Tatton Asset Management PLC Acquisition and Strategic Distribution Partnership (7843L)

15 Septiembre 2021 - 1:00AM

UK Regulatory

TIDMTAM

RNS Number : 7843L

Tatton Asset Management PLC

15 September 2021

15 September 2021

Tatton Asset Management PLC

("TAM plc", the "Group" or the "Company")

ACQUISITION AND STRATEGIC DISTRIBUTION PARTNERSHIP

Acquisition of GBP650 million Verbatim Funds

and

Strategic Distribution Partnership with Fintel plc

TAM plc (AIM: TAM), the investment management and IFA support

services group, is pleased to announce the acquisition of GBP650m

Verbatim funds ("Verbatim funds") for a cash consideration of up to

GBP5.8m and a long-term strategic distribution partnership with

Fintel plc (AIM: FNTL), a leading provider of fintech and support

services to the UK retail financial services sector.

Key highlights of the transaction:

-- the transaction supports the Group's strategy to grow assets under

management ("AUM") through both acquisition and through strategic

partnerships that extend its distribution channels facilitating further

organic growth;

-- the acquisition of the Verbatim multi-asset and multi-index funds

adds c.GBP650m to Tatton Investment Management's ("Tatton") AUM, complementing

and extending our existing fund range;

-- the five-year strategic distribution partnership with Fintel plc provides

access to over 3,800 new financial intermediary firms and its 6,000

Defaqto users, significantly enhancing our reach and distribution

to further contribute to the organic growth of our AUM; and

-- the technology provides insights and analysis, enabling targeted product

design and distribution further benefiting the Group through access

to 2,500 market-leading fintech licences to distribute to Tatton and

Paradigm firms and users.

Financial impact:

-- the transaction, which includes both the acquisition of the funds

and a five-year strategic distribution partnership agreement, is expected

to be earnings enhancing in the financial year ending 31 March 2022

("FY22") and beyond;

-- over the remainder of FY22, the partnership, including the Verbatim

funds, is expected to generate adjusted operating profit of c.GBP0.6m,

with adjusted operating profit of c.GBP1.5m expected in FY23, the

first full financial year;

-- consideration of up to GBP5.8m, representing c.0.9% of AUM, of which

GBP2.8m has been paid in cash on completion with the remainder also

payable in cash, being subject to certain performance conditions over

the next four years;

-- the acquisition is being funded from existing cash resources on the

balance sheet; and

-- post transaction the Group will still have strong cash resources of

c.GBP15m.

Commenting on the transaction and partnership Paul Hogarth,

Chief Executive Officer, said:

"I am delighted to announce the acquisition of GBP650m of the

Verbatim funds and this five-year strategic partnership with Fintel

plc, a firm whose strategy and values are aligned with our own;

keeping the IFA at the heart of our respective businesses.

"The transaction clearly demonstrates the progress we are making

in executing on our growth strategy. We have set out a roadmap for

growth over the next three years, growing our AUM organically and

by acquisition and extending our reach to the IFA community, the

lifeblood of our industry, through strategic partnerships. This

transaction is evidence of that strategy in action and it enhances

our proposition to IFAs and their clients further, with the

multi-index and multi-asset funds complementing and extending our

current fund range.

"We are excited to be working more closely with Fintel plc, a

business we have known and respected for a very long time. I have

no doubt that this is a fantastic opportunity for both businesses

to continue to deliver against their strategic objectives, while

delivering real shareholder value."

For further information, please contact:

Tatton Asset Management PLC

Paul Hogarth (Chief Executive Officer)

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment Officer) +44 (0) 161 486 3441

Zeus Capital - Nomad and Broker

Martin Green (Corporate Finance)

Dan Bate (Corporate Finance and QE) +44 (0) 20 3829 5000

Singer Capital Markets - Joint Broker

Peter Steel (Investment Banking) +44 (0) 20 7496 3061

Rachel Hayes (Investment Banking) +44 (0) 20 7496 3189

Belvedere Communications - Financial

PR +44 (0) 7407 023147

John West / Llew Angus (media) + 44 (0) 7715 769078

Cat Valentine / Keeley Clarke (investors) tattonpr@belvederepr.com

Trade Media Enquiries

Roddi Vaughan Thomas +44 (0) 20 7139 1452

For more information, please visit:

www.tattonassetmanagement.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQLIMMTMTTBTAB

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

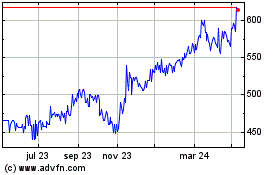

Tatton Asset Management (LSE:TAM)

Gráfica de Acción Histórica

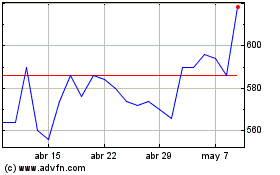

De Mar 2024 a Abr 2024

Tatton Asset Management (LSE:TAM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024