TIDMCOBR

RNS Number : 3694M

Cobra Resources PLC

21 September 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS (SI

2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

21 September 2021

Cobra Resources plc

("Cobra" or "the Company")

Half Year Results

Cobra, a gold exploration company focused on the Wudinna Gold

Project in South Australia, announces its results for the six

months ended 30 June 2021 ("H1 2021").

Key Highlights:

-- Rupert Verco, a highly experienced South Australian mining

specialist, appointed as Chief Executive Officer in July 2021

-- Executed a successful geochemical sampling programme in H1

2021, providing more detailed information on the orientation and

continuity of known mineralisation, as well as refining drill

targets for priority exploration targeting

o The drilling programme in H1 2021 included 138 holes across

two targets

o Post period-end, the Company has drilled a further 875 holes

across eight priority targets

-- The results of the geochemical sampling programme are being

assayed and interpreted. They will underpin the design of the

Reverse Circulation ("RC") drilling programme, expected to commence

around late-October

-- The Company's ongoing exploration activities are progressing

to plan, with Cobra well-placed to achieve the stage 2 earn-in for

the Wudinna Gold Project before the end of 2021, resulting in the

Company increasing its ownership of the project to 65%

Greg Hancock, Chairman of Cobra, commented:

"The first half of 2021 has been a period of detailed data

collection and analysis. It has helped consolidate the geological

models and will provide an excellent springboard for planned

exploration activities. The determination of key pathfinder

elements and their confirmation in saprolite provides a

cost-effective and strategic exploration methods from which we can

prioritise our exploration targets, including some exciting IOCG

prospects. The Company has executed material progress in the first

half and is now very well positioned as we move into the next phase

of exploration."

The full financial statements can be viewed on the Company's

website: https://cobraplc.com/category/financial-reports/

Enquiries:

Cobra Resources plc via Vigo Consulting

Rupert Verco (Australia) +44 (0)20 7390 0234

Dan Maling (UK)

SI Capital Limited (Joint Broker)

Nick Emerson

Sam Lomanto +44 (0)1483 413 500

Peterhouse Capital Limited (Joint

Broker)

Duncan Vasey

Lucy Williams +44 (0)20 7469 0932

Vigo Consulting (Financial Public

Relations)

Ben Simons

Fiona Hetherington

Kendall Hill +44 (0)20 7390 0234

About Cobra

Cobra's Wudinna Gold Project is located in the Gawler Craton

which is home to some of the largest IOCG discoveries in Australia

including Olympic Dam, as well as Prominent Hill and Carrapateena.

Cobra's Wudinna tenements contain extensive orogenic gold

mineralisation and are characterised by potentially open-pitable,

high-grade gold intersections, with ready access to nearby

infrastructure. In total Cobra has over 22 orogenic gold prospects,

with grades of between 16 g/t up to 37.4 g/t outside of the current

211,000 oz JORC resource, as well as one copper-gold prospect, and

four IOCG targets.

Wudinna Project Description

The Eyre Peninsula Gold Joint Venture comprises a 1,928 km(2)

land holding in the Gawler Craton. The Wudinna Gold Project within

the Joint Venture tenement holding comprises a cluster of gold

prospects which includes the Barns, White Tank and Baggy Green

deposits.

Operational Review

In the first six months of 2021, Cobra focused on building on

the encouraging results of the 2020 RC drilling programme, which

realised one of the largest high-grade intersections in the Wudinna

Gold Project's history. The Company has progressed in the first

half of 2021 with advanced geochemical sample collection and

analysis in order to quantify the orientation and continuity of

known mineralisation, as well as to further refine priority

exploration targets.

Despite a booming exploration market in Australia, combined with

travel restrictions related to the COVID-19 pandemic, making access

to sampling rigs challenging, the Company successfully completed

the following sampling programmes in the period:

Calcrete infill sampling multi-element analysis of Barns and

White Tank Resources:

-- Successfully obtained 99 samples at Barns deposit, confirming

the orientation of mineralisation

-- Executed drilling of 39 holes at White Tank, also confirming orientation of mineralisation

The drilling programme continued into the second half, with the

following results:

-- Drilling of 185 holes [for 2,548 metres] at Clarke via RAB

drilling, confirming the orientation and continuity of

mineralisation

-- Drilling of 252 holes [for 1,299 metres] at Baggy Green via

sonic/RAB drilling, confirming current geological interpretations

at Baggy Green North and South

-- Drilling of 130 holes [for 1,963 metres] at Benaud via

aircore, to define priority RC drill targets

-- Drilling of 192 holes [for 302.5 metres] at Barns via

aircore, to test east-west calcrete anomaly and define resource

extensions

-- Drilling of 51 holes [for 453 metres] at Laker via aircore,

to test for granitoid margins, define RC targets and test for

anomolus copper

-- Drilling of 67 holes [for 766.5 metres] at IOCGs 1-3 via

aircore, to test baseline IOCG geochemistry

The data collected from this programme is currently undergoing

detailed geochemical analysis and will be used in the design of the

4,000 metre RC drilling programme, which the Company expects to

commence in late-October.

As we move into the second half, drilling and exploration is

progressing well, and in line with the Company's expectations. As

such, the Company expects to achieve the Stage 2 expenditure

commitment, as agreed in the Heads of Terms agreement with

Andromeda Pty Ltd ("Andromeda"), that will result in Cobra

increasing its ownership of the Wudinna Project from 50% to 65%.

The Company hopes to have confirmed this milestone by the end of Q4

calender year 2021.

During the first half of 2021, an Electronic Programme for

Environmental Protection & Reconciliation ("EPEPR") application

was prepared for the Company's Prince Alfred Copper project, to

enable ongoing exploration. The EPEPR has been submitted and is

currently being assessed.

Corporate Development

Global gold markets have remained strong during the COVID-19

pandemic and the economic outlook is favourable. Furthermore, there

is a strong economic outlook for copper, a key metal in green

technologies such as electric vehicles.

The Company is focused on the Wudinna Project. However, being an

active explorer with a substantial tenement holding in the Central

Gawler Craton, management receives and reviews additional project

opportunities on an ongoing basis as they arise. The Company will

continue to be highly selective in these opportunities, and only

look for those that are best in class and deliver long-term

shareholder value.

In the period, the Company completed a planned move of the

technical office from Perth to Adelaide. The new office location -

in closer proximity to Cobra's key South Australian assets - will

provide a strategic footing when managing its operations.

Financial Review

Cobra reported an unaudited operating loss for the six months

ended 30 June 2021 of GBP 842,631 which equates to a loss per share

for the period of GBP 0. 0025. This compares to a loss for the six

month period to 30 June 2020 of GBP296,424 which equated to a loss

per share for the period of GBP0.0019.

In April 2021, 1,445,713 shares were issued to Hagstrom Drilling

following drilling on the Wudinna Project across 2019 and 2020, and

in line with the Hagstrom Equity agreement which was announced in

August 2020.

As at 30 June 2021, the Company had available cash of GBP1.12m

(30 June 2020: GBP627,696), sufficient for the Company to execute

its planned exporation activities.

Outlook

Cobra's immediate focus for the second half is to execute its

planned exploration activites. Initially this will involve the

completion of the 875 hole geochemical Reverse Air Core (RAB)

sampling programme. The results of the geochemical programme,

coupled with a ground gravity survey, will inform the design of a

4,000m RC programme commencing late-October that will follow up

previous results at Clarke, resource extensions at Barns and Baggy

Green and, pending results, the maiden drilling of IOCG targets to

confirm their prospectivity.

The first half of 2021 has been a period of detailed data

collection and analysis. It has helped us consolidate our

geological models and will provide an excellent springboard for our

planned exploration activities. The determination of key pathfinder

elements and their confirmation in saprolite provides a

cost-effective and strategic exploration method from which we can

prioritise our exploration targets. The Company has executed

material progress in the first half and we are now very well

positioned as we move into the next phase of exploration.

Greg Hancock

Chairman

21 September 2021

Consolidated Income Statement

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

Revenue - - -

Other income - - 50,280

Administrative expenses (232,626) (296,424) (1,057,030)

IPO expenses - -- --

Operating loss (232,626) (296,424) (1,006,750)

Loss on derecognition

of financial liability* (610,005) - -

Loss on ordinary activities

before taxation (842,631) (296,424) (1,006,750)

Tax on loss on ordinary - - -

activities

------------ -------------- --------------

Loss for the financial

period attributable

to equity holders (842,631) (296,424) (1,006,750)

------------ -------------- --------------

Loss per share -

see note 4 GBP(0 GBP(0.0019) GBP(0.0035)

Basic and diluted . 0025)

* The loss on derecognition of financial liabilities is a

reflection of the Consideration shares paid to the previous Lady

Alice Mines unit holders upon completion of Stage 1 earn-in as

agreed upon at time of acquisition, and the value of the 31,049,819

shares issued at 2.4p per share as settlement of the liability

during the period.

Consolidated Statement of Comprehensive Income

6 months 6 months Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (842,631) (296,424) (1,006,750)

Items that may subsequently

be reclassified to

profit or loss:

* Exchange differences on translation of foreign

operations (66,640) 25,498 66,916

Total comprehensive

loss attributable

to equity holders

of the parent company (909,271) (270,926) (939,834)

---------- ---------- -------------

Consolidated Statement of Financial Position

6 months 6 months Year ended

to 30 June to 30 31 December

2021 June 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Non-current assets

Intangible assets 1,556,680 701,676 1,495,519

Property, plant and

equipment 2,040 2,693 2,400

-------------- -------------- --------------

Total non-current

assets 1,558,720 704,369 1,497,919

-------------- -------------- --------------

Current assets

Trade and other receivables 26,911 46,143 69,408

Cash and cash equivalents 1,121,787 627,694 1,338,851

-------------- -------------- --------------

Total current assets 1,148,698 673,837 1,408,259

-------------- -------------- --------------

Non-current liabilities

Deferred consideration (187,500) (350,066) (322,691)

-------------- -------------- --------------

Current liabilities

Trade and other payables (85,414) (74,785) (169,314)

Deferred consideration (135,191) (28,867) (188,721)

-------------- -------------- --------------

Total current liabilities (220,605) (453,718) (358,035)

-------------- -------------- --------------

Net assets/(liabilities) 2,299,313 924,488 2,225,451

============== ============== ==============

Capital and reserves

Share capital 3,283,845 1,872,692 2,829,566

Share premium 1,093,027 497,376 564,173

Share based payment

reserve 993,448 69,038 1,006,239

Retained losses (3,069,823) (1,538,655) (2,239,982)

Foreign currency

reserve (1,184) 24,037 65,456

-------------- -------------- --------------

Total equity 2,299,313 924,488 2,225,451

-------------- -------------- ==============

Consolidated Statement of Cash Flows

6 months 6 months Year ended

to to 30 June 31 December

30 June 2020 2020

2021

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Operating loss (842,631) (296,424) (1,006,750)

Equity settled share

based payment 20,000 - 265,189

Depreciation 360 735 1,028

Foreign exchange (66,640) 25,498 66,916

Change in estimate of

contingent consideration - - 161,346

Loss on derecognition

of financial liability 610,005 - -

Decrease/(increase)/

in receivables 42,496 (8,710) (31,975)

(Decrease)/increase

in payables (137,431) (548,386) (482,725)

Net cash used in operation

activities (373,841) (827,288) (1,026,971)

------------ ------------ -------------

Cash flows from investing

activities

Payments for exploration

and evaluation activities (61,161) (89,433) (883,277)

Net cash (used)/generated

in investing activities (61,161) (89,433) (883,277)

------------ ------------ -------------

Cash flows from financing

activities

Proceeds from issue

of shares 128,044 1,508,514 3,428,384

Transaction costs of

issue of shares - (59,960) (186,961)

Shares issued in lieu - 88,188 -

of fees

Shares issued in lieu 89,894 - -

of cash

Net cash generated from

financing activities 217,938 1,536,742 3,241,423

------------ ------------ -------------

Net (decrease)/increase

in cash and cash equivalents

Cash and cash equivalents (217,064) 620,021 1,331,176

at the beginning of

period 1,338,851 7,675 7,675

------------ ------------ -------------

Cash and cash equivalents

at end of period 1,121,787 627,696 1,338,851

------------ ------------ -------------

Consolidated Statement of Changes in Equity

Share Share Share Retained Foreign Total

capital premium based earnings currency

payment reserve

reserve

GBP GBP GBP GBP GBP GBP

At 31 December

2019 672,335 160,992 69,038 (1,242,232) (1,461) (341,328)

---------- ------------ ---------- ------------ ---------- -------------

Loss for the

period - - - (296,424) - (296,424)

---------- ------------ ---------- ------------ ---------- -------------

Total comprehensive

income - - - (296,424) - (296,424)

---------- ------------ ---------- ------------ ---------- -------------

At 30 June 2020 672,335 160,992 69,038 (1,538,656) (1,461) (637,752)

---------- ------------ ---------- ------------ ---------- -------------

Loss for the

period - - - (710,326) - (710,326)

---------- ------------ ---------- ------------ ---------- -------------

Translation

differences - - - - 66,917 66,917

---------- ------------ ---------- ------------ ---------- -------------

Total comprehensive

income - - - (710,326) 66,917 (643,409)

Share capital

issued 2,157,231 1,537,142 - - - 3,694,373

Cost of share

issue - (1,133,961) - - - (1,133,961)

Share based

payment expired - - (3,833) 3,833 - -

Exercise of

options & warrants - - (17,967) 5,167 - (12,800)

Share warrant

charge - - 947,000 - - 947,000

Share option

charge - - 12,000 - - 12,000

---------- ------------ ---------- ------------ ---------- -------------

At 31 December

2020 2,829,566 564,173 1,006,238 (2,239,982) 65,456 2,225,451

Loss for the

period - - - (842,631) - (842,631)

Translation

differences - - - - (66,640) (66,640)

---------- ------------ ---------- ------------ ---------- -------------

Total comprehensive

income - - - (842,631) (66,640) (909,271)

Share capital

issued 454,279 528,854 - - - 983,133

Cost of share - - - - - -

issue

Transfer of

warrants exercised - - (12,790) 12,790 - -

---------- ------------ ---------- ------------ ---------- -------------

Total contributions

by and distributions

to owners of

the Company 454,279 528,854 (12,790) 12,790 - 983,133

---------- ------------ ---------- ------------ ---------- -------------

At 30 June 2021 3,283,845 1,093,027 993,448 (3,069,823) (1,184) 2,299,313

Half-yearly report notes

1. Half-yearly report

This half-yearly report was approved by the Directors on 21

September 2021.

The information relating to the six month periods to 30 June

2021 and 30 June 2020 are unaudited.

The information relating to the year to 31 December 2020 is

extracted from the audited financial statements of the Company

which have been filed at Companies House and on which the auditors

issued an unqualified audit report. The condensed interim financial

statements have not been reviewed by the Company's auditor.

2. Basis of accounting

The report has been prepared using accounting policies and

practices that are consistent with those adopted in the statutory

financial statements for the period ended 31 December 2020,

although the information does not constitute statutory financial

statements within the meaning of the Companies Act 2006. The

half-yearly report has been prepared under the historical cost

convention.

Going concern

The Company's day-to-day financing is from its available cash

resources.

Post period-end in July 2021, the Company had GBP1.12m of cash

at hand. These funds will enable to Company to execute its planned

exploration campaigns across its key projects within the second

half of the year. The Directors are confident that adequate funding

can be raised as required to meet the Company's current and future

liabilities.

For the reasons outlined above, the Directors are satisfied that

the Company will be able to meet its current and future

liabilities, and continue trading for the foreseeable future, and,

in any event, for a period of not less than twelve months from the

date of approving this report. The preparation of these financial

statements on a going concern basis is therefore considered to

remain appropriate.

These half-yearly financial statements are prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union and the Disclosure and Transparency Rules of the

UK Financial Conduct Authority.

This half-year report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report should be read in conjunction with the annual report for the

year ended 31 December 2020, which have been prepared in accordance

with International Financial Reporting Standards (IFRS) as adopted

by the European Union.

The Company will report again for the full year to 31 December

2021.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in the Company's 2019 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

Half-yearly report notes, continued

2. Basis of accounting, continued

Intangible assets

Exploration and development costs

All costs associated with mineral exploration and investments

are capitalised on a project-by-project basis, pending

determination of the feasibility of the project. Costs incurred

include appropriate technical and administrative expenses but not

general overheads. If an exploration project is successful, the

related expenditures will be transferred to mining assets and

amortised over the estimated life of economically recoverable

reserves on a unit of production basis.

Where a licence is relinquished or a project abandoned, the

related costs are written off in the period in which the event

occurs. Where the Group maintains an interest in a project, but the

value of the project is considered to be impaired, a provision

against the relevant capitalised costs will be raised.

The recoverability of all exploration and development costs is

dependent upon the discovery of economically recoverable reserves,

the ability of the Group to obtain necessary financing to complete

the development of reserves and future profitable production or

proceeds from the disposition thereof.

3. Intangible assets

6 months Period Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

At Beginning of the

period 1,495,519 612,242 612,242

------------- ---------- -------------

Additions 61,161 89,434 883,277

At End of the period 1,556,680 701,676 1,495,519

------------- ---------- -------------

The Directors undertook an assessment of the following areas and

circumstances that could indicate the existence of impairment:

-- The Group's right to explore in an area has expired, or will

expire in the near future without renewal;

-- No further exploration or evaluation is planned or budgeted

for;

-- A decision has been taken by the Board to discontinue

exploration and evaluation in an area due to the absence of a

commercial level of reserves; or

-- Sufficient data exists to indicate that the book value will

not be fully recovered from future development and production.

Following their assessment, the Directors concluded that no

impairment charge was necessary for the period ended 30 June

2021.

Half-yearly report notes, continued

4. Earnings per share

6 months Period Year ended

to to 31 December

30 June 30 June 2020

2021 2020

Unaudited Unaudited Audited

GBP GBP GBP

These have been calculated (296, 424 (1,006,

on a loss of: (842,631) ) 750 )

-------------- ----------- -------------

The weighted average

number of shares 156,577, 282,956,

used was: 328,384,591 093 585

-------------- ----------- -------------

Basic and diluted GBP(0. GBP(0. GBP(0.

loss per share: 0025 ) 0019 ) 0035 )

-------------- ----------- -------------

5. Events after the reporting period

There were no reportable events after the reporting period other

than those highlighted in the 'Financial Review'.

The Condensed interim financial statements were approved by the

Board of Directors on 21 September 2021.

By order of the Board

Rupert Verco

Chief Executive Officer

21 September 2021

Half-yearly Report

Copies of this half-yearly report are available free of charge

by application in writing to the Company Secretary at the Company's

registered office: 9(th) Floor, 107 Cheapside, London, EC2V 6DN, or

by email to info@london-registrars.co.uk .

Responsibility Statement

We confirm that to the best of our knowledge:

-- The interim financial statements have been prepared in

accordance with International Accounting Standard 34, Interim

Financial Reporting, as adopted by the EU;

-- Give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- The interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- The interim financial information includes a fair review of

the information required by DTR 4.2.8R of the Disclosure and

Transparency Rules, being the information required on related party

transactions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCCBDDGBG

(END) Dow Jones Newswires

September 21, 2021 02:00 ET (06:00 GMT)

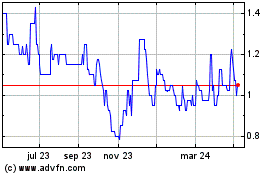

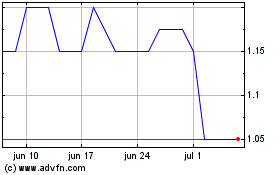

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024