Duke Royalty Limited Trading Update (3670G)

26 Julio 2021 - 1:00AM

UK Regulatory

TIDMDUKE

RNS Number : 3670G

Duke Royalty Limited

26 July 2021

26 July 2021

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

Trading Update

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad, is pleased to provide the following trading and

operational update for its first financial quarter ended 30 June

2021 ("Q1 FY22"), and to provide guidance on trading for the second

quarter of the Company's financial year ended 30 September 2021

("Q2 FY22").

Highlights:

-- Q1 FY22 cash revenue, being cash distributions from Duke's

royalty partners and cash gains from sales of equity assets,

totalled GBP2.9 million for the quarter which was marginally above

management's expectations

-- On a normalised basis, excluding the effects of redemption

premiums and/or equity sales, GBP2.9 million represented a record

cash revenue quarter for the Company, surpassing the GBP2.8 million

generated in Q4 FY20

-- Successful exit of the non-core investment in Berkley

Recruitment (Group) Limited, delivering an IRR of 16.0% in

April

-- GBP35 million oversubscribed equity placing completed,

increasing liquidity to fund the growing pipeline of investment

opportunities

-- Diversified and increased its revenue base through a EUR10.0

million investment into a new royalty partner, Fairmed Healthcare

AG, a provider of high-quality generic prescription medicines,

over-the-counter pharmaceuticals, dermocosmetics and dietary

supplements in various EU countries

-- Elected to exercise warrants granted to Duke from the

previous royalty agreement with XtremePush ("XP"). Following the

exercise, Duke will hold a 2.7% equity stake in the ordinary shares

of XP. The exercise was undertaken concurrent with XP's raise of

US$33 million in growth capital to accelerate its global

expansion.

-- Based on current trading, Duke expects cash revenue for Q2

FY22 to be GBP3.2 million, which would again represent a record

normalised cash revenue quarter for the Company

Neil Johnson, CEO of Duke Royalty, said:

"I am delighted to report that the Company delivered record

normalised quarterly cash revenue in Q1 FY22, surpassing the

previous highs that were generated prior to the destabilising

effects of COVID. This performance is testament to both the

resilience of our underlying royalty partners but also the hard

work that has been invested by Duke's investment team to

successfully navigate these economic headwinds.

"Duke's current strong liquidity position, combined with its

deep pipeline of late stage deal opportunities, gives me confidence

that further deployments will be completed in the short term that

will translate into further increases in quarterly cash revenue for

the benefit of all shareholders."

***ENDS***

For further information, please visit www.dukeroyalty.com or

contact:

Neil Johnson / Charlie

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc Stephen Keys / Callum

(Nominated Adviser Davidson / Julian Morse

and Joint Broker) / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity Adam James / Georgina

(Joint Broker) McCooke +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell/ Richard + +44 (0) 20 3757 6882

Bicknell/ Megan Kovach dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSTDFIEFIL

(END) Dow Jones Newswires

July 26, 2021 02:00 ET (06:00 GMT)

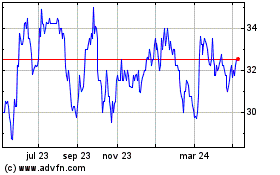

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

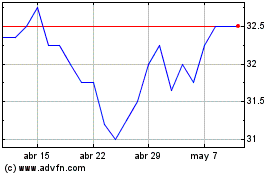

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024