TIDMPCTN

12 November 2020

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Half Year Results

Picton announces its half year results for the period to 30 September 2020.

Financial Highlights

* EPRA earnings of GBP10.1 million

* Profit of GBP3.7 million

* Net assets of GBP506 million, or 93p per share

* Total return of 0.7%

* Dividend cover of 148%

* Loan to value ratio of 22%

* GBP50 million available through new undrawn revolving credit facility

Operational Highlights

* Total property return of 1.5%, outperforming the MSCI UK Quarterly Property

Index of -1.6%

* Occupancy increased to 90%

* Nine lettings completed, securing GBP1.2 million per annum, 2.8% ahead of

March 2020 ERV

* 16 lease renewals / regears completed, retaining GBP2.3 million per annum,

14.3% above March 2020 ERV

* Five rent reviews completed, securing an uplift of GBP0.3 million per annum,

16.3% above March 2020 ERV

* Additional income of GBP1.3 million received from asset management

initiatives

* Retail and Leisure exposure reduced to 12% from 18% of the total property

portfolio

Rent Collection

* Received 90% of the March quarter's rent, expected to rise to 96% under

agreed deferred payment plans

* Received 90% of the June quarter's rent, expected to rise to 93% under

agreed deferred payment plans

* To date 93% of the September quarter's rent has been collected or is

expected to be received under monthly payment plans

Subsequent Events

* Dividend increased by 12% to 2.8p per share effective November 2020

* Completed a further GBP0.4 million per annum of lettings, 2.4% above

September 2020 ERV, including the first letting at Stanford Building, WC2

* Good leasing pipeline with approximately GBP0.7 million per annum of

transactions agreed, subject to contract, across industrial, office and

retail sectors

Balance Sheet 30 Sept 2020 31 March 2020

Property valuation GBP661.6m GBP664.6m

Net assets GBP505.9m GBP509.3m

EPRA NAV per share 93p 93p

Income Statement Six months to Six months to

30 Sept 2020 30 Sept 2019

Profit after tax GBP3.7m GBP14.5m

EPRA earnings GBP10.1m GBP10.2m

Earnings per share 0.7p 2.7p

EPRA earnings per share 1.8p 1.9p

Total return 0.7% 2.8%

Total shareholder return -28.3% 0.3%

Total dividend per share 1.25p 1.75p

Dividend cover 148% 107%

Picton Chairman, Nicholas Thompson, commented:

"Picton has delivered a profit in what has undoubtedly been a challenging

period. Cognisant of this performance and the overall strength of the balance

sheet, we felt it was appropriate to take the first step in restoring the

dividend to pre-Covid levels by announcing a 12% increase, effective November

2020."

Michael Morris, Chief Executive of Picton, commented:

"We have delivered robust progress at a portfolio level and rent collection in

excess of 90%. As well as improving occupancy, generating additional income to

offset Covid-19 impacts and completing some key asset management projects, we

have also increased our weightings to the better performing industrial and

office sectors."

This announcement contains inside information.

For further information:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP662

million diversified UK commercial property portfolio, invested across 47 assets

and with around 350 occupiers (as at 30 September 2020). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

For more information please visit: www.picton.co.uk

CHAIRMAN'S STATEMENT

Introduction

The past six months has been dominated by the Covid-19 pandemic and mitigating

its impact. Throughout this unprecedented and challenging period, we have

adapted where required and focused on operating as close to normal as possible,

whilst supporting our occupiers as appropriate.

Ultimately the business has been resilient with low gearing and a portfolio

positioned to those sectors that have been less impacted by measures introduced

to limit the virus. Against this backdrop, I am pleased to report a profit for

the period of GBP3.7 million.

Performance

We have delivered a positive total return of 0.7% over the six months and our

net assets have dipped only slightly to GBP506 million, still reflecting a net

asset value of 93 pence per share.

We are mindful that the shareholder total return has dislocated from the

accounting return, but this is unfortunately a feature that is currently

prevalent across most of the listed real estate sector. This discount may

partially reflect concerns over rent collection levels across the market, which

have not been helped by emergency Government legislation prohibiting owners

from escalating recovery options where there is non-payment. However, we have

continued to engage constructively with our occupiers and consequently have

collected 90% of the rent due for the March and June quarters. Rent collection

levels for September are currently 93%, including monthly payment plans, and

this is expected to improve as the quarter progresses. These results also

include provisions made against rent outstanding as set out in the Financial

Overview.

Our EPRA earnings for the period are similar to last year. Despite lower than

usual rent collection we have been able to offset this with additional one-off

income from active management initiatives, whilst reducing both property and

administrative costs relative to this period last year.

Property Portfolio

We have once again outperformed the MSCI UK Property Quarterly Index for the

period, which continues our long-term track record of outperformance. In

particular, our industrial portfolio has demonstrated its defensive qualities

with a valuation increase over this period.

In line with market practice, our independent valuer has also removed the

material uncertainty clause that was included in the March and June 2020

valuations.

We have continued to invest into the portfolio by upgrading assets and I am

pleased to report completion of the office and retail scheme at Stanford

Building in London WC2, where we have already welcomed our first occupier post

period end.

A combination of the forthcoming disposal of a retail asset announced on 21

September, pleasingly 30% ahead of the March and June 2020 valuations, and a

reclassification of the Stanford Building, post refurbishment, means that we

have increased the weighting of the portfolio towards industrial and office

assets, with almost 90% of the portfolio now allocated to these more resilient

sectors.

We have been able to increase occupancy, which now stands at 90%, as a result

of a number of key lettings, principally in the industrial sector. It is

clearly harder and is likely to take longer to capture the reversionary

potential in the retail and office sectors as leasing demand is generally

weaker and reflects the uncertainties the economy is facing. Despite this, many

of our assets continue to attract occupational interest and we have only had GBP

0.1 million per annum of income lost from occupiers vacating. A more detailed

portfolio review is set out below.

Capital Structure

We have maintained a relatively low loan-to-value ratio throughout the period,

which has remained constant at 22%. Our lower distribution policy has provided

short-term support to ensure that our balance sheet is not undermined. As

previously announced, we completed the refinancing of our revolving credit

facilities during the period, which now means we have a single facility that

remains fully undrawn and provides GBP50 million for appropriate investment

opportunities should they arise.

Dividends

In April we reacted swiftly to mitigate the impact of the pandemic and

concluded that it was in the interest of our stakeholders to reduce the

dividend to provide more operational flexibility with the expectation of a

worsening economic backdrop. Over the period, we have been able to secure

additional income, which, combined with a lower level of distributions, has

supported dividend cover of 148%. Excluding the additional income, this reduces

to 129% over the six-month period.

As announced at the end of last month, we have taken the first steps in

rebuilding the dividend to its prior level, recognising the current position

but also the prevailing economic environment. This higher dividend, reflecting

a 12% increase or 2.8 pence on an annualised basis, will be effective for the

dividend payable this month.

Governance

I would like to thank Roger Lewis, who retired on 30 September, for the

significant contribution he has made to the Company over the last decade and

would also like to welcome Richard Jones who joined the Board on 1 September as

an independent Non-Executive Director and also as Chair of our Property

Valuation Committee.

On 13 October, we announced the appointment of Lena Wilson CBE as my successor

and she will be joining the Company next year and taking over from me as Chair

in February. Lena will bring a wealth of experience from both her executive and

non-executive career and I look forward to working with her prior to my

departure next February. I wish her and my colleagues future success in taking

the Company forward.

In light of Covid-19 restrictions, our AGM will be held as a closed meeting

later this month, but I would encourage shareholders to vote by proxy and ask

questions of the Board as detailed in the proxy form.

Sustainability

This remains a key area of focus as we develop our sustainability commitments

within our corporate strategy and establish the key metrics and targets to

measure our sustainability performance and success.

As part of this commitment, we have also joined the Better Buildings

Partnership, which is a collaboration of leading businesses from across the

real estate sector. As a member, we will be able to participate in the debate

around the environmental impact of real estate and the direction the industry

is taking in respect of sustainability.

In August, we published our 2020 Sustainability Report and I am pleased to note

that it has again been recognised with a Gold award from EPRA.

Outlook

Although encouraged by the recent news of a vaccine breakthrough, we are

mindful that a second national lockdown, together with the end of the Brexit

transition period, are contributing to further economic uncertainties. Despite

this, we have a strong business model and a clear strategy focused on

Operational Excellence, Portfolio Performance and Acting Responsibly. I am

confident that this approach will help to guide us through these more difficult

times.

Nicholas Thompson

Chairman

11 November 2020

MARKET OVERVIEW

Economic Backdrop

During the last six months, global economies including the UK have been damaged

by the disruption caused by the impacts of the Covid-19 pandemic.

The latest IMF forecasts indicate that the UK economy will contract by nearly

10% in 2020 and rank fifth out of the G7 economies in terms of adverse impact.

The quarterly contraction in UK GDP of -19.8% recorded by the Office for

National Statistics for the three months to June 2020 was the largest fall on

record.

To mitigate the impact of Covid-19, there has been a large response both in

terms of UK Government policy and measures introduced by the Bank of England,

including the furlough scheme, record low interest rates (0.1% since March

2020) and quantitative easing.

The range of support provided by the UK Government has been relatively generous

and comprehensive. The furlough scheme has cushioned the blow to households by

supporting incomes and encouraging businesses to retain employees. However due

to this support, the UK Government's debt to GDP ratio reached a 57-year high

and is likely to increase further off the back of additional quantitative

easing announced in November. The 'Eat Out to Help Out' scheme has been widely

cited as being responsible for the sharp fall in the Consumer Price Index (CPI)

in August. CPI fell to 0.2% in August 2020, down from 1.0% in July and now

stands at 0.5%.

As businesses adapted to social distancing measures, the economy showed signs

of recovery following the first national lockdown. In September 2020, the ONS

recorded the fifth consecutive month of growth for retail sales volumes, which

are now 5.5% above February's pre-pandemic level. The proportion of online

spending peaked during lockdown and now stands at 27.5%, up from 20.1% in

February.

Positively, the Household Savings Ratio increased to 29.1% in the second

quarter of 2020, the highest level on record and the Stamp Duty holiday

introduced in July has reinvigorated the UK housing market.

While less restrictive, the recently introduced second lockdown now in force in

England will still cause major disruption to all those businesses directly or

indirectly impacted, particularly in retail, hospitality and travel. It is

anticipated that over the short-term, the economic recovery will be

intermittent and disproportionately focused upon digital commerce.

Although the second lockdown is scheduled to last just one month, a tiered

approach is likely to remain in effect until a Covid-19 vaccine is in

circulation. The above, coupled with uncertainty arising from the UK's post

Brexit transition period which ends in December, and speculation as to the pace

of future trade deals, adds further to a short-term challenging outlook.

With UK Government bond yields currently at very low or even negative levels,

the expectation is for lower investment returns generally. As recently

announced, further quantitative easing and a continued low interest rate

environment are considered supportive for the property market, despite weaker

occupational demand. Against this backdrop, UK commercial property investment

looks favourable with the MSCI UK Quarterly Property Index All Property Net

Initial Yield standing at 4.7% in September 2020.

UK Property Market

The MSCI Monthly UK Property Index shows a total return for All Property for

the six months to September 2020 of -1.6%, with an income return of 2.7% and

capital growth of -4.2%. Rental growth was -1.7% for the six months to

September 2020, compared to -0.5% for the six months to March 2020. Initial

yields have moved from 5.2% in March 2020 to 5.1% in September 2020.

Of the three main property sectors, industrial was the only sector to produce a

positive total return for the period. The market performance for the six months

to September 2020 for the three main sectors was as follows:

In the industrial sector, the six-month total return was 1.7%, comprising 2.4%

income return and -0.7% capital growth. In terms of capital growth by segment,

this ranged from -2.7% in the South West to 0.9% in London. London industrial

was the only industrial segment to show positive capital growth. All Industrial

rental growth was 0.6%. Rental growth was positive across all segments, ranging

from 0.1% in Eastern to 1.1% in Inner South East.

In the office sector, the six-month total return was -0.8%, comprising 2.4%

income return and -3.2% capital growth. Capital growth was negative across all

office segments. The range was from -5.7% in Scotland to -1.8% in Outer South

East. All Office rental growth was

-0.7%. Rental growth by segment ranged from -1.7% for Rest of London to 1.0% in

South West. Three office market segments had positive rental value growth;

South West, Eastern and Midlands & Wales.

The All Retail total return was -5.8%, comprising 3.6% income return and -9.1%

capital growth. Capital growth was negative across all segments, ranging from

-17.1% for Standard Retail Yorkshire & Humberside to -4.5% for Retail Warehouse

London. All Retail rental growth was -5.0%. Rental growth was negative for all

segments, ranging from -8.8% for Standard Retail Eastern to -2.0% for Standard

Retail North East.

Occupancy at an All Property level fell by 1% over the six months, with the

MSCI Monthly UK Property Index recording an occupancy rate of 90.8% for

September 2020 (March 2020: 91.8%).

According to Property Data, total investment for the six months to September

2020 was GBP11.8 billion, a decrease of -64% compared to GBP33.0 billion in the six

months to March 2020. Of the total investment in the period, 40% was from

overseas.

BUSINESS REVIEW

Valuation

The independent portfolio valuation on 30 September, as provided by CBRE

Limited, was GBP661.6 million, reflecting a net initial yield of 5.0% and a

reversionary yield of 6.5%. There was a modest decrease in the value of the

portfolio of -0.5% over the six months, principally reflecting the impact of

Covid-19.

Sector Portfolio Sept 20 Like-for-like

weightings valuation change

Industrial 49.5% GBP327.6m 2.9%

South East 37.0% 3.9%

Rest of UK 12.5% 0.3%

Office 38.2% GBP252.4m -2.6%

London City and West 9.2% -3.4%

End

Inner and Outer 5.5% -5.0%

London

South East 11.3% -2.9%

Rest of UK 12.2% -0.7%

Retail and Leisure 12.3% GBP81.6m -6.4%

Retail warehouse 6.9% -5.3%

High Street - Rest 3.8% -7.4%

of UK

Leisure 1.6% -8.3%

Total 100% GBP661.6m -0.5%

Performance

For the six months to September, the portfolio returned 1.5%, outperforming the

MSCI UK Quarterly Property Index, which delivered -1.6%. The income return was

2.3%, 0.2% ahead of the Index.

Again, there has been a divergence of valuation movements between the sectors,

with the impact of the Covid-19 pandemic and lockdown restrictions affecting

sectors differently. All sectors outperformed the benchmark, with the

industrial portfolio increasing by 2.9%, the office portfolio decreasing by

-2.6% and the retail and leisure portfolio declining by -6.4%.

The overweight position to the industrial sector, accounting for 50% of the

portfolio, and the low retail and leisure weighting, now accounting for 12%,

combined with leasing and asset management activity, contributed to this

outperformance.

We only have 7% of our portfolio invested in retail warehouses, under 4% in

high street retail and under 2% in the leisure sector, all of which have been

more affected by the pandemic.

We completed nine lettings securing income of GBP1.2 million per annum, 2.8%

ahead of ERV. This included the upsizing of three existing occupiers reflecting

our Picton Promise; five key commitments that underpin every aspect of the

occupier experience we provide. There were also 16 lease renewals or regears

retaining income of GBP2.3 million per annum, an increase on the previous passing

rent of 12.1%, and 14.3% above ERV. Break options were removed or pushed back

in three leases, securing GBP0.5 million per annum for a further period. Five

rent reviews were concluded, securing a GBP0.3 million per annum uplift in

income, 16.3% above ERV.

Contractual passing rent increased by 1.7% to GBP36.8 million per annum. The

increase reflects the letting activity, combined with higher rents being

secured overall on lease events and various other asset management

transactions.

Encouragingly, the portfolio's ERV increased by 0.2% to GBP45.3 million per

annum, due to rental growth of 2.6% in the industrial portfolio, offset by a

nominal decline of -0.6% in the office portfolio and a -3.7% decline in the

retail portfolio.

Of the transactions undertaken, lettings were on average 2.8% ahead of March

2020 ERVs, rent reviews and lease renewals were 14.8% ahead of March 2020 ERVs

and the one disposal agreed was 30% ahead of the March 2020 independent

valuation.

Managing the impact of Covid-19

Our occupier focused approach means we have built good relationships with our

occupiers and, with an understanding of their businesses, have been able to

work closely with those requiring support. Each situation is different and we

have agreed bespoke solutions depending on individual circumstances, including

switching to monthly payments, deferred payments in part or in full and

extending lease terms and income in return for upfront incentives to assist

short-term cash flow.

Examples include an office occupier at 50 Farringdon Road, London where we

removed a 2022 break option, securing GBP0.2 million per annum, subject to

review, until 2027 in return for an additional four-months' rent free. At

Briggate, Leeds, where a retail occupier had an expiry in October 2021, we

re-based the rent from March 2020 and provided three months' rent free. In

return we secured a five-year renewal lease at GBP0.1 million per annum, ahead of

ERV.

Whilst these types of transaction have reduced income in the short-term, they

have secured longer term leases which are positively reflected in the relative

valuation movements.

At the same time, we have actively looked to reduce costs at our buildings.

This has included a number of initiatives, such as reducing service charges by

between 10% and 40% at ten properties, deferring works if not essential, moving

to remote security and reducing landscaping visits.

Business activity in the industrial portfolio has remained high during the

period, with sites generally operating at or around their normal levels.

Whilst all our offices have robust Covid-19 occupancy plans and detailed risk

assessments, actual occupation over the period has remained relatively low.

Following the Government's encouragement to return to the office and schools

reopening, we saw a gradual increase in staff returning over the summer,

particularly in regional locations with many businesses having up to 50% of

their workforce back. We expect the number of people in the office will

continue to ebb and flow as Covid-19 restrictions change.

Our retail warehousing has remained busy due to parking availability, large

units allowing social distancing and shoppers being able to click and collect.

This sub-sector has outperformed high street retail, where footfall has been

lower over the period, whilst the leisure and hotel sectors have been most

affected.

Our rent collection for the March and June quarters now stands at 90% and will

increase further on receipt of deferred payments. Including monthly payment

plans, the September quarter is higher, currently at 93%. Further detail is

provided in the Financial Overview.

Occupancy

Capital investment was GBP2.5 million for the period, with nearly 60% of the void

portfolio under refurbishment, predominantly in the office sector.

As at 30 September 2020 we had a total void ERV of GBP4.4 million and have

increased occupancy from 89% to 90% through a number of initiatives, including

securing several key lettings, principally in the industrial sector, and

incurring minimal occupier departures, having regeared many 2020 lease expiries

last year.

Around half the increase in occupancy relates to the short-term letting of our

distribution unit in Rugby to UPS. The industrial portfolio currently only has

two small vacant multi-let units, one of which is under offer.

Industrial Portfolio

The industrial portfolio has performed well over the half-year. Resilient

occupational demand, a shortage of supply and limited development, especially

in the South East and multi-let sector, has resulted in further rental growth,

which we are capturing through asset management activity.

Capital values increased by 2.9%, or GBP9.3 million. The passing rent increased

by 4.5%, or GBP0.7 million per annum, and the ERV grew by 2.6%, or GBP0.5 million.

The UK-wide distribution warehouse assets total 1.2 million sq ft in five

units, which are fully income-producing with a weighted average unexpired lease

term of 6.2 years.

The multi-let estates, of which 96% by value are in the South East, total 1.4

million sq ft and are 99.6% let. Only two units are vacant out of 126, both of

which came back at the end of the period and one is already under offer.

Five units, including our distribution unit in Rugby, were let during the

period, securing GBP1.0 million per annum, 3.5% ahead of ERV. We are actively

pursuing surrenders where we can secure a premium and re-let at higher rents.

We have secured GBP0.2 million of additional income from three rent reviews

settled over the period, 19.6% ahead of ERV. Three occupiers have been retained

at renewal, increasing the passing rent by 35.4% to GBP0.3 million per annum,

11.3% above ERV.

The industrial portfolio currently has GBP2.3 million of reversionary income

potential, with GBP0.1 million relating to the void units.

Office Portfolio

There was a divergence of performance across our offices, with the regional

offices declining in value by -1.7%, and the smaller component of central

London offices declining in value by -4.0%, reflecting the tougher leasing

conditions and the greater impact of Covid-19 disruption. Occupational demand

has been muted, with the ongoing uncertainty surrounding working from home

resulting in occupiers deferring decisions and wanting to retain flexibility in

the short-term.

We are, however, beginning to see occupational interest where occupiers are

looking for best-in-class Grade A space, for example at Stanford Building,

London WC2, where we pre-let an office floor after the period end. Our offices,

all of which are low-rise, have remained operational throughout the period with

Covid-19 occupancy plans in place and we are liaising closely with our

occupiers.

Capital values declined by -2.6% or GBP6.8 million. Notwithstanding this, the

passing rent increased by 1.6%, or GBP0.2 million per annum, with only two small

suites coming back over the period with an ERV of GBP40,000 per annum. The office

portfolio ERV declined by -0.6% over the period, or GBP0.1 million, with the

regional assets being stable and London declining by -1.6%.

Stanford Building, London WC2, has been reclassified as an office following the

planning application to convert the first floor from retail to office space.

Due to this building being vacant at the period end the office portfolio

occupancy is 81%. Our second largest void is at 50 Pembroke Court, Chatham,

where we have leased part of the vacant space post period end. Third is Angel

Gate, London EC1, where we are introducing a flexi-leasing strategy to secure

occupiers.

Eight occupiers have been retained at renewal, increasing the passing rent by

22.8% to GBP0.8 million per annum, 5.4% above ERV and we have secured a 37.4%

uplift at one rent review to GBP0.2 million per annum.

The office portfolio currently has GBP5.9 million of reversionary income

potential, with GBP3.7 million relating to the void units.

Retail and Leisure Portfolio

The retail and leisure property market has been hit by the Government lockdown

and non-essential retailers being forced to close for a period. Combined with

retailer failures across the market, this has continued to weaken sentiment

towards the sector with high street retail and leisure suffering more than the

retail warehouse parks.

Our portfolio has not been immune to the decline in investment and occupational

demand and capital values reduced by -6.4% or -GBP5.6 million. This was

principally driven by declining ERVs although no occupiers vacated over the

period and the portfolio has a weighted average unexpired lease term of 8.9

years. The passing rent declined by -4.5% or -GBP0.3 million per annum and the

ERV declined by -3.7% or -GBP0.3 million over the period with declines being seen

across all sub-sectors.

Against this difficult backdrop, we have worked with our occupiers where

assistance was needed and been successful in extending leases in return for

re-basing rents or providing upfront incentives in Bury, Leeds and Stockport.

The void ERV is only GBP0.6 million, reflecting a higher level of occupancy of

91%, with two retail warehouse units in Bury accounting for over 40% of the

total, one of which is under offer. The overall reversionary income is GBP0.3

million, reflecting the level of over-renting in the portfolio.

Investment Activity

As recently announced, we exchanged contracts on the disposal of a high street

retail asset in Peterborough for GBP4.0 million, reflecting a 30% premium to the

March 2020 valuation.

The property comprises two retail units, with one let to TK Maxx who intend to

vacate in March 2021 and the other vacant and previously occupied by New Look.

We had reviewed alternative use options and made a pre-application in respect

of converting the upper floors to residential use. The purchaser, Peterborough

City Council, intends to convert the building into a new city library and

community hub. We will keep the rental income until completion, which is due on

or before 22 December 2020.

The proceeds will be deployed into other identified asset enhancement projects

across the portfolio.

In terms of acquisition opportunities, these have been more muted, reflecting

the reduced liquidity in the property investment market for much of the period.

We are starting to see more opportunities, particularly since the summer and

will continue to take a disciplined approach to acquisitions, especially given

the current environment. We believe that opportunities are likely to arise,

especially where vendors may have redemptions, occupier defaults or to ensure

loan covenant compliance.

Looking Ahead

Our focus is on continuing to work with our occupiers through this difficult

period, whilst capturing the reversionary income potential embedded within the

portfolio, principally through leasing vacant space and further value creation

through active asset management.

In summary there is GBP8.5 million per annum of upside from the current passing

rent. This includes GBP3.3 million per annum which follows expiries of rent-free

periods. There is a further GBP4.4 million per annum potentially available from

leasing currently vacant space. Finally, there is GBP0.8 million of potential

income where ERVs are higher than the passing rent, providing scope for rental

uplifts at either review or lease expiry.

Recognising the strength of the portfolio in terms of its location, sector,

asset quality and diversified income, we remain confident in our ability to

unlock upside over the medium-term.

Top Ten Assets

The largest assets in the portfolio as at 30 September 2020, ranked by capital

value, represent 54% of the total portfolio valuation and are detailed below:

Sector Approximate Appraised

area (sq ft) value

Parkbury Industrial Estate, Radlett, Industrial 336,700 >GBP40m

Herts.

River Way Industrial Estate, Harlow, Industrial 454,800 >GBP40m

Essex

Angel Gate, City Road, London EC1 Office 64,500 GBP30m-GBP40m

Stanford Building, Long Acre, London Office 19,700 GBP30m-GBP40m

WC2

Tower Wharf, Cheese Lane, Bristol Office 70,800 GBP20m-GBP30m

50 Farringdon Road, London EC1 Office 31,000 GBP20m-GBP30m

Shipton Way, Rushden, Northants. Industrial 312,900 GBP20m-GBP30m

Datapoint, Cody Road, London E16 Industrial 55,500 GBP20m-GBP30m

Lyon Business Park, Barking, Essex Industrial 99,400 GBP20m-GBP30m

Colchester Business Park, Office 150,700 GBP20m-GBP30m

Colchester, Essex

A full portfolio listing is available on the Company's website:

www.picton.co.uk

Top Ten Occupiers

The top ten occupiers, based as a percentage of annualised contracted rental

income, after lease incentives, as at 30 September 2020, are summarised below:

Occupier %

1 Public Sector 4.6

2 Belkin Limited 4.1

3 B&Q PLC 3.0

4 The Random House Group Limited 2.9

5 Snorkel Europe Limited 2.7

6 XMA Limited 2.4

7 Portal Chatham LLP 1.9

8 DHL Supply Chain Limited 1.9

9 TK Maxx 1.7

10 Canterbury Christ Church University 1.7

26.9

Financial Overview

Income Statement

For the six months to 30 September our total profit was GBP3.7 million,

representing earnings per share of 0.7 pence. Given the exceptional

circumstances over the last six months, we believe this is a positive result.

There was a small decline in the portfolio valuation for the period,

principally across the retail assets, continuing the theme of last year.

Our EPRA earnings, being recurring income less costs of running the business,

were GBP10.1 million for the period, or 1.8 pence per share. This is very similar

to last year's results, but achieved in much more challenging circumstances.

Our property revenue is lower this period compared to a year ago, reflecting

the difficult leasing market as well as the impact of increased provisions

being made against income receivable. During the period, we have included GBP1.3

million of additional income arising from active asset management, principally

dilapidations settlements. We also successfully reduced our property costs and

administrative expenses, thus offsetting the lower rental income.

Throughout the period, we have focused on rent collection, which given the

circumstances has been positive, helped by our lower exposure to the more

problematic retail and hospitality sectors. The following table shows our

collection rates for the last three quarters. Including agreed monthly payment

plans, the September quarter figures are higher than the March and June

quarters and we expect this to increase further as the quarter progresses.

Sept 2020 June 2020 March 2020

Collected 86% 90% 90%

Moved to monthly 7% - -

Deferred - 3% 6%

Concessions agreed 1% 1% 1%

Outstanding 6% 6% 3%

We have made prudent provisions of GBP2.2 million against these recent three

quarters, and will keep this under review and remain in active dialogue with

our occupiers.

Administrative expenses for the period were GBP2.3 million, some 19% lower than

the previous period. This reduction is largely due to lower staff costs, where

the variable elements of remuneration are aligned with the Company's

performance and share price. We have not required any form of Government

support nor needed to furlough any employees.

Finance costs are broadly unchanged at GBP4.1 million for the half year. Our

average interest rate across all our borrowings is 4.2% which is unchanged

since year end.

In the early stages of the pandemic we took the difficult decision to reduce

the dividend by 30%, in order to provide us with extra headroom and flexibility

during such a period of uncertainty. We have paid two interim dividends at this

lower rate of 0.625 pence per share, or GBP6.8 million in total.

Dividend cover for the six months was 148%, or 129% excluding additional

income. Recognising our rent collection performance and high dividend cover we

have decided to increase the dividend by 12% to 0.7 pence per quarter,

effective from the November payment which is a first step in restoring the

dividend to its previous level.

Balance Sheet

The net assets of the Group declined slightly over the period by -GBP3.4 million,

to GBP505.9 million, a decrease of -0.7%.

The external valuation of the property portfolio stood at GBP661.6 million at 30

September. We have exchanged contracts on the disposal of one small retail

asset for gross proceeds of GBP4.0 million, and additionally we have invested GBP

2.5 million in capital projects undertaken across the portfolio.

Borrowings now stand at GBP166.8 million, representing a loan to value ratio of

22%. We have met all of our loan covenants throughout the period and have ample

headroom against them. In the period we have refinanced our GBP50 million

revolving credit facility, for a three-year term to June 2023, and with the

option of two one-year extensions. This gives us operational flexibility to

fund potential future projects and investment opportunities.

DIRECTORS' RESPONSIBILITIES

STATEMENT OF PRINCIPAL RISKS AND UNCERTAINTIES

The Company's assets comprise direct investments in UK commercial property. Its

principal risks are therefore related to the commercial property market in

general and its investment properties. Other risks faced by the Company include

economic, investment and strategic, regulatory, management and control,

operational and financial risks.

These risks, and the way in which they are managed, are described in more

detail under the heading 'Managing Risk' within the Strategic Report in the

Company's Annual Report for the year ended 31 March 2020. The Company's

principal risks and uncertainties have not changed materially since the date of

that Report.

STATEMENT OF GOING CONCERN

The Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable future.

Therefore, they continue to adopt the going concern basis in preparing the

financial statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE INTERIM REPORT

We confirm that to the best of our knowledge:

a. the condensed set of consolidated financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

b. the Chairman's Statement and Business Review (together constituting the

Interim Management Report) together with the Statement of Principal Risks and

Uncertainties above include a fair review of the information required by the

Disclosure Guidance and Transparency Rules ('DTR') 4.2.7R, being an indication

of important events that have occurred during the first six months of the

financial year, a description of principal risks and uncertainties for the

remaining six months of the year, and their impact on the condensed set of

consolidated financial statements; and

c. the Chairman's Statement together with the condensed set of consolidated

financial statements include a fair review of the information required by DTR

4.2.8R, being related party transactions that have taken place in the first six

months of the current financial year and that have materially affected the

financial position or performance of the Company during that period, and any

changes in the related party transactions described in the last Annual Report

that could do so.

The Directors are responsible for the maintenance and integrity of the

corporate and financial information included on the Company's website, and for

the preparation and dissemination of financial statements. Legislation in

Guernsey governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

By Order of the Board

Andrew Dewhirst

Director

11 November 2020

INDEPENT REVIEW REPORT TO PICTON PROPERTY INCOME LIMITED

CONCLUSION

We have been engaged by Picton Property Income Limited (the "Company") to

review the condensed set of financial statements in the half-yearly financial

report for the six months ended 30 September 2020 of the Company and its

subsidiaries (together the "Group") which comprises the condensed consolidated

balance sheet and the condensed consolidated statements of comprehensive

income, changes in equity and cash flows, and the related explanatory notes.

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the half-yearly

financial report for the six months ended 30 September 2020 is not prepared, in

all material respects, in accordance with IAS 34 Interim Financial Reporting

and the Disclosure Guidance and Transparency Rules ("the DTR") of the UK's

Financial Conduct Authority ("the UK FCA").

SCOPE OF REVIEW

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the Auditing

Practices Board for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review procedures. We

read the other information contained in the half-yearly financial report and

consider whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

A review is substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does not enable

us to obtain assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not express an audit

opinion.

DIRECTORS' RESPONSIBILITIES

The half-yearly financial report is the responsibility of, and has been

approved by, the directors. The directors are responsible for preparing the

half-yearly financial report in accordance with the DTR of the UK FCA.

As disclosed in note 2, the annual financial statements of the Group are

prepared in accordance with International Financial Reporting Standards. The

directors are responsible for preparing the condensed set of financial

statements included in the half-yearly financial report in accordance with IAS

34.

OUR RESPONSIBILITY

Our responsibility is to express to the Company a conclusion on the condensed

set of financial statements in the half-yearly financial report based on our

review.

THE PURPOSE OF OUR REVIEW WORK AND TO WHOM WE OWE OUR RESPONSIBILITIES

This report is made solely to the Company in accordance with the terms of our

engagement letter to assist the Company in meeting the requirements of the DTR

of the UK FCA. Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Company for our review work, for

this report, or for the conclusions we have reached.

Deborah Smith

For and on behalf of KPMG Channel Islands Limited

Chartered Accountants, Guernsey

11 November 2020

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF YEARED 30 SEPTEMBER 2020

Note 6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2020 2019 2020

unaudited unaudited audited

Total Total Total

GBP000 GBP000 GBP000

Income

Revenue from properties 3 21,653 23,399 45,664

Property expenses 4 (5,120) (6,190) (12,027)

Net property income 16,533 17,209 33,637

Expenses

Administrative expenses (2,342) (2,879) (5,563)

Total operating expenses (2,342) (2,879) (5,563)

Operating profit before movement 14,191 14,330 28,074

on investments

Investments

Profit on disposal of investment 9 - - 3,478

properties

Investment property valuation 9 (6,392) 4,341 (882)

movements

Total (loss)/ profit on (6,392) 4,341 2,596

investments

Operating profit 7,799 18,671 30,670

Financing

Interest income 3 3 9

Interest expense (4,122) (4,235) (8,295)

Total finance costs (4,119) (4,232) (8,286)

Profit before tax 3,680 14,439 22,384

Tax - 68 124

Profit after tax and total 3,680 14,507 22,508

comprehensive income for the

period/ year

Earnings per share

Basic and diluted 7 0.7p 2.7p 4.1p

All income is attributable to the equity holders of the Company. There are no

minority interests. Notes 1 to 15 form part of these condensed consolidated

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF YEARED 30 SEPTEMBER 2020

Note Share Other Retained Total

Capital Reserves Earnings GBP000

GBP000 GBP000 GBP000

Balance as at 31 March 2019 157,449 (286) 342,252 499,415

Profit for the period - - 14,507 14,507

Dividends paid 6 - - (9,493) (9,493)

Issue of ordinary shares 7,137 - - 7,137

Issue costs of shares (186) - - (186)

Vesting of shares held in trust - 54 (54) -

Share based awards - 146 - 146

Purchase of shares held in trust - (844) - (844)

Balance as at 30 September 2019 164,400 (930) 347,212 510,682

Profit for the period - - 8,001 8,001

Dividends paid 6 - - (9,546) (9,546)

Share based awards - 146 - 146

Balance as at 31 March 2020 164,400 (784) 345,667 509,283

Profit for the period - - 3,680 3,680

Dividends paid 6 - - (6,819) (6,819)

Share based awards - 388 - 388

Purchase of shares held in trust - (643) - (643)

Balance as at 30 September 2020 164,400 (1,039) 342,528 505,889

Notes 1 to 15 form part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 30 SEPTEMBER 2020

Note 30 30 31 March

September September 2020

2020 2019 audited

unaudited unaudited GBP000

GBP000 GBP000

Non-current assets

Investment properties 9 646,668 683,208 654,486

Tangible assets 17 23 20

Total non-current assets 646,685 683,231 654,506

Current assets

Investment properties held for sale 9 3,975 - -

Accounts receivable 20,501 17,765 17,601

Cash and cash equivalents 18,899 17,125 23,567

Total current assets 43,375 34,890 41,168

Total assets 690,060 718,121 695,674

Current liabilities

Accounts payable and accruals (18,250) (21,062) (19,438)

Loans and borrowings 10 (915) (860) (888)

Obligations under leases (107) (108) (108)

Total current liabilities (19,272) (22,030) (20,434)

Non-current liabilities

Loans and borrowings 10 (163,191) (183,699) (164,248)

Obligations under leases (1,708) (1,710) (1,709)

Total non-current liabilities (164,899) (185,409) (165,957)

Total liabilities (184,171) (207,439) (186,391)

Net assets 505,889 510,682 509,283

Equity

Share capital 11 164,400 164,400 164,400

Retained earnings 342,528 347,212 345,667

Other reserves (1,039) (930) (784)

Total equity 505,889 510,682 509,283

Net asset value per share 13 93p 94p 93p

These condensed consolidated financial statements were approved by the Board of

Directors on 11 November 2020 and signed on its behalf by:

Andrew Dewhirst

Director

Notes 1 to 15 form part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 SEPTEMBER 2020

Note 6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 audited

unaudited unaudited GBP000

GBP000 GBP000

Operating activities

Operating profit 7,799 18,671 30,670

Adjustments for non-cash items 12 6,783 (4,191) (2,295)

Interest received 3 3 9

Interest paid (3,837) (4,073) (7,952)

Tax received 56 11 123

Increase in accounts receivables (2,900) (3,456) (4,078)

Decrease in payables and accruals (1,365) (1,260) (2,936)

Cash inflows from operating activities 6,539 5,705 13,541

Investing activities

Capital expenditure on investment properties 9 (2,549) (2,765) (8,861)

Disposal of investment properties - - 33,859

Purchase of tangible assets - (2) (4)

Cash (outflows)/ inflows from investing activities (2,549) (2,767) 24,994

Financing activities

Borrowings repaid (622) (7,595) (33,204)

Borrowings drawn - - 6,000

Financing costs (574) - -

Issue of ordinary shares - 7,137 7,137

Issue costs of ordinary shares - (186) (186)

Purchase of shares held in trust (643) (844) (844)

Dividends paid 6 (6,819) (9,493) (19,039)

Cash outflows from financing activities (8,658) (10,981) (40,136)

Net decrease in cash and cash equivalents (4,668) (8,043) (1,601)

Cash and cash equivalents at beginning of period/ 23,567 25,168 25,168

year

Cash and cash equivalents at end of period/year 18,899 17,125 23,567

Notes 1 to 15 form part of these condensed consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF YEARED 30 SEPTEMBER 2020

1. GENERAL INFORMATION

Picton Property Income Limited (the "Company" and together with its

subsidiaries the "Group") was established in Guernsey on 15 September 2005 and

entered the UK REIT regime on 1 October 2018.

The financial statements are prepared for the period from 1 April to 30

September 2020, with unaudited comparatives for the period from 1 April to 30

September 2019. Comparatives are also provided from the audited financial

statements for the year ended 31 March 2020.

2. SIGNIFICANT ACCOUNTING POLICIES

These financial statements have been prepared in accordance with IAS 34

'Interim Financial Reporting'. They do not include all of the information

required for full annual financial statements and should be read in conjunction

with the financial statements of the Group as at and for the year ended 31

March 2020.

The accounting policies applied by the Group in these financial statements are

the same as those applied by the Group in its financial statements as at and

for the year ended 31 March 2020.

The annual financial statements of the Group are prepared in accordance with

International Financial Reporting Standards ('IFRS') as issued by the IASB. The

Group's annual financial statements for the year ended 31 March 2020 refer to

new Standards and Interpretations none of which has a material impact on these

financial statements. There have been no significant changes to management

judgements and estimates as disclosed in the last annual report and financial

statements for the year ended 31 March 2020.

3. REVENUE FROM PROPERTIES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Rents receivable (adjusted for lease incentives) 17,646 19,369 37,780

Surrender premiums 11 363 603

Dilapidation receipts 1,195 413 471

Other income 80 82 81

Service charge income 2,721 3,172 6,729

21,653 23,399 45,664

Rents receivable includes lease incentives recognised of GBP0.7 million (30

September 2019: GBP0.8 million, 31 March 2020: GBP1.3 million).

4. PROPERTY EXPENSES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Property operating costs 914 1,342 2,293

Property void costs 1,485 1,676 3,005

Recoverable service charge costs 2,721 3,172 6,729

5,120 6,190 12,027

5. OPERATING SEGMENTS

The Board is charged with setting the Group's business model and strategy. The

key measure of performance used by the Board to assess the Group's performance

is the total return on the Group's net asset value. As the total return on the

Group's net asset value is calculated based on the net asset value per share

calculated under IFRS as shown at the foot of the Balance Sheet, assuming

dividends are reinvested, the key performance measure is that prepared under

IFRS. Therefore, no reconciliation is required between the measure of profit or

loss used by the Board and that contained in the financial statements.

The Board has considered the requirements of IFRS 8 'Operating Segments'. The

Board is of the opinion that the Group, through its subsidiary undertakings,

operates in one reportable industry segment, namely real estate investment, and

across one primary geographical area, namely the United Kingdom, and therefore

no segmental reporting is required. The portfolio consists of 47 commercial

properties, which are in the industrial, office, retail and leisure sectors.

6. DIVIDS

Declared and paid: 6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Interim dividend for the period ended 31 March 2019: 0.875 - 4,712 4,712

pence

Interim dividend for the period ended 30 June 2019: 0.875 - 4,781 4,781

pence

Interim dividend for the period ended 30 September 2019: - - 4,773

0.875 pence

Interim dividend for the period ended 31 December 2019: 0.875 - - 4,773

pence

Interim dividend for the period ended 31 March 2020: 0.625 3,409 - -

pence

Interim dividend for the period ended 30 June 2020: 0.625 3,410 - -

pence

6,819 9,493 19,039

The interim dividend of 0.7 pence per ordinary share in respect of the period

ended 30 September 2020 has not been recognised as a liability as it was

declared after the period end. A dividend of GBP3,833,000 will be paid on 30

November 2020.

7. EARNINGS PER SHARE

Basic and diluted earnings per share is calculated by dividing the net profit

for the period attributable to ordinary shareholders of the Company by the

weighted average number of ordinary shares in issue during the period,

excluding the average number of shares held by the Employee Benefit Trust. The

diluted number of shares also reflects the contingent shares to be issued under

the Long-term Incentive Plan.

The following reflects the profit and share data used in the basic and diluted

profit per share calculation:

6 months 6 months Year ended

ended ended 31 March

30 30 2020

September September

2020 2019

Net profit attributable to ordinary shareholders of the 3,680 14,507 22,508

Company from continuing operations (GBP000)

Weighted average number of ordinary shares for basic profit 545,627,913 542,883,818 544,192,866

per share

Weighted average number of ordinary shares for diluted profit 547,188,142 545,054,006 546,227,914

per share

8. FAIR VALUE MEASUREMENTS

The fair value measurement for the financial assets and financial liabilities

are categorised into different levels in the fair value hierarchy based on the

inputs to valuation techniques used. The different levels have been defined as

follows:

Level 1: quoted prices (unadjusted) in active markets for identical assets or

liabilities that the Group can access at the measurement date.

Level 2: inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly or indirectly. The fair

value of the Group's secured loan facilities, as disclosed in note 10, are

included in Level 2.

Level 3: unobservable inputs for the asset or liability. The fair value of the

Group's investment properties is included in Level 3.

The Group recognises transfers between levels of the fair value hierarchy as of

the end of the reporting period during which the transfer has occurred. There

were no transfers between levels for the period ended 30 September 2020.

The fair value of all other financial assets and liabilities is not materially

different from their carrying value in the financial statements.

The Group's financial risk management objectives and policies are consistent

with those disclosed in the consolidated financial statements for the year

ended 31 March 2020.

9. INVESTMENT PROPERTIES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Fair value at start of period/year 654,486 676,102 676,102

Capital expenditure on investment properties 2,549 2,765 8,861

Disposals - - (33,073)

Realised gains on disposal - - 3,478

Unrealised movement on investment properties (6,392) 4,341 (882)

Transfer to assets classified as held for sale (3,975) - -

Fair value at the end of the period/year 646,668 683,208 654,486

Historic cost at the end of the period/year 622,946 650,809 629,932

The fair value of investment properties reconciles to the appraised value as

follows:

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Appraised value 661,570 693,355 664,615

Valuation of assets held under head leases 1,366 1,519 1,489

Lease incentives held as debtors (12,293) (11,666) (11,618)

Assets classified as held for sale (3,975) - -

Fair value at the end of the period/year 646,668 683,208 654,486

As at 30 September 2020 contracts had been exchanged to sell 62-68 Bridge

Street, Peterborough so this asset has been classified as an asset held for

sale. The sale is due to complete by December 2020.

As at 30 September 2020, all of the Group's properties are Level 3 in the fair

value hierarchy as it involves the use of significant inputs and there were no

transfers between levels during the period. Level 3 inputs used in valuing the

properties are those which are unobservable, as opposed to Level 1 (inputs from

quoted prices) and Level 2 (observable inputs either directly, i.e. as prices,

or indirectly, i.e. derived from prices).

The investment properties were valued by CBRE Limited, Chartered Surveyors, as

at 30 September 2020 on the basis of fair value in accordance with the RICS

Valuation - Global Standards (incorporating the International Valuation

Standards) and the UK national supplement (the Red Book) current as at the

valuation date.

The pandemic and the measures taken to tackle Covid-19 continue to affect

economies and real estate markets globally. Nevertheless, as at the valuation

date some property markets have started to function again, with transaction

volumes and properties on the market returning to levels where in general an

adequate quantum of market evidence exists upon which to base opinions of

value. Accordingly, and for the avoidance of doubt, the valuation is not

reported as being subject to 'material valuation uncertainty' as defined by VPS

3 and VPGA 10 of the RICS Valuation - Global Standards.

There were no significant changes to the inputs into the valuation process

(ERV, net initial yield, reversionary yield and true equivalent yield), or

assumptions and techniques used during the period, further details on which

were included in note 13 of the consolidated financial statements of the Group

for the year ended 31 March 2020.

The Group's borrowings (note 10) are secured by a first ranking fixed charge

over the majority of investment properties held.

10. LOANS AND BORROWINGS

Maturity 30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Current

Aviva facility - 1,285 1,231 1,258

Capitalised finance costs - (370) (371) (370)

915 860 888

Non-current

Santander revolving credit facility - - 4,500 -

Santander revolving credit facility - - 14,500 -

Canada Life facility 24 July 2027 80,000 80,000 80,000

Aviva facility 24 July 2032 85,558 86,843 86,207

Capitalised finance costs - (2,367) (2,144) (1,959)

163,191 183,699 164,248

Total loans and borrowings 164,106 184,559 165,136

The Group has a loan with Canada Life Limited for GBP80 million which matures in

July 2027. Interest is fixed at 4.08% over the life of the loan.

Additionally, the Group has a loan facility agreement with Aviva Commercial

Finance Limited for GBP95.3 million, which was fully drawn on 24 July 2012. The

loan matures in 2032, with approximately one-third repayable over the life of

the loan in accordance with a scheduled amortisation profile. Interest on the

loan is fixed at 4.38% over the life of the loan.

The fair value of the secured loan facilities at 30 September 2020, estimated

as the present value of future cash flows discounted at the market rate of

interest at that date, was GBP197.9 million (30 September 2019: GBP225.9 million,

31 March 2020: GBP197.0 million). The fair value of the secured loan facilities

is classified as Level 2 under the hierarchy of fair value measurements.

In May 2020 the Group entered into a new GBP50 million revolving credit facility

("RCF") with National Westminster Bank Plc; this replaces the facilities held

with Santander Corporate & Commercial Banking which have been cancelled. The

new facility is for an initial term of three years with the option of two,

one-year extensions. Currently undrawn, the RCF will incur interest at 150

basis points over LIBOR on drawn balances and an undrawn commitment fee of 60

basis points.

The weighted average interest rate on the Group's borrowings as at 30 September

2020 was 4.2% (30 September 2019: 4.1%, 31 March 2020: 4.2%).

11. SHARE CAPITAL AND OTHER RESERVES

The Company has 547,605,596 ordinary shares in issue of no par value (30

September 2019: 547,605,596, 31 March 2020: 547,605,596).

The balance on the Company's share premium account as at 30 September 2020 was

GBP164,400,000 (30 September 2019: GBP164,400,000, 31 March 2020: GBP164,400,000).

30 30 31 March

September September 2020

2020 2019

Ordinary share capital 547,605,596 547,605,596 547,605,596

Number of shares held in Employee Benefit Trust (2,052,269) (2,103,683) (2,103,683)

Number of ordinary shares 545,553,327 545,501,913 545,501,913

The fair value of awards made under the Long-term Incentive Plan is recognised

in other reserves.

Subject to the solvency test contained in the Companies (Guernsey) Law, 2008

being satisfied, ordinary shareholders are entitled to all dividends declared

by the Company and to all of the Company's assets after repayment of its

borrowings and ordinary creditors. The Trustee of the Company's Employee

Benefit Trust has waived its right to receive dividends on the 2,052,269 shares

it holds but continues to hold the right to vote. Ordinary shareholders have

the right to vote at meetings of the Company. All ordinary shares carry equal

voting rights.

12. ADJUSTMENT FOR NON-CASH MOVEMENTS IN THE CASH FLOW STATEMENT

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2020

2020 2019 GBP000

GBP000 GBP000

Profit on disposal of investment properties - - (3,478)

Movement in investment property valuation 6,392 (4,341) 882

Share based provisions 388 146 292

Depreciation of tangible assets 3 4 9

6,783 (4,191) (2,295)

13. NET ASSET VALUE

The net asset value per share calculation uses the number of shares in issue at

the period end and excludes the actual number of shares held by the Employee

Benefit Trust at the period end; see note 11.

At 30 September 2020, the Company had a net asset value per ordinary share of GBP

0.93 (30 September 2019: GBP0.94, 31 March 2020: GBP0.93).

14. RELATED PARTY TRANSACTIONS

There have been no changes in the related party transactions described in the

last annual report that could have a material effect on the financial position

or performance of the Group in the first six months of the current financial

year.

The Company has no controlling parties.

15. EVENTS AFTER THE BALANCE SHEET DATE

A dividend of GBP3,833,000 (0.7 pence per share) was approved by the Board on 22

October 2020 and is payable on 30 November 2020.

END

END

(END) Dow Jones Newswires

November 12, 2020 02:00 ET (07:00 GMT)

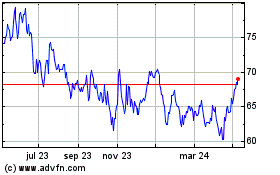

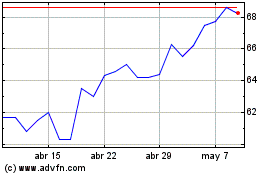

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024