TIDMBOR

RNS Number : 6931N

Borders & Southern Petroleum plc

26 September 2019

26 September 2019

Borders & Southern Petroleum plc

("Borders & Southern" or "the Company")

Unaudited Results for the six month period ended 30 June

2019

Borders & Southern Petroleum Plc (AIM: BOR) is pleased to

announce its unaudited interim financial statements for the six

months to 30 June 2019. The accounts contained within this report

represent the consolidation of Borders & Southern Petroleum Plc

and its subsidiary Borders & Southern Falkland Islands

Limited.

Chief Executive's Statement

The Company reports an operating loss for the six-month period

ending 30 June 2019 of $820,000 (compared to a loss for the

corresponding period last year of $961,000). The cash balance at 30

June 2019 was $4.4 million (30 June 2018: $6.8 million), with the

majority of the Company's funds continuing to be held in Sterling.

The Company does not hold any debt.

With the help of our advisors we are actively pursuing a farm-in

partner for our Darwin project. Industry reach has been extensive

and we continue to present our robust technical and commercial

proposition to new companies. The external environment remains

challenging despite the relative recovery in oil price. Global

conventional exploration drilling is recovering slowly but is still

significantly below the level seen in 2012. However, discoveries in

2019 have increased, including a significant amount in deep water,

which is helping to provide a more positive sentiment. The Board

remains confident that the Company will secure funding for the next

phase of drilling and further updates will be made as and when

appropriate.

In order to support our farm-out activities we continue to

improve our sub-surface technical case. During the past six months

we have refined our channel / fan prospects and leads, enhancing

our palaeogeographical reconstructions of the Lower Cretaceous.

Moving forward we aim to concentrate on detailed structural and

stratigraphic analysis of the Darwin reservoir. One of the key

objectives of this work will be to evaluate potential additional

hydrocarbon pools (some of which have seismic amplitude support)

that have been identified adjacent to the Darwin East and West

fault blocks. The current un-risked best estimate of 462 million

barrels for total recoverable liquids (condensate and LPGs) for

Darwin East and West (as previously announced) does not include

these pools. The work will determine whether they could be

economically exploited, thereby increasing the prospective resource

and enhancing the value of the discovery.

The financial statements will shortly be on the Company's

website.

Howard Obee

Chief Executive

25 September 2019

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

For further information please visit www.bordersandsouthern.com

or contact:

Borders & Southern Petroleum plc

Howard Obee, Chief Executive

Tel: 020 7661 9348

Strand Hanson Limited (Nominated & Financial Adviser)

James Spinney / Ritchie Balmer / Georgia Langoulant

Tel: 020 7409 3494

Mirabaud Securities Limited (Broker)

Peter Krens

Tel: 020 7878 3362

Tavistock (Financial PR)

Simon Hudson / Barney Hayward / Nick Elwes

Tel: 020 7920 3150

Notes to Editors:

Borders & Southern Petroleum plc is an oil & gas

exploration company listed on the London Stock Exchange AIM (BOR).

The Company operates and has a 100% interest in three Production

Licences in the South Falkland Basin covering an area of nearly

10,000 square kilometres. The Company has acquired 2,517 square

kilometres of 3D seismic and drilled two exploration wells, making

a significant gas condensate discovery with its first well.

Competent Person Disclosure:

The technical aspects of this announcement have been reviewed,

verified and approved by Dr Howard Obee in accordance with the

Guidance Note for Mining, Oil and Gas Companies, issued by the

London Stock Exchange in respect of AIM companies. Dr Obee is a

petroleum geologist with more than 30 years relevant experience. He

is a Fellow of the Geological Society and member of the American

Association of Petroleum Geologists and the Petroleum Exploration

Society of Great Britain.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2019

12 months

6 months 6 months

ended ended ended

30 June 30 June 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

Notes $000 $000 $000

Administrative expenses (820) (783) (1,802)

loss from operations (820) (783) (1,802)

Finance income 3 17 15 29

Finance expense 3 (17) (193) (193)

LOSS BEFORE TAX (820) (961) (1,966)

Tax expense - - -

LOSS FOR THE PERIOD AND

TOTAL COMPREHENSIVE LOSS

FOR THE PERIOD ATTRIBUTABLE

TO EQUITY OWNERS OF THE

PARENT (820) (961) (1,966)

============== ============== ==============

(Loss) per share - basic 2 (0.2) cents (0.2) cents (0.41) cents

and diluted

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2019

At At At

30 June 30 June 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

$000 $000 $000

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 102 4 15

Intangible assets 291,675 291,639 291,367

Total non-current assets 291,777 291,643 291,382

CURRENT ASSETS

Other receivables 416 34 260

Cash and cash equivalents 4,407 6,784 5,626

-------------- -------------- --------------

TOTAL CURRENT ASSETS 4,823 6,818 5,886

TOTAL ASSETS 296,600 298,461 297,268

============== ============== ==============

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (489) (527) (337)

-------------- -------------- --------------

TOTAL LIABILITIES (489) (527) (337)

TOTAL NET ASSETS 296,111 297,934 296,931

EQUITY

Share capital 8,530 8,530 8,530

Share premium 308,602 308,602 308,602

Other reserve 1,775 1,773 1,775

Retained deficit (22,780) (20,955) (21,960)

Foreign currency reserve (16) (16) (16)

TOTAL EQUITY 296,111 297,934 296,931

============== ============== ==============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2019

Foreign

Share Other Retained currency

capital Share premium reserve deficit reserve Total

$000 $000 $000 $000 $000 $000

Unaudited

Balance at 1 January 2019 8,530 308,602 1,775 (21,960) (16) 296,931

Total comprehensive loss

for the period - - - (820) - (820)

Balance at 30 June 2019 8,530 308,602 1,775 (22,780) (16) 296,111

========== =============== ========== ========== =========== =========

Unaudited

Balance at 1 January 2018 8,530 308,602 1,773 (19,994) (16) 298,895

Total comprehensive loss

for the period - - - (961) - (961)

Balance at 30 June 2018 8,530 308,602 1,773 (20,955) (16) 297,934

======= ========= ======= ========== ====== =========

Audited

Balance at 1 January 2018 8,530 308,602 1,773 (19,994) (16) 298,895

Total comprehensive loss

for the year - - - (1,966) - (1,966)

Recognition of share based

payments - - 2 - - 2

Balance at 31 December

2018 8,530 308,602 1,775 (21,960) (16) 296,931

======= ========= ======= ========== ====== =========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2019

6 months 12 months

ended ended

6 months 31 December

30 June 2019 ended 2018

30 June 2018

(unaudited) (unaudited) (audited)

Cash flow from operating

activities $000 $000 $000

(loss) before tax

Adjustments for: (820) (961) (1,966)

Depreciation 97 7 1

Share-based payment - - 2

Net finance (income) / costs - 178 164

Realised foreign exchange

gains / (losses) - (20) 21

(723) (796) (1,778)

(Increase)/decrease in trade

and other receivables (156) 406 180

Increase/ (decrease) in trade

and other payables 72 (106) (296)

Tax paid - - -

Net cash outflow from operating

activities (807) (496) (1,894)

Cash flows used in investing

activities

Interest received 17 15 29

Purchase of intangible fixed

assets (308) (814) (541)

Lease interest (10)

Lease repayments (104)

Proceeds from disposal of

tangible fixed assets (5)

Net cash used in investing

activities (405) (799) (517)

Net decrease in cash and

cash equivalents (1,212) (1,295) (2,411)

Cash and cash equivalents

at the beginning of the period 5,626 8,251 8,251

------------------------ --------------- --------------

Exchange losses on cash and

cash equivalents (7) (172) (214)

------------------------ --------------- --------------

Cash and cash equivalents

at the end of the period 4,407 6,784 5,626

======= =============== =====================================

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2019

1. Basis of preparation

The unaudited condensed consolidated interim financial

statements have been prepared using the recognition and measurement

principles of International Accounting Standards, International

Reporting Standards and Interpretations adopted for use in the

European Union (collectively EU IFRSs). The Group has not elected

to comply with IAS 34 "Interim Financial Reporting" as permitted.

The principal accounting policies used in preparing the interim

financial statements are unchanged from those disclosed in the

Group's Annual Report for the year ended 31 December 2018 and are

expected to be consistent with those policies that will be in

effect at the year end.

The condensed consolidated financial statements for the six

months ended 30 June 2019 and 30 June 2018 are unreviewed and

unaudited. The comparative financial information does not

constitute statutory financial statements as defined by Section 435

of the Companies Act 2006. The comparative financial information

for the year ended 31 December 2018 is not the company's full

statutory accounts for that period. A copy of those statutory

financial statements has been delivered to the Registrar of

Companies. The auditors' report on those accounts was unqualified,

did not include references to any matters to which the auditors

drew attention by way of emphasis without qualifying their report

and did not contain a statement under section 498(2)-(3) of the

Companies Act 2006.

Adoption of IFRS 16 'Leases'

The new IFRS standard on leases came into effect on 1 January

2019. The new standard sets out the principles for the recognition,

measurement, presentation and disclosure of leases and requires

lessees to account for most leases under a single on-balance sheet

model.

The Group adopted IFRS 16 from 1 January 2019 using the modified

retrospective approach and accordingly the information presented

for 2018 is not restated. It remains as previously reported under

IAS 17 and related interpretations. On initial application, the

Group elected to record right-of-use assets based on the

corresponding lease liability. A right-of-use asset and lease

obligations of $0.3m were recorded as of 1 January 2019, with no

net impact on retained earnings. The Group also elected to use the

recognition exemptions for lease contracts that, at the

commencement date, have a lease term of 12 months or less and do

not contain a purchase option ('short term leases'), and lease

contracts for which the underlying asset is of low value

('low-value assets').

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17 Leases. These

liabilities were measured at the present value of the remaining

lease payments.

Straight-line operating lease expense recognition in cost of

sales is replaced with a depreciation charge for the right-of-use

assets and an interest expense on the recognised lease liabilities

(included in finance charges). In the earlier periods of the lease,

the expenses associated with the lease under IFRS 16 will be higher

when compared to lease expenses under IAS 17. However, EBITDA

results improve as the operating expense is now replaced by

interest expense and depreciation in profit or loss.

For classification within the cash flow statement, previously

operating lease payments were presented as operating cash flows.

These lease payments are now disclosed in financing activities with

the interest portion included within in operating cash flows.

2. EARNINGS per share

The calculation of the basic earnings per share is based on the

profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

During the period the potential ordinary shares are anti-dilutive

and therefore diluted loss per share has not been calculated. At 30

June 2019, there were 7,050,000 (30 June 2018: 7,050,000, 31

December 2018:7,050,000) potentially dilutive ordinary shares being

the share options.

(Loss) after Weighted

tax for the average (Loss) per

period/year number of share

$000 shares cent

basic and diluted

Six months ended 30 June 2019

(unaudited) (820) 484,098.484 (0.2)

Six months ended 30 June 2018

(unaudited) (961) 484,098,484 (0.2)

Twelve months ended 31 December

2018 (audited) (1,966) 484,098,484 (0.41)

3. FINANCE INCOME AND EXPENSE

Finance income 6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2018

2019 2018 $000

$000 $000

Bank interest receivable 17 15 29

Foreign exchange gain / (loss) (7) (193) -

Interest on leased assets (10)

- (178) 29

========== ========== ==============

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR QELFLKKFFBBV

(END) Dow Jones Newswires

September 26, 2019 02:00 ET (06:00 GMT)

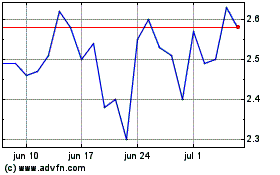

Borders & Southern Petro... (LSE:BOR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Borders & Southern Petro... (LSE:BOR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024