Rusoro Mining Reports Q1 2008 Financial Results

06 Junio 2008 - 7:29PM

Marketwired Canada

Rusoro Mining Ltd. ("Rusoro" or the "Company") (TSX VENTURE:RML) is pleased to

report its financial results for the quarter ended March 31, 2008. The Company's

Q1 consolidated financial statements and management's discussion and analysis

(MD&A) for the quarter ended March 31, 2008 have been filed on SEDAR

(www.sedar.com).

The first quarter of 2008 marked the first full quarter of reporting since the

Company acquired all the assets and liabilities of Gold Fields Netherlands

Services BV, ("Gold Fields"), which included the Choco 10 operating mine. The

completion of this transaction on November 30, 2007 also marked the Company's

transition from being an exploration company to being a gold producer.

All amounts set out in the Company's financial statements and MD&A are unaudited

and in United States dollars, unless otherwise stated.

Q1 2008 Highlights

The following are the highlights for the quarter ended March 31, 2008 and

related information. For detailed information regarding Rusoro's Q1 2008

financial information, please refer to the Financials Statements and the MD&A

which have been filed on SEDAR at www.sedar.com and can be found on the

Company's website at www.rusoro.com.

Financial:

- The first quarter of 2008 marked Rusoro's first full quarter of reporting from

the Choco 10 mine in El Callao. Rusoro took over as the mine operator on Oct 11,

2007 and assumed full ownership of the mine on November 30, 2007.

- The Company recorded its first full quarter of revenues as a gold producer of

$11.7 million.

Operational

--------------------------------------------------------------------------

Q4 2007, ending Q1 2008, ending

Choco 10 Mine Dec 31st 2007 March 31st, 2008

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Ore Processed/tonnes milled 563,355 616,664

--------------------------------------------------------------------------

Average tonnes milled per day 6,943 7,250

--------------------------------------------------------------------------

Average gold grade (g/t) 1,67 1,41

--------------------------------------------------------------------------

Average Gold Recovery 83.04% 86.58%

--------------------------------------------------------------------------

Gold Ounces Produced (i)27,790 25,040

--------------------------------------------------------------------------

(i) "Rusoro assumed management responsibility under the terms of the

acquisition for the Choco 10 mine on October 11, 2007 and became the

legal owner on Nov 30, 2007. The ounces of gold produced in the table

above for Q4 2007 includes 18,119 Au/oz produced during the period

Oct 11, 2007 and Nov 30, 2007 while the mine was under Rusoro's

control."

- Choco 10 Mine produced 25,040 ounces of gold at an average cash operating cost

of $498 per ounce of gold. Under the previous operator for the same period (Q1)

in 2007 the mine produced 8,221 ounces of gold at an average cash operating cost

of $748/oz. Q1 2008 showed an increase in production of 205% and a reduction in

operating cash costs of $250/oz or 33.4% compared to the same period last year.

- Permitting for the development and mining of oxide ore from the Increible 6 to

be processed at the Choco 10 mill is well underway. Preliminary mine design has

been completed.

- Scoping and Feasibility studies for the planned production expansion at the

Choco 10 Mine were awarded to Micon International Ltd. and work on the ground

has been initiated.

- Capital expenditures of $25 million on a new mobile mine fleet and plant

equipment were initiated during the quarter. Some delays have been encountered

in the importation of this new equipment, however delivery and phasing in of

mobile fleet is expected to occur throughout Q2 2008.

- Mine development at the SREP gold deposit through the development of a 1.8 km

ramp to access the ore bodies at 200m depth continues and is scheduled for

completion in Q4 2008, though minor delays have occurred due to seasonal rains.

Exploration:

- Resource and reserve in-fill drilling, in addition to geotechnical drilling,

is being carried out in the Choco 10 Mine lease areas. Highlights of this

drilling include; from the Coacia Area, 18.63g/t Au over 12m, 13.74g/t Au over

14m, 3.86g/t Au over 39m and from the VBK Area, 7.73g/t Au over 13.2m and

9.39g/t Au over 9.2m.

- Significant gold discoveries recently made at the Valle Hondo, Increible 14

and Yuruan projects.

- Recent results for all of these projects were released in a news release on

May 22, 2008.

Rusoro is very pleased with the progress being made in all facets of its growth

strategy. Operations continue to improve as the processes at the plant are

optimized, expansion continues to move forward at both the Choco and Emilia

mills and the exploration programs continue to prove the world class geology of

Venezuela for the discovery of gold.

Rusoro's President George Salamis reports: "We are very pleased that we have

been able to demonstrate that our turn-around strategy for the Choco 10 Mine is

proving to be successful. Going forward we are confident that we can continue to

improve significantly on our operational numbers and have in fact had a record

month in May 2008 for total tonnes of ore processed in the mill at 226,660

tonnes. The execution of our Mine optimization goals, in addition to this recent

ore processing record, is a testament to the hard work and dedication of our

Mine Management team and employees at the Choco 10 Mine."

Diamond drilling was conducted by Perforaciones Mayortec (Major Drilling),

Technodrilling and Core Biel Drilling of Puerto Ordaz, Venezuela. RC drilling

was completed by AK Drilling of Peru. All drilling and drill sampling have been

completed using industry standard practices. All drill core is described in

detail and photographed and one half of the core remains for inspection and

reference.

Sample analyses have been conducted at Acme Analytical, Actlabs, SGS labs and

Triad Labs located in Guasipati, Tumeremo, El Dorado and El Callao, Bolivar

State Venezuela. All sample analyses were completed using industry standard

practices and standard samples, blanks and duplicate check samples were randomly

inserted into the sample stream to ensure quality control. A review of the QA/QC

results shows no significant bias and all results are considered highly

reliable. Sample rejects for all drill samples are stored in Rusoro's secure

facilities in Tumeremo, Venezuela, and will continue to be available for any

further testing which may be required. All QA/QC is completed under the

direction of G.F. Smith, P.Geo.

Qualified Person: Mr. Gregory Smith, P.Geo, the Vice-President Exploration of

the Company, is the Qualified Person as defined by National Instrument 43-101,

and is responsible for the accuracy of this news release.

About Rusoro

Rusoro Mining is an advanced junior gold producer with a large land position in

the prolific Bolivar State region of Venezuela. The Company's current NI 43-101

compliant resource estimation stands at 6.630 M/oz gold in the M & I category

(84.0 M/t @ 2.5 g/t) and 6.220 M/oz gold in the inferred category (108.2 Mt @

1.8 g/t). The Company expects to produce approximately 120,000 Au ounces in 2008

and expand its annualized production rate to over 150,000 oz/yr by year end.

Rusoro will drill up to 300,000 meters in 2008 to expand and upgrade its gold

ounces for projected production expansion at both the Choco 10 Mine in El Callao

and the Emilia Mine in El Dorado.

ON BEHALF OF THE BOARD

George Salamis, President

Forward-looking statements: This document contains statements about expected or

anticipated future events and financial results that are forward-looking in

nature and as a result, are subject to certain risks and uncertainties, such as

general economic, market and business conditions, the regulatory process and

actions, technical issues, new legislation, competitive and general economic

factors and conditions, the uncertainties resulting from potential delays or

changes in plans, the occurrence of unexpected events, and the Company's

capability to execute and implement its future plans. Actual results may differ

materially from those projected by management. For such statements, we claim the

safe harbour for forward-looking statements within the meaning of the Private

Securities Legislation Reform Act of 1995.

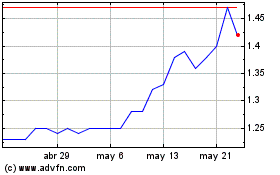

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

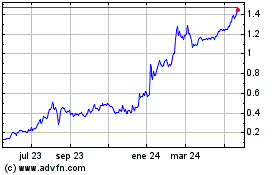

Rusoro Mining (TSXV:RML)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024