liabilities and equity |

17,910,455 |

|

|

As at March

31, 2024 |

|

|

$ |

| Exploration and

Evaluation expenses |

842,840 |

| Interest

expense (income) |

(2,928) |

| Foreign

exchange loss (gain) |

(177,623) |

|

Operating loss |

662,289 |

|

Other expenses (income) |

605,225 |

|

Net loss and comprehensive loss |

1,267,514 |

3. INVESTMENT

IN AN ASSOCIATE OR JOINT VENTURE CORPORATION (CONT’d)

3.1 Financial Asset – Related

Party

Subject to a Subscription and Shareholder

Agreement dated 13 April 2023, the Corporation undertakes to

subscribe to two ordinary shares in Gardaq (the “Amaroq shares”) at

a subscription price of GBP 5,000,000 no later than 10 business

days after the third anniversary of the completion of the

subscription agreement.

Amaroq’s subscription will be completed by the

conversion of Gardaq’s related party balance into equity shares.

Gardaq’s related party payable balance consists of overhead,

management, general and administrative expenses payable to the

Corporation. In the event that the related party payable balance is

less than GBP 5,000,000, the Corporation shall, no later than 10

business days after the third anniversary of Completion:

(a) subscribe to one Amaroq

share by conversion of the amount payable to the

Corporation,(b) subscribe to one Amaroq share at a

subscription price equal to GBP 5,000,000 less the amount payable

to the Corporation

In the event that the amount payable to the

Corporation exceeds GBP 5,000,000, the Corporation shall subscribe

to the Amaroq shares at a subscription price equal to GBP 5,000,000

by conversion of GBP 5,000,000 of the amount due from Gardaq.

Gardaq shall not be liable to repay any of the balance payable to

the Corporation that exceeds GBP 5,000,000 (equivalent to CAD

8,557,000 as at 31 March 2024). See note 12.1.

4. MINERAL

PROPERTIES

|

|

As at December

31,2023 |

Transfer |

As at March

31,2024 |

|

|

$ |

$ |

$ |

| Nalunaq - Au |

1 |

- |

1 |

| Tartoq - Au |

18,431 |

- |

18,431 |

| Vagar - Au |

11,103 |

- |

11,103 |

| Nuna Nutaaq -

Au |

6,076 |

- |

6,076 |

| Anoritooq -

Au |

6,389 |

- |

6,389 |

| Siku - Au |

6,821 |

(138) |

6,683 |

| Naalagaaffiup

Portornga - Strategic Minerals |

- |

- |

- |

| Saarloq -

Strategic Minerals |

- |

- |

- |

| Sava - Strategic

Minerals |

- |

- |

- |

| Kobberminebugt -

Strategic Minerals |

- |

- |

- |

| Stendalen -

Strategic Minerals |

- |

- |

- |

|

North Sava - Strategic Minerals |

- |

- |

- |

|

Total mineral

properties |

48,821 |

- |

48,683 |

4. MINERAL

PROPERTIES (CONT’d)

|

|

As at December

31,2022 |

Additions |

As at March

31,2023 |

|

|

$ |

$ |

$ |

| Nalunaq - Au |

1 |

- |

1 |

| Tartoq - Au |

18,431 |

- |

18,431 |

| Vagar - Au |

11,103 |

- |

11,103 |

| Nuna Nutaaq -

Au |

6,076 |

- |

6,076 |

| Anoritooq -

Au |

6,389 |

- |

6,389 |

| Siku - Au |

6,821 |

- |

6,821 |

| Naalagaaffiup

Portornga - Strategic Minerals |

6,334 |

- |

6,334 |

| Saarloq -

Strategic Minerals |

7,348 |

- |

7,348 |

| Sava - Strategic

Minerals |

6,562 |

- |

6,562 |

| Kobberminebugt -

Strategic Minerals |

6,840 |

- |

6,840 |

| Stendalen -

Strategic Minerals |

4,837 |

- |

4,837 |

|

North Sava - Strategic Minerals |

4,837 |

- |

4,837 |

|

Total mineral

properties |

85,579 |

- |

85,579 |

5. CAPITAL

ASSETS

|

|

Field equipment

andinfrastruc-

ture |

Vehicles and

rolling stock |

Equipment (including software) |

Construc- tion In

Progress |

Total |

|

|

$ |

$ |

$ |

$ |

$ |

|

Three months ended March

31, 2024 |

|

|

|

|

|

|

Opening net book value |

1,537,379 |

3,312,118 |

108,822 |

33,283,240 |

38,241,559 |

|

Additions |

- |

- |

138 |

22,699,972 |

22,700,110 |

|

Disposals |

- |

- |

- |

- |

- |

|

Depreciation |

(49,594) |

(107,571) |

(15,598) |

- |

(172,763) |

|

Closing net book

value |

1,487,785 |

3,204,547 |

93,362 |

55,983,212 |

60,768,906 |

|

|

Field equipment

andinfrastruc-

ture |

Vehicles and

rolling stock |

Equipment (including software) |

Construc- tion In

Progress |

Total |

|

|

$ |

$ |

$ |

$ |

$ |

|

As at March

31, 2024 |

|

|

|

|

|

|

Cost |

2,351,041 |

4,466,971 |

232,369 |

55,983,212 |

63,033,593 |

|

Accumulated depreciation |

(863,256) |

(1,262,424) |

(139,007) |

- |

(2,264,687) |

|

Closing net book

value |

1,487,785 |

3,204,547 |

93,362 |

55,983,212 |

60,768,906 |

5. CAPITAL

ASSETS (CONT’d)

Depreciation of capital assets related to

exploration and evaluation properties is being recorded in

exploration and evaluation expenses in the consolidated statement

of comprehensive loss, under depreciation. Depreciation of $157,262

($164,011 for the three months ended March 31, 2023) was expensed

as exploration and evaluation expenses during the three months

ended March 31, 2024 and the remaining depreciation was capitalised

to Construction in Progress.

As at March 31, 2024, the Corporation had

capital commitments, of $88,948,607. These commitments relate to

the development of Nalunaq Project, rehabilitation of the Nalunaq

mine, construction of processing plant, purchases of mobile

equipment and establishment of surface infrastructure.

During first three months of 2024 the Company

capitalised borrowing costs of $1,223,021 to construction in

progress, which are included in additions.

6. CONVERTIBLE

NOTES

|

|

Convertible notes loan |

Embedded Derivatives at FVTPL |

Total |

|

|

$ |

$ |

$ |

| Balance as at

December 31, 2023 |

11,763,053 |

23,980,074 |

35,743,127 |

| Accretion of

discount |

843,673 |

- |

843,673 |

| Accrued

interest |

379,348 |

- |

379,348 |

| Fair value

change |

- |

4,300,213 |

4,300,213 |

|

Foreign exchange loss (gain) |

284,980 |

- |

284,980 |

|

Balance as at December 31, 2023 |

13,271,054 |

28,280,287 |

41,551,341 |

|

Non-current portion |

- |

- |

- |

|

Current portion |

13,271,054 |

28,280,287 |

41,551,341 |

6.1 Revolving Credit

Facility

A $25 million (US$18.5 million) Revolving Credit Facility

(“RCF”) provided by Landsbankinn hf. and Fossar Investment Bank,

with a two-year term expiring on 1 September 2025 and priced at

SOFR plus 950bps. Interest is capitalized and payable at the end of

the term.

The credit facility is denominated in US Dollars and the SOFR

interest rate is determined with reference to the CME Term SOFR

Rates published by CME Group Inc. The Landsbankinn hf. and Fosar

revolving credit facility carries (i) a commitment fee of 0.40% per

annum calculated on the undrawn facility amount and (ii) an

arrangement fee of 2.00% on the facility amount where 1.5% is to be

paid on or before the closing date of the facility and 0.50% is to

be paid on or before the first draw down. The facility is not

convertible into any securities of the Corporation.The facility

will be secured by (i) a bank account pledge from the Corporation

and Nalunaq A/S, (ii) share pledges over all current and future

acquired shares in Nalunaq A/S and Gardaq A/S held by the

Corporation pursuant to the terms of share pledge agreements, (iii)

a proceeds loan assignment agreement, (iv) a pledge agreement in

respect of owner’s mortgage deeds and (v) a licence transfer

agreement. The Corporation has not yet drawn on this facility.

6. CONVERTIBLE

NOTES (CONT’d)

6.2 Convertible notes

Convertible notes represent $30.4 million (US$22.4 million)

notes issued to ECAM LP (US$16 million), JLE Property Ltd.

(US$4 million) and Livermore Partners LLC (US$2.4 million)

with a four-year term and a fixed interest rate of 5%. The

conversion price of $0.90 per common share is the closing Canadian

market price of the Amaroq shares on the day, prior to the closing

day of the Debt Financing.

The convertible notes are denominated in US Dollars and will

mature on September 30, 2027, being the date that is four years

from the convertible note offering closing date. The principal

amount of the convertible notes will be convertible, in whole or in

part, at any time from one month after issuance into common shares

of the Corporation ("Common Shares") at a conversion price of $0.90

(£0.525) per Common Share for a total of up to 33,812,401 Common

Shares. The Corporation may repay the convertible notes and accrued

interest at any time, in cash, subject to providing 30 days’ notice

to the relevant noteholders, with such noteholders having the

option to convert such convertible notes into Common Shares at the

conversion price up to 5 days prior to the redemption date. If the

Corporation chooses to redeem some but not all of the outstanding

convertible notes, the Corporation shall redeem a pro rata share of

each noteholder's holding of convertible notes. The Corporation

shall pay a commitment fee to the holders of the convertible notes

of, in aggregate, $5,511,293 (US$4,484,032), which shall be paid

pro rata to each noteholder's holding of convertible notes. The

commitment fee is payable on the earlier of (a) the date falling 20

business days after all amounts outstanding under the Bank

Revolving Credit Facility have been repaid in full, but no earlier

than the date that is 24 months after the date of issuance of the

notes; and (b) the date falling 30 (thirty) months after the date

of the subscription agreement in respect of the notes, irrespective

of whether or not notes have converted at that date or been

repaid.

The convertible notes will be secured by (i) bank account pledge

agreements from the Corporation and Nalunaq A/S, (ii) share pledges

over all current and future acquired shares in Nalunaq A/S and

Gardaq A/S held by the Corporation pursuant to the terms of share

pledge agreements, (iii) a proceeds loan assignment agreement, (iv)

a pledge agreement in respect of owner’s mortgage deeds and (v) a

licence transfer agreement.

The convertible notes represent hybrid financial instruments

with embedded derivatives requiring separation. The debt host

portion (the “Host”) of the instrument is classified at amortized

cost, whereas the aggregate conversion and repayment options (the

“Embedded Derivatives”) are classified at fair value through profit

and loss (FVTPL).

The fair value of the convertible notes at inception was

recognized at $30.4 million (US$22.4 million) and $19.4 million

(US$14.3 million) embedded derivative component was isolated and

determined using a Black Scholes valuation model which required the

use of significant unobservable inputs. As of March 31, 2024 the

Corporation identified the fair value of embedded derivative

associated with the early conversion option to be $28.2 million

($24.0 million as of December 31, 2023). The change in fair value

of embedded derivative in the period from January 1, 2024 to March

31, 2024 has been recognized in the statement of Income (loss) and

comprehensive income (loss). The Host liability component at

inception, before deducting transaction costs, was recognized to be

the residual amount of $10.9 million (US$8.1 million) which is

subsequently measured at amortized cost. Transaction costs incurred

on the issuance of the convertible note amounted to $1,004,030, of

which $362,502 was allocated to, and deducted from, the host

liability component, and $641,528 was allocated to the embedded

derivative component and charged to profit and loss.

6. CONVERTIBLE

NOTES (CONT’D)

6.3 Cost Overrun Facility

$13.5 million (US$10 million) Revolving Cost Overrun Facility

from JLE Property Ltd. on the same terms as the Bank Revolving

Credit Facility.

The Overrun Facility is denominated in US Dollars with a

two-year term, expiring on 1 September 2025, and will bear interest

at the CME Term SOFR Rates by CME Group Inc. and have a margin of

9.5% per annum. The Overrun Facility carries a stand-by fee of 2.5%

on the amount of committed funds. The Overrun Facility is not

convertible into any securities of the Corporation.

The Overrun Facility will be secured by (i) bank account pledge

agreements from the Corporation and Nalunaq A/S, (ii) share pledges

over all current and future acquired shares in Nalunaq A/S and

Gardaq A/S held by the Corporation pursuant to the terms of share

pledge agreements, (iii) a proceeds loan assignment agreement, (iv)

a pledge agreement in respect of owner’s mortgage deeds and (v) a

licence transfer agreement. The Corporation has not yet

drawn on this facility.

7.

LEASE LIABILITIES

|

|

As atMarch

31,2024 |

As atDecember

31,2023 |

|

|

$ |

$ |

| Balance

beginning |

657,440 |

729,237 |

| Lease

additions |

155,214 |

- |

| Lease

payment |

(26,718) |

(105,894) |

| Interest |

8,574 |

34,097 |

|

Adjustment |

- |

- |

|

Balance ending |

794,510 |

657,440 |

|

Non-current portion – lease liabilities |

(681,723) |

(577,234) |

|

Current portion – lease liabilities |

112,787 |

80,206 |

The Corporation has two leases for its offices.

In October 2020, the Corporation started the lease for five years

and five months including five free rent months during this period.

The monthly rent is $8,825 until March 2024 and $9,070 for the

balance of the lease. The Corporation has the option to renew the

lease for an additional five-year period at $9,070 monthly rent

indexed annually to the increase of the consumer price index of the

previous year for the Montreal area. In March 2024, the Corporation

started a new lease for a two-year term with the option to extend

for two more years. The monthly rent is $5,825 until March 2025

after which the monthly rent may increase as per the lease

terms.

7. LEASE LIABILITIES

(CONT’d)

7.1

Right of use asset

|

|

As at |

As at |

|

|

March 31, |

December 31, |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Opening net book

value |

574,856 |

655,063 |

| Additions |

161,039 |

- |

| Disposals |

- |

- |

| Adjustment |

- |

- |

|

Amortisation |

(19,997) |

(80,207) |

|

Closing net book value |

715,898 |

574,856 |

| |

|

|

|

Cost |

997,239 |

836,200 |

|

Accumulated amortisation |

(281,341) |

(261,344) |

|

Closing net book value |

715,898 |

574,856 |

8. STOCK-BASED

COMPENSATION

8.1 Stock

options

An incentive stock option plan (the “Plan”) was

approved initially in 2017 and renewed by shareholders on

June 15, 2023. The Plan is a “rolling” plan whereby a

maximum of 10% of the issued shares at the time of the grant are

reserved for issue under the Plan to executive officers, directors,

employees and consultants. The Board of directors grants the stock

options and the exercise price of the options shall not be less

than the closing price on the last trading day, preceding the grant

date. The options have a maximum term of ten years. Options granted

pursuant to the Plan shall vest and become exercisable at such time

or times as may be determined by the Board, except options granted

to consultants providing investor relations activities shall vest

in stages over a 12-month period with a maximum of one-quarter of

the options vesting in any three-month period. The Corporation has

no legal or constructive obligation to repurchase or settle the

options in cash.

On January 17, 2022, the Corporation granted its

officers, employees and consultant 4,100,000 stock options with an

exercise price of $0.60 and expiry date of

January 17, 2027. The stock options vested 100% at the

grant date. The options were granted at an exercise price equal to

the closing market price of the shares the day prior to the grant.

Total stock-based compensation costs amount to $1,435,000 for an

estimated fair value of $0.35 per option.

On April 20, 2022, the Corporation granted a

senior employee 73,333 stock options with an exercise price of

$0.75 and expiry date of April 20, 2027. The stock

options vested 100% at the grant date. The options were granted

with an exercise price equal to the closing market price of the

shares the day prior to the grant. Total stock-based compensation

costs amount to $32,267 for an estimated fair value of $0.44 per

option. The fair value of the options granted was estimated using

the Black-Scholes model with no expected dividend yield, 68.9%

expected volatility, 2.7% risk-free interest rate and a 5-year

term. The expected life and expected volatility were estimated by

benchmarking comparable companies to the Corporation.

- STOCK-BASED

COMPENSATION (CONT’d)

On July 14, 2022, the Corporation granted an

employee 39,062 stock options with an exercise price of $0.64 and

expiry date of July 14, 2027. The stock options vested 100% at the

grant date. The options were granted with an exercise price equal

to the closing market price of the shares the day prior to the

grant. Total stock-based compensation costs amount to $14,844 for

an estimated fair value of $0.38 per option. The fair value of the

options granted was estimated using the Black-Scholes model with no

expected dividend yield, 69% expected volatility, 3.1% risk-free

interest rate and a 5-year term. The expected life and expected

volatility were estimated by benchmarking comparable companies to

the Corporation.

On December 30, 2022, the Corporation granted

its employees and consultant 1,330,000 stock options with an

exercise price of $0.70 and expiry date of

December 30, 2027. The stock options vested 100% at the

grant date. The options were granted at an exercise price equal to

the closing market price of the shares the day prior to the grant.

Total stock-based compensation costs amount to $545,300 for an

estimated fair value of $0.41 per option.

On July 24, 2023, the Corporation granted an

on-hire incentive stock option award to a new senior employee of

Amaroq. The option award gives the employee the right to acquire up

to 19,480 common shares under the Corporation's stock option Plan.

The option has an exercise price of $0.77 per share which vested on

October 24, 2023. The option will expire if it remains unexercised

five years from the date of the award.

Changes in stock options are as follows:

|

Three months ended March

31, 2024 |

|

|

Number of

options |

Weighted average exercise

price |

|

|

|

$ |

| Balance,

beginning |

9,188,365 |

0.57 |

|

Exercised |

(150,000) |

0.43 |

|

Balance, end |

9,038,365 |

0.58 |

|

Balance, end exercisable |

9,033,755 |

0.59 |

Stock options outstanding and exercisable as at

March 31, 2024 are as follows:

|

Number of

options outstanding |

Number of

options exercisable |

Exercise price |

Expiry date |

|

|

|

$ |

|

|

1,670,000 |

1,670,000 |

0.38 |

December 31, 2025 |

|

100,000 |

95,390 |

0.50 |

September 13, 2026 |

|

1,245,000 |

1,245,000 |

0.78 |

December 31, 2026 |

|

3,600,000 |

3,600,000 |

0.60 |

January 17, 2027 |

|

73,333 |

73,333 |

0.75 |

April 20, 2027 |

|

39,062 |

39,062 |

0.64 |

July 14, 2027 |

|

1,330,000 |

1,330,000 |

0.70 |

December 30, 2027 |

|

900,000 |

900,000 |

0.59 |

December 31, 2027 |

|

19,480 |

19,480 |

0.77 |

July 24, 2028 |

|

61,490 |

61,490 |

1.09 |

December 20, 2028 |

|

9,038,365 |

9,033,755 |

|

|

8. STOCK-BASED COMPENSATION

(CONT’d)

8.2

Restricted Share Unit

8.2.1 Description

Conditional awards were made in 2022 that give

participants the opportunity to earn restricted share unit awards

under the Corporation’s Restricted Share Unit Plan (“RSU Plan”)

subject to the generation of shareholder value over a four-year

performance period.

The awards are designed to align the interests

of the Corporation’s employees and shareholders, by incentivising

the delivery of exceptional shareholder returns over the long-term.

Participants receive a 10% share of a pool which is defined by the

total shareholder value created above a 10% per annum compound

hurdle.

The awards comprise three tranches, based on

performance measured from January 1, 2022, to the following

three measurement dates:

- First Measurement Date:

December 31, 2023;

- Second Measurement Date:

December 31, 2024; and

- Third Measurement Date:

December 31, 2025.

Restricted share unit awards granted under the

RSU Plan as a result of achievement of the total shareholder return

performance conditions are subject to continued service, with

vesting as follows:

- Awards granted after the First

Measurement Date - 50% vest after one year, 50% vest after three

years.

- Awards granted after the Second

Measurement Date - 50% vest after one year, 50% vest after two

years.

- RSUs granted after the Third

Measurement Date - 100% vest after one year.

The maximum term of the awards is therefore four

years from grant.

The Corporation’s starting market capitalization

is based on a fixed share price of $0.552. Value created by share

price growth and dividends paid at each measurement date will be

calculated with reference to the average closing share price over

the three months ending on that date.

- After December 31, 2023, 100%

of the pool value at the First Measurement Date is delivered as

restricted share units under the RSU Plan, subject to the maximum

number of shares that can be allotted not being exceeded.

- After December 31, 2024, the

pool value at the Second Measurement Date is reduced by the pool

value from the First Measurement Date (increased in line with share

price movements between the First and Second Measurement Dates).

100% of the remaining pool value, if any, is delivered as

restricted share units under the RSU Plan.

- After December 31, 2025, the

pool value at the Third Measurement Date is reduced by the pool

value from the Second Measurement Date (increased in line with

share price movements between the Second and Third Measurement

Dates), and then further reduced by the pool value from the First

Measurement Date (increased in line with share price movements

between the First Measurement Date and the Third Measurement Date).

100% of the remaining pool value, if any, is delivered as

restricted share units under the RSU Plan.

8.2.2 RSU Plan Amendment

The RSU Plan was amended by a shareholders

General Meeting on June 15, 2023. As a result of the amendment the

number of shares that could be issued under the RSU Plan to satisfy

the conditional awards and other share awards was increased from

10% of a fixed share capital amount of 177,098,740 shares to 10% of

share capital at the time of award, amounting to 10% of 263,073,022

shares, reduced by the number

8. STOCK-BASED COMPENSATION (CONT’d)

of outstanding options at each calculation date.

As a result, an additional expense based on the difference between

the fair value of the conditional awards before and after the

modification will be recognised over the service period. The

incremental fair value was determined and incorporated info the

valuation in 12.2.2.

8.2.3 New Conditional Award under RSU

Plan

On 13 October 2023, Amaroq made an award (the

“Award”) under the RSU Plan as detailed below. The Award consists

of a conditional right to receive value if the future performance

targets, applicable to the Award, are met. Any value to which the

participants are eligible in respect of the Award will be granted

as Restricted Share Units (each an “RSU”), with each RSU entitling

a participant to receive common shares in the Corporation. Each RSU

will be granted under, and governed in accordance with, the rules

of the Corporation's Restricted Share Unit Plan.

|

Award Date |

October 13, 2023 |

|

Initial Price |

CAD 0.552 |

|

Hurdle Rate |

10% p.a. above the Initial Price |

|

Total Pool |

10% of the growth in value above the Hurdle rate, not exceeding 10%

of the Corporation’s share capital.The number of shares will be

determined at the Measurement Dates. |

|

Participant proportion |

Edward Wyvill, Corporate Development 10% |

|

Performance Period |

January 1, 2022 to December 31, 2025 (inclusive) |

|

Normal Measurement Dates |

First Measurement Date: December 31, 2023, 50% vesting on the

first anniversary of grant, with the remaining 50% vesting on the

third anniversary of grant. Second Measurement Date:

December 31, 2024, 50% vesting on the first anniversary of

grant, with the remaining 50% vesting on the second anniversary of

grant. Third Measurement Date: December 31, 2025, vesting on

the first anniversary of grant. |

8.2.4

Valuation

The fair value of the award granted in December

2022 and modified June 2023, in addition to the award granted

October 13, 2023, increased to $7,378,000 based on 90% of the

available pool being awarded. A charge of $711,500 was recorded

during the three months ended March 31, 2024 ($449,000 during the

three months ended March 31, 2023).

The fair value was obtained through the use of a

Monte Carlo simulation model which calculates a fair value based on

a large number of randomly generated projections of the

Corporation’s share price.

|

Assumption |

Value |

|

Grant date |

December 30, 2022 |

|

Amendment date |

June 15, 2023 |

|

Additional award date |

October 13, 2023 |

|

Expected life (years) |

2.22 – 3.00 |

|

Share price at grant date |

$0.70 - $0.97 |

|

Exercise price |

N/A |

|

Dividend yield |

0% |

|

Risk-free rate |

3.60% - 4.71% |

|

Volatility |

55% - 72% |

|

Fair value of awards - First Measurement Date |

$4,420,000 |

|

Fair value of awards - Second Measurement Date |

$1,946,000 |

|

Fair value of awards - Third Measurement Date |

$1,012,000 |

|

Total fair value of awards (90% of pool) |

$7,378,000 |

Expected volatility was determined from the

daily share price volatility over a historical period prior to the

date of grant with length commensurate with the expected life. A

zero dividend yield has been used based on the dividend yield as at

the date of grant.

9. EXPLORATION AND

EVALUATION EXPENSES

|

Three months ended March

31, |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Geology |

13,997 |

113,105 |

| Drilling |

- |

- |

| Lodging and

on-site support |

184,469 |

|

| Analysis |

5,033 |

- |

| Transport |

- |

304,200 |

| Helicopter

charter |

- |

79,868 |

| Logistic

support |

- |

- |

| Insurance |

- |

- |

| Maintenance

infrastructure |

480,754 |

294,119 |

| Supplies and

equipment |

31,722 |

170,558 |

| Project

Engineering |

- |

55,792 |

|

Government fees |

1,976 |

- |

|

Exploration and

evaluation expenses

before depreciation |

717,951 |

1,017,642 |

|

Depreciation |

157,262 |

164,011 |

|

Exploration and

evaluation expenses |

875,213 |

1,181,653 |

10.GENERAL AND

ADMINISTRATION

|

Three months ended March

31, |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Salaries and

benefits |

869,415 |

617,589 |

| Director’s

fees |

159,000 |

157,000 |

| Professional

fees |

939,809 |

611,878 |

| Marketing and

investor relations |

166,037 |

141,968 |

| Insurance |

78,916 |

67,602 |

| Travel and other

expenses |

604,513 |

301,269 |

|

Regulatory fees |

393,733 |

192,941 |

|

General and

administration before

following elements |

3,211,423 |

2,090,247 |

| Stock-based

compensation |

712,306 |

451,014 |

|

Depreciation |

35,498 |

35,774 |

|

General and

administration |

3,959,227 |

2,577,035 |

11. FINANCE

COSTS

|

|

Three monthsended March 31, |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Lease

interest |

8,574 |

8,737 |

|

|

8,574 |

8,737 |

12. RELATED

PARTY TRANSACTIONS AND KEY MANAGEMENT COMPENSATION

12.1 Gardaq Joint Venture

|

|

Three monthsended March 31, |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Gardaq

management fees and allocated cost |

636,326 |

- |

| Foreign

exchange revaluation |

42,115 |

- |

|

|

678,441 |

- |

As at March 31, 2024, the balance receivable

from Gardaq amounted to $4,200,379 ($3,521,938 as at

December 31, 2023). This receivable balance represents

allocated overhead and general administration costs to manage the

exploration work programmes and day-to-day activities of the joint

venture. This balance will be converted to shares in Gardaq within

10 business days after the third anniversary of the completion of

the Subscription and Shareholder Agreement dated 13 April 2023 (See

note 3.1).

12.2 Key Management Compensation

The Corporation’s key management are the members

of the board of directors, the President and Chief Executive

Officer, the Chief Financial Officer, the Vice President

Exploration, and the Corporate Secretary. Key management

compensation is as follows:

|

|

Three monthsended September

31 |

|

|

2024 |

2023 |

|

|

$ |

$ |

| Short-term

benefits |

|

|

|

Salaries and benefits |

445,723 |

331,747 |

|

Director’s fees |

159,000 |

157,000 |

| Long-term

benefits |

|

|

|

Stock-based compensation |

- |

- |

|

Total compensation |

604,723 |

488,747 |

13. NET EARNINGS (LOSS) PER COMMON SHARE

The calculation of net loss per share is shown

in the table below. As a result of the net loss incurred during the

periods presented, all potentially dilutive common shares are

deemed to be antidilutive and thus diluted net loss per share is

equal to the basic net loss per share for these periods.

|

|

|

Three monthsended March

31, |

|

|

|

2024 |

2023 |

|

|

|

$ |

$ |

|

Net income (loss) and comprehensive income

(loss) |

|

(9,217,515) |

(3,376,893) |

|

|

|

|

|

| Weighted

average number of common shares outstanding - basic |

|

290,574,484 |

263,203,347 |

| Weighted

average number of common shares outstanding – diluted |

|

290,574,484 |

263,203,347 |

| Basic earnings

(loss) per share |

|

(0.03) |

(0.01) |

|

Diluted earnings (loss) per common share |

|

(0.03) |

(0.01) |

14. FINANCIAL INSTRUMENTS AND RISK

MANAGEMENT

The Corporation is exposed to various risks

through its financial instruments. The following analysis provides

a summary of the Corporation's exposure to and concentrations of

risk at March 31, 2024:

14.1 Credit Risk

Credit risk is the risk that one party to a

financial instrument will cause financial loss for the other party

by failing to discharge an obligation. The Corporation’s main

credit risk relates to its prepaid amounts to suppliers for placing

orders, manufacturing and delivery of process plant equipment, as

well as an advance payment to a mining contractor. The Corporation

performed expected credit loss assessment and assessed the amounts

to be fully recoverable.

14.2 Fair Value

Financial assets and liabilities recognized or

disclosed at fair value are classified in the fair value hierarchy

based upon the nature of the inputs used in the determination of

fair value. The levels of the fair value hierarchy are:

• Level 1 - Quoted

prices (unadjusted) in active markets for identical assets or

liabilities • Level 2 - Inputs other than quoted prices

included within level 1 that are observable for the asset or

liability, either directly (i.e., as prices) or indirectly (i.e.,

derived from prices) • Level 3 - Inputs for the asset or liability

that are not based on observable market data (i.e., unobservable

inputs)

14. FINANCIAL INSTRUMENTS AND RISK

MANAGEMENT (CONT’d)

The following table summarizes the carrying value of the

Corporation’s financial instruments:

|

|

March 31,2024 |

December 31, 2023 |

|

|

$ |

$ |

|

Cash |

65,086,851 |

21,014,633 |

|

Due from a related party |

- |

3,521,938 |

|

Sales tax receivable |

144,108 |

69,756 |

|

Prepaid expenses and others |

17,469,706 |

18,681,568 |

|

Deposit |

27,944 |

27,944 |

|

Escrow account for environmental monitoring |

5,697,903 |

598,939 |

|

Financial Asset – Related Party |

4,200,379 |

- |

|

Investment in equity-accounted joint arrangement |

22,846,379 |

23,492,811 |

|

Accounts payable and accrued liabilities |

(7,258,359) |

(6,273,979) |

|

Convertible notes |

(41,551,341) |

(35,743,127) |

|

Lease liabilities |

(794,510) |

(657,440) |

Due to the short-term maturities of cash,

prepaid expenses, and accounts payable and accrued liabilities, the

carrying amounts of these financial instruments approximate fair

value at the respective balance sheet date.

The carrying value of the convertible note

instrument approximates its fair value at maturity and includes the

embedded derivative associated with the early conversion option and

the host liability at amortized cost.

The carrying value of lease liabilities

approximate its fair value based upon a discounted cash flows

method using a discount rate that reflects the Corporation’s

borrowing rate at the end of the period.

14.3 Liquidity Risk

Liquidity risk is the risk that the Corporation

will encounter difficulty in meeting obligations associated with

financial liabilities. The Corporation seeks to ensure that it has

sufficient capital to meet short-term financial obligations after

taking into account its exploration and operating obligations and

cash on hand. The Corporation anticipates seeking additional

financing in order to fund general and administrative costs and

exploration and evaluation costs. The Corporation’ options to

enhance liquidity include the issuance of new equity instruments or

debt.

The following table summarizes the carrying

amounts and contractual maturities of financial liabilities:

|

|

As at March 31, 2024 |

As at December 31, 2023 |

|

|

Trade and other payables |

Convertible Notes |

Lease liabilities |

Trade and other payables |

Convertible Notes |

Lease liabilities |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

| Within 1 year |

7,258,359 |

- |

149,050 |

6,273,979 |

- |

108,345 |

| 1 to 5 years |

- |

41,551,341 |

566,839 |

- |

35,743,127 |

544,178 |

|

5 to 10 years |

- |

- |

208,601 |

- |

- |

126,975 |

|

Total |

7,258,359 |

41,551,341 |

924,490 |

6,273,979 |

35,743,127 |

779,498 |

The Corporation has assessed that it is not

exposed to significant liquidity risk due to its cash balance in

the amount of $65.1 million at the period end.

- Q1 2024 Financial Results

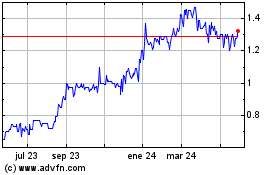

Amaroq Minerals (TSXV:AMRQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

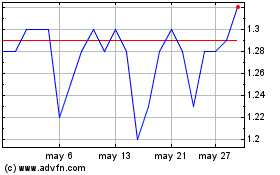

Amaroq Minerals (TSXV:AMRQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024