TIDMINS

RNS Number : 3130K

Instem plc

01 September 2021

Instem plc

("Instem" or "the Company" or "the Group")

Earnings Enhancing Acquisition of PDS Pathology Data Systems

Consolidates Non-Clinical Market; Further Extending Instem's

Leadership in Study Management and Regulatory SEND Submission

Support

Instem plc (AIM: INS), a leading provider of IT solutions to the

global life sciences market, announces the acquisition of life

sciences software company PDS Pathology Data Systems Ltd ("PDS")

for a total enterprise value of CHF 14.25m (c.GBP11.4m). The

consideration will be satisfied by a combination of cash and

ordinary shares in the Company (the "Acquisition").

Highlights

-- Further extends Instem's Study Management and SEND market share

-- Deepens Instem's relationships with some of its largest clients

-- Opportunity for competing product and service rationalisation to:

o Enhance client experience

o Increase operating margin

-- The Acquisition is expected to be immediately earnings enhancing

About PDS

Headquartered in Switzerland with offices in the United States

and Japan, PDS has been a direct competitor of Instem for over 25

years. PDS provides software for non-clinical study management and

software and outsourced services for regulatory submissions using

SEND (the Standard for the Exchange of Non-clinical Data). Seven of

the world's top ten pharmaceutical companies have relied on PDS, as

have leading contract research organisations, chemical companies,

universities and regulatory agencies.

PDS has a highly experienced and respected team with deep

product and market domain expertise in non-clinical study

management and the complex and continually evolving area of SEND

submissions.

In the year ended December 2020, PDS had unaudited, normalised

profits before tax of CHF 0.75m (c. GBP0.6m) on sales of CHF 6.5m

(c. GBP5.1m), of which CHF 2.3m (c. GBP1.8m) was recurring SaaS and

software maintenance revenue. As at 31 December 2020, PDS had net

liabilities of CHF 1.5m (c. GBP1.2m), including loans from its

shareholders of approximately CHF 3.0m (c. GBP2.4m). These loans

will be settled in full out of the proceeds received by PDS

shareholders.

Increased Opportunity

Instem will fully integrate approximately 35 additional PDS

staff into its operations and expects to retain all of the combined

workforce. The Acquisition will immediately increase Instem's

operational capacity, providing an opportunity to combine teams

operating in the significant United States, Swiss and Japanese

markets.

The Acquisition will enable Instem to concentrate investment on

a single line of SEND and preclinical study management products,

removing unnecessary duplication in the market. The combination of

technologies and highly experienced teams will enable the Company

to enhance the development and delivery of existing and new

solutions that provide higher value to its clients.

The Acquisition will also enable Instem to further strengthen

its relationship with joint clients - 70% of PDS' top 20 clients

are already clients of Instem. The Acquisition also broadens

Instem's customer base, with the addition of over 30 new clients

providing opportunities for the cross-selling of the wider Instem

product and service portfolio.

Terms of the Acquisition

The consideration comprises CHF 8.2m payable to the sellers of

PDS on completion of the Acquisition (the "Initial Consideration"),

CHF 3.0m of seller loan repayments, CHF 2.0m to satisfy other net

PDS liabilities and CHF 1.0m of deferred consideration (the

"Deferred Consideration").

The Initial Consideration is being satisfied by CHF 4.7m in cash

(c. GBP3.8m) and CHF 3.5m (c. GBP2.8m) in new ordinary shares of 10

pence each in the Company (the "Consideration Shares"), equating to

the issue of 359,157 shares at a deemed price of a 777 pence per

share. The cash payment, loan repayments and other net liabilities

payments are being funded from the Group's existing financial

resources.

The shareholders of PDS comprise the founder and a holding

company, PDS Group Holding AG, owned by one current and one former

executive of the company ("the Vendors"). Other than CEO Vicente

Nogués who is retiring, all of the PDS executives and employees

will continue to be employed by the Group following the

Acquisition. The Vendors will be subject to lock-in agreements,

precluding them from selling 179,579 of their Consideration Shares

prior to the 9-month anniversary of completion of the Acquisition

and the remaining 179,578 for a further 9 months.

The Deferred Consideration, to be satisfied in cash, comprises

CHF 1m payable to the Vendors on the 12-month anniversary of

completion.

Issue of Equity

Application has been made to the London Stock Exchange for the

admission to trading of the 359,157 Consideration Shares to AIM

("Admission"). It is expected that Admission will occur and that

dealings will commence at 8.00 a.m. on 7 September 2021. The

Consideration Shares will rank pari passu with the existing

ordinary shares in the Company.

Total Voting Rights

Following the issue and allotment of the above Consideration

Shares, the Company's issued share capital comprises 22,139,856

ordinary shares of 10 pence each. The Company does not hold any

ordinary shares in treasury, therefore the total number of voting

rights in the Company is 22,139,856.

The figure of 22,139,856 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change of their

interest in, the Company under the FCA's Disclosure and

Transparency Rules.

Investor Presentation

Management will be hosting a presentation through the digital

platform Investor Meet Company later this month when it announces

results for the six months to 30 June 2021, providing an

opportunity to talk more about today's acquisition.

Investors can sign up for free and request to attend the

presentation via the following link

https://www.investormeetcompany.com/instem-plc/register-investor

Questions can be submitted pre-event via your Investor Meet

Company dashboard up until 9am the day before the meeting or at any

time during the live presentation.

Phil Reason, CEO of Instem, commented: "We are delighted to have

completed our third acquisition of 2021 which, along with the

Company's strong organic growth, ensures that Instem is positioned

as the foremost authority and driving force in generating,

analysing and leveraging data from discovery through late-stage

clinical trials.

"We have known the team at PDS for many years and are well aware

of their industry standing. We have spoken on several occasions

about a potential combination and are delighted that they have

agreed to join us at Instem, at a time when both of our businesses

and the life sciences market are thriving. We look forward to

integrating the business and benefiting from the scale and

increased reach that will further cement our leading market

position".

Vicente Nogués, CEO at PDS, commented: "This was a natural next

step in our quest to help clients do more and go further than ever

before. Our mission, values and overall company cultures are

aligned very well - which was the highest of priorities for

PDS.

"As part of Instem, our clients will now have access to the most

comprehensive range of solutions found in the market today backed

by excellent customer service, while our staff will enjoy

additional opportunities for professional growth. Together, we are

looking forward to advancing the ever-important mission of helping

clients to bring their life enhancing products to market

faster".

For further information, please contact:

Instem plc Via Walbrook

Phil Reason, CEO

Nigel Goldsmith, CFO

Singer Capital Markets (Nominated

Adviser & Broker) +44 (0) 20 7496 3000

Peter Steel

Alex Bond

Rachel Hayes

Walbrook Financial PR +44 (0) 20 7933 8780

Tom Cooper instem@walbrookpr.com

Nick Rome

Nicholas Johnson

About Instem

Instem is a leading provider of IT solutions & services to

the life sciences market delivering compelling solutions for Study

Management and Data Collection; Regulatory Solutions for

Submissions and Compliance; and Informatics-based Insight

Generation.

Instem solutions are in use by over 600 customers worldwide,

including all the largest 25 pharmaceutical companies, enabling

clients to bring life enhancing products to market faster. Instem's

portfolio of software solutions increases client productivity by

automating study-related processes while offering the unique

ability to generate new knowledge through the extraction and

harmonisation of actionable scientific information.

Instem products and services address aspects of the entire drug

development value chain, from discovery through to market launch.

Management estimate that over 50% of all drugs on the market have

been through some part of Instem's platform at some stage of their

development.

To learn more about Instem solutions and its mission, please

visit www.instem.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQDKDBDNBKBAFN

(END) Dow Jones Newswires

September 01, 2021 02:00 ET (06:00 GMT)

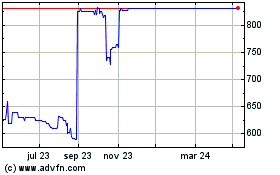

Instem (LSE:INS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Instem (LSE:INS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024