TIDMSWG

RNS Number : 6776G

Shearwater Group PLC

28 July 2021

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

28 July 2021

SHEARWATER GROUP PLC

("Shearwater", or the "Group")

Final Results

Strong cash generation and growth in underlying EBITDA;

well-positioned for FY22

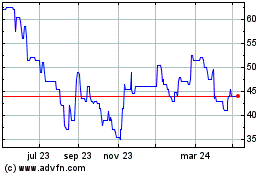

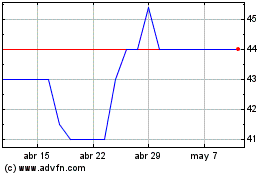

Shearwater Group plc (AIM: SWG), the organisational resilience

group that provides cybersecurity advisory and managed security

services, is pleased to announce its final results for the year

ended 31 March 2021.

Highlights:

-- Group revenue in the period of GBP31.8m (FY20: GBP33.0m)

-- GBP4.3m from the Software division (FY20: GBP5.5m)

-- GBP27.4m from the Services division (FY20: GBP27.5m)

-- Underlying EBITDA of GBP3.7m (FY20: GBP3.4m) ahead of market

expectations, against the backdrop of a challenging market

-- Underlying EBITDA margin of 12% (FY20: 10%)

-- Underlying profit before tax for the year of GBP2.4m (FY20: GBP2.2m)

-- Adjusted basic and diluted earnings per share of 10p (FY20: adjusted earnings per share 8p)

-- Strong financial position with a year-end adjusted net

cash(1) balance of GBP6.0 million (31 March 2020: GBP1.4m net

debt)

-- Continued progress in delivering strategic initiatives

KPIs

-- 155 new customer wins in the period (FY20: 150)

-- New Software revenue of GBP1.3m secured from new clients and

up-selling (FY20: GBP2.1m), with FY20 benefiting from a large

one-off contract, plus non-recurring sales associated with

widespread moves by customers to remote working in the prior

year

-- Proportion of revenue which is recurring in nature remained stable at c.40% (FY20: c.40%)

-- GBP0.7m of revenue generated through cross-selling

-- 67% of client base with long-standing relationships of more than three years

Post-period highlights and outlook:

-- Trading in Q1 FY22 was strong, with positive signs of returning business confidence

-- Hiring across all areas of the Group's businesses, with a

budgeted plan to increase headcount in both sales and technical

roles in FY22 to support the future growth of the Group

-- Currently assessing a pipeline of potential acquisitions

whilst maintaining the Group's disciplined approach to assessing

opportunities

-- Well positioned in a high growth sector, with healthy cash

balances and undrawn bank facilities providing a robust liquidity

position and a strong management team continuing to move the Group

forward

(1) Net cash adjusted to account for outstanding GBP1.3m VAT

deferral due to be paid from existing cash balances in FY22.

Phil Higgins, CEO of Shearwater Group, commented:

"I am pleased to report Shearwater's FY21 results reflecting the

successful development of the Group in the face of an unprecedented

year. We adapted well to challenging circumstances and continued to

win new clients, expanded our scope with many existing clients ,

made progress against our growth strategy and last, but not least,

delivered good growth in underlying EBITDA. I would like to take

this opportunity to thank all of the Group's staff for their

continued hard work and dedication.

We are now extremely well-positioned for continued growth

following the significant progress made over the last two years. We

are looking to the future with optimism, with the Company

well-positioned in a market only set to expand further, with a

strong balance sheet and a clear vision to become the provider of

choice in delivering next generation technology, professional

advisory and cyber security services and solutions.

Investor Presentation

Shearwater Group's CEO, Phil Higgins, and CFO, Paul McFadden,

will provide a live investor presentation, relating to the results,

via the Investor Meet Company platform on 4 August 2021 at 12:30.

Investors can sign up to Investor Meet Company for free and add to

meet Shearwater Group via

https://www.investormeetcompany.com/shearwater-group-plc/register-investor

.

Enquiries:

Shearwater Group plc www.shearwatergroup.com

David Williams c/o Alma PR

Phil Higgins

Cenkos Securities plc - NOMAD and

Joint Broker

Ben Jeynes / Max Gould - Corporate

Finance

Julian Morse / Michael Johnson

- Sales +44 (0) 20 7397 8900

Berenberg - Joint Broker

Matthew Armitt / Mark Whitmore +44 (0) 20 3207 7800

Alma PR shearwater@almapr.co.uk

Susie Hudson / Caroline Forde / +44 (0) 20 3405 0205

Joe Pederzolli

About Shearwater Group plc

Shearwater Group plc is an award-winning group providing cyber

security, managed security and professional advisory solutions to

create a safer online environment for organisations and their end

users.

The Group's differentiated full service offering spans identity

and access management and data security, cybersecurity solutions

and managed security services, and security governance, risk and

compliance. Its growth strategy is focused on building a scalable

group that caters to the entire spectrum of cyber security and

managed security needs, through a focused buy and build

approach.

The Group is headquartered in the UK, serving customers globally

across a broad spectrum of industries.

Shearwater shares are listed on the London Stock Exchange's AIM

under the ticker "SWG". For more information, please visit

www.shearwatergroup.com .

Chairman's statement

It is pleasing to report a record set of results for the Group, ahead

of underlying EBITDA expectations, for the year ended 31 March 2021.

Following the reorganisation and streamlining of our Group in FY20,

the benefits have shone through in the performance we achieved against

the backdrop of the pandemic. Not only is there now a more cohesive

culture within the Group, with all divisions contributing to the cross

fertilisation of opportunities, we have strengthened our financial position

and our margins, whilst continuing to invest to ensure we are providing

the very best services and solutions for our clients as we continue

to expand.

I would like to take this opportunity to thank all our staff and clients

for their understanding and efforts during what has been a difficult

period of uncertainty for everyone. Furthermore, I would like to extend

my thanks to our Non-Executive Directors and the members of our Advisory

Panel for their wise counsel and continued assistance, which has proven

invaluable.

Growth opportunities

Moving forwards, the Group is in a good position to expand through attracting

additional talented individuals, winning new business, extending contracts

with existing clients, or through acquisitions. The ability to capitalise

on these opportunities is underpinned by our strong balance sheet.

The Group continues to assess a pipeline of potential acquisitions,

with the ambition to take the Group to the next stage of its development.

As always, we are looking for deals that fit within our strategy of

enhancing our existing Software division or where they add clients to

our Services division, in doing so, the Group is an attractive acquiror

given the ability for vendors to develop their businesses more effectively

as part of the Group than they would be able to independently.

It does take time to find such opportunities, and the Group will remain

disciplined in respect of its acquisition criteria, but we are now in

better shape than ever before. Our pipeline is healthy, and we are confident

we will find success in securing businesses that will be of benefit

to our shareholders.

Our commitment to responsible business

I am also delighted to report on the continued commitment of the Group

to responsible business practices. We are particularly proud of the

progress made with our sustainability initiatives over the period.

As an early adopter, the Group launched its zero-carbon program in March

2019 and I am pleased to report that we have now fully offset all our

Group's carbon emissions for two years.

We also evolved our efforts further in partnership with DODO.eco, a

specialist carbon reduction consultancy. The Group continues to carry

out its charitable initiatives, with Group companies undertaking fundraisers

for The Brain Tumour Charity, Action for Children, and Xploro among

others. At the Group level we made a significant donation to Save The

Children during the period and we will continue to commit the business

towards responsible business initiatives moving forwards.

Outlook

We entered FY22 upbeat, despite the ongoing macroeconomic uncertainty

associated with Covid-19 and have seen positive signs of returning business

confidence with trading in Q1 FY22 strong. We are well positioned in

a high growth sector, have a healthy net cash balance, a robust liquidity

position and a strong team in place to continue to move our Group forward.

Significant progress was made in FY21 and I am excited for the year

ahead.

David Williams

Chairman

27 July 2021

Chief Executive's review

Overview

I am pleased to report on what has been a good year for Shearwater;

a year in which we have clearly delivered against what we set out to

achieve despite the challenging external circumstances.

I am proud to say that this year we have continued to provide an excellent

service and quality products to our clients, won new business, made

progress against our growth strategy and last, but not least, to have

achieved good growth in underlying EBITDA, profit before tax and our

net cash balance, all against the backdrop of a truly unprecedented

environment. Pleasingly, this is the second year in a row our teams

have delivered numbers either meeting or exceeding analyst expectations.

Having delivered a substantial turn-around in FY20, over the past year

our focus has been largely to navigate the headwinds posed by Covid-19,

whilst continuing to pursue new business and drive forward strategic

initiatives. It was a year of two halves. We were impacted by Covid-19

related decision-making delays, and the inability to provide on-site

advisory services in H1. However, we still delivered a resilient performance

in the first half with underlying EBITDA ahead of the prior year, due

to our diverse range of offerings and the benefits of margin expansion

flowing through. This was built on further in the second half, when

improvements in business confidence drove a substantial increase in

sales when compared to the same period one year prior. Our sales are

typically weighted towards the final quarter of the year as organisations

finalise their annual budgets and we saw this trend play out once again

in FY21.

Group revenue for the period was GBP31.8m (FY20: GBP33.0m), reflecting

the impact of the pandemic, however thanks to margin growth and strong

cost control we achieved an underlying EBITDA of GBP3.7m, up 9% on the

prior year (FY20: GBP3.4m).

Additionally, we strengthened our balance sheet substantially, with

strong cash collection, cash management and the payment of legacy debts

resulting in a year end net cash balance of GBP7.3m as at 31 March 2021

(31 March 2020: GBP1.4m net debt). GBP1.3m of year-end net cash is allocated

to be applied towards the settlement of deferred VAT payments relating

to FY21 revenues but this still amounts to the strongest financial position

in the Group's history, positioning us well for growth in FY22 and beyond.

During the period the business introduced 155 new clients across both

divisions, which was slightly ahead of the prior year (2020: 150) and

demonstrates the relevance of our products and services during what

has been a challenging time for many businesses. Our Software division

generated GBP1.3m of new and uplift sales which included the first sales

of some of our new product offerings, which we now expect to make meaningful

contributions in the coming years. Finally, it is pleasing to report

that the Group has maintained renewal rates in excess of 40%.

A key strategic achievement has been the notable growth in the level

of cross-selling seen between Group businesses, following the introduction

of several initiatives designed to encourage collaboration in FY20 and

early FY21 in order to create incremental opportunities. Revenue generated

via new business introductions taking place between Group subsidiaries

for the period was GBP0.7m, demonstrating the early success of this

part of our growth strategy, and there remain great opportunities to

further expand cross-selling across the Group in future periods.

With business confidence returning, cyber threats and customer awareness

of the threats that they pose to their organisations continuing to increase

and a strong platform for growth established, we are in an exciting

position. We are set to build upon our successes and to drive the expansion

of the business in the coming period.

I would like to thank sincerely the entire Shearwater team for robustly

responding to the challenges faced this year with determination and

a drive to succeed. They have worked incredibly hard to deliver the

results we are reporting, continuing to collaborate and innovate, and

we hugely appreciate all they have achieved.

Growth strategy

Our vision is for the Group to become the provider of choice delivering

Next Generation Technology, Professional Advisory, and Cyber Security

Services and Solutions. Our offerings help our clients identify and

manage risk, maintain compliance and defend against the constant barrage

of cyber security threats. Within our Software division we aim to build

the next generation converged access management and data discovery solutions,

which we expect to become the 'must-have' product when connecting securely

and with confidence to the connected world. For our award-winning Services

division, we aim to be the partner of choice delivering managed security

solutions, test and advisory consulting; again providing an end-to-end

offering. Our opportunity will grow as we increase in scale, expand

overseas and further consolidate the market.

The way in which we aim to achieve this is through building a group

of cyber security, managed security and professional advisory companies

with leading products, solutions or service capabilities whose full

potential can be unlocked through active management and capital investment.

Our strategy has evolved across the last year but continues to be based

around a focused acquisition strategy and the acceleration of the Group's

growth. Whilst we have not made an acquisition in the period, as we

held fast to our strict acquisition criteria, we have made good strides

against strategic initiatives designed to accelerate growth. This includes

the aforementioned progress with cross -- selling, R&D investment, new

client wins and the renewal of existing client contracts, as well as

the continued amalgamation of central functions to unlock synergy savings.

Moving forwards, we have an active pipeline of acquisition opportunities.

Any future acquisition will be earnings enhancing as well as increasing

our ability to provide an end-to-end offering to our clients.

Operational Review

Our Group is split into two segments, Software (14% of revenue, 41%

of operating profit(2) ) and Services (86% of revenue, 59% of operating

profit(2) ).

Our Software division designs and builds leading edge software to help

clients secure their corporate environments and helps make them compliant

with applicable regulations. The Services division is focused on delivering

the Group's managed security and cyber solutions, test, advisory and

consultancy offerings, as well as our strategic third-party partners'

technical solutions.

Shearwater remains largely UK-focused, however we service clients across

46 countries globally. The Group's international footprint has grown

during the year by adding new additional reseller partners representing

our software to their clients in new territories. This is being enhanced

by our recruitment program into the US, forming a key part of the Group's

growth strategy.

We pride ourselves on the quality of our staff and the strong relationships

we have with both our vendors and clients, with 67% of clients having

a long-term relationship with the Group.

Further detail on the progress of our two divisions is outlined below.

Software

Our Software division has performed well. Whilst revenue declined year-on-year,

reflecting a one-off large bespoke contract secured in the prior period

which did not repeat in FY21, we have made good progress in the development

of our offering and expect to see the benefits of the improved range

flow through in FY22.

Software

-------------------------------------------------

2021 2020

GBPm GBPm %

Revenue 4.3 5.5 -21%

Gross profit 3.5 4.1

Gross margin % 80% 75%

Overheads 1.3 1.4

---------------------------- ----- ----- -----

Underlying EBITDA 2.2 2.7 -19%

Underlying EBITDA margin % 50% 49%

We have invested significantly in R&D this year, in line with our aim

of becoming a leading Security-as-a-Service converged platform provider

- a 'one stop shop' for all an organisation's Access Management needs.

The Access Management Software market is forecast by Gartner to grow

to a value of US$9.2bn globally in 2025. We have added several new cloud

-- based applications and capabilities (for example a new location matrix)

to enhance this offering and its development roadmap has generated strong

interest from both clients and industry analysts.

Notwithstanding the one-off large bespoke contract secured in the prior

period which did not repeat in FY21 we have been pleased with the rate

at which both SecurEnvoy and Geolang have secured new business during

the pandemic. SecurEnvoy now serves roughly 1,100 clients in 36 countries,

with key notable contract wins coming from a major UK high street retailer

and a large Nordic healthcare systems provider with 20,000 users. Over

the period, SecurEnvoy experienced strong growth in the DACH territory

securing over 50% more new client logos versus the previous year. Notable

contract wins for Geolang came via a top global management consulting

firm, for the provision of its data discovery product.

Services

In the Services division, we were able to maintain revenue at prior

year levels despite the challenging environment and were pleased to

deliver improved underlying EBITDA driven by improved margins and lower

overheads.

Services

------------------------------------------------

2021 2020

GBPm GBPm %

Revenue 27.4 27.5 0%

Gross profit 6.4 6.1

Gross margin % 23% 22%

Overheads 3.3 3.8

---------------------------- ----- ----- ----

Underlying EBITDA 3.1 2.3 36%

Underlying EBITDA margin % 11% 8%

Our Services companies secured a number of significant contract wins

in FY21. As announced at the end of December 2020, Brookcourt signed

two significant new contract wins to be delivered over a three year

period for a British multinational investment bank and financial services

company. This was shortly followed by signing a five-year supply agreement

with a global fashion retailer headquartered in New York, testament

to the Group's growing international presence. Pentest secured a long

term partnership with a leading UK IT service provider, to provide penetration

testing and adversary simulation to the company's existing customer

base as well as new prospects while Xcina Consulting signed a 3-year

contract with a UK bank headquartered in Africa to deliver business

risk services.

We launched a number of new service lines across the group embracing

new and innovative ways of working. The use of drone laptops, for example,

has enabled us to carry out remote infrastructure testing despite social

distancing measures. Across the group we are seeing a significant shift

from appliance-based deployments to virtual stack infrastructure via

subscription and/or software-based computing.

As previously alluded to, cross-selling has been integral to the creation

of opportunities across our Services division. I am delighted with the

manner in which our portfolio companies have been creating opportunities

for one another. Pentest for example, supplied 15 leads into other Shearwater

companies, and received 28 sales leads from the staff incentive scheme,

winning 10 of these as new clients to date. Brookcourt also introduced

significant business for Pentest, Xcina and Geolang. Beyond this, Group

companies are increasingly working together to provide a multi-disciplinary

response to clients' demands.

The strong relationships between our businesses will remain integral

to our future growth and remain pertinent to our growth strategy. Despite

the pressure the pandemic placed on organisations globally, we managed

to maintain a healthy day rate across the year and the fact that we

have been able to win new business in such a challenging market provides

real reason for optimism moving forwards.

Market Opportunity

Our confidence moving forwards is underpinned by the opportunities which

lie within the market. The frequency of cyber-crime activity has increased

significantly, and it is now considered one of the biggest threats faced

by an organisation. As of February 2021, the UK government reported

that the UK cyber security industry is now valued at over GBP8.9 billion(3)

following record investment last year. Similarly, Lindy Cameron, CEO

of the National Cyber Security Centre ("NCSC"), warned in June 2021

that ransomware was the key threat facing the UK(4) , urging the public

and businesses to take it seriously.

With such a large number of people set to continue working from home

moving forwards, Covid-19 has accentuated the need for businesses to

create a safer and more secure online environment for staff, clients

and end users, with a greater number of people at risk to cyber-crime

whilst working from home. The growing need for our services highlights

the market opportunity within the sector.

Current Trading and Outlook

Following on from the strong trading and positive signs of returning

business confidence noted in H2 FY21, trading in Q1 FY22 was strong.

We are hiring across all Group businesses, with a budgeted plan to increase

headcount in both sales and technical roles in FY22 to support long-term

growth. We have a healthy pipeline of new projects to convert requiring

this investment.

Moving forwards, the Group has a great opportunity for growth ahead,

with Shearwater having established a strong market position in a rapidly

expanding sector. Our differentiated offering sets us apart from competitors,

in addition to a quality team, and a strong financial position. We look

forward to the future with confidence.

(2) Operating profit represents divisional split of profitability before

central head office administrative expenses

(3) https://www.gov.uk/government/news/record-year-for-uks-89bn-cyber-security-sector

(4) https://www.ncsc.gov.uk/news/rusi-lecture

Phil Higgins

Chief Executive Officer

27 July 2021

Financial Review

Overview

The Group has demonstrated its resilience against the backdrop of the

ongoing COVID19 pandemic, delivering improved year-on-year profitability

with underlying profit before tax 9% ahead of FY20. While revenue decreased

slightly in the period owing to the impact of COVID-19 on some of our

advisory businesses and delayed client decision-making, the Group has

maintained a high level of cash conversion which has significantly strengthened

our financial position.

Despite the challenges faced by some of our businesses, we chose not

to furlough any staff as we believed the long-term demand for our services

remained strong and the contract delays we experienced were only temporary.

This has borne out as we began to see delayed engagements being realised

in the second half of the fiscal year. We did utilise an option to defer

tax payments to HMRC which will be repaid in the next fiscal year.

As we now focus our attentions to the future, we do so with a much-improved

financial position. We are optimistic of what lies ahead of us in the

coming year and beyond.

Alternative performance measures

The Group uses alternative performance measures alongside statutory

measures to manage the performance of the business. In the opinion of

the Directors, alternative performance measures can provide additional

relevant information on past and future performance to the reader in

assessing the underlying performance of the business.

The table below details reported and alternative performance measures:

2021 2020

GBPm GBPm % change

------------------------------------- ------ ------ ---------

Revenue 31.8 33.0 -4%

Gross profit 9.9 10.2

Overheads (underlying) 6.2 6.8

------------------------------------- ------ ------ ---------

Underlying EBITDA 3.7 3.4 +9%

Underlying EBITDA margin 12% 10%

Finance charge 0.2 0.6

Depreciation 0.3 0.3

Amortisation of intangible assets

- computer software 0.8 0.3

------------------------------------- ------ ------ ---------

Underlying profit before tax 2.4 2.2 +9%

Amortisation of acquired intangible

assets 2.1 2.1

Exceptional items - 0.7

Share based payments 0.3 0.3

Fair value adjustment for deferred

consideration - 0.1

Contingent consideration - 0.3

------------------------------------- ------ ------ ---------

Profit/(loss) before tax 0.0 (1.3)

Taxation (credit)/charge (0.1) 0.2

Profit/(loss) after tax 0.1 (1.5)

------------------------------------- ------ ------ ---------

Revenue

In the year ended 31 March 2021 revenue decreased 4% (GBP1.2m) to GBP31.8m

(2020: GBP33.0m). COVID-19 lockdown restrictions impacted some of our

businesses, with advisory revenues 27% behind the prior year as a result

of clients choosing to delay consultancy engagements until they can

be undertaken in person. In H2, our Services division saw strong sales

of managed services, warranties and monitoring solutions which grew

17% year-on-year helping to offset the deficit in advisory revenues.

Our Software division saw a year-on-year decrease in revenues as a result

of a one-off revenue spike in the previous year that was not repeated

in the current year, however it is pleasing to note that we secured

the first sales of some of our new product offerings which we believe

will drive incremental revenues moving forward.

Underlying EBITDA

The Group delivered strong underlying EBITDA of GBP3.7m in the year

(2020: GBP3.4m), 9% ahead of the prior year and ahead of market expectations.

Margin improvement has driven the increase in profitability, with our

EBITDA margin of 12% ahead of the prior year (2020: 10%). Both Software

and Services divisions reported improved underlying EBITDA margins,

with the Software division seeing improved gross margins as a result

of a small reorganisation to its sales and marketing function in the

prior year which has resulted in a blended EBITDA margin of 50% for

the current year (2020: 49%). Our Services division has seen EBITDA

margins increase to 11% (2020: 8%) with improved gross margins reflecting

the continued change in revenue mix which has seen managed services

and warranties revenue replacing one-off security solutions revenues.

The division has utilised the Group's shared services function which

has created efficiencies which has led to some administrative savings.

Finance charges

Finance charges of GBP0.2m have reduced by GBP0.4m (2020: GBP0.6m) following

the settlement of legacy loans. The Group has replaced a previously

utilised invoice discounting facility with a more cost-effective three-year

GBP4.0m revolving credit facility with Barclays Bank plc. As at 31 March

2021 this facility remained unutilised.

Depreciation

Depreciation of GBP0.3m (2020: GBP0.3m) is in line with the prior fiscal

period and incorporates GBP0.3m of depreciation of right of use assets.

Amortisation of intangible assets - computer software

Amortisation of computer software has increased by GBP0.5m to GBP0.8m

(2020: GBP0.3m), following the go-live of a number of internally developed

software projects.

Underlying profit before tax

The Group delivered underlying profit before tax for the year of GBP2.4m

(2020: GBP2.2m), a 9% increase on the prior year, which is driven by

the improvement in underlying EBITDA of GBP0.3m and a GBP0.4m reduction

in finance charges which has been offset by a GBP0.5m increase in internally

developed software amortisation.

Amortisation of intangible assets - acquired intangibles

Amortisation of acquired intangible assets of GBP2.1m (2020: GBP2.1m)

is in line with the previous year.

Exceptional items

There have been no exceptional items in the year. Exceptional items

in the prior year of GBP0.7m included GBP0.3m of one-off costs incurred

as part of the reorganisation of the Group implemented by the incoming

CEO in April 2019 which included the costs associated with discontinuation

of a few smaller business areas which had not achieved the required

return on investment. GBP0.3m costs relate to the acquisition of Pentest

and the remaining GBP0.1m is for legacy one-off legal costs.

Fair value adjustment for deferred consideration

The fair value adjustment for deferred consideration relates to the

remaining share consideration owed to the previous owners of GeoLang

Holdings Limited. Shares were issued in the year settling the remaining

GBP0.2m deferred consideration.

Contingent consideration

There has been no contingent consideration paid in the year. Contingent

consideration in the prior year of GBP0.3m represented the issue of

14,388,567 ordinary shares (pre-share consolidation) of the Group to

the GeoLang sellers. These additional consideration shares were issued

pursuant to the acquisition of GeoLang Holdings Limited announced on

4 April 2018.

Taxation

Taxation credit in the period of GBP0.1m includes a GBP0.2m charge for

the current year less GBP0.3m movements in deferred taxation from the

unwinding of deferred tax liabilities created for acquired intangible

assets.

Earnings/(loss) per share

Adjusted basic and diluted earnings per share of GBP0.10 (2020: Adjusted

earnings per share GBP0.08) and reported basic and diluted earnings

per share of GBP0.01 (2020: loss GBP0.07) represents the continued improvement

the business has made in the last twelve months.

Statement of financial position

Intangible assets

Intangible assets decreased in the year by GBP2.2m to GBP54.6m at 31

March 2021 (2020: GBP56.8m). This movement comprises GBP0.7m of internally

developed software additions which includes the continued development

of our cloud IAM platform (UD), less GBP2.9m amortisation in the year,

of which GBP2.1m relates to amortisation of acquired intangibles.

Property, plant and equipment

Property, plant and equipment decreased in the year by GBP0.3m to GBP0.4m

at 31 March 2021 (2020: GBP0.7m). Minimal additions of GBP0.1m include

GBP0.06m for a new office lease which has been recognised as a right

of use asset from January 2021. Other movements in the period include

depreciation in the year of GBP0.3m and a small disposal which is less

than GBP0.1m.

Trade and other receivables

Trade and other receivables have decreased by GBP0.9m in the year from

GBP10.5m to GBP9.6m at 31 March 2021. Material movements include a GBP0.4m

increase in trade receivables which was driven by strong year-end sales,

less a GBP1.2m reduction of prepayments which included a prior year

prepaid third-party expense relating to sales which were recognised

post year-end.

Trade and other payables

Trade and other payables have decreased by GBP2.4m in the year from

GBP14.6m to GBP12.2m at 31 March 2021. Material movements include a

GBP4.1m decrease in loan balances which were repaid in the year, a GBP1.6m

increase in other taxation and social security which includes GBP1.3m

of VAT deferment the Group chose to utilise following the announcement

of the government's range of COVID-19 support schemes, GBP0.4m increase

in trade, other payables and accruals which have increased as a result

of additional third-party costs which relate to year-end revenues, and

GBP0.3m decrease in deferred consideration relating to holdback share

consideration for the GeoLang acquisition which was issued in the year.

Creditors: amounts falling due after more than one year

Creditor amounts falling due after more than one year have decreased

by GBP0.4m to GBP4.0m at 31 March 2021. Reductions include a GBP0.3m

reduction in deferred tax relating to acquired intangible assets and

GBP0.1m decrease in lease liabilities relating to office leases held

by the Group.

Share capital

During the year 1,562,500 new ordinary shares of GBP0.10 each were issued

to new and existing institutional shareholders as part of a fundraise

which raised GBP3.75m. A further 129,602 new ordinary shares of GBP0.10

were issued to the previous owners of GeoLang Holdings for the remaining

acquisition consideration and a further 8,320 new ordinary shares were

issued to an adviser of the Group which exercised options during the

year.

Statement of cash flows

The Group delivered strong operating cashflows in the year which, with

the addition of a small fundraise completed in April 2020, has led to

a significantly higher cash balance at 31 March 2021 of GBP8.0 million

(2020: GBP3.3m). Adjusted cash generated from operations of GBP5.3m

was slightly below the prior year (2020: GBP5.6m) with cash conversion

well in excess of 100% in the year.

Adjusting items in the year include GBP1.3m VAT deferral offered to

companies by the government during the year which will be repaid in

full in the coming year (2020: included GBP0.7m exceptional costs incurred

by the Group).

The table below provides a summary of cashflows in the year: 2021 2020

GBPm GBPm

------------------------------------------------ ------ ------

Underlying EBITDA 3.7 3.4

Movements in working capital 2.9 1.5

Cash generated from operations 6.6 4.9

------------------------------------------------ ------ ------

Adjusted cash generated from operations 5.3 5.6

Adjusting items 1.3 (0.7)

Cash generated from operations 6.6 4.9

------------------------------------------------ ------ ------

Capital expenditure (net of disposal proceeds) (0.7) (1.4)

Tax paid - 0.4

Interest paid - (0.1)

Payments of lease liabilities (0.3) (0.2)

Proceeds from issue of share capital 3.8 -

Proceeds from issue of loans - 0.5

Loan repayments (4.2) (1.3)

FX and other (0.5) (0.1)

------------------------------------------------ ------ ------

Movement in cash 4.7 2.7

Opening cash and cash equivalents 3.3 0.6

Closing cash and cash equivalents 8.0 3.3

------------------------------------------------ ------ ------

Loans (0.7) (4.7)

------------------------------------------------ ------ ------

Net cash / (debt) 7.3 (1.4)

------------------------------------------------ ------ ------

Capital expenditure

Capital expenditure of GBP0.7m (2020: GBP1.4m) in the year represents

capitalised software costs for developing our software businesses' product

sets. Expenditure of property, plant and machinery remains minimal with

expenditure of less than GBP0.05m in the period (2020: GBP0.02m).

Financing activities

In April 2020 the Group completed a fundraise of c.GBP3.8m which the

Group plans to use to part-finance its next acquisition. During the

year the Group settled GBP4.2m of legacy loan and deferred completion

cash, which with the addition of the fundraise has significantly improved

the Group's financial position at 31 March 2021.

Key performance indicators

The Board believes that revenue and underlying EBITDA are key metrics

to monitor the performance of the Group, as they provide a good basis

to judge underlying performance and are recognised by the Group's shareholders.

In addition to this, as we now start to see a more consistent run rate

of amortisation from internally developed software projects, underlying

profit before tax is another measure that we are using to track the

underlying performance of the Group. These metrics are presented within

the financial highlights on page 16.

A reconciliation of both underlying EBITDA and underlying profit before

tax to reported measures is detailed below:

2021 2020

GBPm GBPm

-------------------------------------------------- ------ ------

Underlying EBITDA 3.7 3.4

Exceptional items - (0.7)

Share based payments (0.3) (0.3)

Fair value adjustment for deferred consideration - (0.1)

Contingent consideration - (0.3)

Finance charge (0.2) (0.6)

Depreciation (0.3) (0.3)

Amortisation of intangible assets - computer

software (0.8) (0.3)

Amortisation of acquired intangible assets (2.1) (2.1)

Reported profit before tax - (1.3)

-------------------------------------------------- ------ ------

2021 2020

GBPm GBPm

-------------------------------------------------- ------ ------

Underlying profit before tax 2.4 2.2

Amortisation of acquired intangible assets (2.1) (2.1)

Exceptional items - (0.7)

Share based payments (0.3) (0.3)

Fair value adjustment for deferred consideration - (0.1)

Contingent consideration - (0.3)

Reported profit before tax - (1.3)

-------------------------------------------------- ------ ------

Paul McFadden

Chief Financial Officer

27 July 2021

Consolidated statement of comprehensive income

for the year ended 31 March 2021

2021 2020

Note GBP (000) GBP (000)

------------------------------------------------- ----- ---------- ----------

Revenue 31,766 33,004

Cost of sales (21,871) (22,817)

------------------------------------------------- ----- ---------- ----------

Gross profit 9,895 10,187

Administrative expenses (6,501) (7,785)

Depreciation and amortisation (3,200) (2,734)

Other operating expenses 37 (378)

Total operating costs (9,664) (10,897)

------------------------------------------------- ----- ---------- ----------

Operating profit / loss 231 (710)

Underlying EBITDA 3,705 3,409

Depreciation and amortisation (3,200) (2,734)

Exceptional items - (678)

Share based payments (311) (329)

Other operating expenses 37 (378)

Operating profit / loss 231 (710)

------------------------------------------------- ----- ---------- ----------

Finance income 2 8

Finance cost (200) (560)

Profit / loss before taxation 33 (1,262)

------------------------------------------------- ----- ---------- ----------

Income tax credit / (charge) 112 (242)

Profit / loss for the year and attributable

to equity holders of the Company 145 (1,504)

------------------------------------------------- ----- ---------- ----------

Other comprehensive income

Items that may be reclassified to profit and

loss:

Change in financial assets at fair value

through OCI 0 (4)

Exchange differences on translation of foreign

operations (3) 7

Total comprehensive profit / loss for the

year 142 (1,501)

------------------------------------------------- ----- ---------- ----------

Earnings / loss per ordinary share attributable

to the owners of the parent

Basic and diluted (GBP per share) 2 0.01 (0.07)

Adjusted basic and diluted (GBP per share) 2 0.10 0.08

Consolidated statement of financial position

as at 31 March

2021

2021 2020

GBP (000) GBP (000)

--------------- ---- ---------- --------------------- ---------- ------------ ------------

Assets

Non-current

assets

Intangible

assets 54,616 56,767

Property, plant

and equipment 405 692

Deferred tax

asset - 186

Total

non-current

assets 55,021 57,645

----------------- ---------- --------------------- ---------- ------------ ------------

Current assets

Trade and other

receivables 9,611 10,505

Cash and cash

equivalents 8,049 3,343

Total current

assets 17,660 13,848

----------------- ---------- --------------------- ---------- ------------ ------------

Total assets 72,681 71,493

----------------- ---------- --------------------- ---------- ------------ ------------

Liabilities

Current

liabilities

Trade and other

payables 12,237 14,586

Total current

liabilities 12,237 14,586

----------------- ---------- --------------------- ---------- ------------ ------------

Non-current

liabilities

Creditors:

amounts falling

due after more

than one

year 3,956 4,393

Total

non-current

liabilities 3,956 4,393

----------------- ---------- --------------------- ---------- ------------ ------------

Total

liabilities 16,193 18,979

----------------- ---------- --------------------- ---------- ------------ ------------

Net assets 56,488 52,514

----------------- ---------- --------------------- ---------- ------------ ------------

Capital and

reserves

Share capital 22,277 22,107

Share premium 34,581 34,581

FVTOCI reserve 14 14

Other reserves 24,376 20,714

Translation

reserve 24 27

Accumulated

losses (24,784) (24,929)

Equity attributable

to owners

of the Company 56,488 52,514

--------------------- ---------- --------------------- ---------- ------------ ------------

Total equity and

liabilities 72,681 71,493

----------------- ---------- --------------------- ---------- ------------ ------------

P Higgins,

Chief

Executive

Officer

27 July 2021

Consolidated statement of changes in equity

for the year ended 31 March 2021

Share

capital

(Note Share FVTOCI Other Translation Accumulated Total

18) premium reserve reserve reserve losses equity

GBP GBP

Group GBP (000) GBP (000) (000) GBP (000) GBP (000) GBP (000) (000)

----------------- -------------- ---------- --------- ---------- ------------ ------------ --------

At 1 April 2019 19,040 34,578 18 19,123 20 (23,425) 49,354

Loss for the

year - - - - - (1,504) (1,504)

Other

comprehensive

loss

for the year - - (4) - 7 - 3

Total

comprehensive

loss

for the year - - (4) - 7 (1,504) (1,501)

Contributions by and

distributions

to owners

Issue of share

capital 3,067 3 - - - - 3,070

Merger relief

reserve - - - 1,262 - - 1,262

Share based

payments - - - 329 - - 329

At 31 March 2020 22,107 34,581 14 20,714 27 (24,929) 52,514

----------------- -------------- ---------- --------- ---------- ------------ ------------ --------

Profit for the

year - - - - - 145 145

Other

comprehensive

loss

for the year - - - - (3) - (3)

Total

comprehensive

profit

for the year - - - - (3) 145 142

Contributions by and

distributions

to owners

Issue of share

capital 170 - - 3,351 - - 3,521

Share based

payments - - - 311 - - 311

At 31 March 2021 22,277 34,581 14 24,376 24 (24,784) 56,488

----------------- -------------- ---------- --------- ---------- ------------ ------------ --------

Consolidated Cash Flow Statement

for the year ended 31 March 2021

2020/21 2019/20

GBP (000) GBP (000)

-------------------------------------------- --- ---------- ----------

Cash flows from operating activities

Profit / loss for the year 145 (1,504)

Adjustments for:

Amortisation of acquired intangible

assets 2,860 2,418

Depreciation of property, plant

and equipment 340 316

Share-based payment charge 311 329

Impairment of intangible assets - -

Fair value adjustment of deferred

consideration (37) 69

Contingent consideration - 309

Finance income (2) (8)

Finance cost 200 560

Gain/loss on sale of asset - (1)

Income tax (112) 242

Cash flow from operating activities

before changes in working capital 3,705 2,730

Decrease/(increase) in trade and

other receivables 894 4,384

(Decrease)/increase in trade and

other payables 2,029 (2,239)

Cash generated from operations 6,628 4,875

--------------------------------------------- --- ---------- ----------

Net foreign exchange movements 3 8

Finance cost paid (38) (62)

Tax paid - 399

--------------------------------------------- --- ---------- ----------

Net cash generated from operating

activities 6,593 5,220

--------------------------------------------- --- ---------- ----------

Investing activities

Purchase of property, plant and

machinery (45) (20)

Purchase of software (709) (1,409)

Proceeds from disposal of held-for-sale

assets - 27

Proceeds from disposal of tangible

assets 17 1

Net cash used in investing activities (737) (1,401)

--------------------------------------------- --- ---------- ----------

Financing activities

Proceeds from issue of share capital 3,750 2

Proceeds from issue of loans - 500

Repayment of loan liabilities (4,151) (1,341)

Expenses paid in connection with

share issues (466) -

Repayment of lease liabilities (281) (236)

Net cash used in financing activities (1,148) (1,075)

--------------------------------------------- --- ---------- ----------

Net increase/(decrease) in cash and

cash equivalents 4,708 2,744

---------------------------------------------- --- ---------- ----------

Foreign exchange movement on cash

and cash equivalents (2) 2

Cash and cash equivalents at the beginning

of the period 3,343 597

Cash and cash equivalents at the

end of the period 8,049 3,343

--------------------------------------------- --- ---------- ----------

Notes to the Consolidated Financial Statements

General Information

The Group is a public limited company incorporated and domiciled

in the UK. The address of its registered office is 22 Great James

Street, London, WC1N 3ES.

The Group is listed on the Alternative Investment Market ('AIM')

on the London Stock Exchange. The Group provides cyber solutions

and operational resilience solutions to a range of end user

markets.

1. Statement of accounting policies

The significant accounting policies applied in preparing the

financial statements are outlined below. These policies have been

consistently applied for all the years presented, unless otherwise

stated.

Basis of preparation

The Consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS'), including International Accounting Standards ('IAS') and

interpretations ('IFRS ICs') issued by the International Accounting

Standards Board ('IASB') and its committees, and as adopted in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006.

The consolidated financial statements have been prepared under

the historic cost convention, except for certain financial

instruments that have been measured at fair value. The consolidated

financial statements are presented in Sterling, the functional

currency of Shearwater Group plc, the Parent Company. All values

are rounded to the nearest thousand pounds (GBP'000) except where

otherwise indicated.

Going concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for at least twelve months from the date of

signing these financial statements. Accordingly, they continue to

adopt the going concern basis in preparing these consolidated

financial statements.

In light of the continued evolution of the COVID-19 crisis the

Directors have maintained a close eye on the Group's going concern

position and have taken steps to ensure that the Group is in a

robust position to manage potential trading downturns should they

occur. Over the past year the Group demonstrated its ability to

trade through challenging conditions which saw its advisory

businesses impacted by COVID driven restrictions on movement that

prevented face-to-face engagements for much of the year.

Despite these challenges, the Group has built on the prior year

when it achieved its maiden EBITDA profit, delivering a GBP3.7m

underlying EBITDA in the current year (2020: GBP3.4m) 9% ahead of

the prior year. Cash conversion has remained in excess of 100% in

the year with GBP6.6m generated from its ongoing operations.

At 31 March 2021 the Group has been able to report a much

improved financial position and is well capitalised with a net cash

position of GBP7.3m (2020: net debt GBP1.4m) and an untouched

three-year GBP4.0 million Group revolving credit facility with

Barclays Bank plc.

The Directors' have reviewed detailed budget cash flow forecasts

for the period to at least 31 March 2023 and have challenged the

assumptions used to create these budgets. The budget figures are

carefully monitored against actual outcomes each month and

variances are highlighted and discussed at Board level on a

quarterly basis as a minimum. The Group has adapted to respond to

the challenges arising from COVID-19 and the unique trading

conditions that this has created and the Directors' believe the

Group has a stable footing to develop its business over the

immediate future.

The Board has reviewed current trading to 30 June 2021 and is

pleased to report that trading is tracking in line with budget for

the first quarter, with a number of businesses reporting material

year-on-year improvement in trading which provides for increased

optimism moving forward.

In response to the additional challenges created by Covid 19,

the Board has reviewed and challenged what it believes to be an

extreme scenario reverse stress test on the Group up to March 2023.

The purpose of the reverse stress test for the Group is to test at

what point the cash facilities would be fully utilised if the

assumptions in the budget are altered.

The reverse stress test assumes significant adjustments to the

Group's budget which include the removal of all new business

revenue across both Software and Services divisions, reduction of

renewal rates in our Software division to 50% (currently c80%),

scaling back of revenues in our Services division leaving just

critical managed services revenues and already contracted revenues.

Costs have been scaled back sensitively in line with the reduction

in revenues.

In the event that the performance of the Group is not in line

with the projections, action will be taken by management to address

any potential cash shortfall for the foreseeable future. The

actions that could be taken by the Directors include both a review

and restructuring of employment-related costs. Additionally, the

Directors could also negotiate access to other sources of finance

from our lenders.

Overall, the sensitised cash flow forecast demonstrates that the

Group will be able to pay its debts as they fall due for the period

to at least 31 March 2023 and therefore the Directors are satisfied

there are no material uncertainties to disclose regarding going

concern. The Directors are therefore satisfied that the financial

statements should be prepared on the going concern basis.

Critical accounting judgements, estimates and assumptions

The preparation of financial statements requires management to

make judgements, estimates and assumptions that affect the amounts

reported for income and expenses during the year and that affect

the amounts reported for assets and liabilities at the reporting

date.

Business Combinations

Management make judgements, estimates and assumptions in

assessing the fair value of the net assets acquired on a business

combination, in identifying and measuring intangible assets arising

on a business combination, and in determining the fair value of the

consideration. If the consideration includes an element of

contingent consideration, the final amount of which is dependent on

the future performance of the business, management assess the fair

value of that contingent consideration based on their reasonable

expectations of future performance. In determining the fair value

of intangible assets acquired, key assumptions used include

expected future cash flows, growth rates, and the weighted average

cost of capital.

Impairment of goodwill, intangible assets and investment in

subsidiaries

Management make judgements, estimates and assumptions in

supporting the fair value of goodwill, intangible assets and

investments in subsidiaries. The Group carries out annual

impairment reviews to support the fair value of these assets. In

doing so, management will estimate future growth rates, weighted

average cost of capital and terminal values. Further information

can be found on note 9.

Leases

Management make judgements, estimates and assumptions regarding

the life of leases. At present, management are assessing all

existing leases, which all relate to office space, as we look to

reduce the number of offices across the Group. For this reason

management have assumed that the life of leases does not extend

past the current contracted expiry date. A judgement has been taken

with regard to the incremental borrowing rate based upon the rate

at which the Group can borrow money.

Basis of consolidation

The Group's consolidated financial statements incorporate the

results and net assets of Shearwater Group plc and all its

subsidiary undertakings made up to 31 March each year. Subsidiaries

are all entities over which the Group has control (see note 2 of

the Company financial statements). The Group controls an entity

when the Group is exposed to, or has rights to, variable returns

from its involvement with the entity and has the ability to affect

those returns through its power over the entity. Subsidiaries are

fully consolidated from the date on which control is transferred to

the Group. They are deconsolidated from the date that control

ceases. Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by the Group. All inter-group

transactions, balances, income and expenses are eliminated on

consolidation.

Business combinations and goodwill

Business combinations are accounted for using the acquisition

accounting method. This involves recognising identifiable assets

(including previously unrecognised intangible assets) and

liabilities of the acquired business at fair value. Any excess of

the cost of the business combination over the Group's interest in

the net fair value of the identifiable assets and liabilities is

recognised in the consolidated statement of financial position as

goodwill and is not amortised. To the extent that the net fair

value of the acquired entity's identifiable assets and liabilities

is greater than the cost of the investment, a gain is recognised

immediately in the consolidated statement of comprehensive

income.

After initial recognition, goodwill is stated at cost less any

accumulated impairment losses, with the carrying value being

reviewed for impairment at least annually and whenever events or

changes in circumstances indicate that the carrying value may be

impaired. Goodwill assets considered significant in comparison to

the Group's total carrying amount of such assets have been

allocated to cash-generating units or groups of cash-generating

units. Where the recoverable amount of the cash-generating unit is

less than its carrying amount including goodwill, an impairment

loss is recognised in the consolidated statement of comprehensive

income.

Acquisition costs are recognised in the consolidated statement

of comprehensive income as incurred.

Revenue

The Group recognises revenue in accordance with IFRS 15 Revenue

from Contracts with Customers: Revenue with customers is evaluated

based on the five-step model under IFRS 15 'Revenue from Contracts

with Customers': (1) identify the contract with the customer; (2)

identify the performance obligations in the contract; (3) determine

the transaction price; (4) allocate the transaction price to

separate performance obligations; and (5) recognise revenues when

(or as) each performance obligation is satisfied.

Revenue recognised in the statement of comprehensive income but

not yet invoiced is held on the statement of financial position

within accrued income. Revenue invoiced but not yet recognised in

the statement of comprehensive income is held on the statement of

financial position within deferred revenue.

The Group's revenues are comprised of a number of different

products and services across our two divisions, details of which

are provided below:

Software

-- Software licences whereby the customer buys software that it

sets up and maintains on its premises is recognised fully at the

point the licence key / access has been granted to the client. The

Group sells the majority of its services through channels and

distributors who are responsible for providing 1(st) and 2(nd) line

support to the client.

-- Software licences for the new 'Authentication as a Services'

product whereby the customer accesses the product via a cloud

environment maintained by the Company is recognised in two parts,

whereby 80% of the subscription is recognised at the point that the

licence key is provided to the customer with the remaining 20%

recognised evenly over the length of the contract. This deferred

proportion represents the obligation to maintain and support the

platform that the software runs on.

Services

-- Sale of third-party hardware, software and warranties:

a) Where the contract entails only one performance obligation to

provide software or hardware, revenue is recognised in full at a

point in time upon delivery of the product to the end client. This

delivery will either be in the form of the physical delivery of a

product or the emailing of access codes to the client for them to

access third-party software or warranties; and

b) Where a contract to supply external hardware, software and/or

warranties also includes an element of ongoing internal support,

multiple performance obligations are identified and an allocation

of the total contract value is allocated to each performance

obligation based on the standalone costs of each performance

obligation. The respective costs of each performance obligation are

traceable to supplier invoice and applying the fixed margins,

standalone selling prices are determined. Internal support is

recognised equally over the period of time detailed in the

contract.

-- Sales of consultancy services are usually based on a number

of consultancy days that make up the contracted consideration.

Consultancy days generally comprise of field work and (where

required) report writing and delivery which are considered to be of

equal value to the client. Revenue is recognised over time based on

the number of consultancy days provided within the period compared

to the total in the contract.

Segmental reporting

For internal reporting and management purposes, the Group is

organised into two reportable segments based on the types of

products and services from which each segment derives its revenue -

Software and Services. The Group's operating segments are

identified on the basis of internal reports that are regularly

reviewed by the chief operating decision maker in order to allocate

resources to the segment and to assess its performance.

Exceptional items

The Group's statement of comprehensive income separately

identifies exceptional items. Such items are those that in the

Directors' judgement are one-off in nature and need to be disclosed

separately by virtue of their size and incidence. In determining

whether an item or transaction should be classified as an

exceptional item, the Directors' consider quantitative as well as

qualitative factors such as the frequency, predictability of

occurrence and significance. This is consistent with the way that

financial performance is measured by management and reported to the

Board. Exceptional items may not be comparable to similarly titled

measures used by other companies. Disclosing adjusted items

separately provides additional understanding of the performance of

the Group. Please see note 4 for further details.

Current and deferred income tax

The charge for taxation is based on the profit or loss for the

year and takes into account deferred tax. Deferred tax is the tax

expected to be payable or recoverable on temporary differences

between the carrying amounts of assets and liabilities in the

financial statements and the corresponding tax based in the

computation of taxable profit or loss and is accounted for using

the balance sheet method.

The current income tax charge is calculated on the basis of the

tax laws enacted or substantively enacted at the balance sheet date

in the countries where the Group's subsidiaries operate and

generate taxable income. Management periodically evaluate positions

taken in tax returns with respect to situations where applicable

tax regulation is subject to interpretation. It establishes

provisions where appropriate on the basis of amounts expected to be

paid to the tax authorities.

Deferred tax assets are only recognised to the extent that it is

probable that future taxable profit will be available in the

foreseeable future against which the temporary differences can be

utilised.

Deferred income tax assets and liabilities are measured at the

rates that are expected to apply when the related asset is

realised, or liability settled, based on tax rates and laws enacted

or substantively enacted at the reporting date.

Intangible assets

Intangible assets are carried at cost less accumulated

amortisation and accumulated impairment losses. Intangible assets

acquired as part of a business combination are recognised outside

goodwill if the assets are separable or arise from contractual or

other legal rights and their fair value can be measured reliably.

Material expenditure on internally developed intangible assets is

taken to the consolidated statement of financial position if it

satisfies the six-step criteria required under IAS 38.

Intangible assets with a finite life have no residual value and

are amortised over their expected useful lives as follows:

Computer software 2-5 years straight-line basis

Customer relationships 1-15 years straight-line basis

Software 10 years straight-line basis

Tradenames 10 years straight-line basis

The amortisation expense on intangible assets with finite lives

is recognised in the statement of comprehensive income within

administrative expenses. The amortisation period and the

amortisation method for intangible assets with finite useful lives

are reviewed at least annually.

The carrying value of intangible assets is reviewed for

impairment whenever events or changes in circumstances indicate the

carrying value may not be recoverable.

Property, plant and equipment

Property, plant and equipment is stated at historical cost less

accumulated depreciation. Cost includes the original purchase price

of the asset plus any costs of bringing the asset to its working

condition for its intended use. Depreciation is provided at the

following annual rates, on a straight-line basis, in order to write

down each asset to its residual value over its estimated useful

life.

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at the end of each reporting period.

Plant and machinery 20-33 per cent per annum

Office equipment 25 per cent per annum

Shorter of useful life of the asset

Right of use assets or lease term

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised, as adjusted

items if significant, within the statement of comprehensive

income.

Financial instruments

Shearwater's financial assets and financial liabilities are

recognised in the Group's balance sheet when the Group becomes a

party to the contractual provisions of the instrument.

Financial assets

Trade and other receivables are measured at amortised cost less

a provision for doubtful debts, determined as set out below in

'impairment of financial assets'. Any write-down of these assets is

expensed to the statement of comprehensive income.

Equity investments not qualifying as subsidiaries, associates or

jointly controlled entities are measured at fair value through

other comprehensive income (FVTOCI), with fair value changes

recognised in other comprehensive income (OCI) and dividends

recognised in profit or loss.

Impairment of financial assets

The impairment model under IFRS 9 reflects expected credit

losses, as opposed to only incurred credit losses under IAS 39.

Under the impairment approach in IFRS 9, it is not necessary for a

credit event to have occurred before credit losses are recognised.

Instead, the Group always accounts for expected credit losses and

changes in those expected credit losses. The amount of expected

credit losses are updated at each reporting date.

The new impairment model only applies to the Group's financial

assets that are debt instruments measured at amortised costs or

FVTOCI as well as the Group's contract assets and issued financial

guarantee contracts. The Group has applied the simplified approach

to recognise lifetime expected credit losses for its trade

receivables and contracts assets as required or permitted by IFRS

9.

Expected credit losses are calculated with reference to average

loss rates incurred in the three most recent reporting periods then

adjusted taking into account forward-looking information that may

either increase or decrease the current rate. The Group's average

combined loss rate is 0.3% (2020: 0.3%). This percentage rate is

then applied to current receivable balances using a probability

risk spread as follows:

-- 80% of debt not yet due (i.e. the Group's average combined

loss rate of 0.3% is discounted by 20%, meaning a 0.24% provision

would be made to debt not yet due);

-- 85% of debt that is <30 days overdue;

-- 90% of debt that is 30-60 days overdue;

-- 95% of debt that is 60-90 days overdue; and

-- 100% of debt that is >90 days overdue.

Management have performed the calculation to ascertain the

expected credit loss, which works out to GBP27,191 (2020:

GBP26,377). This movement has been recognised in the statement of

comprehensive income. To date, the Group has a record of minimal

bad debts with less than GBP0.04 million being written off in the

past 3 years.

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire, or when

it transfers the financial asset and substantially all the risks

and rewards of ownership of the asset to another entity. On

derecognition of a financial asset measured at amortised cost, the

difference between the asset's carrying amount and the sum of the

consideration received and receivable is recognised in the

statement of comprehensive income.

Financial liabilities

Trade and other payables

Financial liabilities within trade and other payables are

initially recognised at fair value, which is usually the invoiced

amount. They are subsequently carried at amortised cost using the

effective interest method (if the time value of money is

significant).

Loans are initially recognised at fair value, which is the

amount stated in the loan agreement. Subsequently, loan balances

are restated to include any interest that has become payable.

The Group utilised an invoice discounting facility in the prior

year. Advances under this facility were initially recognised at

fair value, which was the amount advanced. Subsequently, accrued

interest was recognised as per the terms of the facility. The

invoice discounting facility was closed on 20 March 2020 following

the settlement of all outstanding advances.

Lease liabilities have been recognised at fair value in line

with the requirements of IFRS16. Details of lease disclosures are

included in note 16.

Deferred consideration which relates to the future issue of

ordinary shares has been initially recognised at fair value based

on the closing share price at the reporting date. Deferred

consideration is revalued and recognised at fair value based on the

closing share price for all future reporting dates. Movements in

fair value between periods are reported in the statement of

comprehensive income.

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire. The difference between the carrying amount of the financial

liability derecognised and the consideration paid and payable,

including any non-cash assets transferred or liabilities assumed,

is recognised in the statement of comprehensive income.

Leases

IFRS 16: Leases which supersedes IAS 17: Leases and IFRIC 4:

Determining whether an arrangement contains a lease sets out the

principles for recognition, measurement, presentation and

disclosures of leases and requires lessees to account for most

leases under a single on-balance sheet model.

Right of use assets

In determining if a lease exists, management considers if a

contract conveys the right to control the use of an identified

asset for a period of time in return for a consideration. When

assessing whether a contract states a right to control the use of

an identified asset, management considers:

-- If a contract involves the use of an identified asset, this

could be specified explicitly or implicitly and should be

physically distinct.

-- If the Group has obtained the right to gain substantially all

of the economic benefit from the use of the asset throughout the

period of use.

-- If the Group has the right to direct the use of the asset.

Identified 'Right of use assets' since 1 April 2019 are valued

at the commencement date of the lease (this is usually the date the

underlying asset is available for use). For leases that began prior

to 1 April 2019 a right of use asset has been created at 1 April

2019 when the Group adopted IFRS 16.

Right of use assets are depreciated on a straight-line basis

from the commencement date (this is usually the date the underlying

asset is available for use, or 1 April 2019 if the lease commenced

before this date) to the earlier of the end of useful life of the

right of use asset or the end of the lease term. The right of use

asset may be subject to impairment following certain remeasurement

of lease liabilities.

Details of the Group's right of use assets are contained in note

11 of the consolidated financial statements.

Lease liability

At the commencement date of a lease (or 1 April 2019 for leases

which commenced before this date) the group recognises lease

liabilities, measuring them at the present value of lease payments

at commencement of the lease (or 1 April 2019 for leases which

commenced before this date) discounted at the determined

incremental borrowing rate.

The lease liability is measured at the amortised cost using the

effective interest method. Should there be a change in expected

future lease payments arising from a lease modification or if the

Group changes its assessment of whether it will exercise an

extension or termination option, the lease liability would be

remeasured.

Remeasurement of a lease liability will give rise to a

corresponding adjustment being made to the carrying value of the

right to use asset.

Lease liabilities are detailed in notes 13, 14 and 16 of the

consolidated financial statements.

Practical expedients

IFRS 16 provides for certain optional practical expedients,

including those related to the initial adoption of the standard.

The Group applies the following practical expedients when applying

IFRS 16 to leases previously classified as operating leasing under

IAS 17:

-- Applied a single discount rate to all leases with similar characteristics;

-- Applied the exemption not to recognise right of use assets

and liabilities for leases with less than 12 months of the lease

term remaining as at the date of initial application

-- Applied the exemption for low-value assets whereby leases

with a value under GBP5,000 (usually IT equipment) have been

classed as short-term leases and not recognised on the statement of

financial position even if the initial term of the lease from the

lease commencement date may be more than twelve months.

Incremental borrowing rate

IFRS 16 states that all components of a lease liability are

required to be discounted to reflect the present value of the

payments. Where a lease (or Group of leases) does not state an

implicit rate an incremental borrowing rate should be used.

The incremental borrowing rate should represent what the lessee

would have to pay to borrow over a similar term and with similar