St. James's Place PLC Q3 New Business Inflows and Funds under Management (7089P)

21 Octubre 2021 - 1:00AM

UK Regulatory

TIDMSTJ

RNS Number : 7089P

St. James's Place PLC

21 October 2021

-1-

ST. JAMES'S PLACE plc

27 St. James's Place, London SW1A 1NR

Telephone 020 7493 8111

PRESS RELEASE

21 October 2021

ST. JAMES'S PLACE WEALTH MANAGEMENT

RECORD THIRD QUARTER FLOWS AND FUNDS UNDER MANAGEMENT

St. James's Place plc ("SJP"), the wealth management group,

today issues an update on new business inflows and funds under

management for the three months ended 30 September 2021.

Q3 2021 Q3 2020

GBP'Billion GBP'Billion

Gross inflows 4.32 3.05

Net inflows 2.59 1.44

Closing funds under management 148.06 118.70

Year-to-date funds under management retention

rate (annualised) 96.2% 96.4%

Year-to-date net inflows/opening funds under

management (annualised) 8.4% 6.8%

Andrew Croft, Chief Executive, commented:

"I am delighted to report another strong quarter for St. James's

Place. Increased personal savings and improving consumer confidence

have provided a favorable market backdrop and this, together with

the great work our advisers do in supporting clients with their

long-term financial planning, has driven gross inflows of GBP4.32

billion for the quarter, up strongly against a soft comparator in

2020. Retention has remained robust, underpinning net inflows of

GBP2.59 billion for the period, and contributing to funds under

management closing at GBP148.06 billion, up 14% year to-date.

There remains uncertainty around the near-term economic and

investment market outlook, but our business is in great shape and

we now anticipate the rate of gross inflow growth for the second

half to be modestly ahead of our previous guidance issued in late

July. As a result, we expect growth in gross inflows for the full

year to be around 25%. Beyond 2021, it is natural that we will see

variations in the pattern of new business growth we achieve over

time, but our performance this year gives us every confidence in

the 2025 ambitions we set out for St. James's Place earlier this

year."

-2-

The details of the announcement are attached.

Enquiries:

Hugh Taylor, Director - Investor Tel: 07818 075143

Relations

Jamie Dunkley, External Communications Tel: 07779 999651

Director

Brunswick Group: Charles Pretzlik/Eilis Tel: 020 7404 5959

Murphy

Email: sjp@brunswickgroup.com

Contents

1. Funds under management

2. Analysis of funds under management

3. Gross inflow figures

4. EEV net asset value per share

-3-

1. Funds under management

Three months ended 30 September 2021 Investment Pension UT/ISA & DFM Total

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 34.46 69.15 40.16 143.77

Gross inflows 0.62 2.34 1.36 4.32

Net investment return 0.38 0.89 0.43 1.70

Regular income withdrawals and maturities (0.08) (0.42) - (0.50)

Surrenders and part surrenders (0.35) (0.37) (0.51) (1.23)

------------ ------------ ------------- ------------

Closing funds under management 35.03 71.59 41.44 148.06

============ ============ ============= ============

Net inflows 0.19 1.55 0.85 2.59

============ ============ ============= ============

Implied surrender rate as a percentage of

average funds under management 4.0% 2.1% 5.0% 3.4%

Rowan Dartington Group FUM was GBP3.38 billion at 30 September

2021, gross inflows were GBP0.15 billion for the quarter and

outflows were GBP0.03 billion. SJP Asia FUM was GBP1.48 billion at

30 September 2021, gross inflows were GBP0.08 billion for the

quarter and outflows were GBP0.02 billion.

Three months ended 30 September 2020 Investment Pension UT/ISA & DFM Total

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 29.88 53.52 32.28 115.68

Gross inflows 0.33 1.96 0.76 3.05

Net investment return 0.31 0.86 0.41 1.58

Regular income withdrawals and maturities (0.06) (0.40) - (0.46)

Surrenders and part surrenders (0.28) (0.37) (0.50) (1.15)

------------ ------------ ------------- ------------

Closing funds under management 30.18 55.57 32.95 118.70

============ ============ ============= ============

Net inflows (0.01) 1.19 0.26 1.44

============ ============ ============= ============

Implied surrender rate as a percentage of

average funds under management 3.7% 2.7% 6.1% 3.9%

Rowan Dartington Group FUM was GBP2.72 billion at 30 September

2020, gross inflows were GBP0.09 billion for the quarter and

outflows were GBP0.03 billion. SJP Asia FUM was GBP1.06 billion at

30 September 2020, gross inflows were GBP0.06 billion for the

quarter and outflows were GBP0.01 billion.

-4-

Nine months ended 30 September 2021 Investment Pension UT/ISA & DFM Total

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 32.22 61.31 35.81 129.34

Gross inflows 1.86 7.32 4.33 13.51

Net investment return 2.29 5.35 2.95 10.59

Regular income withdrawals and maturities (0.20) (1.27) - (1.47)

Surrenders and part surrenders (1.14) (1.12) (1.65) (3.91)

------------ ------------ ------------- ------------

Closing funds under management 35.03 71.59 41.44 148.06

============ ============ ============= ============

Net inflows 0.52 4.93 2.68 8.13

============ ============ ============= ============

Implied surrender rate as a percentage of

average funds under management 4.5% 2.2% 5.7% 3.8%

Rowan Dartington Group FUM was GBP3.38 billion at 30 September

2021, gross inflows were GBP0.43 billion for the nine-month period

and outflows were GBP0.11 billion. SJP Asia FUM was GBP1.48 billion

at 30 September 2021, gross inflows were GBP0.26 billion for the

nine-month period and outflows were GBP0.09 billion.

Nine months ended 30 September 2020 Investment Pension UT/ISA & DFM Total

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 31.22 52.84 32.93 116.99

Gross inflows 1.26 6.07 2.98 10.31

Net investment return (1.22) (1.46) (1.57) (4.25)

Regular income withdrawals and maturities (0.19) (0.99) - (1.18)

Surrenders and part surrenders (0.89) (0.89) (1.39) (3.17)

------------ ------------ ------------- ------------

Closing funds under management 30.18 55.57 32.95 118.70

============ ============ ============= ============

Net inflows 0.18 4.19 1.59 5.96

============ ============ ============= ============

Implied surrender rate as a percentage of

average funds under management 3.9% 2.2% 5.6% 3.6%

Rowan Dartington Group FUM was GBP2.72 billion at 30 September

2020, gross inflows were GBP0.30 billion for the nine-month period

and outflows were GBP0.12 billion. SJP Asia FUM was GBP1.06 billion

at 30 September 2020, gross inflows were GBP0.21 billion for the

nine-month period and outflows were GBP0.04 billion.

-5-

2. Analysis of funds under management

The following table provides an analysis of the funds under

management at 30 September split by geography and asset type:

30 September 2021 30 September 2020

GBP'Billion % of total GBP'Billion % of total

North American Equities 41.8 28% 27.0 23%

Fixed Interest 24.0 16% 22.2 19%

Asia and Pacific Equities 21.4 14% 17.4 15%

UK Equities 19.8 13% 16.6 14%

European Equities 17.5 12% 12.5 10%

Alternative Investments 11.5 8% 9.7 8%

Cash 6.2 4% 7.8 7%

Property 2.5 2% 2.6 2%

Other 3.4 3% 2.9 2%

------------ ----------- ------------ -----------

Total 148.1 100% 118.7 100%

============ =========== ============ ===========

3. Gross inflow figures

Unaudited Unaudited

3 Months to 9 Months to

30 September 30 September

2021 2020 2021 2020

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Gross inflows

Investment 0.62 0.33 1.86 1.26

Pension 2.34 1.96 7.32 6.07

Unit Trust/ISA & DFM 1.36 0.76 4.33 2.98

------------ ------------ ------------ ------------

4.32 3.05 +42% 13.51 10.31 +31%

============ ============ ============ ============

4. EEV net asset value per share

The net asset value on the European Embedded Value basis at 30

September 2021 was approximately 1,590 pence per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZMZGFGRGMZM

(END) Dow Jones Newswires

October 21, 2021 02:00 ET (06:00 GMT)

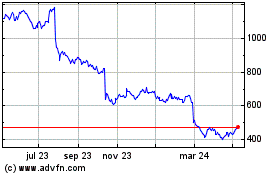

St. James's Place (LSE:STJ)

Gráfica de Acción Histórica

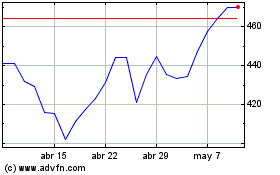

De Mar 2024 a Abr 2024

St. James's Place (LSE:STJ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024