Mondi PLC Trading Update

07 Octubre 2021 - 1:00AM

UK Regulatory

TIDMMNDI

Mondi plc

(Incorporated in England and Wales)

(Registered number: 6209386)

LEI: 213800LOZA69QFDC9N34

LSE share code: MNDI ISIN: GB00B1CRLC47

JSE share code: MNP

7 October 2021

Trading update: Strong Q3 performance

Underlying EBITDA for the third quarter was ?388 million, up 27% compared to

the prior year period (Q3 2020: ?306 million) and 9% on a sequential basis (Q2

2021: ?356 million).

Andrew King, Chief Executive Officer, said: "Mondi delivered a strong

performance in the third quarter with higher average prices across the business

and strong volume growth year-on-year, against a backdrop of sharply higher

input costs. Throughout this period of high demand, we remained focused on

ensuring security of supply and high-quality service for our customers. Our

growth is underpinned by our leading packaging portfolio and we continue to

develop innovative and sustainable packaging solutions to help our customers

achieve their environmental goals.

Our major capital investment projects are progressing well. With these

investments we capture opportunities in our growing packaging markets,

strengthen our cost competitiveness and deliver sustainability benefits. We

also have expansionary projects underway at a number of our converting

operations to grow with our customers, enhance our product and service

offering, and improve efficiencies and converting costs. We are excited by the

possibilities offered by our high-quality asset base, supported by strong

structural growth trends in the markets we serve, including eCommerce and the

demand for more sustainable packaging solutions, and we continue to evaluate

further organic development opportunities in our packaging businesses."

Business unit overview

Demand for Corrugated Packaging continued to be strong across all end-uses. On

the back of tight global markets, we implemented price increases during the

quarter across our portfolio of containerboard grades. Corrugated Solutions

performed strongly, growing volumes significantly year-on-year, while making

good progress in passing on higher input paper costs. The integration of the

Olmuksan acquisition continues to progress well.

Flexible Packaging delivered strong volume growth in consumer, building and

construction, eCommerce and specialised applications. On the back of strong

order books, price increases across our range of kraft papers and paper bags

were implemented during the quarter, where not fixed by annual or semi-annual

contracts. The business made progress in passing on higher plastic resin costs.

Engineered Materials' performance in the quarter was stable, as expected, with

good volume growth in functional papers and films driven by a recovery in

industrial and specialised applications, and strong demand for sustainable

packaging materials.

Uncoated Fine Paper sales volumes increased year-on-year with our customers

valuing the stability of a long-term supplier in the key markets where we

operate. Average uncoated fine paper prices were higher both year-on-year and

sequentially, following price increases implemented during the year.

Input costs and maintenance shuts

Input costs were significantly higher in the quarter, both year-on-year and

sequentially. When compared with the second quarter of 2021, we saw higher

energy, resins, transport and chemical costs. Paper for recycling costs were

mostly stable, although they increased towards the end of the quarter. Energy

costs in Europe increased through the period and rose sharply at the end of the

quarter on the back of material increases in electricity and gas prices. We

expect them to remain at these elevated levels in the fourth quarter.

The impact of scheduled maintenance shuts on underlying EBITDA during the

period was around ?30 million. The fourth quarter's impact is estimated at

around ?70 million, in line with previous estimates, and includes an extended

project-related shut at Richards Bay (South Africa) as part of the ongoing

modernisation programme at the mill.

Outlook

Demand remains strong and we are implementing price increases across the

business that will support the recovery of ongoing inflationary pressures.

While in the short term the fourth quarter will be impacted by recent input

cost increases alongside planned maintenance and project-related shuts, the

Group remains well-placed to deliver sustainably into the future, supported by

our leading offering of sustainable packaging solutions, integrated

cost-advantaged asset base and culture of continuous improvement.

Contact details

Investors/analysts

Clara Valera +44 193 282 6357

Mondi Group Head of Strategy and Investor

Relations

Media

Kerry Cooper +44 193 282 6323

Mondi Group Head of External Communication

Richard Mountain +44 790 968 4466

FTI Consulting

Conference call dial-in details

A conference call will be held today at 08:00 (UK) / 09:00 (South Africa).

The conference call dial-in numbers are:

UK 0800 279 6619

South Africa 0800 014 552

Other +44 2071 928 338

Conference ID 3055818

Should you have any issues with accessing the dial-in conference call, please

call +44 2071 928 338.

A replay facility will be available until 21 October 2021 (Pin number:

3055818). The dial in details are:

United Kingdom 0844 571 8951

Other +44 3333 009 785

Notes

This trading update provides an overview of our financial performance and

financial position since the half-year ended 30 June 2021. Financial metrics

have not been audited or reviewed by Mondi's external auditors.

Underlying EBITDA is an Alternative Performance Measure that is not defined or

specified according to International Financial Reporting Standards. This

measure is defined as operating profit before special items, depreciation,

amortisation and impairments not recorded as special items.

About Mondi

Mondi is a global leader in packaging and paper, contributing to a better world

by making innovative packaging and paper solutions that are sustainable by

design. Our business is integrated across the value chain - from managing

forests and producing pulp, paper and plastic films, to developing and

manufacturing effective industrial and consumer packaging solutions.

Sustainability is at the centre of our strategy and intrinsic in the way we do

business. We lead the industry with our customer-centric approach,

EcoSolutions, where we ask the right questions to find the most sustainable

solution. In 2020, Mondi had revenues of ?6.66 billion and underlying EBITDA of

?1.35 billion.

Mondi has a premium listing on the London Stock Exchange (MNDI), and a

secondary listing on the JSE Limited (MNP). Mondi is a FTSE 100 constituent,

and has been included in the FTSE4Good Index Series since 2008 and the FTSE/JSE

Responsible Investment Index Series since 2007.

Sponsor in South Africa: UBS South Africa Proprietary Limited.

END

(END) Dow Jones Newswires

October 07, 2021 02:00 ET (06:00 GMT)

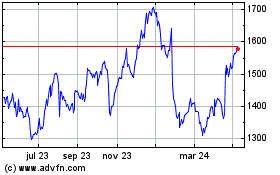

Mondi (LSE:MNDI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

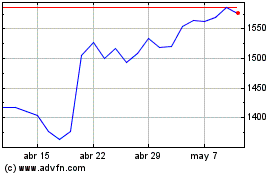

Mondi (LSE:MNDI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024