TIDMDELT

RNS Number : 6357L

Deltic Energy PLC

14 September 2021

14 September 2021

Deltic Energy Plc / Index: AIM / Epic: DELT / Sector: Natural

Resources

Deltic Energy Plc ("Deltic" or "the Company")

Interim Results

Deltic Energy Plc, the AIM-quoted natural resources investing

company with a high impact exploration and appraisal portfolio

focused on the Southern and Central North Sea, is pleased to

announce its interim results for the six months ended 30 June

2021.

Highlights

-- Confirmation of first well to be drilled by Deltic on the Pensacola Prospect (Licence P2252)

o Deltic-Shell JV scheduled to drill Pensacola well in Q2

2022

o Well planning rapidly progressing with site survey

commenced

-- Transformational farm-out deal with Cairn Energy PLC ("Cairn") over five Deltic licences

o Introduction of Cairn further enhances Deltic's strong partner

base

o Endorsement of the quality of Deltic's assets, technical team

and strategy to identify opportunities and attract partners

o Will accelerate development of Deltic's core Southern North

Sea (SNS) licences and see significant investment through to a

drilling decision.

-- 3D seismic survey over P2428, the Cupertino Area, has commenced

-- The Company has retained a strong balance sheet with cash of

GBP11.1m as at 30 June 2021 (30 June 2020: GBP12.8m)

-- Loss for the period of GBP 691,754 (six months to 30 June 2020: GBP869,505)

-- Cash out flow for the period of GBP873, 064 ( six months to 30 June 2020: GBP1,030,654)

Graham Swindells, CEO, commented:

"I am extremely pleased with my team's achievements in 2021 so

far, with great progress across the portfolio. The decision to

drill Pensacola and transformational deal with Cairn have been

particular highlights. Both demonstrate our strategy to build a

diverse portfolio of opportunities and attract high quality

partners. We are looking forward to commencing our partnership with

Cairn, as well as continuing our work with Shell as we progress

towards drilling our high impact SNS gas prospects. The next twelve

months are set to be an exciting time for our company."

C ha ir man's Statement

Has the global population ever experienced a single event which

has so dominated its communities? Reading my Chairman's statement

from a year ago, in September 2020, the pandemic was a dominant

force. World leaders had no idea if this would cause health systems

to buckle; economies were on hold; and our sector faced pressures

from commodity price volatility.

A year on, while challenges as always remain in our sector, our

situation is again transformed. This time for the better.

Over the last 12 months, economies have begun to recover.

Pent-up demand on a global scale has driven the oil price from $40

- $45 per barrel to a stable $70 - $75 per barrel. Natural Gas

prices, a strategic aspect of the Deltic Energy business plan, have

reached all-time record highs of well over 100p/therm.

At a national level, the UK government has demonstrated that it

understands the necessity of these natural resources for our

economy and in the lives of people. Jobs and Treasury receipts, in

both direct and indirect tax income, all benefit from this

industry.

In the last year, the UK Government has recognised, through

formal policy such as the North Sea Transition Deal, that a healthy

domestic production of oil and gas, with mitigation, is part of the

solution, not part of the problem. The independent Committee on

Climate Change has effectively stated: "No gas means no net zero"

for 2050 greenhouse gas emissions.

Deltic's business model, strategy and daily operations are

entirely aligned with this country's energy requirements and this

government's view. We use gas to heat homes, light rooms and cook

meals. That's how simple it is; how fundamental our work is to the

way of life of families across the nations of the UK. We need

commodities such as natural gas and we should be producing it,

where possible, from domestic sources which are governed by some of

the strictest environmental controls globally. So let's control its

production and responsibly deal with the by-product rather than

assume (or ignore how) it will be dealt with elsewhere in the

world.

Deltic is fully committed to the government's net zero targets

and our gas focussed portfolio will allow us to play our part in

contributing to the energy transition. Our recently announced

multi-licence deal with Cairn over multiple gas prospects in

addition to our existing partnership with Shell is an example of

the repeatability of our business model and will allow us to

accelerate the development of our conveyor belt of UK gas assets in

a manner which supports the Government's climate change goals.

Mark Lappin

Chairman

14 September 2021

CEO Statement

Despite the UK being in lockdown for the majority of the first

three months of 2021, Deltic has had a very successful year to

date, making significant progress as we continue to execute our

natural gas focussed exploration strategy. Particular highlights

have been the achievement of a transformational deal with Cairn,

which will see Cairn farm in to five of Deltic's SNS gas licences,

as well as the positive well investment decision from Shell to

commit to the drilling of the Pensacola Prospect on our licence

P2252, both of which create a strong platform for further

success.

Cairn Energy Farm-in to Licences P2560, 2561, 2562, 2567 and

2428

Deltic started the year having recently been awarded six

additional North Sea licences. This success allowed the Company to

create an extremely strong strategic position of contiguous gas

licences in the Southern North Sea, built up through the previous

two licensing rounds. This provides the Company with a valuable

core of licences and significant running room to facilitate an

entire basin entry, as opposed to being confined to a single

licence farm-out.

The groundwork for this transaction was laid during 2020 with

the identification of additional prospectivity on P2428 (Cupertino

Area), following the delivery of reprocessed seismic data. Three

distinct prospects were delineated in the Zechstein, Leman

Sandstone and the Carboniferous. A farm out process commenced

shortly before the start of the year, which attracted a significant

level of interest in this licence with the Plymouth Zechstein Reef

prospect emerging as the primary target. It quickly became apparent

that interest extended beyond that of P2428 to include a number of

the additional SNS licences awarded to Deltic in the 32(nd)

Licensing Round, including Licence P2567 which contains the Cadence

Prospect.

On 12 August 2021, the Company was delighted to announce that it

had entered into a binding, conditional farm-out agreement in

relation to five of its gas licences in the Southern North Sea with

Cairn . Under the terms of the farm-out, Cairn will acquire a 70%

working interest in licences P2560, P2561 and P2562 ( which are

located between the Breagh and Tolmount Gas Fields) and a 60%

interest in licences P2567 (Cadence) and P2428 (Cupertino Area). In

return, Cairn will pay an initial consideration of USD$1m on

completion and will fully carry Deltic through 100% of an agreed

work programme for each of the five licences, up to the point of

making a drill or drop decision on each licence. This includes the

shooting of new seismic data over Licence P2428. At the point of a

drilling decision on either of P2428 and P2567 (the two licences

with the most advanced prospects), Cairn will fund 70% of the costs

of whichever well is drilled first, subject to a gross well cost

cap of USD$25 million.

This agreement represents the commencement of a wide-ranging

partnership with Cairn, whose successful history of opening up new

basins is very much aligned with our exploration-focused strategy.

The partnership will result in a significant investment across

multiple licences within Deltic's Southern North Sea gas

exploration portfolio, as we jointly progress the next high impact

drilling targets. It also provides further endorsement of the

quality of the portfolio that our team has developed and our gas

focussed exploration strategy, as we continue to develop our

portfolio of opportunities and attract the highest quality

partners.

We are particularly excited at the prospect of building our

partnership with Cairn, a well-funded and highly experienced North

Sea operator. Both parties share a commitment to pursuing high

impact exploration opportunities in the Southern North Sea and

successfully developing these gas prospects.

The partnership is committed to immediate activity and this is

highlighted by the fact that the shooting of the new 3D seismic

survey over P2428 has already commenced.

Pensacola & Selene

We have continued to work closely throughout the year with

Shell, and we confirmed a positive well investment decision on the

Pensacola Prospect at the end of March. Well planning is now

progressing rapidly as we start to count down to the drilling of

the Company's first well in Q2 next year, while we also continue to

work towards reaching a positive well investment decision on the

Selene Prospect.

The decision to drill the Pensacola gas prospect followed an

extensive evaluation of the new 3D data acquired. This work led to

a significant de-risking of the prospect, resulting in the

geological chance of success (GCoS) increasing from 20% to 55%.

Well planning has been underway for some time with the site survey,

a key part of well planning, currently taking place following the

appointment of Fugro to carry out this work. Pensacola will be the

first well which Deltic drills and, if successful, will be

transformational and have a far reaching positive impact on the

business. The Zechstein reef play is an exciting emerging play -

the large Plymouth Reef prospect on licence P2428 is analogous to

Pensacola and is a key focus for the Deltic-Cairn JV.

As confirmed at the time, the Deltic-Shell JV expect the

Pensacola well to be drilled in Q2 2022. Well costs are being

refined, however Deltic remains fully funded for its 30% share of

well costs.

On the Selene Prospect on Licence P2437, the Company's other JV

with Shell, the partnership has continued to progress the technical

and commercial workflows required to support a well investment

decision. Deltic considers Selene to represent the largest

undrilled structure of its kind in this part of the SNS, and the

Company remains committed to progressing this prospect to

drilling.

Central North Sea

The Company continues to work on its key licences in the Central

North Sea, being P2352 (Dewar) and P2542 (Syros).

The Dewar Prospect remains an attractive, highly prospective

opportunity located close to existing infrastructure and one which

could be developed quickly. Appetite for oil prospects such as

Dewar was badly affected by the pandemic, however the Company

continues to believe this to be an attractive drill-ready prospect

with strong economics and therefore remains committed to seeking a

partner which will lead to the Dewar Prospect being drilled.

P2542 which contains the Syros Prospect, was awarded formally in

December 2020. Technical work has commenced and will continue into

next year with a view to commencing a farm out process in due

course.

Outlook

Looking ahead, Deltic will build on its groundbreaking

partnerships with Shell and Cairn, both on existing licences as

well as the potential to collaborate on other future licence

opportunities. We will continue to work with Shell on the planning

of the Pensacola well and towards a well investment decision on

Selene. Following the announcement of the partnership with Cairn we

are already starting to work with them on the various work

programmes with the seismic survey on P2428 having already

started.

We have had a successful year to date and the introduction of a

further first class partner in Cairn represents a major achievement

for our company. With multiple opportunities and two of the highest

quality partners following the farm-outs, we believe that we have

created a unique proposition within our space. This success

demonstrates the repeatability of our strategy and reflects the

quality of our team. We continue to focus on our strengths in UKCS

exploration and building a portfolio of predominantly gas focussed

assets. Our portfolio of gas assets, in addition to driving

shareholder value, has an increasingly important role to play in

supporting the UK's net zero targets and the energy transition.

Graham Swindells

Chief Executive Officer

14 September 2021

Ope r ati ng Revi ew

Despite what remains a challenging operating environment for oil

and gas companies, Deltic has continued to make impressive progress

in delivering a conveyor belt of drilling opportunities across its

portfolio of UKCS exploration assets. During the reporting period

the Company was focussed on technical engagement with other

operators, in particular Cairn Energy, across the SNS portfolio,

resulting in a successful farm-out as communicated post reporting

period in August. In parallel, the Deltic technical team has been

engaged with Shell in relation to the Pensacola site survey

planning and well design work to support next year's drilling

activity. Engagement with Shell on the Selene well investment

decision continues and we remain confident that a positive well

investment decision can be made before the end of 2021.

Over the coming months we look forward to progressing our work

with Cairn, accelerating the technical workflows required to

support drilling decisions across the five farm-in licences, and in

the acquisition of new seismic data.

P2 2 52 - Pensa c o la ( 3 0% Deltic)

On 29 March 2021 the Shell-Deltic JV confirmed its intention to

drill the Pensacola exploration well. The JV remains on schedule to

commence drilling activities in Q2 2022. Preparatory works to

support drilling activities are well advanced with the recent

commencement of site survey work.

Licence P2252, located in the Southern North Sea Gas Basin,

contains the Pensacola prospect. Pensacola is estimated to contain

gross P50 Prospective Resources of 309 BCF in a Zechstein carbonate

build-up. The licence was farmed out to Shell U.K. Ltd in February

2019, which resulted in the Company being fully carried through the

3D seismic acquisition and processing-based work programme through

to well investment decision. Following the well investment decision

on 29 March 2021, Deltic is now paying its 30% share of costs

associated with this well and remains fully funded to do so.

P2 4 37 - S e l ene ( 5 0% Deltic)

The Shell-Deltic JV continues to progress the Selene prospect in

anticipation of a well investment decision and Deltic remains

confident that a positive well decision can be made during 2021.

Given the delay in coming to a final well investment decision, it

is now anticipated that the earliest the Selene exploration well

could be drilled is the end of 2022.

Licence P2437 is located in the Leman Sandstone fairway of the

Southern North Sea Gas Basin and contains the Selene prospect which

we believe is the largest undrilled prospect in this mature play.

Deltic estimates that the Selene prospect contains gross P50

Prospective Resources of 271 BCF with a GCoS of 70%. The P2437

licence was farmed out to Shell U.K. Ltd in April 2019, with Deltic

retaining a 50% interest and operatorship until a final well

investment decision is made. Once the well investment decision is

taken, Shell will assume operatorship and will pay for 75% of the

costs of the initial exploration well, up to a gross well cost of

USD$25M.

P2 4 28 - C upe rti no Area ( 100% Deltic)

During the period, the focus of work on Licence P2428 was

securing a successful outcome to the farm-out process that

commenced in December 2020. This was achieved with the binding,

conditional farm-out to Cairn Energy PLC, announced on 12 August

2021. Work continues to discharge standard conditions related to

regulatory approvals required before the transaction becomes

unconditional and completes. Following completion, a 60% working

interest and licence operatorship will be transferred to Cairn.

The primary target in the P2428 licence area is the Plymouth

Zechstein reef prospect. New 3D seismic data will be acquired over

the Plymouth prospect throughout September and October, with final

data expected to be delivered mid-2022. A drilling decision will be

made once this new data has been fully evaluated by the

Cairn-Deltic JV.

The Plymouth prospect is a build-up of the Z2 Zechstein

carbonate, which is analogous to the Crosgan discovery and the

Pensacola prospect which the Company is due to drill with Shell in

2022. Deltic estimates that Plymouth contains gross P50 Prospective

Resources of 282 BCF with a GCoS of 19%, which we anticipate will

be significantly improved following acquisition of 3D seismic over

this area.

Significant additional upside exists across the licence area in

the Richmond prospect in the Leman Sandstone and in the deeper

Cupertino prospect in the Carboniferous. Both prospects will be

further evaluated following the acquisition of the new 3D seismic

data.

P2567 - Cadence (100% Deltic)

Licence P2567 contains prospects in both the Carboniferous and

Triassic Bunter Sandstone and was included in the farm-out to Cairn

Energy announced on 12 August. Work continues to discharge standard

conditions related to regulatory approvals required before the

transaction completes and becomes unconditional. Following

completion, a 60% working interest and licence operatorship will be

transferred to Cairn Energy.

It is anticipated that technical work over the coming months

will focus on the reprocessing of the legacy 3D seismic survey that

covers 100% of the licence area, which will in turn be followed by

detailed technical evaluation of the previously identified

prospectivity. In line with the licence conditions, the latest the

OGA can be informed of the JV's intentions in relation to future

drilling activity on the licence is early September 2023. Deltic

are fully carried by Cairn for the pre-well investment technical

work programme through to a drill or drop decision.

P2560, P2561 & P2562 - South Breagh Area ( 1 0 0% D eltic)

Licences P2560, P2561 and P2562 were also awarded in the most

recent 32(nd) Licensing Round. The licences contain early stage

exploration opportunities located between the Breagh and Tolmount

gas fields and have significant potential in the Carboniferous

sandstones, Permian Leman Sandstones and the Zechstein carbonates.

The area is covered by a mixture of legacy 2D and older 3D seismic

data which requires modern reprocessing, which will be the key

focus over the coming year.

All three licences were included in the farm-out to Cairn Energy

announced on 12 August. Work continues to discharge standard

conditions related to regulatory approvals required before the

transaction becomes unconditional and completes. Following

completion, a 70% working interest in each of the three licences,

along with licence operatorship, will be transferred to Cairn

Energy.

P2 3 52 - De w ar ( 1 0 0% Deltic)

Licence P2352, located in the Central North Sea, was awarded to

the Company in the 30th UK Offshore Licensing Round with an

effective date of 1 October 2018. The primary prospect on Licence

P2352 is the Dewar prospect, which is estimated to contain gross

P50 Prospective Resources of 39.5 MMBO in a Forties Sandstone

channel. The Dewar Prospect is supported by a clear amplitude

versus offset (AVO) anomaly and has a GCoS of 41%.

In the event of exploration success, the Dewar Prospect is a

highly attractive commercial proposition as it is located

approximately 5km east of BP's Eastern Trough Area Project (ETAP)

Central Processing Facility. A commercial feasibility study

commissioned by the Company in 2019 demonstrated that the project

would be highly economic.

With the recent recovery in oil prices, there appears to be a

renewed interest in the Central North Sea, demonstrated by a modest

increase in M&A activity. Over the coming months we will

continue to pursue farm-out discussions with several companies,

building on the positive dialogues established prior to the COVID

enforced lockdowns.

Other Licences

Licence P2435, which is operated by The Parkmead Group, and

contains the Blackadder prospect, has effectively been on a 'care

and maintenance' footing over the last 18 months due to the COVID

pandemic. However, with restrictions lifting and an improved gas

price environment we will continue work with Parkmead to establish

the technical and commercial way forward for this licence. The

Phase A period of this Licence runs until 30 September 2022.

Licence P2542 was awarded to Deltic in the most recent 32(nd)

Licensing Round. Technical work on this licence, which is located

in the Central North Sea and contains the Syros prospect, has

commenced. Work over the next 12 months will focus on maturing that

prospect, such that farm-out marketing can be commenced in

mid-2022.

Portfolio Management

During the period our technical review of Licence P2424 was

completed and, although we have identified significant resource

potential associated with this licence, the prospects identified

are particularly high risk when compared to other opportunities

within the portfolio. It is considered unlikely that these

opportunities can be matured into viable drilling targets,

particularly with the currently available seismic datasets. In line

with Deltic's business model, which centres upon the rigorous

screening of large areas of geologically prospective acreage, and

then focusing investment on the opportunities that are most likely

to be attractive to potential partners and ultimately result in

drilling activity, the Company has taken the decision to allow this

licence to lapse at the end of its Phase A on 30 September

2021.

Similarly, Licence P2384 in the Central North Sea was awarded as

a remnant of a much larger multi-block licence application in the

30(th) Offshore Licensing Round and retained purely for its option

value. However, following a review of the prospectivity associated

with this very small licence, it is clear that it only captures the

very fringes of the prospects targeted in the original licence

application. Given that there is no obvious drilling target located

on block it has been decided to hand back this licence. This will

take effect on 30 September 2021 being the end of Year 3 of the

Licence.

Andrew Nunn

Chief Operating Officer

14 September 2021

Qualified Person

Andrew Nunn, a Chartered Geologist and Chief Operating Officer

of Deltic, is a "Qualified Person" in accordance with the Guidance

Note for Mining, Oil and Gas Companies, June 2009 as updated 21

July 2019, of the London Stock Exchange. Andrew has reviewed and

approved the information contained within this announcement.

Fina n ci al Rev i ew

I am pleased to advise that Deltic finished the period to 30

June 2021 in strong financial health with a cash position of

GBP11.1m (30 June 2020: GBP12.8m) having seen the full benefits of

some of the decisive steps Deltic took during 2020 to minimise

expenditure, preserve cash and focus on progressing core

assets.

Income Statement

The C o m pany incurred a l oss for the peri od of GBP691,754 co

m pared with a l oss of GBP869,505 f or the six mo nths to 30 June

2 020.

The operating loss of GBP674,718 (six months to 30 June 2020:

GBP920,238) included cash expenditure of GBP607,626 (six months to

30 June 2020: GBP791,415), n on-cash share-based pay ment ex pense

of GBP61,435, (six months to 30 June 2020: GBP85,501), and other

non-cash costs of GBP62,585 not directly attribu ted to existi ng

licences (six months to 30 June 2020: GBP54,576).

Expenditure directly relati ng to invest ment in the C om pan

y's N orth Sea licences is capitalised to intangible assets;

reflecting the o ng oing technical in vestment in the Co m pan y's

p ortf olio of lice nces. Expenditure on inta ngible assets t

otalled GBP210,884 during the peri o d (six months to 30 June 2020:

GBP155,585).

Trade and other payables of GBP352,811 ( 31 Dece m ber 2 020:

GBP252,167) increased by GBP199,375, all of which related to

operating activities.

Balance Sheet

The Company's cash position was GBP11,095,794 at 30 June 2021

(31 December 2020: GBP11,968,858) reflecting a net cash outflow of

GBP873,064 for the period (six months to 30 June 2020:

GBP1,030,654). Cash used in operating activities for the six months

to 30 June 2021 was GBP607,626 (six months to 30 June 2020:

GBP791,415). A further GBP210,993 was used in investing activities

(six months to 30 June 2020: GBP204,285) including GBP210,884

relating to expenditure capitalised in intangible assets (six

months to 30 June 2020: GBP181,246) and GBP1,393 relating to the

purchase of property, plant and equipment (six months to 30 June

2020: GBP87,366).

While expenditure and cash outflow for the first six months of

the year are significantly lower than for the first half of 2020,

expenditure is expected to increase in the second half of the year

now that Deltic is responsible for its 30% share of costs

associated with drilling the well on Pensacola and as well planning

progresses.

Sarah McLeod

Chief Financial Officer

14 September 2021

UNAUDITED INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE

LOSS

For the period ended 30 June 2021

Note Period Period Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

Administrative expenses (674,718) (920,238) (1,699,344)

Operating loss (674,718) (920,238) (1,699,344)

Finance income 1,284 57,732 59,818

Finance costs (18,320) (6,999) (26,049)

Loss before tax (691,754) (869,505) (1,665,575)

Income tax expense - - -

------------ ------------ --------------

Loss and comprehensive loss

for the period attributable

to equity holders of the

Company (691,754) (869,505) (1,665,575)

Loss per share from continuing

operations expressed in

pence per share:

Basic and diluted 3 (0.05)p (0.06)p (0.12)p

UNAUDITED BALANCE SHEET

As at 30 June 2021

Note 30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP GBP GBP

NON-CURRENT ASSETS

Intangible Assets 1,859,523 1,283,527 1,430,915

Property, Plant and Equipment 443,076 537,690 496,542

Other receivables 37,422 91,110 37,422

------------ ------------ ------------

2,340,021 1,912,327 1,964,879

CURRENT ASSETS

Trade and other receivables 84,740 97,344 53,887

Cash and cash equivalents 11,095,794 12,818,746 11,968,858

------------ ------------ ------------

11,180,534 12,916,090 12,022,745

TOTAL ASSETS 13,520,555 14,828,417 13,987,624

CAPITAL AND RESERVES ATTRIBUTABLE

TO EQUITY HOLDERS OF THE COMPANY

Share capital 4 7,029,824 7,029,824 7,029,824

Share premium 20,296,030 20,296,030 20,296,030

Share-based payment reserve 1,051,813 928,145 990,378

Accumulated retained deficit (15,570,251) (14,082,427) (14,878,497)

------------ ------------ ------------

TOTAL EQUITY 12,807,416 14,171,572 13,437,735

CURRENT LIABILITIES

Trade and other payables 352,811 252,167 153,436

Lease liability 94,388 56,612 92,605

------------ ------------ ------------

447,199 308,779 246,041

NON-CURRENT LIABILITIES

Lease liability 265,940 348,066 303,848

------------ ------------ ------------

TOTAL LIABILITIES 713,139 656,845 549,889

TOTAL EQUITY AND LIABILITIES 13,520,555 14,828,417 13,987,624

UNAUDITED STATEMENT OF CHANGES IN EQUITY

For the period ended 30 June 2021

Share-based Accumulated

Share Share payment Retained Total

capital premium reserve deficit equity

GBP GBP GBP GBP GBP

Balance at 1 January 2021 7,029,824 20,296,030 990,378 (14,878,497) 13,437,735

Comprehensive income for

the year

Loss for the period - - - (691,754) (691,754)

------------------------------------ ---------- ----------- ------------ ------------- ------------

Total comprehensive loss

for the period - - - (691,754) (691,754)

Contributions by and distributions

to owners

Share-based payment - - 61,435 - 61,435

Total contributions by and

distributions to owners - - 61,435 - 61,435

---------- -----------

Balance at 30 June 2021

(Unaudited) 7,029,824 20,296,030 1,051,813 (15,570,251) 12,807,416

------------------------------------ ---------- ----------- ------------ ------------- ------------

Balance at 1 January 2020 7,029,824 20,296,030 842,644 (13,212,922) 14,955,576

Comprehensive income for

the year

Loss for the period - - - (869,505) (869,505)

------------------------------------ ---------- ----------- ------------ ------------- ------------

Total comprehensive loss

for the period - - - (869,505) (869,505)

Contributions by and distributions

to owners

Share-based payment - - 85,501 - 85,501

Total contributions by and

distributions to owners - - 85,501 - 85,501

---------- -----------

Balance at 30 June 2020

(Unaudited) 7,029,824 20,296,030 928,145 (14,082,427) 14,171,572

------------------------------------ ------------ ------------- ------------

Balance at 1 January 2020 7,029,824 20,296,030 842,644 (13,212,922) 14,955,576

Comprehensive income for

the year

Loss for the year - - - (1,665,575) (1,665,575)

Total comprehensive loss

for the year - - - (1,665,575) (1,665,575)

Contributions by and distributions

to owners

Share-based payment - - 147,734 - 147,734

Total contributions by and

distributions to owners - - 147,734 - 147,734

---------- ----------- ------------ ------------- ------------

Balance at 31 December 2020

(Audited) 7,029,824 20,296,030 990,378 (14,878,497) 13,437,735

UNAUDITED STATEMENT OF CASH FLOWS

For the period ended 30 June 2021

Period ended 30 June 2021 Period ended 30 June 2020 Year ended 31 December

2020

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating

activities

Loss before tax (691,754) (869,505) (1,665,575)

Adjustments for:

Finance income (1,284) (57,732) (59,818)

Finance costs 18,320 6,999 26,049

Depreciation 57,317 50,590 106,029

Amortisation 5,268 3,986 6,711

Impairment of intangible

assets - - -

Income from farm-out licence

interest - - 2,783

Share-based payment 61,435 85,501 147,734

-------------------------- -------------------------- --------------------------

(550,698) (780,161) (1,436,087)

Increase in trade and other

receivables (30,853) (56,927) 38,270

Increase in trade and other

payables (26,075) 45,673 29,700

-------------------------- -------------------------- --------------------------

Net cash used in operating

activities (607,626) (791,415) (1,368,117)

Cash flows from investing

activities

Purchase of intangible

assets (210,884) (181,246) (358,672)

Purchase of property, plant

and equipment (1,393) (87,366) (190,108)

Property, plant and

equipment landlord

contributions - - 30,222

Interest received 1,284 64,326 59,818

Net cash used in investing

activities (210,993) (204,286) (458,740)

Cash flows from financing

activities

Payment of principal portion

of lease liabilities (36,125) (34,331) (27,635)

Interest on lease

liabilities (18,320) (622) (26,050)

-------------------------- -------------------------- --------------------------

Net cash used in financing

activities (54,445) (34,953) (53,685)

Decrease increase in cash

and cash equivalents (873,064) (1,030,654) (1,880,542)

Cash and cash equivalents at

beginning of period / year 11,968,858 13,849,400 13,849,400

-------------------------- -------------------------- --------------------------

Cash and cash equivalents at

end of period / year 11,095,794 12,818,746 11,968,858

NOTES TO THE FINANCIAL INFORMATION

For the period ended 30 June 2021

1. GENERAL

The interim financial information for the period to 30 June 2021

is unaudited and does not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006.

2. ACCOUNTING POLICIES

The interim financial information in this report has been

prepared on the basis of the accounting policies set out in the

audited financial statements for the period ended 31 December 2020

together with new and amended standards applicable to periods

commencing 1 January 2021, which complied with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006, and with those parts of the Companies Act 2006

applicable to companies reporting under International Financial

Reporting Standards (IFRS).

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board ("IASB") and the IFRS

Interpretations Committee and there is an on-going process of

review and endorsement by the UK Endorsement Board since January

2021 (previously the European Commission).

The financial information has been prepared on the basis of IFRS

that the Directors expect to be applicable as at 31 December 2021,

with the exception of IAS 34 Interim Financial Reporting.

The Directors have assessed the Company's ability to continue as

a going concern. Although the oil and gas industry is currently

facing the dual challenge of recent commodity price volatility

coupled with the effects of Covid-19, fortunately, as a gas focused

explorer the Company does not have direct exposure to the oil price

and, having taken the decision to raise funds in 2019 to protect

itself from capital market volatility, is currently well funded

with no debt. Based on the cash and cash equivalents balance at the

period end and the Company's commitments, the Directors are of the

opinion that the Company has adequate financial resources to meet

its budgeted exploration programme and working capital

requirements, and accordingly will be able to continue and meet its

liabilities as they fall due for a minimum of 12 months from the

date of these interim financial statements.

The condensed financial information for the period ended 31

December 2020 set out in this interim report does not comprise the

Group's statutory accounts as defined in section 434 of the

Companies Act 2006.

The statutory accounts for the year ended 31 December 2020,

which were prepared under International Accounting Standards in

conformity with the requirements of the Companies Act 2006, and

with those parts of the Companies Act 2006 applicable to companies

reporting under IFRS, have been delivered to the Registrar of

Companies. The auditors reported on these accounts; their report

was unqualified and did not contain a statement under section

498(2) or 498(3) of the Companies Act 2006.

3. LOSS PER SHARE

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Given the Company's reported loss for the period, share options

and warrants are not taken into account when determining the

weighted average number of ordinary shares in issue during the year

and therefore the basic and diluted loss per share are the

same.

Basic and diluted loss per share

Period ended Period ended Year ended

30 June 2021 30 June 31 December 2020

2020

Loss for the period (GBP) (691,754) (869,505) (1,665,575)

Weighted average number of ordinary shares (number) 1,405,964,857 1,405,964,855 1,405,964,855

Loss per share from continuing operations (0.05)p (0.06)p (0.12)p

============== ============== ==================

4. SHARE CAPITAL

a) Share Capital

The Company has one class of ordinary share which carries no

right to fixed income nor has any preferences or restrictions

attached.

Issued and fully paid:

30 June 30 June 31 December

2021 2020 2020

GBP GBP GBP

1,405,964,855 ordinary shares

of 0.5p each (30 June 2020:

1,405,964,855 ordinary shares) 7,029,824 7,029,824 7,029,824

5. SUBSEQUENT EVENTS

On 12 August 2021 the Company announced that it had entered into

a farm-out agreement with Cairn Energy PLC. Under the terms of the

farm-out, Cairn will acquire a 70% working interest in licences

P2560,2561 and 2562 and a 60% interest in licences P2567 and P2428.

In return, Cairn will pay initial consideration of $1m on

completion and will fully carry Deltic through the work programme

on each of the licences up to the point of making a well investment

decision. Completion of the farm-out is conditional on the entering

into of a Joint Operating Agreement and obtaining standard

regulatory consents from the Oil & Gas Authority, subject to a

three-month backstop.

6. COPIES OF INTERIM REPORT

Copies of the interim report are available to the public free of

charge from the Company at Deltic Energy Plc, First Floor, 150

Waterloo Road, London, SW1P 3JS during normal office hours,

Saturdays and Sundays excepted, for 14 days from today and will

shortly be available on the Company's website at

www.delticenergy.com .

I n v e st i ng po l i cy

In addition to the development of the North Sea Oil & Gas

assets Deltic Energy Plc has acquired to date, the Company proposes

to continue to evaluate other potential oil & gas and mining

projects globally in line with its investing policy, as it aims to

build a portfolio of resource assets and create value for

shareholders. As disclosed in the Company's AIM Admission Document

in May 2012, the Company's Investment Policy is as follows:

The proposed investments to be made by the Company may be either

quoted or unquoted; made by direct acquisition or through farm-ins;

either in companies, partnerships or joint ventures; or direct

interests in oil & gas and mining projects. It is not intended

to invest or trade in physical commodities except where such

physical commodities form part of a producing asset. The Company's

equity interest in a proposed investment may range from a minority

position to 100 per cent. ownership.

The Board initially intends to focus on pursuing projects in the

oil & gas and mining sectors, where the Directors believe that

a number of opportunities exist to acquire interests in attractive

projects. Particular consideration will be given to identifying

investments which are, in the opinion of the Directors,

underperforming, undeveloped and/or undervalued, and where the

Directors believe that their expertise and experience can be

deployed to facilitate growth and unlock inherent value.

The Company will conduct initial due diligence appraisals of

potential projects and, where it is believed further investigation

is warranted, will appoint appropriately qualified persons to

assist with this process. The Directors are currently assessing

various opportunities which may prove suitable although, at this

stage, only preliminary due diligence has been undertaken.

It is likely that the Company's financial resources will be

invested in either a small number of projects or one large

investment which may be deemed to be a reverse takeover under the

AIM Rules. In every case, the Directors intend to mitigate risk by

undertaking the appropriate due diligence and transaction analysis.

Any transaction constituting a reverse takeover under the AIM Rules

will also require Shareholder approval.

Investments in early stage and exploration assets are expected

to be mainly in the form of equity, with debt being raised later to

fund the development of such assets. Investments in later stage

projects are more likely to include an element of debt to equity

gearing. Where the Company builds a portfolio of related assets, it

is possible that there may be cross holdings between such

assets.

The Company intends to be an involved and active investor.

Accordingly, where necessary, the Company may seek participation in

the management or representation on the Board of an entity in which

the Company invests with a view to improving the performance and

use of its assets in such ways as should result in an upward

re-rating of the value of those assets.

Given the timeframe the Directors believe is required to fully

maximise the value of an exploration project or early stage

development asset, it is expected that the investment will be held

for the medium to long term, although disposal of assets in the

short term cannot be ruled out in exceptional circumstances.

The Company intends to deliver Shareholder returns principally

through capital growth rather than capital distribution via

dividends, although it may become appropriate to distribute funds

to Shareholders once the investment portfolio matures and

production revenues are established.

Given the nature of the Investing Policy, the Company does not

intend to make regular periodic disclosures or calculations of its

net asset value.

The Directors consider that as investments are made, and new

investment opportunities arise, further funding of the Company will

be required.

Fo rw a rd l ooking statements

This interim rep ort c o ntains certain f orward-lo oking state

ments that are subject to the usual risk facto rs and uncertainties

ass ociated with the oil and gas ex plo ration and pro ducti on

business. Whilst the Direct ors believe the ex pectati on reflected

herein to be reaso n a ble in light of the info r mati on available

up to the ti me of their appro val of this report, the actual o

utcome may be materially different owing to fact ors either beyo nd

the Co m pan y 's control or otherwise within the C o m pan y's c o

ntrol b ut, f or ex a m ple, owing to a change of plan or strategy.

Accordingly, no reliance may be placed on t he fo rwar d-looking

state ments.

Gl o s sa ry of T e c hn ic al T e r ms

AVO: Amplitude Versus Offset - AVO analysis is a technique that

geo p h ysicists can execute on seis mic data to deter mine a r

ock's fluid co nte nt, p o r osit y, density or seis mic vel ocit

y, shear wave info r mati o n, fluid indicators (h y drocarb on

indicatio ns).

P RM S: Pet r oleum Res o urces Management System ( 2 0 0 7)

BCF: Billion Cubic Feet

m m b o : Million barrels of oil

P rospect i ve Res o urces: Are estimated volumes associated

with undiscovered accumulations. These represent quantities of

petroleum which are estimated, as of a given date, to be

potentially recoverable from oil and gas deposits identified on the

basis of indirect evidence but which have not yet been drilled.

Chance of Succe ss (GC oS): for pr ospecti ve re s o urces,

means the chance or pr o b a bility of disc o vering h y drocarb o

ns in sufficient quantity f or th em to be tested to t he surface.

This, then, is t he chance or pro bability of t he p r ospecti ve

reso u rce maturing into a co ntingent reso urce. Prospect i ve res

ources have b oth an associated chan ce of disc o very ( g e o l o

gical chan ce of s uccess) and a chance of de vel o pment (ec o no

mic, re gulat ory, market and facility, corp orate co mm itment and

p olitical risks). T he chance of commerciality is the pro du ct of

t h ese two risk c om p o n e nts. T hese e stim ates have been

risked for chance of disc o very but not f or chance of de vel o

pment.

P 5 0 reso urc e: reflects a v olu me esti mate that, assu ming

the accum ulation is d e vel o ped, there is a 5 0% p r o bability

t hat the quantities actual ly recove red will equal or exceed the

estim ate. This is theref ore a median or best case est i mate of

reso urce.

The P r o s pective Res o urces have b een prese nted in acc

ordan ce with the 2 0 07 Pet r oleum Reso u rces Manag e ment S

ystem ( P R MS) p repared by t he Oil and Gas Reser ves Com mittee

of the Society of Pet r oleum Engin eers (S PE), rev iewed, and

jointly sp o nso red by the W orld Petroleum C o uncil (W PC), the

American Association of Petro leum Ge olo gists (AA PG) and the S

ociety of Pet r oleum E valuation Enginee rs (SPEE).

**ENDS**

For further information please contact the following:

Deltic Energy Plc Tel: +44 (0) 20 7887

2630

Graham Swindells / Andrew Nunn / Sarah McLeod

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20 3328

& Joint Broker) 5656

David Hart / Alex Brearley (Corporate Finance)

Kelly Gardiner (Sales and Corporate Broking)

Stifel Nicolaus Europe Limited (Joint Broker) Tel: +44 (0) 20 7710

7600

Callum Stewart / Simon Mensley / Ashton

Clanfield

Vigo Consulting (IR & PR Adviser) Tel: +44 (0) 20 7390

0230

Patrick d'Ancona / Chris McMahon / Oliver

Clark

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKNBBCBKDBCD

(END) Dow Jones Newswires

September 14, 2021 02:00 ET (06:00 GMT)

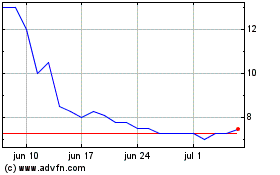

Deltic Energy (LSE:DELT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Deltic Energy (LSE:DELT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024