TIDMEUA

Eurasia Mining PLC

14 January 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

14 January 2022

Eurasia Mining Plc

Kola Nickel Incorporation

Eurasia Mining Plc ("Eurasia" or the "Company"), the palladium,

platinum, rhodium, iridium and gold producing company, is pleased

to announce that Eurasia has incorporated a 100% beneficially owned

subsidiary, Kola Nickel LLC, following the Tier-1 Scale JORC

Mineral Resource Estimate produced by Wardell Armstrong

International ("WAI") at NKT, a nickel mine formerly operated by

Norilsk Nickel (as announced via RNS on 16 December 2021).

Highlights:

-- Nickel is now the main metal in Eurasia's basket of metals

(on a Net Smelter Royalty basis) following the JORC Mineral

Resource Estimate produced by Wardell Armstrong International at

NKT. Work is being finalised on the high-grade veins part and the

open pit part of NKT, as well as on the assaying to upgrade the

resource to be separately announced in due course (please refer to

RNS dated 16 December 2021).

-- Kola Nickel LLC was incorporated as Eurasia's 100%

beneficially owned subsidiary in order to carve out all the nickel

assets of Eurasia into one subsidiary company.

-- Similar to NKT, Nyud's main metal is also nickel. Nyud is

included in the agreement with Rosgeo (for more information on Nyud

please refer the last bullet point below and RNS of 26 August

2021).

-- Wardell Armstrong International was engaged by Eurasia to

produce JORC Mineral Resource Estimate at Nyud, as well as a CPR

and net present value model. The results of this engagement is

almost complete and will be announced separately.

-- Like NKT, Nyud is a nickel open pit mine previously operated

by Norilsk Nickel. A trial open pit was developed at Nyud by

Norilsk Nickel and nickel dominant ore was shipped directly to

Severonickel, the world's largest nickel processing plant. Similar

to NKT, the Nyud area is well served with the infrastructure

required for the relaunch of mining and processing and the tailings

will be used as backfill for the old NKT mine developed in the

past, following the best practices in ESG and saving on the

tailings storage facility capital expenditure.

Christian Schaffalitzky, Executive Chairman of Eurasia

commented: " The Directors are focused on further prioritising

nickel as Eurasia's main metal, while we consolidate formerly

operating nickel mines in one subsidiary company. We continue to

observe significant interest in nickel dominant mines, especially

in the ones closer to production like formerly operating NKT and

Nyud brownfields relaunch ".

James Nieuwenhuys, CEO and Managing Director of Eurasia

commented: "The Board members are looking forward to finalising the

consolidation of formerly operating nickel mines on the Kola

Peninsula. Splitting our nickel, PGM and hydrogen projects into

separate subsidiary companies allows us to execute on our strategy

as announced".

Glossary

"Tier 1 Scale" means deposits that are "company making". They

are large, long life and low cost. Using long run commodity prices,

they generate >$300-600 million per annum of revenue and are in

the bottom quartile of the cost curve. They have very robust

economics and will be developed irrespective of the current

business cycle and whether the deposit has been fully drilled out

for resource and reserves purposes. It is expected that the

economics of the deposit will achieve a >12% internal rate of

return after-tax.

A copy of this announcement is also available on Eurasia's

website at:

https://www.eurasiamining.co.uk/investors/news-announcements.

For further information, please contact:

Eurasia Mining Plc +44 (0) 20 7932 0418

Christian Schaffalitzky / Keith Byrne

SP Angel (Nominated Advisor and Joint Broker)

Ewan Leggat / David Hignell / Adam Cowl +44 (0) 20 3470 0470

Optiva Securities (Joint Broker)

Christian Dennis +44 (0) 20 3137 1902

About Eurasia Mining Plc

Eurasia Mining plc is a PGM and battery metals producing

company, operating the established West Kytlim Mine in the Urals,

and also being the operator of the Monchetundra Project comprising

two predominantly palladium open pit deposits located 3km away from

Severonickel, one of Norilsk Nickel's largest base metals and PGM

processing facilities, near the town of Monchegorsk on the Kola

Peninsula.

Eurasia's project portfolio also includes

Nittis-Kumuzhya-Travyanaya (NKT), Tier-1 scale Nickel mine formerly

operated by Norilsk Nickel.

A parallel business development strategy based on the Hydrogen

Economy forms a new development arm of the Company.

About Wardell Armstrong International

Wardell Armstrong International is a multidisciplinary

Environmental, Engineering and Mining consultancy operating in the

UK and internationally helping clients get the best possible

financial returns - while doing things in a sustainable,

responsible way, continually improving environmental performance in

own activities and in the advice to the clients.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRASFAFDLEESESF

(END) Dow Jones Newswires

January 14, 2022 08:11 ET (13:11 GMT)

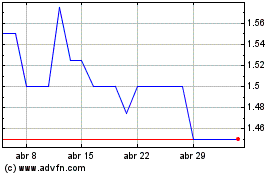

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eurasia Mining (LSE:EUA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024