TIDMJLP

RNS Number : 2975U

Jubilee Metals Group PLC

02 December 2021

Jubilee Metals Group Plc

Registration number (4459850)

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

2 December 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

Jubilee Metals Group Plc

("Jubilee" or the "Company" or the "Group")

Audited results for the year ended 30 June 2021

Notice of Annual General Meeting and availability of Annual

Financial Statements

Jubilee, the AIM and Altx traded metals processing company is

pleased to announce its audited results for the year ended 30 June

2021.

Financial Highlights

o Total revenue for the year increased by a strong 143% to GBP

133 million (ZAR 2.8 billion)(1) (2020: GBP 54.8 million (ZAR 1.1

billion))

o Attributable operational earnings(2) growth of 183% to GBP 71

million (ZAR 1.5 billion) (2020: GBP 25 million (ZAR 494.5

million)) and a return on equity of 35.4%, compared with 21.2% in

the previous year

o Adjusted(3) profit before tax up 324% to GBP 52 million (ZAR

1.1 billion) (2020: GBP 12.3 million (ZAR: 242 million))

o Profit after tax adjusted for non-cash expenses including

impairments, gain on bargain purchase and share based payments up

194% to GBP 49 million (ZAR 1 billion) (2020: GBP 17 million (ZAR:

331 million))

o Adjusted earnings per share up 163% to 2.25 pence (ZAR 46.66

cents) (2020: 0.86 pence (ZAR 16.9 cents))

o Revenue and earnings growth was achieved during a period of

substantial infrastructure investment, integration and planned

operational downtime and has provided a tremendous platform for

further future growth

o Jubilee delivered strong cash flows from operating activities

of GBP 23.8 million (ZAR 108 million) (2020: positive cash flow of

GBP 19.4 million (ZAR 415.4 million))

o During the year under review, a total of GBP 19.8 million (ZAR

391.9 million) was invested in acquisitions and purchases of

property, plant and equipment compared with the previous year's

total investment of GBP 26.1 million (ZAR 558 million) while a

further GBP 1.8 million (ZAR 35.5 million) (2020: GBP 4.2 million

(ZAR 89 million)) of external debt obligations were repaid

o Earnings per share up 93%, to 1.81 pence (ZAR 37.50 cents)

(2020: 0.94 pence (ZAR 18.47 cents))

o The Group boosted its operating profit by a strong 189%, to

GBP 45.9 million (ZAR 949 million) (2020: profit of GBP 15.9

million (ZAR 313.2 million)), with an operating margin of 35%

(2020: 29%)

o The Group's balance sheet strengthened substantially, with

total assets increasing by 49 %, to GBP 195 million (ZAR 3.9

billion) (2020: GBP 130.6 million (ZAR 2.8 billion))

o Total equity increased to GBP 136.5 million (ZAR 2.7 billion),

from GBP 94.2 million (ZAR 2 billion) the year earlier, maintaining

a strong equity ratio of 70% (2020: 72%)

o The Group's gearing remains low, with the net cash position

and current assets(4) covering 147% (2020: 92.7%) of total

liabilities

1. For income statement purposes conversions are at the average

GBP:ZAR rates for the period under review and for balance sheet

purposes at the spot rate as at year end. All other conversions are

at rates at the time announced

2. Attributable operational earnings represent Jubilee's net

share of

operational earnings after distributions to JV partners and before development costs

3. Adjusted for non-cash expenses including impairments, gain on

bargain purchase and share based payments

4. Current assets include inventory, trade and other receivables

and

cash and cash equivalents

Operational Highlights

o Achieved stated target of 50 162 PGM(5) ounces for FY2021 (up

23% compared with 40 743 ounces for FY2020); this was achieved

during a period which included the construction and commissioning

of two new chrome beneficiation facilities and the commencement of

the construction of the expanded and refocused Inyoni PGM

operation

o Chrome Operations delivered 751 223 tonnes of chrome

concentrate (2020: 377 883 tonnes), generating chrome revenue of

GBP 34.5 million (ZAR 714 million) (2020: GBP 17.2 million (ZAR

339.1 million)) on the back of increased operational capacities;

this is set to increase further with the commencement of

commissioning of the new Chrome Beneficiation circuit completed

during Q2 CY2021

o Secured the rights to a further approximately 150 million

tonnes of copper containing surface tailings, targeted to be

upgraded at site before refining at Jubilee's targeted Northern

Refinery in Zambia. This will be done through a joint operation

with the mining rights' holder. Project Elephant alone holds the

potential to produce copper concentrates in excess of the total

Sable Refinery capacity of 14 000 tonnes per annum of copper

cathode

o Copper production reached 2 026 tonnes since commissioning as

part of enabling operational readiness to accept first copper

concentrate production from Project Roan. Project Roan's integrated

copper concentrator is on track for commissioning by January

2022

o Sable Refinery achieved positive earnings as part of its

operational readiness activities with attributable operating

earnings of GBP 3.7 million for FY2021 compared with GBP 1.2

million for FY2020

5. 6 Element Platinum Group Metals (platinum, palladium,

rhodium, ruthenium, iridium + gold)

Operational Highlights Post the Period Under Review

o On 24 August 2021, Jubilee executed a binding Memorandum of

Understanding with Mopani Copper Mines Plc, a subsidiary of ZCCM

Investment Holdings Plc in Zambia, ("Mopani", "ZCCM" and

collectively the "Parties") for the implementation of additional

copper and cobalt refining capacity as part of the implementation

of Jubilee's Northern Copper and Cobalt Refining Strategy (the

"Agreement")

o The Northern Refining Strategy targets to establish an initial

17 000 tonnes of copper refining capacity in addition to the Sable

Refinery's 14 000 tonnes per annum. In addition, a cobalt refining

capacity is being targeted as part of the Northern Refining

Strategy

o The Northern Refining Strategy targets the processing of the

Kitwe and Luanshya copper and cobalt tailings project to fast track

the implementation of the Project which has access to more than 275

million tonnes of tailings

o The Northern Refining Strategy offers the opportunity for

accelerated investment into the region

o Jubilee is committed to prioritising local employment for the

accelerated Project implementation

o Project Roan successfully navigated the challenges posed by

Covid-19 restrictions and is set to commence commissioning

targeting to reach commercial production by Q1 CY2022

o The expansion project of Inyoni PGM operations including an

extended recovery circuit to target a variety of feed materials,

was completed during October 2021

o On 15 September 2021, Jubilee successfully concluded the

buy-out of the JV partner in Project Roan while also increasing its

JV position at Project Elephant.

Key financial and operational indicators

12 months 12 months

Unit to to

30 June 30 June

2021 2020

==================================== ======= ========= =========

Group

Revenue GBP'000 132 845 54 775

Attributable earnings (1) GBP'000 71 112 25 088

Attributable earnings margin % 54 46

EBITDA GBP'000 50 335 22 210

Adjusted EBITDA (2) GBP'000 52 153 22 643

Adjusted EBITDA margin % 39 41

==================================== ======= ========= =========

PGM

PGM revenue GBP'000 88 754 34 590

PGM revenue $'000 112 779 43 594

Attributable PGM earnings GBP'000 62 847 21 486

Attributable PGM earnings $'000 84 632 27 079

Attributable PGM earnings margin % 75 62

Attributable PGM ounces produced oz 50 162 40 743

PGM revenue per ounce $/oz 2 248 1 070

PGM attributable earnings per ounce $/oz 1 687 665

Adjusted PGM production unit cost

(3) $/oz 537 541

==================================== ======= ========= =========

Chrome

Chrome revenue GBP'000 34 506 17 158

Chrome revenue (4) $'000 47 004 21 624

Attributable chrome earnings GBP'000 3 082 803

Attributable chrome earnings $'000 4 150 1 013

Attributable chrome earnings margin % 9 5

Attributable chrome tonnes produced tonnes 751 223 377 883

Chrome revenue per tonne $/t 63 57

Chrome attributable earnings per

tonne $/t 6 3

==================================== ======= ========= =========

1. Attributable earnings refer to earnings allocated to the

group based on the group's contractual rights in each project and

excludes Group overheads and non-cash expenses including

impairments, gain on bargain purchase, share based payments and

foreign exchange differences.

2. Adjusted EBITDA refers to EBITDA adjusted for non-cash

expenses including impairments, gain on bargain purchase, share

based payments and foreign exchange differences on

transactions.

3. The adjusted PGM production unit cost includes all direct and

indirect costs attributable to the project including allocated

corporate charges. The costs for the period under review includes

all the operating costs for the Windsor PGM JV allocated to the

Jubilee attributable PGM ounces.

4. The chrome revenue is recognised on an ex-works basis after

costs of export logistics including freight, shipping and

marketing.

Chief Executive Officer's Review

The Jubilee team delivered an exceptional performance during

this financial year, achieving growth in all of our core business

units; PGMs and Chrome and also generating maiden earnings from our

new Zambian Copper portfolio. During this period, Jubilee in

addition executed a number of targeted transactions and investments

valuing GBP 20 million, to not only underpin our growth but which

also offer the opportunity for further growth. A brief summary of

the transactions and investments included:

Chrome and PGM

o On 13 August 2020, Jubilee entered into a third party

Run-Of-Mine ("ROM") chrome ore offtake agreement that fully commits

its 70 000 tonnes per month Windsor chrome beneficiation plant for

the next three years, with an option for this to be extended

further;

o On 24 August 2020, Jubilee executed a processing agreement

whereby it was appointed as operator to design, operate and

capitalise the expansion of a ROM chrome beneficiation plant to

reach 80 000 tonnes per month for a minimum period of 3 years;

o During February 2021, Jubilee commenced with the

capitalisation and expansion of the 50 000 tonnes per month Inyoni

PGM plant to a 75 000 tonnes per month processing facility. This

formed part of the refocusing of the Inyoni Operation to a

third-party processing facility for a variety of clients;

o On 3 June 2021, Jubilee has entered into a further long-term,

10+ years of mine life, PGM feed supply agreement, with a chrome

mining customer, offering Jubilee the opportunity to expand its PGM

Operations into the Eastern Limb of the PGM-rich Bushveld Complex.

In addition, Jubilee has acquired the rights to the processing of

255 000 tonnes of PGM containing chrome tailings in the Eastern

Limb, further increasing Jubilee's existing surface PGM

tailings;

o On 4 June 2021, Jubilee announced that it had in addition

secured the right to process a further 944 000 tonnes of PGM

containing tailings in the Eastern Limb of the PGM-rich Bushveld

Complex

Copper and Cobalt

o On 6 August 2020, Jubilee established Project Roan by signing

a joint venture agreement with a private Zambian company, to secure

the rights to process 2 million tonnes of copper ROM material

containing in excess of 2% copper, with the potential to increase

the ROM material to 4 million tonnes in addition to a further

approximate 6 million tonnes of copper tailings. The construction

of the new copper concentrator is underway targeting to commence

commissioning activities by January 2022;

o On 5 November 2020, Jubilee established Project Elephant by

concluding a further JV copper tailings transaction to secure the

rights to an additional approximately 115 million tonnes of copper

and cobalt containing surface tailings in Zambia. This transaction

combined with the 150 million tonnes secured at Luanshya

established the Northern Copper and Cobalt Refinery strategy;

o Jubilee completed the capitalisation of the ROM ore processing

circuit to enhance the Sable Refinery's processing

capabilities.

Post the period under review

o On 24 August 2021, Jubilee executed a binding Memorandum of

Understanding with Mopani Copper Mines Plc as part of its Northern

Copper and Cobalt Refining Strategy;

o On 15 September 2021, Jubilee successfully concluded the

buy-out of the JV partner in Project Roan while also increasing its

JV position at Project Elephant.

While all of this work understandably has put significant

pressure on day-to-day operations, I am thrilled to still be

reporting further production and earnings progress. Crucially, the

investment, time and effort spent in building and integrating these

facilities has set a platform for tremendous potential growth

opportunities. The significant upgrade undertaken at the Inyoni PGM

Operations which was completed post the period under review in

October 2021, has enabled Inyoni to pursue a variety of PGM feed

materials ensuring a long-term sustainable operation. The

disruption to production caused by this significant upgrade during

the current H2 CY2021 period is expected to be recovered during H1

CY2022.

We have seen further growth in South Africa during the period

under review, with a number of new, long term PGM supply

agreements, each of significant strategic value given their

locations on the Eastern Limb of the mineral-rich Bushveld Complex.

As well as demonstrating our ability to win and form partnerships

with key chrome mining clients, these new supply agreements provide

us with the opportunity to replicate the success of our Inyoni

Operation in the Western Limb region, which is of significant value

to us in supplying a continued and sustained chrome and PGM

feed.

With the support of our long-term stakeholders, along with some

very welcome blue-chip institutional investors to the share

register during the period, our maturing Company continues on a

very exciting growth trajectory, both operationally and

financially, as our strategy continues to be implemented.

Operationally, the Company has achieved its stated target of 50

000 PGM ounces for FY 2021 at 50 162 ounces (an increase of 23%

compared with 40 743 ounces for FY2020). This target was achieved

during a period which included the construction and commissioning

of two new chrome beneficiation facilities and the commencement of

the construction of the expanded Inyoni PGM operation which is

expected to be completed during Q4 of CY2021. The expansion and

upgrade of the Inyoni operations is in-line with the re-focusing of

the Inyoni operations from previously only processing historical

tails stockpiled and generated by Hernic Ferrochrome Proprietary

Limited, prior to it being placed in Business Rescue and the assets

ultimately being sold to Samancor, to focusing Inyoni on the

processing of feed material supplied by a variety of clients

secured under medium- and long-term feed supply agreements. During

the period under review, the Company also expanded its operational

footprint in the Eastern Limb of the Bushveld Complex in South

Africa - a strategic development which demonstrates Jubilee's

ability to continue to grow its business by re-investing its

earnings into high growth projects.

Chrome operations achieved 751 223 chrome concentrate tonnes for

FY2021 (377 883 tonnes during FY2020) on the back of increased

operational capacities. This is set to increase further with the

commissioning of the new Chrome Beneficiation circuit, which was

completed at the end of Q2 CY2021.

In Zambia, early earnings from copper production were achieved.

Copper production increased to 1 387 tonnes of copper for FY2021 as

part of the process of securing operational readiness to accept

first copper concentrate production from Project Roan. Project

Roan's integrated copper concentrator is set for commissioning and

targeting to commence commercial operations during Q1 CY2022, which

will result in the first significant increase in copper production

by the Sable Refinery targeting 10 000 tonnes of copper units

annually. The fully operational Sable Refinery achieved positive

earnings as part of its operational readiness activities with

attributable operational earnings of GBP 3.7 million for FY2021

compared to GBP 1.2 million for FY2020.

Achieving first delivery, on time, of partially upgraded copper

concentrate from Project Roan to the fully operational Sable

Refinery was the first major step in Jubilee's commitment to

achieving its targeted production of 25 000 tonnes per annum of

copper within the next four years. The commissioning of the

integrated copper concentrator is on track and scheduled to reach

commercial production in Q1 CY2022, while Jubilee's second copper

project, located in the Luanshya area, has completed the

development programme and is concluding the detail design phase to

commence the implementation programme in the next few months.

On 24 August 2021, Jubilee executed a binding Memorandum of

Understanding with Mopani Copper Mines Plc, a subsidiary of ZCCM

Investment Holdings Plc in Zambia, ("Mopani", "ZCCM" and "Parties")

for the implementation of additional copper and cobalt refining

capacity through the re-capitalisation of existing refining

capacity placed under care and maintenance by Mopani (the

"Agreement"). The Agreement forms a key part of Jubilee's Northern

Refining strategy which offers the potential to establish an

accelerated refining presence at both its Sable Refinery in the

South as well as at Kitwe in the North to better serve all of its

secured copper and cobalt tailings projects - offering the

potential of a combined refining capacity of 31 000 tonnes of

copper units per annum. Jubilee is now able to accelerate the

implementation of its Zambian copper strategy at significantly

reduced capital and project risk.

Chairman's Statement

As we have done over recent years, our company has experienced

another year of significant progress across all aspects of the

business. Jubilee has delivered a strong financial performance with

growth in all aspects of the business, both in South Africa and in

Zambia, during a phase of new build, extension to existing

facilities and feed and new project acquisitions.

As a rapidly developing company, the Board has exercised

considerable attention to ESG matters to ensure that there is no

disconnect between operational and financial performance, against

our environmental, social and governance obligations. ESG has

always been at the heart of what Jubilee does and is captured in

The Jubilee Way of doing business. I am pleased to say that the

word "obligations", whilst being a modern requirement, has always

been at the forefront of the Board's mind and as such further

formalisation of our protocols has not been unduly onerous. We

continue to progress formalisation to ensure that all aspects of

our business remain synchronised, with a common mission of

responsible, efficient and strongly commercial growth.

The effects and uncertainty of the COVID-19 pandemic remains to

be felt by the world. Jubilee continues to navigate these effects

with our operations being able to, in the most part, avoid any

direct impact. While our construction projects in Zambia were

impacted for a time by the disruptions in supply chains and freight

logistics, I am pleased that, despite these impacts, we will

shortly commence with the commissioning of our new copper

concentrator at Project Roan in Zambia with delivery of copper

concentrates to our Sable Refinery on track for Q1 CY2022 next

year. At the outset of the pandemic, we put in stringent testing

and reporting measures to protect our staff. I do thank everyone

involved in the Company for the responsible approach to this

pandemic, which we remain incredibly vigilant of.

The year under review was about successfully extending and

consolidating our chrome and PGM operations in South Africa as we

aimed to serve a wider client base to de-risk the business from any

one source, especially following the financial collapse of Hernic

Ferrochrome, while also establishing and expanding our copper

presence in Zambia. We successfully completed a major upgrade

programme at Inyoni which has significantly enhanced our processing

capabilities with us now able to process a wide variety of

third-party materials leaving us in a unique position to further

capitalise on the materials in the market.

In terms of our Zambian operations, we announced during the year

the acquisition of several tailings projects in Luanshya and Kitwe,

which amounted to gaining the rights to some 300 million tonnes of

tailings of varying grades of copper, and in some cases cobalt. The

period saw the ramping up of production at the Sable Refinery as

they prepare for the commissioning of Project Roan which targets an

annual 10 000 tonnes of copper, which may increase to 14 000 tonnes

per annum.

Post the period under review, we announced a binding MOU for the

Mopani Refining Facility and peripheral hardware which will

significantly accelerate our production plans for the Luanshya and

Kitwe tailings as part of our Northern Copper and Cobalt refining

strategy. The acquisition of these redundant facilities and

refurbishing, together with localised tailings dams, will greatly

reduce our capital requirements and bring forward processing

availability timing by at least 2 years. In general, our

achievements in the Zambian copper arena are advancing to plan and

we fully expect to attain our target of 25 000 tonnes of annualised

copper production to be achieved. The copper potential of Zambia

remains and as such we maintain an aggressive programme to advance

our position and annual production in country.

At the beginning of May 2021, we announced our option with

Caerus Mineral Resources Plc to research and test dumps in Cyprus

left by many mining operations over many years. The dumps are

likely to be copper and gold containing, and a number of cases

could be quite sizable. We are currently carrying out test work on

a number of samples derived from various sites, with a view to

assessing likely processing results. The dumps are thought to be

high grade, both in copper and gold. This option represents our

first venture out of Africa and commences the role out of our

brand, which we call The Jubilee Way, since the way of doing

business in the tailings space is unique to our company.

In terms of PGM and chrome production, we increased our

financial performance throughout the period despite a planned

significant upgrading of our Inyoni Operations, which was

disruptive to the current operation and completed post the period

under review in October 2021. The new expanded Inyoni Operations

are now able to process a variety of feed sources which was

previously limited to the treatment of historical material provided

by the then Hernic.

Towards year end we announced a substantial acquisition for the

rights to 944 000 tonnes of PGM containing tailings in the Eastern

Limb, which marks our entry into gaining position in the Eastern

Limb of the South African Bushveld Complex. The move to PGM supply

agreements in the Eastern Limb was a key strategic decision too,

giving access to this area offering a platform to pursue further

growth opportunities.

During the year we have seen with the pandemic biting into

everyone's lives in various ways, showing no respite and

reproducing itself in new forms and the uncertainty of pandemic

management still exists. Against this uncertain environment stock

markets have advanced to all-time highs and commodity prices have

seen unprecedented growth. Any and all metals which will be

required for future clean energy generation or storage have seen

significant price increases. The outlook for copper in particular

remains buoyant, with many predictions that the year CY2030 will

see a doubling in demand for copper. I for one, see the supply side

being severely challenged, with Chile as a major contributor to the

copper supply, being challenged technically and socially. The large

copper systems that are now in favour are few and far between and

have a gestation period of some twelve years. The lack of big

projects being developed will, to me, facilitate smaller copper

production from both surface and underground mines. The reason

being simply that the period to bring into production is much less.

The inability of supply to keep up the demand should keep the price

of copper above US$ 8 500 per tonne. We do, however, anticipate

that prices may exceed US$ 11 000 per tonne during CY2023 and

beyond. The possession of copper secondaries, mined and on surface,

gives Jubilee a very good position in tomorrow's copper production

and promises superior returns to its shareholders.

Likewise, in the PGM space, we see the emergence of the fuel

cell, particularly in China, which will underpin the PGM price and

increase the price as demand for fuel cell energy increases over

the coming years. Your company is well positioned in the new energy

space and has a style of doing business which is both unique and

transferable, The Jubilee Way.

We look forward to continuing to deliver to our shareholders

with our further growth and development in the exciting space of

waste retreatment. We most definitely have a first mover

advantage.

Finally, I would like to thank everyone in our team for the

tireless efforts in producing splendid results in challenging

times. Upwards and onwards, and long may it continue.

Colin Bird

Non-executive Chairman

2 December 2021

Group statements of financial position at 30 June 2021

Figures in Sterling 2021 2020

========================================= === ========== ==========

Assets

Non-current assets

Property, plant, and equipment 33 011 518 20 076 448

Intangible assets 58 831 075 72 901 175

Investments in subsidiaries - -

Investments in associates 426 505 450 598

Loans to Group companies - -

Other financial assets 7 234 002 3 406 644

Deferred tax 9 463 653 3 223 254

---------- ----------

108 966 100 058

753 119

---------- ----------

Current assets

Other financial assets 544 195 -

Inventories 17 765 937 2 140 239

Current tax assets 466 176 -

Trade and other receivables 38 126 369 13 083 307

Contract assets 9 154 250 5 408 622

Cash and cash equivalents 19 643 047 9 947 822

---------- ----------

85 699 974 30 579 990

---------- ----------

194 666 130 638

Total assets 727 109

---------- ----------

Equity and liabilities

Equity attributable to equity holders of

parent

Share capital and share 120 013 114 585

premium 187 392

Reserves 6 612 905 10 317 560

(33 201

Accumulated profit/(loss) 6 753 964 211)

---------- ----------

133 380

056 91 701 741

Non-controlling interest 3 162 527 2 479 277

---------- ----------

136 542

583 94 181 018

---------- ----------

Liabilities

Non-current liabilities

Other financial liabilities 2 803 434 10 428 719

Lease liabilities 164 088 -

Deferred tax liability 14 997 333 10 944 698

Provisions 720 759 694 358

---------- ----------

18 685 614 22 067 775

---------- ----------

Current liabilities

Other financial liabilities 5 337 310 1 460 968

Trade and other payables 29 338 988 12 422 880

Contract liabilities - 505 468

Revolving credit facility 3 839 225 -

Current tax liabilities 923 007 -

---------- ----------

39 438 530 14 389 316

---------- ----------

Total liabilities 58 124 144 36 457 091

---------- ----------

194 666 130 638

Total equity and liabilities 727 109

---------- ----------

The financial statements were authorised for issue and approved

by the Board on 2 December 2021 and signed on its behalf by:

Leon Coetzer

Chief Executive Officer

Company number: 04459850

Group statements of comprehensive income for the year ended 30

June 2021

Figures in Sterling 2021 2020

132 845

Revenue 252 54 774 818

(61 733

Cost of sales 675) (29 687 220)

======================================= ============= ==============

Gross profit 71 111 577 25 087 598

Other income - 1 470 631

(25 728

Operating expenses 382) (10 670 041)

======================================= ============= ==============

Operating profit 45 383 195 15 888 188

Investment revenue 500 173 125 264

Fair value adjustments (1 161 418) (5 021 585)

Gain on bargain purchase through

business combinations - 6 606 755

Finance costs (1 673 787) (2 420 875)

Share of loss from associates (24 093) (1 444 879)

======================================= ============= ==============

Profit before taxation (1) 43 024 070 13 732 868

Taxation (2 792 867) 4 495 716

======================================= ============= ==============

Profit for the year 40 231 203 18 228 584

======================================= ============= ==============

Earnings for the year

Attributable to:

Owners of the parent 39 599 917 18 320 392

Non-controlling interest (631 287) (91 808)

======================================= ============= ==============

40 231 203 18 228 584

======================================= ============= ==============

Earnings per share (pence) 1.81 0.94

Diluted earnings per share

(pence) 1.78 0.93

Reconciliation of other comprehensive

income:

Profit for the year 40 231 203 18 228 584

Other comprehensive income:

Exchange differences on translation

foreign operations (3 863 624) (12 388 588)

======================================= ============= ==============

Total comprehensive profit 36 367 579 5 839 996

======================================= ============= ==============

Total comprehensive profit

attributable to:

Owners of the parent 35 707 874 6 317 824

Non-controlling interest 659 705 (477 828)

======================================= ============= ==============

36 367 579 5 839 996

======================================= ============= ==============

Group statements of changes in equity for the year ended 30 June

2021

Total

attributable

Share Foreign Share- Convertible to equity

capital currency based notes holders Non-

Figures in and share Translation Merger payment reserve Total Accumulated of the Group/ controlling

Sterling premium reserve reserve reserve reserves loss Company interest Total equity

================= =========== ============= ============ =========== ============ =========== ============== ============= ============ =============

Group

Balance at 30 105 820 22 319

June 2019 411 (3 587 451) 23 184 000 2 519 435 203 040 024 (51 842 700) 76 296 733 2 393 082 78 689 814

Changes in equity

Profit for the

year - - - - - - 18 320 392 18 320 392 (477 828) 17 842 564

Other

comprehensive (12 002 (12 002 (12 002 (12 002

income - 568) - - - 568) - 568) - 568)

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Total

comprehensive

income (12 002 (12 002

for the year - 568) - - - 568) 18 320 392 6 317 824 (477 828) 5 839 996

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Issue of share

capital

net of costs 8 764 981 - - - - - - 8 764 981 - 8 764 981

Share warrants

issued - - - 205 903 - 205 903 - 205 903 - 205 903

hare options

exercised/lapsed - - - (324 597) - (324 597) 321 097 (3 500) - (3 500)

Share options

issued - - - 119 800 - 119 800 - 119 800 - 119 800

Business

combinations - - - - - - - - 564 024 564 024

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

(12 002 (12 001

Total changes 8 764 981 568) - 1 106 - 462) 18 641 489 15 405 008 86 196 15 491 204

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Balance at 30 114 585 (15 590 10 317

June 2020 392 019) 23 184 000 2 520 541 203 040 562 (33 201 211) 91 701 741 2 479 278 94 181 020

Changes in equity

Profit for the

year - - - - - - 39 599 917 39 599 917 659 705 40 259 622

Other

comprehensive (3 892

income - (3 892 044) - - - 044) - (3 892 044) (3 892 044)

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Total

comprehensive

income (3 892

for the year - (3 892 044) - - - 044) 39 599 917 35 707 873 659 705 36 367 578

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Issue of share

capital

net of costs 5 427 796 - - - - - - 5 427 796 - 5 427 796

Share warrants

exercised - - - (232 812) - (232 812) 232 812 - - -

Share warrants

issued - - - 161 974 - 161 974 - 161 974 - 161 974

Share options

exercised/lapsed - - - (156 821) - (156 821) 145 990 (10 830) - (10 830)

Share options

issued - - - 415 046 - 415 046 - 415 046 - 415 046

Changes in

ownership no

control lost - - - - - - (23 544) (23 544) 23 544 -

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

(3 704

Total changes 5 427 796 (3 892 044) - 187 387 - 657) 39 955 175 41 678 315 683 249 42 361 563

----------- ------------- ------------ ----------- ------------ ----------- -------------- ------------- ------------ -------------

Balance at 30 120 013 (19 482 133 380 136 542

June 2021 187 063) 23 184 000 2 707 928 203 040 6 612 905 6 753 964 056 3 162 527 583

------------

Group statements of cash flow for the year ended 30 June

2021

Figures in Sterling 2021 2020

Cash flows from operating activities

Cash generated from operations 33 002 604 21 734 031

Interest income 500 173 125 264

Finance costs (1 673 787) (2 420 875)

Taxation paid (8 034 521) -

============================================ ============= =============

Net cash from operating activities 23 794 469 19 438 420

============================================ ============= =============

Cash flows from investing activities

Purchase of property, plant, and (17 865

equipment 679) (1 389 730)

Sale of property, plant, and equipment (8 427) 246 783

(16 713

Purchase of intangible assets (1 942 019) 185)

Business combinations - (7 732 100)

(19 816 (25 588

Net cash from investing activities 125) 232)

============================================ ============= =============

Cash flows from financing activities

Net proceeds on share issues 1 144 436 5 696 278

Proceeds from revolving credit

facilities 3 839 225 -

Proceeds from trade financing arrangements 2 525 914 -

Increase in loans to joint ventures (4 371 552) (276 235)

Decrease in other financial liabilities (1 795 310) (4 168 297)

Lease payments (219 847) -

============================================ ============= =============

Net cash from financing activities 1 122 866 1 251 746

============================================ ============= =============

Total cash movement for the year 5 101 210 (4 898 066)

Total cash at the beginning of

the year 9 947 822 18 865 288

Effect of exchange rate movement

on cash balances 4 594 015 (4 019 400)

============================================ ============= =============

Total cash at end of the year 19 643 047 9 947 822

============================================ ============= =============

Notes to the Group financial statements for the year ended 30

June 2021

1. Statement of accounting policies

Jubilee Metals Group PLC is a public company listed on AIM of

the LSE and Altx of the JSE, incorporated and existing under the

laws of England and Wales, having its registered office at 1st

Floor, 7/8 Kendrick Mews, London, SW7 3HG, United Kingdom.

The Group and Company results for the year ended 30 June 2021

have been prepared using the accounting policies applied by the

Company in its 30 June 2021 annual report, which are in accordance

with International Financial Reporting Standards ("IFRS") and IFRC

interpretations, as issued by the International Accounting

Standards Board ("IASB") and adopted for use in the EU (IFRS),

including the SAICA financial reporting guides as issued by the

Accounting Practices Committee and the Companies Act 2006 (UK).

The financial statements are presented in Pound Sterling. For

income statement purposes conversions are at average exchange rates

and for balance sheet purposes at the closing rate as at the period

end. All other conversions are at rates as at the time

announced.

2. Earnings per share

Figures in Sterling 2021 2020

Earnings attributable to ordinary equity holders

of the parent (GBP) 39 599 917 18 320 392

===================================================== ========== ==========

Weighted average number of shares for basic earnings 2 185 345 1 955 965

per share 903 289

Effect of dilutive potential ordinary shares

- Share options and warrants 40 742 711 19 299 151

===================================================== ========== ==========

Diluted weighted average number of shares for 2 226 088 1 975 264

diluted earnings per share 614 440

===================================================== ========== ==========

Basic earnings per share (pence) 1.81 0.94

Diluted basic earnings per share (pence) 1.78 0.93

===================================================== ========== ==========

The Group reported a net asset value of 6.09 pence (ZAR 120.43

cents) (2020: 4.46 pence (ZAR 95.26 cents)) per ordinary share.

Tangible net asset value for the period under review was 1.99 pence

(ZAR 39.42 cents) (2020: 1.01 pence (ZAR 21.52 cents)). The total

number of ordinary shares in issue at 30 June 2021 was 2 242 509

468 (2020: 2 112 509 573) shares.

There have been no other transactions involving ordinary shares

or potential ordinary shares between the reporting date and the

date of authorisation of these financial statements. There were no

share transactions post year end to the date of this report that

could have impacted earnings per share had it occurred before year

end.

3. Share Capital, Share Premium and Warrants

Figures in pound sterling 2021 2020

Authorised

The share capital of the Company is divided into

an unlimited number of ordinary shares of GBP

0.01 each.

Issued share capital fully paid

Ordinary shares of 1 pence each 22 425 093 21 125 096

Share premium 97 588 094 93 460 296

================================================= ========== ==========

120 013 114 585

Total issued capital 187 392

================================================= ========== ==========

The Company issued the following shares during the period:

Number of Issue price

Date issued shares (pence) Purpose

=========================== ============= =========== =================

Opening balance at 1 July

2020 2 112 509 573

07-Dec-20 694 445 6.120 Warrants

12-Jan-21 19 417 476 3.375 Warrants

13-Jan-21 610 445 4.000 Warrants

13-Jan-21 1 473 055 3.380 Warrants

21-Jan-21 80 728 619 2.810 Debt settlement

21-Jan-21 4 393 736 13.000 Director dealing

21-Jan-21 14 760 730 13.000 Director dealing

03-Feb-21 4 000 000 3.400 Warrants

08-Feb-21 3 000 000 6.000 Options exercised

18-Feb-21 80 000 6.120 Warrants

09-Mar-21 200 000 6.120 Warrants

11-Mar-21 502 500 6.120 Warrants

14-May-21 138 889 6.120 Warrants

=========================== ============= =========== =================

Closing balance at 30 June

2021 2 242 509 468

=========================== ============= =========== =================

During the year share transaction costs accounted for as a

deduction from the share premium account amounted to GBP 314 842

(2020: GBP 747 412). On 21 September 2021, post the period under

review, the Company issued 187 149 096 new ordinary shares at a

price of 16.03 pence to raise GBP 30 million before expenses,

bringing the total shares in issue at the date of this report to 2

429 658 564 shares.

The company recognised a share-based payment expense in the

share premium account in an amount of GBP 161 974 (2020: GBP 205

903) in accordance with section 610 (2) of the United Kingdom

Companies Act 2006. The charge relates to the issue of new Jubilee

shares in lieu of warrants exercised and the amount was accounted

for as a deduction from the share premium account.

Warrants

At year-end and at the last practicable date the Company had the

following warrants outstanding:

Subscription Share price

Issue Date Number of Price Expiry at issue date

warrants pence date (pence)

======================= =================== ============ =========== ==============

19 Jan 2018 63 661 944 6.12 19 Jan 2023 3.55

28 Dec 2018 10 000 000 3.38 28 Dec 2023 2.40

19 Nov 2019 7 818 750 4.00 19 Nov 2022 4.13

22 Jun 2020 750 000 3.40 22 Jun 2023 3.90

21 Jan 2021 4 036 431 13.00 21 Jan 2024 13.20

======================= =================== ============ =========== =================

86 267 125

======================= =================== ============ =========== =================

Reconciliation of the number of warrants

in issue 2021 2020

========================================================= =========== ==============

112 292

Opening balance 488 99 113 293

Issued during the year 4 036 431 13 179 195

(30 061

Expired/exercised during the year 794) -

========================================================= =========== ==============

112 292

Closing balance 86 267 125 488

========================================================= =========== ==============

4. Segmental analysis

In the opinion of the Directors, the operations of the Group

companies comprise of four reporting segments being:

o the processing of PGM, chrome and copper containing materials

("Metals Processing");

o a combination of targeted process consulting and developing,

focussed on the development and implementation of process

solutions, specifically targeting both liquid and solid waste

streams from mine processes. This includes existing pilot

operations as part of the process development cycle to provide

mature solutions which includes extractive-metallurgy,

pyro-metallurgy and hydro-metallurgy ("Business Development");

o the exploration (Exploration); and

o the parent company operates a head office based in the United

Kingdom, which incurs certain administration and corporate costs.

("Corporate").

The Group's operations span five countries, South Africa,

Australia, Mauritius, Zambia and the United Kingdom. There is no

difference between the accounting policies applied in the segment

reporting and those applied in the Group financial statements.

Madagascar does not meet the qualitative threshold under IFRS 8,

consequently no separate reporting is provided.

Segment report for the year ended 30 June 2021

Metals Processing Business

Figures in Sterling development Exploration Corporate Total

============================ ========================== ================= ============= =========== =============

132 845

Total revenues 132 845 176 - - - 176

(61 733

Cost of sales (62 398 524) 664 849 - - 675)

Profit/(loss) before (4 792

taxation 47 254 824 565 611 (3 707) 657) 43 024 070

Taxation (2 792 867) - - - (2 792 867)

(4 792

Profit/(loss) after taxation 44 461 957 565 611 (3 707) 657) 40 231 204

Interest received 480 418 - 71 19 685 500 175

Interest paid (1 673 786) - - - (1 673 786)

Depreciation and

amortisation (5 111 143) - - - (5 111 143)

============================ ========================== ================= ============= =========== =============

(154 959 (34 626 (193 071

Total assets 693) (3 629 684) 843) 145 210 011)

============================ ========================== ================= ============= =========== =============

Total liabilities 50 721 441 (11 808 622) 16 253 772 1 361 839 56 528 430

============================ ========================== ================= ============= =========== =============

Segment report for the year ended 30 June 2020

Metals Business

Figures in Sterling Processing development Exploration Corporate Total

============================ ========================== ================= ============= =========== =============

Total revenue 54 774 818 - - - 54 774 818

(29 687

Cost of sales (29 683 413) (3 807) - - 220)

Forex profits/(losses) 723 787 - - (65 433) 658 354

Profit/(loss) before (6 363

taxation 20 107 447 (10 093) (956) 527) 13 732 871

Taxation 3 541 615 - - 954 101 4 495 716

Profit/(loss) after (5 409

taxation 23 649 062 (10 093) (956) 427) 18 228 586

Interest received 101 214 - 167 23 883 125 264

Interest paid (2 245 776) - 35 (175 134) (2 420 875)

Depreciation and

amortisation (6 501 760) - - - (6 501 760)

============================ ========================== ================= ============= =========== =============

(3 251 (130 638

Total assets (90 719 255) (3 159 299) (33 507 643) 913) 110)

============================ ========================== ================= ============= =========== =============

Total liabilities 31 175 924 11 130 297 15 958 164 453 299 36 457 091

============================ ========================== ================= ============= =========== =============

6. Going Concern

Jubilee operates several chrome-Platinum Group Metal (PGM)

operations in South Africa and has commissioned a copper and cobalt

circuit (the 'Sable' refinery) in Zambia. The Company has a growth

pipeline identified and significant opportunities to find new

projects in Africa (or globally); more specifically it is looking

to increase its copper (cobalt) production in Zambia to make full

use of its Sable Refinery. The company model is to treat its own

waste materials and to supplement these with third party ores and

wastes where possible.

Following conclusion of a number of transactions Jubilee now has

increased PGM production capacity built on the back of secured feed

availability and sustainability. Strong cash flows were generated

from the established and still growing PGM production now bolstered

by additional copper cash flows and profit provide for both

liquidity and funding of further investments, including now

demonstrated ability to raise funding short and long term at very

competitive rates.

Jubilee has also secured increased chrome production capacity

ensuring sustainability through ROM supply contracts and continuous

processing of chrome with fixed margins (no market exposure and

locked in profit), which now secures ongoing current arisings PGM

feed in addition to the secured historical PGM tails. This gives

optimal feed and further increases Jubilee's resource. The

transactions have also brought further opportunity for growth and

expansion in for example the Eastern Limb of the bushveld.

Copper is already generating cash prior to Project Roan coming

on stream. Jubilee is expecting a significant ramp up in copper

activities in Zambia from Q1 CY2022, making Zambia capable of being

self-sufficient in terms of funding for both current operations and

future projects.

Jubilee's business strategy is based on three core business

pillars:

Process research and development (R&D)

o Consists of a combination of targeted process consulting and

R&D, focussed on the development and implementation of process

solutions, specifically targeting both liquid and solid waste

streams from

mine processes.

o Our R&D includes existing pilot operations as part of the

process development cycle to provide mature solutions which

includes extractive-metallurgy, pyro-metallurgy and

hydro-metallurgy.

o This process has led to many previously non-viable

environmental and metals recovery projects becoming commercially

viable. With the growing demand for solutions to mining wastes and

the growing requirement for 'Environmental, Social & Corporate

Governance' (ESG) in mining investments the pedigree, experience

and ability of Jubilee will be of increasing importance.

o Following a very strong demand in Africa, Jubilee has

concluded two acquisitions in Zambia to advance its footprint in

other jurisdictions.

Operations

o Jubilee owns and operates recovery plants for the recovery of

metals and minerals, currently recovering precious metals including

PGMs and Chrome and targeting base metals including lead, zinc,

vanadium and copper.

o Jubilee has a low-cost, high-margin business that capitalises

on Jubilee's experienced, technical management team which has

developed innovative processing techniques to generate cash from

(mainly) the waste material produced as part of the mining cycle;

"the Jubilee Way".

Project Funding

o We are able to provide funding to support our partners within

smaller or larger companies to implement the waste recovery

projects. Such funding would be aimed at especially assisting in

instances where the company holding the mineral right prefers to be

a passive investment partner.

o Our successful R&D work has set the pace for the Company

to partner with strategic owners of rights and waste material to

form joint operations where Jubilee plays the important role of

operator and in some instances funder.

The Group meets its day-to-day working capital requirements

through cash generated from operations. The Group's current

operational projects are all fully funded and self-sustaining.

The current global economic climate creates to some extent

uncertainty particularly over:

o the trading price of metals; and

o the exchange rate fluctuation between the US$ and the ZAR and

thus the consequence for the cost of the company's raw materials as

well as the price at which product can be sold.

The Group's forecasts and projections, taking account of

reasonably possible changes in trading performance, commodity

prices and currency fluctuations, indicates that the Group should

be able to operate within the level of its current cash flow

earnings forecasted for the next twelve months.

The Group is adequately funded and has access to further equity

placings, which together with contracts with several high-profile

customers strengthens the Group's ability to meet its day-to-day

working capital requirements, including its capital expenditure

requirements. Therefore, the directors believe that the Group is

suitably funded and placed to manage its business risks

successfully despite identified economic uncertainties.

The directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future, thus continuing to adopt the going concern

basis of accounting in preparing the annual financial

statements.

7. Events after the reporting period

7.1 Jubilee and Mopani Copper Mines Plc enter into binding MOU

for Refining Facility for Copper

On 24 August 2021 Jubilee executed a binding Memorandum of

Understanding with Mopani Copper Mines Plc, a subsidiary of ZCCM

Investment Holdings Plc in Zambia, ("Mopani", "ZCCM" and

collectively the "Parties") for the implementation of additional

copper and cobalt refining capacity through the recapitalisation of

existing refining capacity placed under care and maintenance by

Mopani (the "Agreement"). This additional refining capacity targets

to increase Jubilee's existing copper refining capacity by a

further 17 000 tonnes of copper per annum (the "Project") and,

together with the Sable Refinery, increases the Group's total

potential refining capacity to in excess of 31 000 tonnes per

annum. The Project will establish Jubilee's Northern Zambian

refining footprint for the refining of the copper and cobalt

concentrates produced at Jubilee's Kitwe and the Luanshya copper

and cobalt tailings. Jubilee's Sable Refinery will be dedicated to

the refining of concentrates produced by its Project Roan currently

under construction and set to commence commissioning by January

2022 as well as its copper tailings at Kabwe and contracted third

party ore suppliers.

As previously announced, during 2020 Jubilee entered into joint

venture agreements to secure rights to process over 300 million

tonnes of copper and cobalt containing tailings in Zambia. The

copper and cobalt tailings are located in three central locations

in Zambia. With the addition of the refinery at Mopani the project

naming convention has been updated for clarity as follows:

o Southern Refinery Strategy (14 000 tpa capacity) which

incorporates the Sable Refinery together with Project Roan located

in the Ndola area; and

o Northern Refinery Strategy (17 000 tpa capacity) which

incorporates the newly targeted refinery at Mopani, called Leopard

together with the copper tailings project in the Luanshya area,

called Project Lechwe (previously Elephant 1), as well as the

copper and cobalt tailings in the Kitwe area called Project

Elephant (previously called Elephant 2). Jubilee has secured

additional copper and cobalt tailings at Mufulira which is

currently being sampled to confirm the quantity and quality and

will form part of the Project Elephant resource.

Jubilee is planning to construct a processing facility at each

of the three locations. The first of the processing facilities is

under construction at Project Roan, which targets a ramp-up over

three phase to reach full production to a rate of approximate 10

000 tonnes of equivalent copper units per annum with commissioning

scheduled to commence by January 2022 and reaching full production

by end of Q2 2022. Roan commenced with the delivery of early

concentrate as part of its phase 1 commissioning to Sable Refinery

in April of this year.

The completion of the design work for the Company's second

copper processing facility, Project Lechwe, whereby Jubilee has

secured the rights to approximately 160 million tonnes of copper

containing surface tailings, is progressing well and remains on

track. Project Lechwe targets to commence production during Q4 2022

targeting a production rate of 7 500 copper units per annum as part

of the Northern Refinery Strategy.

7.2 Agreements to acquire ownership in Zambia Copper and Cobalt Tailings Projects and Placing

Jubilee announced significant further progress at its Copper and

Cobalt tailings projects in Zambia with the successful execution of

three strategic transactions (the "Transactions") which

significantly increases its beneficial interest across the Group's

copper and cobalt tailings projects in Zambia. The Transactions

include Project Elephant (Kitwe Tailings Project), Project Roan

(Ndola Tailings Project) and the Mufulira Project (collectively,

the "Projects"). Completion of the Transactions is subject to

fulfilment of certain conditions precedent that are normal for

transactions of this nature including regulatory approvals and

consent.

At completion of the Transactions, Jubilee will hold a 100%

interest across its integrated Southern Refining Strategy which

includes the Sable copper and cobalt refinery (14 000 tonnes per

annum copper capacity) together with Project Roan (10 000 tonnes

per annum copper concentrator). In addition, Jubilee increases its

beneficial interest across its Northern Refining Strategy, with

Project Elephant's TD52 portion to 80.75% (highest copper and

cobalt concentration of all tailings within Project elephant) which

is specifically targeted by the accelerated development of

Jubilee's cobalt extraction process, Jubilee's beneficial interest

at the Mufulira Project increasing to 97%.

Combined, the Transactions have an aggregate value of c. US$

24.77 million (c. GBP 17.83 million) and offers Jubilee the

flexibility to better schedule the development of the various

tailings projects. As such Jubilee will increase its investment

into the Southern Refining Strategy by expanding Sable Refinery to

increase the copper sulphide recovery circuit as well as expanding

the cobalt recovery circuit.

Accordingly, the Company successfully completed an equity

placing to raise gross proceeds of c. GBP 30 million (c. US$ 41.8

million) by way of a placing of new ordinary shares at a price of

16.03 pence per share, which will be applied to satisfy the

consideration in respect of the Transactions and towards the

expansion of Sable Refinery while accelerating the capitalisation

and progress of Project Lechwe and Project Elephant.

8. Audit Opinion

The auditor's report on the annual financial statements of the

Group was unqualified and did not contain any statements under

section 498(2) or (3) of the Companies Act 2006.

Notice of Annual General Meeting and availability of the Group's

Annual Financial Statements

The Company also hereby gives notice of its 2021 Annual General

Meeting ("AGM") , which will be held on 29 December 2021 at 11:00

am UK time at the offices of Fladgate LLP, 16 Great Queen Street,

London, WC2B 5DG, to transact the business as stated in the notice

of AGM. The Group's Annual Report for the year ended 30 June 2021,

along with the Notice of AGM, has been posted to the website,

www.jubileemetalsgroup.com together with the notice of the

Company's 2021 Annual General Meeting .

In light of current restrictions on public gatherings and to

ensure shareholders can comply with the government measures, the

Company has concluded that shareholders will not be permitted to

attend in person. The Company therefore requests that shareholders

cast their votes by proxy to be received 48 hours (excluding

non-business days) in advance of the time of the AGM. Instructions

on how shareholder can cast their votes for the AGM are included in

the Notice of AGM.

Following the AGM formal business on 29 December 2021, the

Company will be hosting a presentation, live streamed to give the

shareholders an opportunity for a general Company update and

discussion of the group annual audited results. Please send any

questions you may have to info@jubileemetalsgroup.com by 27

December 2021 to be addressed during the live stream. The link to

participate will be published on the Company's website via separate

RNS.

Salient Dates:

Shareholders on the register who are entitled

to receive the notice of AGM (SA) 26 November 2021

Notice of AGM posted to shareholders 2 December 2021

Last date to trade in order to be eligible

to participate in and vote at the AGM (SA) 21 December 2021

Record date for the purposes of determining

which shareholders are entitled to participate 23 December 2021

in and vote at the AGM (UK)

Latest time and date for receipt of CREST

Proxy Instruction and other 11:00 a.m. (UK time) 23 December

uncertificated instructions (UK) 2021

Record date for the purposes of determining

which shareholders are 24 December 2021

entitled to participate in and vote at the

AGM (SA)

Latest time and date for receipt of Dematerialised

Holding Instruction 1 p.m. (SA time) 28 December

and other uncertified instructions (SA) 2021

Annual General Meeting 11:00 a.m. (UK time) 29 December

2021

Results of the Annual General Meeting released 29 December 2021

on RNS and SENS

*Ends*

For further information visit www.jubileemetalsgroup.com ,

follow Jubilee on Twitter (@Jubilee_Metals) or contact:

Jubilee Metals Group PLC

Colin Bird/Leon Coetzer

Tel +44 (0) 20 7584 2155 / Tel +27 (0) 11 465 1913

Nominated Adviser - SPARK Advisory Partners Limited

Andrew Emmott/James Keeshan

Tel: +44 (0) 20 3368 3555

Broker - Shard Capital Partners LLP

Damon Heath/Erik Woolgar

Tel +44 (0) 20 7186 9900

Joint Broker - WHIreland

Harry Ansell/Katy Mitchell

Tel: +44 (0) 20 7220 1670/+44 (0) 113 394 6618

JSE Sponsor - Questco Corporate Adviser

Sharon Owens

Tel +27 (0) 11 809 7500

PR & IR Adviser - Tavistock

Jos Simson/ Gareth Tredway/Charles Vivian

Tel: +44 (0) 207 920 3150

PR & IR Adviser - St Brides Partners Limited

ANNEXURE 1 - Headline earnings per share

Accounting policy

Headline earnings per share ("HEPS") is calculated using the

weighted average number of shares in issue during the period under

review and is based on earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

1/2021 issued by the South African Institute of Chartered

Accountants (SAICA).

In compliance with paragraph 18.19 (c) of the JSE Listings

Requirements the table below represents the Group's Headline

earnings and a reconciliation of the Group's loss reported and

headline earnings used in the calculation of headline earnings per

share:

Reconciliation of headline earnings per share

June 2021 June 2020

========================= ========== ====================================

Gross Net Gross Net

GBP'000 GBP'000 GBP'000 GBP'000

===================================== ========================= ========== =================== ===============

Earnings for the period attributable

to ordinary shareholders 39 600 - 18 320

De-recognition of other financial

assets through profit or loss - 5 021 4 067

Gain on bargain purchase - (6 607) (6 607)

Share of impairment loss from equity

accounted associate 31 24 1 964 1 375

Fair value adjustments 1 161 1 161 - -

===================================== ========================= ========== =================== ===============

Headline earnings from continuing

operations 40 785 17 155

===================================== ===================================== ====================================

Weighted average number of shares

in issue ('000) 2 185 346 1 955 965

Diluted weighted average number

of shares in issue ('000) 2 226 089 1 975 264

Headline earnings per share from

continuing operations (pence) 1.87 0.88

Headline earnings per share from

continuing operations (ZAR cents) 38.62 17.30

Diluted headline earnings per share

from continuing operations (pence) 1.83 0.87

Diluted headline earnings per share

from continuing operations (ZAR

cents) 37.92 17.13

Average conversion rate used for

the period under review GBP:ZAR 0.048 0.051

===================================== ========================= ========== =================== ===============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZMGZGMLGMZZ

(END) Dow Jones Newswires

December 02, 2021 02:00 ET (07:00 GMT)

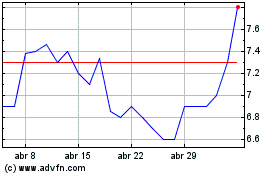

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024