TIDMCHRY

RNS Number : 4251Q

Chrysalis Investments Limited

26 February 2021

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than to professional investors in the Republic of Ireland),

Canada, Australia, Japan or the Republic of South Africa.

This announcement contains inside information.

26 February 2021

Chrysalis Investments Limited ("Chrysalis" or the "Company")

Quarterly NAV Announcement

Net Asset Value

The Company announces that as at 31 December 2020 the unaudited

net asset value ("NAV") per ordinary share was 180.75 pence.

The above NAV calculation is based on the Company's issued share

capital as at 31 December 2020 of 400,931,613 ordinary shares of no

par value.

December's NAV represents a 12.3% uplift since 30 September

2020, driven by the strong operational and financial progress of a

number of assets - including several of the Company's major assets

- and the re-rating of listed comparable companies. The following

investee companies were the most significant drivers of the NAV

increase:

-- THG plc ("THG") - which continued its strong share price

performance over the quarter, closing the period at 780p;

-- FinanceApp AG ("wefox") - which saw a substantial rerating of

its closest listed comparators and continues to grow extremely

strongly;

-- Klarna Holding AB - which experienced on-going robust growth

and saw comparable listed peers continue to re-rate; and

-- Starling Bank Limited - reflecting exceptional growth over the course of 2020.

Overview

The trading performance of the portfolio over the period has

remained generally strong. Many of our investee companies are

continuing to benefit from accelerated channel shift, from offline

to online, caused by COVID-19, and in some cases, this is

supporting faster growth rates than earlier in the year.

Portfolio activity

During the quarter, the following follow-on investments were

undertaken:

-- The Company invested a further GBP5m in a Sorted Holdings

Limited by way of a convertible loan to provide it with further

expansion funding; the Future Fund of the British Business Bank

also participated.

-- The Company invested approximately EUR25 million in wefox by

way of convertible loan. This capital will be used to further

accelerate the wefox offering. The company has performed strongly

during lockdown and has publicly stated it is aiming for revenues

of EUR300 million in 2021, up significantly on 2020.

-- The Company invested approximately GBP6 million in Secret

Escapes Limited. While Secret Escapes has seen a material impact

from COVID-19, the Investment Advisor believes its offering and

technology has continued to evolve over 2020, and that it is well

placed to benefit from any upswing in discretionary consumer

spending.

Over the period the Company trimmed approximately 10% of its THG

position into rising prices, reflecting the strong performance of

this investment since its IPO, and to help redeploy into other

follow-ons. The Investment Advisor remains optimistic about the

long-term potential for growth at THG.

Portfolio Composition

As of 25 February2020 the portfolio composition was as

follows:

Portfolio Company % of investment portfolio

Klarna 15.4%

--------------------------

THG 15.3%

--------------------------

TransferWise 12.3%

--------------------------

Starling 11.1%

--------------------------

wefox 11.1%

--------------------------

Embark 9.4%

--------------------------

Graphcore 8.1%

--------------------------

Featurespace 5.9%

--------------------------

You & Mr Jones 5.8%

--------------------------

Secret Escapes 3.0%

--------------------------

Sorted 2.0%

--------------------------

Growth Street 0.2%

--------------------------

Cash 0.4%

--------------------------

Source: Jupiter Investment Management Limited. Holding sizes, as

of 25 February 2020, are calculated using 31 December 2020

valuations, adjusted for FX as of 25 February 2020 and capturing

transactions concluded post the NAV calculation period, and thus

using cash as of 25 February. The holding value of THG is based on

the closing share price of 780p, as at period end. Due to rounding

the figures may not add up to 100%.

Investment Adviser Outlook

Nick Williamson and Richard Watts (co-portfolio managers)

comment:

"The portfolio performed well in aggregate over the quarter,

with the majority of our major investments continuing to see strong

sales traction and consumer engagement. In addition, investor

interest in high-growth names continues to be high, as both private

and public markets digest the longer-term ramifications of tech

disruption and the legacy of COVID-19.

Against this backdrop, we believe the portfolio is well

positioned to continue to perform, and we continue to actively seek

ways to assist our portfolio companies drive further success via

follow-ons. In combination with a strong pipeline of new

opportunities, we believe there is clear potential to deploy

further capital in a value accretive way for shareholders."

Factsheet

An updated Company factsheet will shortly be available on the

Company's website: http://chrysalisinvestments.co.uk

-ENDS-

For further information, please

contact:

Media:

+44 (0) 20 3770 7920

Montfort Communications chrysalis@montfort.london

Charlotte McMullen/ Toto Reissland-

Burghart/ Miles McKenzie

Jupiter Asset Management:

Magnus Spence +44 (0) 20 3817 1325

Liberum:

Gillian Martin / Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown/ Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Elaine Smeja / Aimee Gontier +44 (0) 1481 749364

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at http://chrysalisinvestments.co.uk .

The information contained in this announcement regarding the

Company's investments has been provided by the relevant underlying

portfolio company and has not been independently verified by the

Company. The information contained herein is unaudited.

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBCGDDRGDDGBU

(END) Dow Jones Newswires

February 26, 2021 02:00 ET (07:00 GMT)

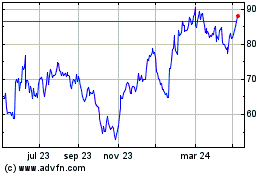

Chrysalis Investments (LSE:CHRY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

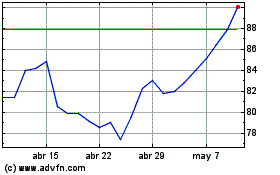

Chrysalis Investments (LSE:CHRY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024