TIDMCMB

RNS Number : 7026D

Cambria Africa PLC

30 June 2021

Cambria Africa Plc

("Cambria" or the "Company")

Interim Results ("the Results")

for the 6 Months ended 28 February 2021 (HY 2021)

EPS of 0.01 US cents and NAV of 1.19 US cents

Cambria Africa PLC ( AIM: CMB ) ("Cambria" or the "Company")

announces its interim accounts for the six months ended 28 February

2021. A copy of this announcement is available on the Company's

website ( www.cambriaafrica.com ).

A Profit after Tax increased three-fold to US $95,000 for the

Half Year 2021 (HY 2021) ended 28 February 2021 compared to $36,000

achieved in the same period in 2020. This profit includes

non-recurring asset sales for items with zero or near-zero book

value in Millchem and Paynet Zimbabwe. While compared to HY 2020,

the Company's Net Asset Value dropped 10% or $704,000 to $6.47

million (1.19 US cents per share) in HY 2021, NAV improved by

$45,000 from $6.23 million at the end of FY 2020.

Excluding minority interests, Profit Attributable to Cambria

Shareholders was $72,000 (0.01 US cents per share) for HY 2021. The

Company's subsidiaries in Zimbabwe continued to operate above

breakeven in both EBITDA and accounting profit despite the

significant shrinkage in its revenue footprint by 60% from US

$1.306 million in HY 2020 to US $526,000 in HY 2021. As expected in

our audited Fiscal Year-end report, the Company's subsidiaries

continue reporting at breakeven levels.

Half Year 2021 Results highlights:

6 Months ended 28 February 2021 (US$'000) HY 2021 HY 2020 % Change

----------------------------------------------- -------- --------- ---------

- Revenue 526 1,306 (60%)

- Operating costs 358 555 (35%)

- Consolidated EBITDA 205 222 (8%)

- Consolidated Profit after tax (PAT) 95 36 164%

- PAT attributable to shareholders (excluding

minority interests) 72 105 (31%)

- Central costs 51 137 (63%)

- EPS - cents 0.01 0.02 (50%)

- NAV 6,468 7,172 (10%)

- NAV per share - cents 1.19 1.32 (10%)

- Weighted average of shares in issue 544,576 544,576 -

- Shares in issue at year end 544,576 544,576 -

Divisional:

- Payserv - consolidated PAT 136 53 157%

- Payserv - consolidated EBITDA 228 180 27%

- Millchem - EBITDA 28 185 (85%)

- Group Highlights HY 2021:

-- Net Equity (NAV) decreased by 10% from US $7.172 million

(1.32 US cents per share) in HY 2020 to $6.468 million (1.19 US

cents per share) in HY 2021. NAV increased marginally by $45,000

from $6.423 million at the end of FY 2020.

-- Group Finance costs dropped by 63% to $13,000 in HY 2021

compared to $35,000 in HY 2020. Finance costs will continue to drop

as the Group's outstanding debt nears zero.

-- Group Revenue continued to drop, as a result of discontinuing

Millchem's industrial sales, to $526,000 from $1.306 million in HY

2020.

-- Cambria's Profit After Tax increased 164% on the back of

asset sales and above break-even operations to $95,000 in HY 2021

compared to $36,000 in HY 2020.

-- Consolidated EBITDA was 8% lower in HY 2021 at $205,000 compared to $222,000 in HY 2020.

Cambria's central costs decreased by 63% to $51,000 compared to

$137,000 in HY 2020. Cambria's CEO and Directors continued to

render services to Cambria without compensation during HY 2021.

-- Foreign currency translation losses and losses attributable

to hyperinflationary accounting in this period were restrained due

to the limited movement in exchange rates and inflation falling to

the 20% range during the period.

- Divisional Highlights

-- Payserv Africa, improved Consolidated Profit after Tax

earnings by 157% to $136,000 in HY 2021 from $53,000 in HY 2020.

This improvement was on the back of improved performance by Autopay

and Tradanet (51% owned subsidiary).

-- Tradanet (Pvt) Ltd, Paynet Zimbabwe's 51% held subsidiary,

continued to provide loan management services to CABS, the

country's largest building society. Improvements in salaries and

allowed increases by CABS to the loan book has allowed improved

performance by Tradanet.

-- Autopay, Paynet Zimbabwe's payroll processing division has

hired a new management team with extensive payroll experience and

established an independent contract relationship with payroll

managers on a pure profit share basis. Despite the shrinkage of its

revenue base in HY 2021, Autopay is operating profitably.

-- Millchem exited the industrial chemical sector and focused on

the sanitizer sector. Despite the resurgence of COVID-19 issues,

its Joint Venture Partner, Merken (Pvt) Ltd has reported

non-material sales of hand sanitizer tubes and bulk disinfectant

and sanitizers. These sales are being audited and Millchem will

invoice Merken upon the completion of this audit of JV sales and

expenses.

Net Equity (Net Asset Value)

The Company reported FY 2020 results in mid-June 2021, little

over two weeks from the publication of this interim report for HY

2021. Since the close of FY 2020 on 31 August 2020, NAV has

improved marginally during HY 2021 by $45,000 on the back of asset

sales and operating profit. Unlike FY 2020 this improvement in NAV

was not impacted by translation losses and hyperinflationary

accounting as asset sales were in USD and the exchange rate and

inflation rates stabilized. It is worth repeating the components of

NAV as at the end HY 2021 which do not differ much from 2020.

Components of NAV at 28 February 2021

The Group NAV of $6.5 million as at the end of HY 2021 consists

of the following tangible and intangible assets:

Building and properties valued at $2.5 million. Management

believes this is a realizable value in US dollars for the Paynet

office headquarters building and the prominently positioned plot

adjacent to it. Management believes this valuation remains valid

and realizable as at the date of this publication

Indirect shareholding of 9.74% of Radar Holdings Limited (4.98

million shares) valued at US $1.743 million (net of minority

interests) or 35 US cents per share. Radar announced a NAV per

share as at the end 30 June 2020 of ZWL 3,821. As at 30 June, 67 US

cents at the official rate of 57.3582 ZWL/USD and 38.21 US cents

per share at the parallel rate of 100 prevailing on that date

according marketwatch.co.zw archives. Based on explanation of the

adverse audit opinion issued by PWC in respect of the Radar June

2020 Financial Statements, we believe the most accurate valuation

of Radar's NAV in USD is to divide by the official rate of ZWL/USD

since the official rate was used to obtain the ZWL rates in the

Radar Statement of Financial Position. Either way, the per share

valuation of 35 US cents on Cambria's Statement of Financial

Position is conservative. An excerpt from PWC adverse opinion on

the Radar's June 2020 Financial Statement follows (emphasis

added):

Valuations rely on historical market evidence for calculation

inputs. ...market evidence for inputs on buildings including

transaction prices for comparable properties, rentals, and costs of

construction were available in US$ at 30 June 2019 when the

independent valuer performed the valuation. The directors performed

the valuation as at 30 June 2020 and used the same USD inputs. In

order to determine the ZWL$ values of the property and equipment

and investment property as at 30 June 2020, US$ inputs were used

and then translated into ZWL$ using the closing interbank exchange

rate . The application of a conversion rate to US$ valuation inputs

to calculate ZWL$ property value is not an accurate reflection of

market dynamics as the risks associated with currency trading do

not reflect the risks associated with property trading. In

addition, as at 30 June 2020 the US$ inputs for valuation were

translated using the interbank rate which is not considered an

appropriate spot rate for translation as required by IAS 21. It was

not practicable to quantify the financial effects of this matter on

the financial statements.

While the above is cryptic, management's conclusion is that the

valuation started in US dollars and was converted at an inflated

value for ZWL - hence should be converted back by the same inflated

value (57.3582 ZWL/USD) yielding a maximum possible value of

Cambria's indirectly held Radar Shares of US $3.34 million. This

optimistic valuation should be tempered by the fact that Cambria

remains a minority shareholder in Hinshaw. Management believes that

this valuation continues to be realizable as at the publication of

this report.

USD Cash and Cash Equivalents - cash net of liabilities outside

Zimbabwe totalled $1.3 million as at 31 May 2021. A further US

$50,000 was held in cash and US dollar denominated accounts in

Zimbabwe. VAL debt fell to $41,000 during HY 2021 significantly

reducing interest costs to $13,000 for the HY and protecting the

remaining cash balances outside Zimbabwe. In valuing the Company's

realizable NAV, we are placing a zero value on the remaining net

monetary assets in Zimbabwe whose value will be to finance the

majority of the subsidiary working capital.

Old Mutual Limited shares - the Company holds 204,047 Old Mutual

Limited common shares suspended on the Zimbabwe Stock Exchange

(ZSE) and valued on its HY 2021 Statement of Financial Position at

US $200,000 based on the closing price of Old Mutual Limited on the

ZSE at suspension. Should the Company be able to repatriate these

shares to Johannesburg Stock Exchange where it purchased them or UK

where these shares continue to trade, their value as at 30 June

2021 based on 67.80 p (LSE) per share is the equivalent of US

$191,468 down from $211,500 reported on 28 May as a result of

depreciation in the value of OM in London and the strengthening of

the US dollar against the pound. By acquiescing to the suspension

of Old Mutual and the discontinuation of fungibility by the

Government of Zimbabwe, Old Mutual plc has forced the Company to

indefinitely hold a position in Old Mutual which is neither its

core business nor in its investments. The Company reiterates its

displeasure with the Board of Old Mutual plc in not protecting its

shareholders in Zimbabwe from the effective freezing of their

shareholding in Old Mutual.

Blocked/Legacy funds of US $1.39 million. This asset sits on the

books at approximately $16,000 due to the official devaluation of

the ZWL from parity to 10.71/USD to the current level of 85/USD.

Management successfully negotiated with the Reserve Bank of

Zimbabwe the payment at parity of $1.25 million and carried the

same on its books at the end of FY 2019 because Cambria had a time

determinate commitment from the Reserve Bank Governor, Dr. John

Mangudya, which was honoured in full during FY 2020. Hence there is

reason to believe that the appropriate and conservative approach of

converting these blocked funds at the prevailing exchange rate may

be a significant underestimation of their realizable value. The

Company intends to negotiate with the RBZ to achieve a win-win

outcome.

Goodwill of US $717,000. The Company has a goodwill value of

$717,000 on its Statement of Financial Position at the current

time. The Company believes this is a fair assessment of its

intangible assets. Despite the shrinkage of Paynet's operations, it

continues to maintain turnaround opportunities in Tradanet and

Autopay when salary levels and market penetration recovers.

Further, it has been apparent that Paynet's technology which was

deployed by the majority of the country's banks to process bulk

salary and merchant payments as well as to clear large transactions

between banks on a gross settlement basis, is yet to be substituted

by a robust inter-platform technology. This FinTech which processed

close to 25 million transactions annually and produced revenues of

over $7 million per annum remains the most cost-effective solution

for the banking industry. The Board of Paynet has approved

licensing an unlabelled version of the product if favourable

transaction terms can be established with a reputable licensor.

The above analysis results in an estimated $6,756,000 (1.24 US

cents per share) in NAV and $6,039,000 (1.11 US cents per share) in

tangible NAV (excluding Goodwill). This estimate can be adversely

or positively impacted by the following factors:

- Central Costs including interest expenses. These costs fell to

$51,000 in HY 2021 and we continue to expect that in FY 2021

Central Costs including interest expenses will be significantly

below $224,000 recorded in FY 2020.

- Eventual price achieved by the sale of Old Mutual shares.

- Commercial Property Values in Zimbabwe. Currently property

values in US dollars have been buoyant and this may well not be

reflected in the Company's property valuations. Much will depend on

government's economic and political policies post-COVID

lockdowns.

- Recovery of Legacy/Blocked Funds at or near parity - this

could add 10 US cents per share to NAV.

- The value of Radar shares. The Company believes that 35 US

cents is a fair realizable value for Radar shares but as this is

highly corelated to residential property values and activity - much

of which is fuelled by diaspora funds - post COVID these values can

increase dramatically.

- Monetizing of Payserv Africa's intellectual property through licensing or equity transfer.

Based on the above analysis the Company believes its tangible,

intangible and realizable NAV are not subject to significant

negative shocks and probably the beneficiary of some positive

outcomes.

Chief Executive's Report

This is probably the shortest CEO report written by Cambria.

Very little has changed since my last CEO report on 15 June 2021

incorporated in our Audited FY 2020 annual report. The "Delta

Variant" of the COVID-19 Virus has resulted in a renewed lockdown

of Zimbabwe's economy. We don't expect that this lockdown will

negatively impact our operations in the short term. The lockdown

may also spur sales of sanitizer products by our Joint Venture

Partner, Merken (Pvt) Ltd.

As I expressed in our Annual Report, Cambria remains with some

hard assets and cash, as well as what I believe continues to be

valuable intellectual property. I do believe that the numbers

achieved by Autopay and Tradanet indicate that these two Payserv

subsidiaries continue to represent meaningful equity for

shareholders over and above the value of Payserv's intellectual

property which we still hope to realize through licensing our

clearing and bulk payment technologies.

We do remain with cash and we are nearly debt free. While we

will jealously guard our cash, we remain alert to possibilities to

deploy these funds to the best advantage of shareholders. Sometimes

the best investment of cash is cash itself.

Samir Shasha

30 June 2021

Contacts

Cambria Africa Plc www.cambriaafrica.com

Samir Shasha +44 (0)20 3287 8814

WH Ireland Limited https://www.whirelandplc.com/

James Joyce / Matthew Chan +44 (0) 20 7220 1666

Cambria Africa Plc

Interim consolidated income statement

For the six-month period ended 28 February 2021

Unaudited Unaudited Audited

6 months 6 months

to to Year to

28-Feb-21 29-Feb-20 31-Aug-20

US$'000 USS'000 US$'000

------------------------------------- ---------- ---------- ----------

Revenue 526 1,306 1,319

Cost of sales (78) (655) (519)

------------------------------------- ---------- ---------- ----------

Gross profit 448 651 800

Operating costs (358) (555) (845)

Other income 69 368 55

Exceptional item - Radar Fair Value

Adjustment (13) (318) (375)

------------------------------------- ---------- ---------- ----------

Operating profit /(loss) 146 146 (365)

Finance income 1 1 1

Finance costs (13) (35) (60)

Net finance costs (12) (34) (59)

------------------------------------- ---------- ---------- ----------

Profit / (loss) before tax 134 112 (424)

Income tax (39) (76) (46)

------------------------------------- ---------- ---------- ----------

Profit / (loss) for the Period 95 36 (470)

===================================== ========== ========== ==========

Attributable to:

Owners of the company 72 105 (408)

Non-controlling Interests 23 (69) (62)

Profit / (loss) for the year 95 36 (470)

===================================== ========== ========== ==========

Earnings/(loss) per share

Basic and diluted earnings/(loss)

per share (cents) 0.01c 0.02c (0.07.c)

Weighted average number of shares

for EPS ('000) 544,576 544,576 544,576

Cambria Africa Plc

Interim consolidated statement of comprehensive income

For the six-month period ended 28 February 2021

Unaudited Unaudited Audited

6 months 6 months

to to Year to

28-Feb-21 29-Feb-20 31-Aug-20

US$'000 USS'000 US$'000

------------------------------------------ ---------- ---------- ----------

Profit / (loss) for the year 95 36 (470)

Other comprehensive income

Items that will not be reclassified

to income statement:

Increase in investment in subsidiary

- impact on equity (72) (74)

Foreign currency translation differences

for overseas operations (28) (256) (511)

Foreign currency translation impact

on non-controlling interests - - -

Total comprehensive profit / (loss)

for the year 67 (292) (1,055)

========================================== ========== ========== ==========

Attributable to:

Owners 44 (223) (993)

Non-controlling interests 23 (69) (62)

Total comprehensive profit / (loss)

for the year 67 (292) (1,055)

========================================== ========== ========== ==========

Cambria Africa Plc

Interim consolidated statement of financial position

As at 28 February 2021

Unaudited Unaudited Audited

Group Group Group

28-Feb-21 29-Feb-20 31-Aug-20

US$'000 US$'000 US$'000

-------------------------------------------- ---- ---------------------- --- ------------------------ --- -----------------------

Property, plant and equipment 2,558 2,680 2,604

Goodwill 717 717 717

Intangible assets 1 1 1

Investments in subsidiaries and associates 2,228 2,228 2,228

Financial Assets at fair value 201 547 201

Total non-current assets 5,705 6,173 5,751

-------------------------------------------------- ---------------------- --- ------------------------ --- -----------------------

Inventories 75 134 102

Financial assets at fair value through

profit and loss 50 30 16

Trade and other receivables 219 191 151

Cash and cash equivalents 1,540 2,328 1,896

Assets for discontinued operation - - -

Total current assets 1,884 2,683 2,165

-------------------------------------------------- ---------------------- --- ------------------------ --- -----------------------

Total assets 7,589 8,856 7,916

================================================== ====================== === ======================== === =======================

Equity

Issued share capital 77 77 77

Share premium account 88,459 88,459 88,459

Revaluation reserve - - -

Share based payment reserve - - -

Foreign exchange reserve (10,763) (10,502) (10,736)

Non- distributable reserves 2,371 2,371 2,371

Retained losses (73,676) (73,233) (73,748)

-------------------------------------------------- ---------------------- --- ------------------------ --- -----------------------

Equity attributable to owners of the

company 6,468 7,172 6,423

Non-controlling interests 506 507 496

Total equity 6,974 7,679 6,919

================================================== ====================== === ======================== === =======================

Liabilities

Loans and borrowing - 7 -

Trade and other payables 65 29 22

Provisions 2 12 1

Deferred tax liabilities 193 215 193

Total non-current liabilities 260 263 216

-------------------------------------------------- ---------------------- --- ------------------------ --- -----------------------

Current tax liabilities 75 56 38

Loans and borrowings 45 510 509

Trade and other payables 235 348 234

Liabilities for discontinued operation - - -

-------------------------------------------- ---- ---------------------- --- ------------------------ --- -----------------------

Total current liabilities 355 914 781

-------------------------------------------------- ---------------------- --- ------------------------ --- -----------------------

Total liabilities 615 1,177 997

================================================== ====================== === ======================== === =======================

Total equity and liabilities 7,589 8,856 7,916

================================================== ====================== === ======================== === =======================

Cambria Africa Plc

Interim consolidated statement of changes in equity

For the six-month period ended 28 February 2021

Foreign

Share Share Revaluation Exchange Retained Non-controlling

US$'000 Capital Premium Reserve Reserve Earnings NDR Total Interest Total

------------------ -------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Balance at 31

August 2019 77 88,459 - (10,251) (73,266) 2,371 7,390 747 8,137

Profit / (loss)

for the period - - - - 105 - 105 (69) 36

(72) (72) (136) (208)

Foreign currency

translation

differences

for overseas

operations - - - (256) - - (256) - (256)

Foreign currency

translation

differences

for overseas

operations - NCI - - - 5 - - 5 (5) -

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Total

comprehensive

profit for the

period - - - (251) 33 - (218) (210) (428)

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Contributions

by/distributions

to

owners of the

Company

recognised

directly in

equity

Dividends paid to

minorities - - - - - - - (30) (30)

NCI on further

investment in A F

Philip & Company - - - - - - - - -

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Total

contributions by

and distributions

to owners of the

Company - - - - - - - (30) (30)

Balance at 29

February 2020 77 88,459 - (10,502) (73,233) 2,371 7,172 507 7,679

=================== ======== ======== ============ ========= ========= ====== =========== ================ =====================

Foreign

Share Share Revaluation Exchange Retained Non-controlling

US$'000 Capital Premium Reserve Reserve Earnings NDR Total Interest Total

------------------ -------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Balance at 1

September 2019 77 88,459 - (10,251) (73,266) 2,371 7,390 747 8,137

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Profit / (loss)

for the period - - - - (408) - (408) (62) (470)

Increase in

investment in

subsidiary

- impact on

equity - - - - (74) (74) (137) (211)

Transfer between

reserves - IAS 29

application - - - - - - - - -

Foreign currency

translation

differences

for overseas

operations - - - (511) - - (511) - (511)

Foreign currency

translation

differences

for overseas

operations - NCI - - - 26 - - 26 (26) -

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Total

comprehensive

profit for the

year - - - (485) (482) - (967) (225) (1,192)

Contributions

by/distributions

to

owners of the

Company

recognised

directly in

equity -

Dividends paid to

minorities - - - - - - - (26) (26)

Total

contributions by

and distributions

to owners of the

Company - - - - - - - (26) (26)

Balance at 31

August 2020 77 88,459 - (10,736) (73,748) 2,371 6,423 496 6,919

=================== ======== ======== ============ ========= ========= ====== =========== ================ =====================

Foreign

Share Share Revaluation Exchange Retained Non-controlling

US$'000 Capital Premium Reserve Reserve Earnings NDR Total Interest Total

------------------ -------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Balance at 1

September 2019 77 88,459 - (10,736) (73,748) 2,371 6,423 496 6,919

Profit for the

period - - - - 72 - 72 23 95

Increase in

investment in

subsidiary

- impact on

equity - - - - - - - - -

Foreign currency

translation

differences

for overseas

operations - - - (28) - - (28) - (28)

Foreign currency

translation

differences

for overseas

operations - NCI - - - 1 - - 1 (1) -

-------- -------- ------------ --------- --------- ------ ----------- ---------------- ---------------------

Total

comprehensive

loss for the

year - - - (27) 72 - 45 22 67

Contributions

by/distributions

to

owners of the

Company

recognised

directly in

equity -

Dividends paid to

minorities - - - - - - - (12) (12)

Total

contributions by

and distributions

to owners of the

Company - - - - - - - (12) (12)

Balance at 28

February 2021 77 88,459 - (10,763) (73,676) 2,371 6,468 506 6,974

=================== ======== ======== ============ ========= ========= ====== =========== ================ =====================

Cambria Africa Plc

Interim consolidated statement of cash flows

For the six-month period ended 28 February 2021

Unaudited Unaudited Audited

6 months 6 months

to to Year to

28-Feb-21 29-Feb-20 31-Aug-20

USS'000 USS'000 USS'000

---------------------------------------------- ---------- ---------- ----------

Cash generated from operations 90 758 605

Taxation paid (2) (33) (43)

----------------------------------------------- ---------- ---------- ----------

Cash generated from operating activities 88 725 562

----------------------------------------------- ---------- ---------- ----------

Cash flows from investing activities

Proceeds on disposal of property,

plant and equipment 72 55 37

Purchase of property, plant and equipment - - -

Net proceeds on disposal of marketable

securities - 227 226

Other investing activities - (210) (210)

Interest received 1 1 1

----------------------------------------------- ---------- ---------- ----------

Net cash from/(used in) investing

activities 73 73 54

----------------------------------------------- ---------- ---------- ----------

Cash flows from financing activities

Dividends paid to non-controlling

interests (12) (30) (26)

Interest paid (13) (35) (60)

Loans repaid (464) (69) (88)

Proceeds from drawdown of loans - - 45

----------------------------------------------- ---------- ---------- ----------

Net cash (utilised)/generated by financing

activities (489) (134) (129)

----------------------------------------------- ---------- ---------- ----------

Net (decrease)/increase in cash and

cash equivalents (328) 664 487

Cash and cash equivalents at the beginning

of the Period 1,896 1,920 1,920

Foreign exchange (28) (256) (511)

Net cash and cash equivalents at the

end of the period 1,540 2,328 1,896

=============================================== ========== ========== ==========

Cash and cash equivalents as above

comprise the following

Cash and cash equivalents attributable

to continuing operations 1,540 2,328 1,896

Net cash and cash equivalents at the

end of the period 1,540 2,328 1,896

=============================================== ========== ========== ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDLFDSEFSEIM

(END) Dow Jones Newswires

June 30, 2021 10:00 ET (14:00 GMT)

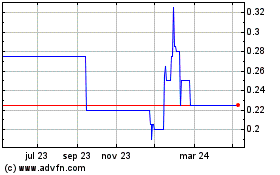

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024