- Current report filing (8-K)

22 Octubre 2010 - 4:14PM

Edgar (US Regulatory)

Securities and Exchange Commission

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant To Section 13 or 15(d) Of

The Securities Exchange Act of 1934

Date of Report: October 22, 2010

AXIS TECHNOLOGIES GROUP, INC.

(Exact Name of Registrant As Specified in Its Charter)

|

Delaware

|

|

000-53350

|

|

26-1326434

|

|

(State Or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

2055 So. Folsom Street

Lincoln, NE 68522

(Address of Principal Executive Offices, Including Zip Code)

(402) 476-6006

(Issuer’s Telephone Number, Including Area Code)

Item 1.02 Termination of a Material Definitive Agreement

In April, 2010, AXTG entered into a agreement with DHAB to acquire 163,192,720 shares of AXTG stock (the “AXTG Stock”) in return for a purchase money note in the amount of $6,000,000 (the “Note”). AXTG retained possession of the AXTG Stock as collateral for the purchase money obligation of DHAB pursuant to the terms of a stock pledge agreement (the “Pledge Agreement”). The Note provided for a maturity date of July 1, 2010. DHAB has defaulted under the Note by failing to pay said sum on or before the stated maturity date. The Note provides that in the event of default, the sole remedy of AXTG is to exercise its rights under the Pledge Agreement. Although the Company may renegotiate a new agreement with DHAB in the future, the passing of the due date of July 1, 2010 has necessitated the termination of the previously announced agreement.

Item 2.04 Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under and Off-balance Sheet Arrangement

On September 20

th

Axis was informed by Gemini Strategies, LLC ("Gemini") that the company was in default of the Note of the Security Agreement dated April 25, 2010, by, amongst other things, failing to make full payment thereunder by July 1, 2010. The failure to pay principal and interest by that date constitutes an Event of Default under the Note. An Event of Default under the Note constitutes an event of default under the security agreement. The balance due under the Note was $2,092,064.92 as of September 24, 2010. On October 13, 2010, Axis received a Notification of Disposition of Collateral.

Axis and several of the company's significant shareholders are actively working with Gemini Strategies to cure this default, including obtaining financing from alternative sources heretofore not possible under the previous agreement with DHAB.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AXIS TECHNOLOGIES GROUP, INC.

|

|

|

|

|

|

Date: October 22, 2010

|

By:

|

/s/ James Erickson

|

|

|

|

James Erickson

|

|

|

|

Chief Accounting Officer and

|

|

|

|

Principal Financial Officer

|

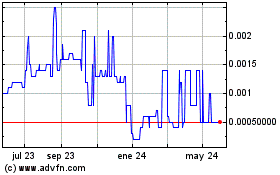

Axis Technologies (PK) (USOTC:AXTG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

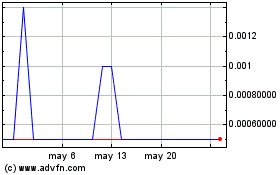

Axis Technologies (PK) (USOTC:AXTG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024