Euro Higher On Italy Budget News

18 Diciembre 2018 - 11:25PM

RTTF2

The euro climbed against its major counterparts in the early

European session on Wednesday, after Italian government struck a

technical agreement with the European Commission over its 2019

budget plan, ending a standoff between Rome and Brussels about

deficit limit.

On Tuesday, Italy's Economy Ministry announced that an informal

agreement had been made with the European Commission over its

budget plan.

The deal is expected to be formalized on Wednesday at a meeting

of EU commissioners in Brussels.

Prime Minister Giuseppe Conte said that "it is necessary to wait

for the procedure to be completed in order to consider the

negotiation definitively concluded." Conte will address the Italian

parliament on Wednesday.

Data from the Federal Statistical Office showed that Germany's

producer price inflation remained at its highest level in 19 months

in November.

Producer prices rose 3.3 percent year-on-year in November, same

as in October. Economists had expected a 3.1 percent increase. The

pace of increase was the fastest since April 2017, when producer

prices rose at the same rate. The currency rose against its major

counterparts in the Asian session, with the exception of the

pound.

The euro firmed to a 9-day high of 1.1405 against the greenback,

from a low of 1.1359 hit at 5:00 pm ET. On the upside, 1.16 is

likely seen as the next resistance for the euro.

The single currency advanced to a 2-day high of 128.20 against

the yen, reversing from a low of 127.71 touched at 7:00 pm ET. The

euro is poised to find resistance around the 130.00 mark.

Data from the Ministry of Finance showed that Japan recorded a

merchandise trade deficit of 737.3 billion yen in November.

That missed forecasts for a deficit of 630.0 billion yen

following the 450.1 billion yen shortfall in October.

The euro climbed to 1.1311 against the franc, its highest since

December 6. Next key resistance for the euro is possibly seen

around the 1.15 level.

Having dropped to 0.8982 against the pound at 5:15 pm ET, the

euro reversed direction and strengthened to 0.9010. The next

possible resistance for the euro is seen around the 0.91 level.

The euro appreciated to 1.5377 against the loonie, a level

unseen since July 25. If the euro rises further, 1.55 is likely

seen as its next resistance level.

The euro rose to 1.5853 against the aussie and 1.6626 against

the kiwi, from its early lows of 1.5806 and 1.6569, respectively.

The euro is seen finding resistance around 1.60 against the aussie

and 1.68 against the kiwi.

Looking ahead, Canada CPI and U.S. existing home sales for

November are set for release in the New York session.

At 2:00 pm ET, the Fed announces its decision on interest rate.

The central bank is expected to raise its interest rate by a

quarter-point to a range of 2.25 percent to 2.5 percent.

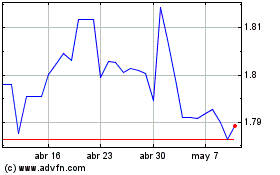

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024