CML Microsystems PLC Move to AIM and Board Update (4320A)

01 Junio 2021 - 5:30AM

UK Regulatory

TIDMCML

RNS Number : 4320A

CML Microsystems PLC

01 June 2021

1 June 2021

CML Microsystems Plc

("CML", the "Company" or the "Group")

Proposed cancellation of the Company's Ordinary Shares from the

Official List, proposed admission to trading on AIM and Board

Update

Move to AIM

CML Microsystems Plc, which develops mixed-signal, RF and

microwave semiconductors for global communications markets, today

announces that the Board is proposing to cancel the admission of

the Company's ordinary shares of 5 pence each ("Ordinary Shares")

from the standard segment of the Official List and from trading on

the London Stock Exchange's Main Market for listed securities

("Cancellation") and is proposing to apply for the admission of the

Company's Ordinary Shares to trading on the AIM market ("AIM") of

the London Stock Exchange ("Admission"), such that Cancellation and

Admission (together the "Move to AIM") will take place

simultaneously.

The Listing Rules do not require a company wishing to cancel the

admission of its shares to listing on the standard segment of the

Official List to seek shareholder approval at a general meeting.

Notwithstanding this, the Directors believe that as a matter of

good corporate governance, the Company's shareholders

("Shareholders") should be consulted and accordingly have resolved

that the Cancellation should be subject to shareholder approval by

way of an ordinary resolution ("Cancellation and Admission

Resolution") to be proposed at the Company's Annual General Meeting

("AGM"). Therefore, the Cancellation and Admission Resolution will

be proposed at the Company's forthcoming AGM.

The Board believes that a move to AIM is in the best interests

of the Company and its Shareholders. Following completion of the

sale of its storage division (the "Disposal"), the Group is fully

focussed on a much larger global opportunity within the wireless

communications market and the Board considers that AIM provides a

more appropriate regulatory environment for the Company and its

growth prospects. The Directors also believe that as an AIM

company, certain Shareholders may also benefit from particular

inheritance tax and stamp duty reserve tax exemptions in respect of

their interests in the Company's Ordinary Shares, which are more

attractive than those applicable to a company on the Main Market.

In addition, given the Company's anticipated growth and income

stream (from dividends), being admitted to trading on AIM may also

assist in diversifying the Company's shareholder base.

The Move to AIM will also enable the Company to improve its

flexibility in relation to future corporate actions, complementing

existing capital resources following the recent Disposal. Further

details of the rationale for the Move to AIM will be set out in the

Notice of AGM.

The Company will in due course invite shareholders to vote on

the Move to AIM at the upcoming AGM which is expected to be held on

4 August 2021. Notice of the AGM plus further information on the

move to AIM is expected to be posted to shareholders on or around 2

July 2021 at the same time as the Company's results (which are due

to be announced on 15 June 2021).

Board Update

The Company's former Group Financial Director departed the Group

in February 2020. Since then, Nigel Clark has held the dual role of

Chairman and Group Finance Director on an interim basis, with the

intention of securing a replacement Finance Director. In December

2020, the Group announced the Disposal, the result of which was to

substantially reduce the scale of the Group's operations. The Board

are of the current view, taking into account the strength in depth

of its finance function, and the significant amount of financial

expertise on the Board, that there is now no immediate need to

appoint a Group Financial Director. As a result, Nigel Clark will

become Executive Chairman effective immediately. Nigel Clark will

retain overall responsibility for the finance function at Board

level.

The Group retains ambitious organic growth plans and potentially

by way of acquisitions, as it seeks to utilise the capital

resources it has available on its balance sheet to grow the

business and generate value for its Shareholders. The Board will

keep under constant review the needs of the business and

requirement for additional bandwidth through the appointment of

additional executive and non-executive directors onto the Board,

with appropriate levels of experience and responsibility.

As part of its Board restructuring, the Company also announces

the appointment of Geoff Barnes, an existing independent

Non-Executive Director, as Senior Independent Non-Executive

Director, effective immediately. Jim Lindop, Independent

Non-Executive Director, has been appointed to the Audit Committee,

again with immediate effect.

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Tel: +44(0)1621 875

Managing Director 500

Nigel Clark, Group

Executive Chairman

Shore Capital

Advisory Tel: +44(0)20 7408 4090

Edward Mansfield

James Thomas

John More

Corporate Broking

Fiona Conroy

SP Angel Corporate

Finance LLP Tel: +44(0)203 463 2260

Jeff Keating

Alma PR

Josh Royston Tel: +44 (0)20 3405

Caroline Forde 0212

Robyn Fisher

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEKFEAPFEFA

(END) Dow Jones Newswires

June 01, 2021 06:30 ET (10:30 GMT)

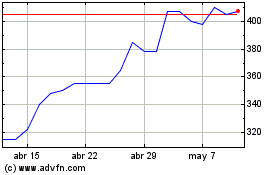

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024