TIDMCASP

RNS Number : 7920H

Caspian Sunrise plc

06 August 2021

Caspian Sunrise PLC

("Caspian Sunrise" or the "Company")

Strategic, Financial, Operational and shareholding update

Introduction

The Board of Caspian Sunrise is pleased to provide the following

strategic, financial and operational update together with details

of new shares to be issued and a reorganisation of the shareholding

of the Oraziman family.

Shareholders are also directed to the responses to shareholder

questions, which will be posted later today to

www.caspiansunrise.com/investors/responsestoshareholdersquestions.

Background

While the past few years have been difficult it seems clear that

the Group has turned the corner both operationally and financially.

Accordingly, we are now in a position to return to a more managed

approach to the development of the Group's assets.

Financial position

Our financial position is materially better in than in recent

times. This better financial position provides the opportunity to

increase the pace at which we seek to develop our assets, and in

particular BNG.

Oil prices

The continued strong oil price provides the backdrop to our

financial position. At $70 plus per barrel the price achieved on

international market is now approximately four times greater than

at the low point of 2020. Additionally, the rapid recent increase

in domestic prices to approximately $19 per barrel is approximately

three times the price received for most of 2020.

Increased production

The additional revenue from the production at our first

horizontal well 154 provides a significant boost to operating

cashflows. We expect this to further improve as production levels

at Well 154 increase and from October as the South Yelemes wells

resume production.

Increased proportion of production to be sold

internationally

We are now close to repaying all the historic local oil trader

funding provided with respect for domestic sales. Once done we

expect a greater share of our total production to be eligible for

international rather than domestic sales.

We own our equipment

In recent years we have opportunistically acquired drilling

equipment at what we consider to be low prices. This significantly

reduces both the drilling costs and the delays in relying on third

party equipment.

As important as the reduced cost is the flexibility that owning

our own equipment provides. We therefore expect to become far more

efficient in undertaking drilling activities.

No external debt

Despite the extremely tight financial position over the past few

years the Group has, with the exception of the amounts due to the

Oraziman family, no external debt.

To further improve the ability to develop assets the Oraziman

family have, subject to independent shareholder and regulatory

approval, agreed to convert their entire debt of approximately $6.2

million to Caspian Sunrise shares to be issued at a price of 3.2p

per share. A General Meeting will be convened in due course to seek

the confirmation of independent shareholders to the terms of such a

conversion.

Dividends

It has been a long-held objective of the group to be a regular

payer of dividends. Accordingly, at the General Meeting referred to

above, shareholders will also be asked to approve a capital

reduction required to allow the payment of dividends.

BNG

Operational update

Production from the BNG Contract Area is currently running at

the rate of 1,950 bopd, with 100% coming from 8 wells on the MJF

structure. Included in this production is a contribution from New

Well 154 of approximately 700 bopd.

Work so far this year on the existing four Deep Wells has not

resulted in any material oil flows.

Operational plans

Next MJF well

Following the success of our first horizontal well, Well 154, we

now plan to drill a horizontal side track from a depth

approximately 2,200 meters from existing Well 153. The side-track

is planned to be approximately 200 meters in length.

We shall use one of our RT50 rigs with the drilling expected to

be complete by the end of August 2021.

Deep Well A8

Also in August 2021, we plan to re-commence drilling A8 from the

current 4,500 meter depth to the original planned depth of 5,300

meters, targeting a possible structure the Devonian. This drilling

work is expected to take approximately two months and will be

undertaken using our G40 rig.

However, we are first clearing a large quantity of dust from the

well before drilling recommences to check for oil flows at the

current 4,500 meter depth.

New Deep Well 802

In September 2021, we plan to spud a new Deep Well 802,

targeting structures in the Devonian. This will be the fifth deep

well at BNG and the second on the Yelemes structure

The well has a planned Total Depth of 5,300 meters and will be

drilled using our RT50 rig. As we have already acquired the casing

for the well and will be using or own rig the additional costs are

expected to be limited to $5 million.

Drilling is expected to take six months to complete.

A5

Deep Well A5 was the first deep well drilled on the BNG Contract

area and is the one we still believe may have the greatest

production levels, once flowing.

We plan to drill a new side-track at this well from a depth of

3,850 meters to 4,500 meters commencing in October 2021 provided we

have access to new drill pipes.

The side-track will be drilled using our G40 rig and once

started is expected to take three months to complete.

Deep Wells A6 & 801

The chemicals used earlier in the year at deep Wells A6 and 801

did not produce the results we hoped for. We are working with

international experts to identify chemicals better suited to work

in extremely high temperatures. It will only be when we have

confidence in the results of this investigative work that we will

look to re-frack both Deep Wells A6 and 801.

3A Best

At 3A Best the responsibility to fund the next stage of

development will rest with our new partners once the updated

licence is issued.

Caspian Explorer

The initial charter for the Caspian Explorer since its

acquisition in October 2020, is due to end in August 2021. While

there has been interest in both multiple future operational

charters and also in acquiring the Caspian Explorer outright to

date none of this interest has translated into a contract.

The income from the first charter more than covers the operating

costs since acquisition and the Board continue to regard the

Caspian Explorer as a valuable asset with the expectation it will

generate meaningful cash for the rest of the Group in the years to

come.

New rig

We have agreed to acquire a further workover rig for a

consideration of $750,000 with the consideration to be settled in

Caspian Sunrise shares to be issued at a price of 2.844p per share.

The new rig will be used initially for workovers on the MJF

structure where some of the earlier wells are showing signs of

decline.

Using an exchange rate of GBP1 - $1.39, would results in

18,972,164 new shares to be issued to the rig owner.

We have also agreed to issue 562,500 shares, credited as fully

paid, to staff below board level as reward for their work on the

successful horizontal well.

Application will made to London Stock Exchange for these shares

to be admitted to trading on AIM ("Admission"), and dealings in the

new ordinary shares are expected to commence on or around 12 August

2021. The new shares will, when issued, rank pari passu in all

respects, and carry the same rights as the existing Ordinary

Shares. Following Admission the total number of ordinary shares in

issue will be 2,110,771,664.

Oraziman family shareholdings

Akku Investments

In December 2020, the Company announced the intention of Aibek

Oraziman and Aidana Urazimanova, the adult children of Kuat

Oraziman, to pool their shares in Akku Investments, a new Kazakh

registered entity.

After further investigation they have decided to retain their

separate beneficial ownerships but have appointed Akku Investments

to act as the discretionary manager of these holdings, including

deciding how the shares are to be voted at General Meetings.

Kuat Oraziman

The Company has also been informed that Kuat Oraziman, the CEO

of the Company, has gifted for zero consideration the 41,485,330

shares equally to Aibek Oraziman and Aidana Urazimanova and

accordingly Kuat Oraziman no longer holds any shares in the

Company.

At today's date the Oraziman family continue to hold 903,429,585

shares representing 42.80% of the shares in issue following the

issue of the new rig consideration shares and the staff reward

shares referred to above.

The beneficial holdings of each member of the Oraziman family

are now:

Aibek Oraziman (non-executive director) # 528,476,278 shares 25.04%

Aidana Urazimanova 374,953,307 shares 17.76%

# Included in the above are 57,369,124 shares held by the late

Mr Rafik Oraziman, which are going through probate.

Following the proposed debt conversion referred to above and

which is conditional on independent shareholder and regulatory

approval the Oraziman family would own 1,042,253,483 shares

representing 46.33 per cent of the total shares in issue.

Comment

Clive Carver, non-executive chairman said

"The improvement in the Group's financial position allows a

return to a more expansive approach to the development of the

Group's assets.

The success of our first horizontal well demonstrates what we

believe may be possible on the two shallow structure at BNG, namely

the MJF and South Yelemes, both of which should have full

international licences by October 2021, with the ability to sell

the majority of oil produced by refence to international rather

than domestic prices.

The intention to clear the way for the commencement of dividend

payments is expected to lead to an increase in the interest in the

Group's shares from investors seeking a regular dividend

return.

We therefore look forward to moving out of a difficult period

into one where we can look forward to further operational

success."

Contacts:

Caspian Sunrise PLC

Clive Carver

Chairman +7 727 375 0202

WH Ireland, Nominated Adviser & Broker

James Joyce +44 (0) 207 220 1666

James Sinclair-Ford

Qualified person

Mr. Asslybek Umbetov, a member Association of Petroleum

Engineers, has reviewed and approved the technical disclosures in

this announcement.

This announcement has been posted to:

www.caspiansunrise.com/investors

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAEPKEEFFEEA

(END) Dow Jones Newswires

August 06, 2021 02:00 ET (06:00 GMT)

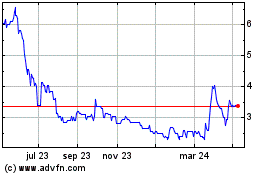

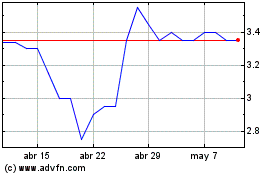

Caspian Sunrise (LSE:CASP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Caspian Sunrise (LSE:CASP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024