Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-274885

PROSPECTUS

SUPPLEMENT NO. 1

(To

Prospectus Dated January 19, 2024)

CALIDI

BIOTHERAPEUTICS, INC.

Up

to 11,500,000 Shares of Common Stock Issuable Upon the Exercise of Public Warrants

23,301,960

Shares of our Common Stock for Resale by the Selling Securityholders

1,912,154

Warrants

This

prospectus supplement (this “Prospectus Supplement”) updates and supplements the prospectus dated January 19, 2024 (the “Prospectus”),

which forms a part of our Registration Statement on Form S-1, as amended (Registration No. 333-274885). This Prospectus Supplement is

being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K,

filed with the Securities and Exchange Commission on February 1, 2024 (the “Form 8-K”). Accordingly, we have attached the

Form 8-K to this Prospectus Supplement.

The

Prospectus and this Prospectus Supplement relates to the issuance by us of an aggregate of up to up to 11,500,000 shares of common stock

that may be issued upon the exercise of public warrants (“Public Warrants”).

In

addition, the Prospectus and this Prospectus Supplement relates to the offer and sale from time to time by the selling securityholders

named in the Prospectus (the “Selling Securityholders”) of (i) up to 23,301,960 shares of our common stock, which consists

of (A) 18,912,982 shares being registered pursuant to an (1) Amended And Restated Registration Rights Agreement dated September 12, 2023;

(2) Voting and Lock-Up Agreement dated as of January 9, 2023, and amended on April 12, 2023, and (3) Series B Preferred Stock Investors’

Rights Agreement dated June 16, 2023 (collectively “Registration Rights Agreements”) by and among us and certain of the Selling

Securityholders, granting such holders registration rights with respect to such shares; (B) 387,820 shares issued in consideration of

the cancellation of certain debt obligations; (C) 1,093,014 shares issued and/or to be issued in connection with entering into certain

forward purchase agreements, new money PIPE agreements and related agreements; (D) up to 1,912,154 shares of common stock that may be

issued upon the exercise of the Private Placement Warrants originally issued to Sponsor, Metric and anchor investors some of which were

transferred to certain Calidi stockholders for settlement of liabilities immediately prior to the closing of the Business Combination;

and (E) 40,218 shares of common stock and 100,000 shares of common stock underlying stock options issued for fees and 15,804 shares of

common stock issued in connection with the Business Combination; and (ii) up to 1,912,154 Private Placement Warrants.

This

Prospectus Supplement should be read together with the Prospectus. If there is any inconsistency between the information in the Prospectus

and this Prospectus Supplement, you should rely on the information in this Prospectus Supplement.

As

of January 31, 2024, there were 35,492,403 shares (excluding 18,000,000 Non-Voting Escalation Shares) of common stock outstanding. The

resale of all shares of common stock being offered pursuant to the Prospectus and Prospectus Supplement represents approximately 65.7%

of our outstanding shares of common stock and the sale of a substantial number of shares of common stock could result in a significant

decline in the public trading price of our common stock. Our common stock and Public Warrants are listed on the NYSE American under the

symbols “CLDI” and “CLDI WS,” respectively. On January 31, 2024, the closing price of our common stock and the

Public Warrant was $0.80 per share and $0.04 per warrant, respectively.

We

are an “emerging growth company” and a “smaller reporting company” as defined under U.S. federal securities laws

and, as such, have elected to comply with reduced public company reporting requirements. The Prospectus, together with this Prospectus

Supplement, complies with the requirements that apply to an issuer that is an emerging growth company and a smaller reporting company.

We are incorporated in Delaware.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section entitled

“Risk Factors” beginning on page 8 of the Prospectus, and under similar headings in any amendments or supplements to the

Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed

upon the accuracy or adequacy of this Prospectus Supplement and the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus

Supplement dated February 1, 2024

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 26, 2024

CALIDI

BIOTHERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40789 |

|

86-2967193 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

4475

Executive Drive, Suite 200,

San

Diego, California |

|

92121 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(858)

794-9600

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

stock, par value $0.0001 per share |

|

CLDI |

|

NYSE

American LLC |

| |

|

|

|

|

| Warrants,

each whole warrant exercisable for one share of common stock |

|

CLDI

WS |

|

NYSE

American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

January 26, 2024, Calidi Biotherapeutics, Inc. (the “Company”) entered into a convertible promissory note purchase agreement

(the “Purchase Agreement”) with an Accredited Investor (the “Lender”), for a loan in the principal amount of

One Million dollars ($1,000,000), the proceeds of which will be used by the Company for working capital purpose (the “Loan”).

In

connection with the Loan, the Company issued a one-year convertible promissory note evidencing the aggregate principal amount of $1,000,000

under the Loan, which accrues at a 12.0% simple interest rate per annum (the “Note”). The Note also provides the Investor

a voluntary right to convert all, but not less than all, the Principal Amount (as defined in the Note) and accrued interest into shares

of the Company’s common stock at a conversion rate equal to a 10% discount to the 10-day VWAP as determined immediately before

January 26, 2024 (the “Conversion Price”). In addition, upon such voluntary conversion by the Investor, the Investor will

be entitled to a warrant for 50% of the number of shares of the Company’s common stock issued upon the Note conversion at an exercise

equal to 120% of the Conversion Price (the “Warrant”). In the event the Company consummates a public offering prior to the

maturity date of the Note, the Note and accrued interest will be subject to a mandatory conversion into the equity securities of the

Company issued and sold to investors in such public offering, equal to the price per share of the equity security sold to other purchasers

and subject to similar terms and conditions of such public offering, except that such equity securities received under a mandatory conversion

will be restricted securities.

The

foregoing descriptions of the Purchase Agreement, Note and Warrant are qualified in their entirety by reference to the Purchase Agreement,

form of the Note and form of the Warrant, which are filed hereto as Exhibits 10.1, 10.3 and 4.1.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information included in Item 1.01 of this Current Report is incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth under Item 1.01 in this Form 8-K is incorporated herein by reference.

The

issuance of the Note and the shares of common stock that may be issuable upon conversion of the Note (the “Securities”) were

made to an accredited investor in reliance on the exemption from registration afforded by Section 4(a)(2) of the Securities Act, as amended

(the “Securities Act”) as provided in Rule 506(b) of Regulation D promulgated thereunder. The offering of the Securities

was not conducted in connection with a public offering, and no public solicitation nor advertisement was made or relied upon by the investor

in connection with the offering.

Item

9.01 Financial Statements and Exhibits.

Exhibit

Index

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CALIDI

BIOTHERAPEUTICS, INC. |

| Dated:

February 1, 2024 |

|

|

| |

By: |

/s/

Andrew Jackson |

| |

Name: |

Andrew

Jackson |

| |

Title: |

Chief

Financial Officer |

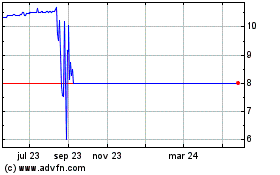

First Light Acquisition (AMEX:FLAG)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

First Light Acquisition (AMEX:FLAG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024