BNP Paribas to Further Reduce Stake in First Hawaiian

30 Julio 2018 - 9:52AM

Noticias Dow Jones

By Anthony Shevlin

BNP Paribas SA (BNP.FR) said Monday that it will reduce its

stake in First Hawaiian Inc (FHB) to around 33% via the public

offering of 20 million shares of common stock by an affiliate of

BNP.

The offered shares will be priced at $27.90 each, First Hawaiian

said in a separate statement Monday.

The selling stockholder has granted underwriters a 30-day option

to purchase up to an additional three million shares of the

company's common stock, First Hawaiian said.

Furthermore, First Hawaiian said it will buy back shares from

the selling stockholder equal to around $50 million.

Upon completion of the public offering and share buyback, BNP's

beneficial ownership stake will reduce to 33.3%--or 31% if the

underwriters' option to purchase additional shares of the company's

common stock is exercised in full--from around 48.8%, First

Hawaiian said.

BNP expects the transaction to have a "positive impact of at

least 10 basis points" on its common equity tier 1 ratio, a measure

of capital strength. The transaction has no effect on the company's

second-quarter results, the French bank said.

BNP added that, as of the third quarter, it will consolidate

First Hawaiian under the equity method in its financial

statements.

In May, BNP said it would reduce its stake in First Hawaiian

following the sale of 15.3 million shares by an affiliate.

Goldman Sachs & Co LLC is acting as underwriter for the

offering.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com

(END) Dow Jones Newswires

July 30, 2018 10:37 ET (14:37 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

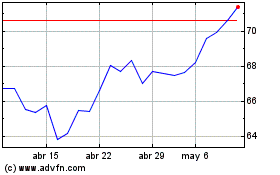

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

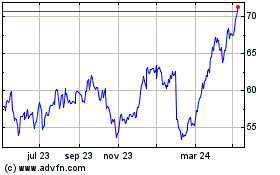

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024