TIDMBIDS

RNS Number : 3825W

Bidstack Group PLC

18 August 2020

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this Announcement, this information is considered to

be in the public domain.

18 August 2020

Bidstack Group Plc

("Bidstack" or the "Company")

Interim Results for the six months ended 30 June 2020

Further strategic progress made and momentum accelerating

Bidstack Group plc (AIM: BIDS.L), the native in-game advertising

group, announces its unaudited Interim Results for the six months

ended 30 June 2020. The Interim Results for the period ended 30

June 2020 will be published on the Company's website -

www.bidstackgroup.com today.

Financial Highlights

-- Revenue of GBP0.3m (period ended 30 June 2019: GBP0.03m);

-- Period end cash balance of GBP5.9m (period ended 30 June 2019: GBP6.0m);

-- Loss per share has increased to 1.18 pence (period ended 30

June 2019: loss of 0.83 pence per share);

-- Oversubscribed placing of 142.5 million shares at 4 pence per

share to raise GBP5.7m (before expenses) for the Company completed

on 10 June 2020.

Operational Highlights

-- Advertising campaigns attracted from the United States, mainland Europe and the UK;

-- Initial small spend campaigns run for brands including

Activision Blizzard, Audi, BBC, Football Index, JBL, MG Motors,

Penguin Random House, Shell, Subway, Unilever, Vodafone, VW and

Warner Music;

-- Appointment of Andrew House, former Group CEO of Sony

Interactive Entertainment, to the Advisory Committee;

-- Programmatic media buying agreement with Gfinity plc (AIM:

GFIN) and Venatus Media to sell advertising space on Gfinity's web

platforms;

-- Bidstack's proprietary technology used to insert the message

"Stay Home Save Lives" in Codemasters' Dirt Rally 2.0. video

game;

-- Lumen Research Study commissioned by Bidstack demonstrated

the value of in-game advertising and how it affects brand

perception and recall when benchmarked against other advertising

channels;

-- Exclusive agreement with Codemasters, to deliver native

in-game advertising for DIRT 5 (TM) scheduled for launch in October

2020 on the next generation Xbox Series X and PlayStation(R)5;

-- First multi-device in-game advertising platform to be awarded

the Internet Advertising Bureau's ("IAB") Gold Standard

Certification;

-- Expanded from 49 employees on 31 December 2019 to 62 at 30 June 2020.

James Draper , Chief Executive, said:

"We have continued to make further progress towards our goal of

becoming a leading platform to deliver in-game advertising and

remain at the forefront of the creation of in-game advertising as a

new advertising category.

"This includes progress on the demand side, where we are now

experiencing advertising customers moving beyond initial test

spends, as well as the supply side where we continue to work with

and engage a number of the world's largest video games developers

and publishers. The award of the IAB's Gold Standard certificate

1.1 opens additional opportunities to become involved with

additional international advertising agencies.

"Following our oversubscribed placing in June 2020, Bidstack has

a healthy cash position and is making material progress in its

approach to building a strong foundation on which to grow and

create value for shareholders. As announced on 28 May 2020, the

Board continues to expect revenues for 2020 to be very

significantly second half weighted and in line with market

expectations for the full year."

-ends-

For further information, please contact:

Bidstack Group Plc

James Draper, CEO via Buchanan

SPARK Advisory Partners Limited

(Nomad)

Mark Brady/Neil Baldwin/James

Keeshan +44 (0) 203 368 3550

Stifel Nicholas Europe Limited

(Broker)

Fred Walsh +44 (0) 20 7710 7600

Buchanan Communications Limited

Chris Lane / Stephanie Watson

/ Kim van Beeck +44 (0) 20 7466 5000

bidstack@buchanan.uk.com

Chairman's Statement

Business Review

The first half of 2020 has seen Bidstack continue to progress

towards its goal of becoming a leading platform to deliver in-game

advertising and the Company remains at the forefront of the

creation of in-game advertising as a new advertising category. As

previously stated, this evolution comes with many technical,

regulatory and commercial hurdles.

I am pleased to report that disruption to the business caused by

the COVID-19 pandemic has largely been contained from an

operational point of view. Our staff have worked tremendously well,

and their performance and dedication has been outstanding.

Advertising

The Company has made material progress on the demand-side of the

business in the first half and we are now seeing advertisers moving

beyond initial test spends. Advertisers are now proposing

significantly larger advertising campaigns as they become

comfortable with the new medium of in-game advertising.

Bidstack has also started our own network of certified partner

agencies in Europe, Africa and South America, which now extends to

nine companies.

Video Games Strategy

Our supply-side strategy continues to be focussed on working

with a number of the world's largest video games developers and

publishers to incorporate our software into their games. These

ongoing commercial and technical discussions with some of the major

players in the video games industry, who have and continue to

publish highly successful "household name" titles, are extensive

and complex and require significant amounts of due diligence. The

Board believes this strategy will establish Bidstack as one of the

leaders in this part of the advertising industry.

Our strategy has had some successes to date as, during the

period, we ran our first campaign in a well-known sports game from

a global leader in digital interactive entertainment. We have also

been actively selling advertising into a title from a leading

creator, publisher and distributor of interactive entertainment and

services.

Technical Developments

Our proprietary AdConsole, the platform that enables games

publishers and advertisers to access real time data on the

performance of their games, is being regularly updated and

developed in line with customer and commercial requirements.

We continue to make progress for the next generation of consoles

expected to be launched in late 2020. In addition, we are working

hard on the streaming platforms which the Directors believe are

likely to be major players in the future of high fidelity gaming

and to capture the extensive secondary viewing market.

Industry Developments

Our work with the Internet Advertising Bureau ("IAB"), the UK

industry trade body which sets technical standards and best

practices for the digital advertising industry, to create a

recognised advertising category for "native in-game advertising"

remains important as it will, eventually, allow programmatic

advertisers to access in-game advertising on a self-serve basis in

the same way they currently access display and video inventory.

The award of the IAB's Gold Standard certificate 1.1 is

important for Bidstack as it opens additional opportunities with

global agency holding groups. Bidstack is the first multi-device

in-game advertising platform to be awarded the IAB Gold Standard

Certification.

Financial Developments

The Company's significantly oversubscribed placing, the results

of which were announced on 5 June 2020, raised gross proceeds of

GBP5.7m for the Company leaving Bidstack in a healthy cash position

to continue to pursue its business plans.

Advisory Committee

In February 2020 we were delighted to welcome Andrew House to

Bidstack's Advisory Committee following his impressive career at

Sony. As the former CEO of Sony Interactive Entertainment before

leading as Group CEO, one of Andrew's career highlights was the

record breaking launch of PlayStation 4 in 2013.

The members of Bidstack's Advisory Committee and Board comprise

an impressive list of key players in the computer games and

advertising industries. The Company will seek to add further high

calibre members to the Advisory Committee and the Board with

appropriate skills and experience to advance Bidstack's growth

prospects.

Future Prospects

The Board believes that the addressable market for video game

advertising is currently going through a period of substantial

change which is likely to continue over the next three to five

years. We are confident that Bidstack is well placed to take

advantage of these changes with new console launches, the growth of

cloud-gaming and e-sports, coupled with legislative restrictions

affecting targeting via app and web-based advertising. We believe

these developments should all work in Bidstack's favour as we

believe that Bidstack is currently the only player in the industry

with an end-to-end proprietary and fully programmatic in-game

advertising platform.

As a result of the COVID-19 environment, the video games

industry has been experiencing record numbers of daily active users

and hours played and Bidstack has experienc ed high levels of

inbound demand from advertising agencies and others . However,

Bidstack's strategy of continuing to work with some of the world's

largest video games developers and publishers will take time to

come to fruition. Nevertheless, the Board remains confident that

the Company's strategy for creating a sound footing on which to

grow the business and create future value for shareholders is

robust.

The Board continues to take a highly conservative view on

revenue prospects in its planning for the remainder of 2020 and

believes it is right to do so, particularly given the currently

unknown duration and impact of COVID-19 related restrictions on

movement and face to face meetings. In line with its strategy, for

the second half of 2020 Bidstack's focus remains on securing

significant commercial and technological deals with games

publishers and others that will position the Company well for

growth in the medium and longer term.

The Board continues to expect revenues for 2020 to be very

significantly second half weighted and in line with market

expectations for the year ending 31 December 2020.

Chief Executive's Statement and Trading Update

I am pleased with the Company's progress in the first half of

2020.

The COVID-19 pandemic caused some disruption to the business

during the first half, primarily due to a number of trade shows

having been cancelled and the economic consequences of the crisis.

This has clearly had an impact on the face to face meetings that

had been scheduled to take place during those events. Despite this,

the systems, procedures and technology we have put in place have

meant that our business has largely been able to proceed

operationally as normally as possible with our staff working

remotely.

As announced on the 7 April 2020, I am proud of the partnership

with Codemasters and the Department for Digital, Culture, Media and

Sport as we delivered the "Stay Home Save Lives" message within

DiRT Rally 2.0.

The disruption to the advertising industry has led to media

buyers turning away from traditional means of advertising and

focusing increasingly on emerging digital options. Bidstack's

platform is well-positioned to capitalise on the increase in demand

for our native in-game advertising inventory.

Over the first half of 2020 the levels of demand side interest

we experienced from media agencies and brands increased

significantly.

During the period, the Company received its first advertising

bookings from the US and has worked with and run campaigns for 11

major advertising agency groups. The recent award of the IAB's Gold

Standard certificate 1.1 has increased the scope of opportunities

available to Bidstack for inclusion in media planning by

international advertising agencies.

Although initial spends have been small, the Company has run

campaigns for many international brands including Activision

Blizzard, Audi, BBC, Football Index, JBL, MG Motors, Penguin Random

House, Shell, Subway, Unilever, Vodafone, VW and Warner Music.

Over the period, the levels of demand side interest we are

experiencing from media agencies and brands has increased

significantly and our experience is that customers are now

providing us with briefs which go beyond initial test spends and

the size and scope of proposed advertising campaigns has increased

substantially.

During the first half of 2020 the Company received its first

bookings from its own network of certified partner agencies in

Europe, Africa and South America, which now extends to nine

companies.

We are continuing progress with a range of content developers to

construct the depth of supply which will enable us to fully exploit

the demand we are starting to generate.

Discussions are ongoing with a number of the world's largest

video games developers and publishers to incorporate our software

into their games. These ongoing commercial discussions and the due

diligence we are undergoing, are far-reaching, multifaceted and

complex. However the Board believes this strategy will bear fruit

and will establish Bidstack as one of the leaders in this corner of

the advertising industry.

In summary, we are executing on our strategy which leverages our

talent and technology to bring our advertising partners the

best-in-market opportunities to reach gamers in a non-intrusive and

immersive way and are establishing a strong foundation with the

global agency holding groups which is further strengthened by our

IAB Gold Standard certification.

While our plan to become a leading platform to deliver in-game

advertising is a longer term ambition, together with the Board I

believe it is the right strategy to create future shareholder

value.

Consolidated statement of comprehensive income

for the six months ended 30 June 2020

Note

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 Jun 2020 30 Jun 2019 31 Dec 2019

GBP GBP GBP

Revenue 274,079 26,692 140,391

Cost of sales (197,337) (20,286) (106,697)

Gross profit 76,742 6,406 33,694

Administrative expenses (3,244,889) (1,805,059) (5,353,375)

Operating loss before acquisition

related costs (3,168,147) (1,798,653) (5,319,681)

Transaction costs - - (44,833)

Operating loss (3,168,147) (1,798,653) (5,364,514)

Finance income 2,352 975 8,060

Finance costs (700) - (967)

Loss before taxation (3,166,495) (1,797,678) (5,357,421)

Taxation 50,493 - 148,141

Loss for the period (3,116,002) (1,797,678) (5,209,280)

Other comprehensive income

Total other comprehensive income - - -

Total comprehensive loss for

the period (3,116,002) (1,797,678) (5,209,280)

Loss per share - basic and diluted

(pence) 3 (1.18) (0.83) (2.26)

The above consolidated statement of profit and loss and other

comprehensive loss for the period relates to continuing operations

for the Group.

Consolidated statement of financial position

as at 30 June 2020

Note Unaudited Unaudited Audited

30 Jun 2020 30 Jun 31 Dec

2019 2019

ASSETS GBP GBP GBP

Non-current assets

Right of use asset 21,369 - 26,710

Intangible assets 290,141 39,306 310,960

Property, plant and equipment 23,795 19,879 22,377

Total non-current assets 335,305 59,185 360,047

Current assets

Trade and other receivables 862,660 717,316 533,207

Cash and cash equivalents 5,917,381 6,004,616 3,148,540

Total current assets 6,780,041 6,721,932 3,681,747

Total assets 7,115,346 6,781,117 4,041,794

EQUITY AND LIABILITIES

Equity

Share capital 4 6,229,259 5,508,307 5,516,759

Share premium account 27,977,197 23,170,484 23,283,880

Share-based payment reserve 1,035,638 497,166 734,365

Merger relief reserve 6,508,673 6,213,021 6,508,673

Reverse acquisition reserve (23,320,632) (23,320,632) (23,320,632)

Warrant reserve 71,480 71,480 71,480

Accumulated losses (12,299,727) (5,772,123) (9,183,725)

Total equity 6,201,888 6,367,703 3,610,800

Non - Current liabilities

Lease liability 15,790 - 8,300

Total non -current liabilities 15,790 - 8,300

Current liabilities

Trade and other payables 897,014 413,414 406,672

Lease liability 654 - 16,022

Total current liabilities 897,668 413,414 422,694

Total equity and liabilities 7,115,346 6,781,117 4,041,794

The interim financial report was approved by the Board of

Directors on 17 August 2020 and signed on its behalf by:

Donald Stewart

Chairman of Bidstack Group Plc

Consolidated statement of changes in equity

for the six months ended 30 June 2020

Share-based Merger Reverse

Share Share payment relief acquisition Warrant Accumulated Total

capital premium reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at

1 January

2020 5,516,759 23,283,880 734,365 6,508,673 (23,320,632) 71,480 (9,183,725) 3,610,800

Comprehensive

income for the

period

Loss and total

comprehensive

income for

the

year - - - - - - (3,116,002) (3,116,002)

----------- ------------ ----------- --------- -------------- -------- ------------ -----------

Total

comprehensive

expense - - - - - - (3,116,002) (3,116,002)

----------- ------------ ----------- --------- -------------- -------- ------------ -----------

Transactions

with

owners

Issue of

shares 712,500 4,987,500 - - - - - 5,700,000

Costs of

raising

equity - (294,183) - - - - - (294,183)

Share-based

payments - - 301,273 - - - - 301,273

----------- ------------ ----------- --------- -------------- -------- ------------

Total

transaction

with owners 712,500 4,693,317 301,273 - - - - 5,707,090

Balance as at

30 June 2020 6,229,259 27,977,197 1,035,638 6,508,673 (23,320,632) 71,480 (12,299,727) 6,201,888

----------- ------------ ----------- --------- -------------- -------- ------------ -----------

Consolidated statement of changes in equity

for the six months ended 30 June 2019

Share-based Merger Reverse

Share Share payment relief acquisition Warrant Accumulated Total

capital premium reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at 1

January

2019 5,286,429 18,000,247 258,060 6,213,021 (23,320,632) 71,480 (3,974,445) 2,534,160

Comprehensive

income

for the period

Loss and total

comprehensive

income for the

year - - - - - - (1,797,678) (1,797,678)

--------- ---------- ----------- --------- -------------- -------- ----------- -----------

Total

comprehensive

expense - - - - - - (1,797,678) (1,797,678)

--------- ---------- ----------- --------- -------------- -------- ----------- -----------

Transactions with

owners

Issue of shares 221,878 5,428,153 - - - - - 5,650,031

Costs of raising

equity - (257,916) - - - - - (257,916)

Share-based

payments - - 239,106 - - - - 239,106

--------- ---------- ----------- --------- -------------- -------- -----------

Total transaction

with owners 221,878 5,170,237 239,106 - - - - 5,631,221

Balance as at 30

June

2019 5,508,307 23,170,484 497,166 6,213,021 (23,320,632) 71,480 (5,772,123) 6,367,703

--------- ---------- ----------- --------- -------------- -------- ----------- -----------

Unaudited Consolidated statement of changes in equity

for the year ended 31 December 2019

Share-based Merger Reverse

Share Share payment relief acquisition Warrant Accumulated Total

capital premium reserve reserve reserve reserve losses equity

GBP GBP GBP GBP GBP GBP GBP GBP

Balance as at 1

January

2019 5,286,429 18,000,247 258,060 6,213,021 (23,320,632) 71,480 (3,974,445) 2,534,160

Comprehensive

income

for the period

Loss and total

comprehensive

income for the

year - - - - - - (5,209,280) (5,209,280)

--------- ---------- ----------- --------- --------------- -------- ----------- -------------

Total

comprehensive

expense - - - - - - (5,209,280) (5,209,280)

--------- ---------- ----------- --------- --------------- -------- ----------- -------------

Transactions

with

owners

Issue of shares 225,982 5,541,549 - - - - - 5,767,531

Issue of

consideration

shares 4,348 - - 295,652 - - - 300,000

Costs of raising

equity - (257,916) - - - - - (257,916)

Share-based

payments - - 476,305 - - - - 476,305

--------- ---------- ----------- --------- --------------- -------- -----------

Total

transaction

with owners 230,330 5,283,633 476,305 295,652 - - - 6,285,920

Balance as at 31

December 2019 5,516,759 23,283,880 734,365 6,508,673 (23,320,632) 71,480 (9,183,725) 3,610,800

--------- ---------- ----------- --------- --------------- -------- ----------- -------------

Consolidated statement of cash flows

for the period ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 Year ended

ended months ended 31 Dec

30 Jun 2020 30 Jun 2019 2019

GBP GBP GBP

Cash flows from operating activities

Loss before taxation (3,116,002) (1,797,678) (5,357,421)

Adjustments for:

Amortisation - Intangibles 26,818 4,906 18,859

Amortisation - Right of use asset 5,341 - 5,337

Depreciation 6,162 3,057 8,330

Equity settled share-based payments 301,273 239,106 476,305

Doubtful debts expense - - 325,200

Finance income (2,352) (975) (8,060)

Finance expense 700 - 967

------------ -------------

(2,778,060) (1,551,584) (4,530,483)

Changes in working capital

(Increase)/decrease in trade and

other receivables (329,453) 90,375 151,646

Increase/(decrease) in trade and

other payables 490,343 (26,268) (80,204)

------------ ------------- -----------

Cash (used in)/generated from operations (2,617,169) (1,487,477) (4,459,041)

Taxation received - - -

------------ -------------

Net cash used in operations (2,617,169) (1,487,477) (4,459,041)

Cash flow from investing activities

Investment in intangible assets (6,000) (370) (370)

Cash acquired with subsidiary - - 6,683

Investment in property, plant and

equipment (7,581) (7,183) (14,272)

------------ ------------- -----------

Net cash flow (used in)/ generated

from investing activities (13,581) (7,553) (7,959)

Cash flow from financing activities

Proceeds from issue of share capital 5,700,000 5,650,030 5,767,531

Cost of issue (294,183) (257,916) (257,916)

Principal paid on finance leases (7,878) - (7,725)

Interest received 2,352 975 8,060

Interest paid on lease liabilities (700) - (967)

------------ -------------

Net cash generated from financing

activities 5,399,591 5,393,089 5,508,983

Increase in cash and cash equivalents

in the period 2,768,841 3,898,059 1,041,983

Cash and cash equivalents at beginning

of period 3,148,540 2,106,557 2,106,557

Cash and cash equivalents at the end

of the period 5,917,381 6,004,616 3,148,540

------------ ------------- -----------

Notes to the unaudited consolidated interim financial report

1 Summary of significant accounting policies

Basis of preparation

The Company is a public limited company which is admitted to

trading on the AIM Market of the London Stock Exchange and is

incorporated and domiciled in the UK. The address of the registered

office is 201 Temple Chambers, 3-7 Temple Avenue, London, EC4Y 0DT.

The registered number of the company is 04466195.

The consolidated interim financial report consolidates those of

the Company and its trading subsidiary, Bidstack Limited (together

the "Group"). The financial information presented in this interim

report have been prepared using accounting policies that are

expected to be applied in the preparation of the financial

statements for the year ending 31 December 2020.

These policies are in accordance with International Financial

Reporting Standards (IFRSs) and International Financial Reporting

Interpretation Committee (IFRIC) interpretations as endorsed by the

European Union ("IFRS-EU"), and those parts of the Companies Act

applicable to companies reporting under IFRS.

The interim results have been prepared on a going concern basis

which assumes that the Group will be able to continue trading for

the foreseeable future. Although an operating loss has been

reported for the reporting period and an operating loss is expected

to be incurred in the 12 months subsequent to the date of this

report, the Directors believe, having considered all available

information, including the cash resources currently available to

the Group and the Company's proven ability to raise further equity

funds from its supportive shareholder base, that the Group will

have sufficient funds to meet its expected committed and

contractual expenditure for the foreseeable future. Thus, the

Directors continue to adopt the going concern basis of accounting

in preparing the interim financial report for the period ended 30

June 2020.

2 Summary of significant accounting policies

The accounting policies applied by the Group in this

consolidated interim financial report are the same as those applied

by the Group in its consolidated financial statements as at and for

the year ended 31 December 2019.

The following is a list of other new and amended standards

which, at the time of writing, had been issued by the IASB and are

effective in the current period, but have no impact on the

consolidated interim financial report.

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Definition of Material)

-- IFRS 3 Business Combinations (Amendment - Definition of Business)

-- Revised Conceptual Framework for Financial Reporting

-- Interest Rate Benchmark Reform (IBOR) reform Phase 1

(Amendments to IFRS 9, IAS 39 and IFRS 7)

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

group.

3 Loss per share

Basic and diluted loss per share

The calculation of basic and diluted loss per share is based

upon the loss of GBP3,116,002 (2019: loss of GBP1,797,678) and the

weighted average number of ordinary shares in issue for the year of

264,555,996 (2019: 216,898,755).

The loss incurred by the Group means that the effect of any

outstanding warrants and options would be considered anti-dilutive

and is ignored for the purposes of the loss per share

calculation.

4 Share capital and reserves

Allotted, called up and fully Ordinary Share capital

paid 0.5p shares

No. GBP

At 1 January 2019 198,807,631 5,286,429

Exercised warrants 4,863,116 24,315

Exercised options 333,334 1,667

Issue of shares 40,000,000 200,000

Issue of consideration shares 869,565 4,348

As at 31 December 2019 244,873,646 5,516,759

-------------------------------- ------------ -------------

Issue of shares 142,500,000 712,500

As at 30 June 2020 387,373,646 6,229,259

-------------------------------- ------------ -------------

All ordinary shares are equally eligible to receive dividends

and the repayment of capital and represent equal votes at meetings

of shareholders.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FFFFITLIDLII

(END) Dow Jones Newswires

August 18, 2020 02:00 ET (06:00 GMT)

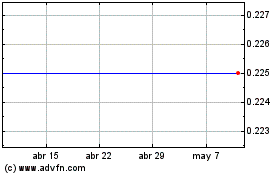

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024