TIDMFUTR

RNS Number : 8619W

Future PLC

13 December 2019

Future plc

PUBLICATION OF ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 AND

NOTICE OF ANNUAL GENERAL MEETING 2020

Future plc (LSE: FUTR; the "Group"), the global platform for

specialist media, has today, in accordance with LR 9.6.1 R of the

Listing Rules, submitted to the Financial Conduct Authority's

National Storage Mechanism copies of the following:

-- Annual Report and Financial Statements 2019

-- Form of Proxy for the 2020 Annual General Meeting

The Notice of Annual General Meeting 2020 is set out on pages

149 to 153 of the Annual Report and Financial Statements 2019. The

Annual General Meeting will be held at Future's London office 1-10

Praed Mews, London W2 1QY on 5 February 2020 at 10.30 a.m.

The documents will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM

The Annual Report and Financial Statements and Notice of Annual

General Meeting are also available on the Future plc website at

www.futureplc.com/resources/#results

A condensed set of the Group's financial statements and

information on important events that have occurred during the

financial year and their impact on the financial statements were

included in Future plc's Full Year Results Announcement on 15

November 2019. That information together with the information set

out below which is extracted from the Annual Report and Financial

Statements 2019 constitute the material required by DTR 6.3.5 of

the Disclosure Guidance and Transparency Rules which is required to

be communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full Annual Report and Financial

Statements 2019. Page and note references in the text below refer

to page numbers and note references in the Annual Report and

Financial Statements 2019. To view the results announcement, slides

of the results presentation and the results webcast please visit

www.futureplc.com/resources/#results

Enquiries

Future plc 01225 442244

Zillah Byng-Thorne, Chief Executive Officer

Penny Ladkin-Brand, Chief Financial Officer

Instinctif Partners 020 7457 2020

Kay Larsen, Chantal Woolcock, Hannah Campbell

About Future

Future is a global platform business for specialist media with

diversified revenue streams.

The Media division is high-growth with three complementary

revenue streams: eCommerce, events and digital advertising

including advertising within newsletters. It operates in a number

of sectors including technology, games, music, home interest,

hobbies and B2B and its brands include TechRadar, PC Gamer, Tom's

Guide, Android Central, Homebuilding & Renovating Show,

GamesRadar+, The Photography Show, Top Ten Reviews, Live Science,

Guitar World, MusicRadar, Space.com and Tom's Hardware.

The Magazine division focuses on publishing specialist content,

with over 75 publications and over 568 bookazines published per

year, totalling global circulation of 1.5 million. The Magazine

portfolio spans technology, games and entertainment, music,

creative and photography, hobbies, home interest and B2B. Its

titles include Classic Rock, Guitar Player, FourFourTwo,

Homebuilding & Renovating, Digital Camera, Guitarist, How It

Works, Total Film, What Hi-Fi? and Music Week.

Appendices

Appendix A: Directors' responsibility statement

The following directors' responsibility statement is extracted

from the Annual Report and Accounts (page 57):

Directors' responsibility statement required by DTR 4.1.12R

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have prepared the Group financial statements in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union, and Company financial statements in accordance

with International Financial Reporting Standards (IFRSs) as adopted

by the European Union. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the Group

and Company, and of the profit or loss of the Group and Company for

that period. In preparing the financial statements, the Directors

are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable IFRSs as adopted by the European

Union have been followed for the Group financial statements, and

IFRSs as adopted by the European Union have been followed for the

Company financial statements, subject to any material departures

disclosed and explained in the financial statements;

-- make judgements and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and Company

will continue in business.

The Directors are also responsible for safeguarding the assets

of the Group and Company, and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group and

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Group and Company, and enable

them to ensure that the financial statements and the Directors'

Remuneration Report comply with the Companies Act 2006 and, as

regards the Group financial statements, Article 4 of the IAS

Regulation.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Directors' confirmations

Each of the Directors, whose names and functions are listed in

the Board of Directors section on pages 51 and 52, confirm that, to

the best of their knowledge:

-- the Company financial statements, which have been prepared in

accordance with IFRS as adopted by the European Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the Company;

-- the Group financial statements, which have been prepared in

accordance with IFRS as adopted by the European Union, give a true

and fair view of the assets, liabilities, financial position and

profit of the Group;

-- they consider the Annual Report and financial statements,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for shareholders to assess the Group's

position and performance, business model and strategy; and

-- the Directors' report includes a fair review of the

development and performance of the business and the position of the

Group and Company, together with a description of the Principal

Risks and uncertainties that it faces.

In the case of each Director in office at the date the

Directors' report is approved:

-- so far as the Director is aware, there is no relevant audit

information of which the Group and Company's auditors are unaware;

and

-- they have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Group and Company's

auditors are aware of that information.

Appendix B: Risks and uncertainties

The following description of the principal risks and

uncertainties that the Company faces is extracted from the Annual

Report and Accounts (pages 35 to 38):

RISKS AND UNCERTAINTIES

Effective risk management is essential to support the

achievement of our strategic and operational objectives as we

address the challenges and uncertainties facing businesses

today.

The Board has overall responsibility for the risk management

framework and for ensuring that we manage risks appropriately.

Future takes its approach to the identification, evaluation and

mitigation of risk and uncertainty extremely seriously, and applies

a robust framework that embeds risk management throughout its

organisation and across its operations. Whilst it is accepted that

risk forms a part of operating in business, delivering its

strategic objectives whilst mitigating those risks is a fundamental

objective for Future's Board and its executive management

teams.

Approach to risk

The Board

-- Sets the Group's risk appetite taking into account its strategic objectives

-- Identifies principal Group risks

-- Conducts 'deep dives' into specific Principal Risks

-- Carries out a robust assessment of any emerging risks

-- Assesses the impact of Principal Risks when analysing the

Group's long-term viability and sustainability

-- Considers views from management and the Audit Committee as

part of its review of the effectiveness of the system of internal

controls

The Audit Committee

-- Monitors the adequacy and effectiveness of internal control and risk management systems

-- Ensures that a robust assessment of the Principal Risks facing the Group has been undertaken

-- Includes an update on risk as a standing agenda item for every meeting

Executive Leadership Team

-- Prioritises Principal Risks through a formal bi-annual review process

-- Allocates resources to manage risks according to potential impact

-- Communicates priorities to the business

-- Reviews detailed risk registers to agree Principal Risks

-- Identifies any emerging actions where Group-wide action is required

-- Reviews effectiveness of risk management procedures

-- Reports to the Audit Committee and Board on a regular basis

The Executive Leadership Team (ELT) is responsible for

identifying risks and working with the Group Financial Controller

to capture them in the Group's risk register. All risks identified

by the ELT are scored out of 5 (with 5 being the highest) in

respect of three areas: the likelihood of the risk crystallising,

the impact if the risk does crystallise, and the strength of any

mitigation in place (in respect of mitigation, a score of 1

represents strong mitigation). A combined score is then calculated

by multiplying each of these scores together (with 125 being the

highest possible score).

Whilst Future operates in an evolving environment with several

clear risks, it takes a pro-active and robust approach to

identifying any new risks, and evaluating and mitigating all known

risks through a regular review process.

Our internal controls seek to minimise the impact of risks,

either by reducing their likelihood or mitigating their impact, as

explained further in the Corporate Governance report on pages 63 to

64, and during the year we have continued to develop those

controls. The more granular approach to risk that was introduced in

the prior year has ensured that effective risk management remains

at the core of the Group's strategy, which includes a formal,

six-monthly review by the ELT and the addition of risk management

to the Audit Committee as a standard agenda item for every meeting.

There have been no significant control failings or weaknesses

identified during the year in respect of risk management.

Our Principal Risks

The output from the above process is a summary of Principal

Risks that is set out in the table on pages 37 to 38 and summarised

in the heat map opposite. The heat map sets out the relative

likelihood of the risk crystallising and the impact on the Group if

the risk did crystallise - effectively the 'gross' risk score

before considering the strength of any mitigation. The relative

strength of the mitigation available to the Group to combat each

risk is depicted in the colour of the risk on the heat map (green

being strong, amber being average and red being low mitigation)

with arrows detailing the movement of the gross risk from the prior

year. The symbol E has been included in the Summary of Principal

Risks table overleaf to indicate risks emerging in FY19.

Each Principal Risk has been analysed according to its impact on

both the Group's existing business model, as set out in the 'Future

Strategy Wheel', and the core elements of the Group's strategy as

set out in the 'Future Playbook'. More information on the Future

Strategy Wheel and the Future Playbook can be found on pages 13 and

14. Considering both the existing business model together with the

strategic direction of the Group, the Board carried out a robust

assessment of long term viability, which included performing

sensitivity analysis and reverse stress-testing.

The symbol V has been included in the Summary of Principal Risks

table overleaf to indicate those that have been taken into account

when performing the viability testing.

Changes to the Group's risk assessment in the year

As a result of the risk review undertaken during the year,

several risks identified as Principal Risks in prior years are no

longer considered to be as significant and are therefore not

included in the Summary of Principal Risks table overleaf, with the

reasons for the reduction in the perceived level of risk set out

below:

FY18 principal risks not included Reason for reduction in risk

in FY19 assessment rating

Operating environment - the The acquisitions of Purch, Mobile

structural change in our operating Nations and SmartBrief, together

environment and the pace of with underlying organic growth

transition from print. in digital revenues, mean that

the Magazine division is a much

smaller proportion of the Group's

revenues which has reduced the

impact of this risk.

--------------------------------------

Changes in advertising models Ad blocking has not had a significant

- the increasing trends towards impact on the Group's ability

ad blocking and privacy could to monetise its websites as

result in Future being unable we have to date effectively

to monetise online advertising mitigated this through the use

inventory to the same extent of technology and working with

it does currently. the Coalition for Better Ads

to ensure that we are at the

forefront of market best-practice.

--------------------------------------

Intellectual property - as a Intellectual property infringement

publisher, Future is responsible and management continues to

for any intellectual property be a vitally important area,

infringement or legal issue. however, with the growth experienced

by the Group in the year the

materiality of this risk in

the context of the overall Group

has reduced.

--------------------------------------

Risks Description Mitigation

Personal data The collection, storage and The Data Protection

V use of personal data by the Officer oversees all

Business Model Group presents a risk of data protection matters

link: i, ii, misuse, loss of personal and works with stakeholders

vi data, or cyber-attack which within the Group to

Strategy link: could result in high penalties review, develop and

3 from the Information Commissioner's improve its data practices

Office (ICO) or claims from and procedures.

data subjects. Future may The Group has implemented

suffer reputational risk, a process to respond

as well as a significant to subject access

financial penalty, if it requests in a proper

is responsible for the breach. and timely fashion

Future (and the third parties and uses a Consent

it relies on) is required Management Platform

to comply with strict data on its websites within

protection and privacy legislation, the IAB's Consent

including the General Data and Transparency Framework.

Protection Regulation (GDPR). Controls and contract

Such laws restrict Future's provisions are in

ability to collect and use place to ensure compliance

personal information and with data protection

place significant transparency legislation and confirmation

and accountability obligations is sought from all

on Future. The need to comply 3rd parties who might

with data protection legislation be involved in providing

is a significant control, or processing data

operational and reputational to ensure they are

risk which can affect the also in compliance

Group. with such legislation.

------------------------------------- ------------------------------

Staff - Key The Group is heavily dependent The Board has undertaken

person risk on its CEO and her absence a detailed succession

Business Model would have a significant planning and talent

link: i-vii impact on the Group. There review exercise in

Strategy link: is not currently an obvious the year to ensure

1-5 candidate within the organisation (wherever possible)

who could step up to replace that the Group is

her as CEO, and the Board not overly exposed

would therefore most likely to any one employee.

have to undertake an external This exercise highlights

search for a successor. how each of the executive

team could be covered

in an emergency and

who were the obvious

successors within

the organisation.

The Group has also

recruited several

new senior roles within

the year to provide

additional strength

in experience and

expertise to the senior

management team.

In order to attract

and retain top talent

and ensure that Future

remains an attractive

place to work, appropriate

reward packages (including

long term incentive

schemes) are in place

for key individuals.

------------------------------------- ------------------------------

Cyber security With the further transition Future seeks to ensure

and IT away from print and growth all of its systems

E in digital revenues the Group and public owned and

Business Model is increasingly reliant on operated infrastructure

link: i, ii, technology. complies with best

iii, vi Strategy Hacking of the Group's websites practice as regards

link: 1 or any hacking or infiltration to security, by continually

of the Group's public owned investing in and upgrading

and operated infrastructure IT systems and processes.

resulting in loss of data, The Group's core network

could result in significant is protected by Two-Factor

interruption to trading, authentication security

disruption to the Group's and firewall restrictions,

operations and damage to with a plan in place

its reputation along with to mitigate the effects

further heavy investment of any hack.

being required. To protect against

The data protection elements system/network outages

of this risk have been considered (caused by fraud or

in the Personal Data risk other issues), Future's

set out above. network has multiple

back-up facilities

held in different

locations that minimises

any single point of

failure. Servers are

distributed across

two main data centre

locations and several

controlled server

rooms in different

buildings in Bath,

Bournemouth and New

York.

Following the completion

of acquisitions, assets

are quickly moved

onto the Group's existing

infrastructure (data

centres and Cloud

based providers) except

where not possible

or practicable. Websites

acquired by the Group

are usually transitioned

to the Group's platform

to ensure they meet

the required security

and best-practice

standards.

------------------------------------- ------------------------------

Economic Political and economic instability This risk is mitigated

downturn / and uncertainty in the UK by keeping abreast

Brexit or US could have an adverse of macro-economic

V impact on the Group's operations. developments and ensuring

Business Model We do not expect Brexit to that the Group responds

link: ii-vi have a significant impact swiftly to any as

Strategy link: on the business however a they materialise.

2 high degree of economic uncertainty The Group is diverse,

still remains which could both geographically

reduce consumer spending, and through its large

resulting in loss of revenue number of revenue

and impact on advertisers. streams. This insulates

it from political

or economic instability

in any particular

country or region.

In addition, the Group

has focused on being

the market leader

wherever possible,

which should make

it more durable in

a recession as historically

advertisers are more

likely to continue

to spend with the

market leader in any

particular sector.

------------------------------------- ------------------------------

Advertising The continued industry shift The Group seeks to

V E in the advertising model mitigate this risk

Business Model from 1st Party advertising by ensuring that its

Link: i, iii-vi to Premium Programmatic advertising sales teams are trained

Strategy link: exposes the Group to commercial to sell the benefits

2 risk as this is likely to associated with working

result in a reduction in with Future (rather

yield. than acquiring advertising

programmatically)

and by ensuring that

we continue to maintain

and develop deep direct

client relationships.

This risk is further

mitigated by the Group's

expansion of its video

offering which further

diversifies its revenue

streams, and through

the use of its Hybrid

technology which ensures

that Future drives

the best yields available

in the market.

------------------------------------- ------------------------------

Reliance on Future is very exposed to Future has a dedicated

'search' Google to the extent that audience development

V its websites are reliant team who work to ensure

Business Model on 'search' (i.e. a user Future embeds best

Link: ii-iv, navigating to one of Future's practice within its

vi, vii websites via a search engine editorial and technical

Strategy link: such as Google). teams.

3 Any unforeseen change to In addition, Future

the Google algorithm, its continues to invest

nature or business model in the creation of

could significantly impact top quality content,

the that follows best

Group's revenues. practice to meet the

needs of audiences

and therefore mitigate

as much as possible

its reliance on 'search'.

The Group's recent

diversification into

B2B drives a direct

relationship with

the end customer and

the Group continues

to invest in other

direct sources to

drive direct traffic

and reduce its reliance

on Google.

------------------------------------- ------------------------------

Acquisitions The Group continues to search The Group has successfully

V for opportunities to grow completed and integrated

Business Model through acquisition. There eight acquisitions

link: i-vii is a risk that any such acquisition over the last 36 months.

Strategy link: or its subsequent integration The management team

5 fails to create value for is highly experienced

shareholders. and adept at identifying

suitable acquisition

opportunities, executing

the deal and integrating

the acquired business

into the wider Group.

The risk is further

mitigated through

the performance of

due diligence appropriate

to the size and scale

of the acquisition,

and the preparation

of a clear and detailed

integration plan which

is carefully managed.

------------------------------------- ------------------------------

The Directors do not see the impact of climate change as one of

the Group's Principal Risks. For more information on Group

initiatives to minimise and mitigate its environmental impact,

please refer to the Corporate Responsibility Report on pages 41 and

42.

Key:

Link to Future's Business Model:

i. Email newsletters

ii. Membership and subscriptions

iii. Advertising

iv. Events & experiential

v. Newstrade

vi. eCommerce and lead gen

vii. Content publishing & licensing

Link to our vision and strategy:

1. A global specialist media platform

2. We create fans of brands

3. Our loyal communities

4. Diversifying monetisation

5. Expanding global reach

Long-term viability:

V: Risk taken into account as part of the Company's long term

viability assessment (see page 39)

E: Emerging risk for FY19

Appendix C: Related Party transactions

The following related party transactions are extracted from the

Annual Report and Accounts (page 143):

The Group had no material transactions with related parties in

2019 or 2018 which might reasonably be expected to influence

decisions made by users of these financial statements.

During the year, the Company had management charges payable of

GBP1.4m (2018: GBP0.9m) to subsidiary undertakings. The outstanding

balance owed at 30 September 2019 was GBP1.4m (2018: GBP0.9m). See

note 21 for details.

No individuals other than the Directors meet the definition of

key management personnel. Details of key management personnel

compensation are set out in the Directors' Remuneration Report on

page 88.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSFFDFEDFUSEDE

(END) Dow Jones Newswires

December 13, 2019 07:45 ET (12:45 GMT)

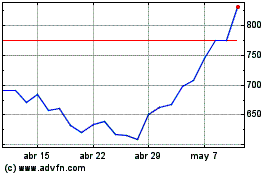

Future (LSE:FUTR)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Future (LSE:FUTR)

Gráfica de Acción Histórica

De May 2023 a May 2024