Sachem Capital Corp. (NYSE American: SACH), a real estate lender

that specializes in originating, underwriting, funding, servicing,

and managing a portfolio of loans secured by first mortgages on

real property, today announced its financial results for the second

quarter ended June 30, 2024.

John Villano, CPA, Sachem Capital’s Chief

Executive Officer, stated: “During the second quarter, we

maintained our disciplined approach across our business by

retaining cash, being selective with our lending, and exercising

prudence in our borrowing. Specifically, in the second quarter we

reduced the total amount of our indebtedness by $33.8 million,

which includes a repayment of $23.7 million of unsecured

unsubordinated notes. We will continue to build our platform and

strengthen our balance sheet for the remainder of 2024 with a view

towards growth in 2025 as accretive capital becomes available.

Lastly, since our inception as a public company in February 2017,

management has built a reliable and robust lending platform, paid

an excellent stream of dividends and, most importantly, increased

book value during some volatile market periods.”

Results of operations for quarter ended

June 30, 2024

Total revenue for the quarter was $15.1 million,

compared to $16.3 million for the quarter ended June 30, 2023.

Interest income totaled $11.8 million, compared to $11.9 million in

the same quarter in 2023. The decrease in interest income was due

primarily to lower number of loans originated, modified or extended

in comparison to the quarter ended June 30, 2023. As a result, fee

income from loans, primarily made up of origination fees, were down

approximately 37.2% compared to the quarter ending June 30,

2023.

Total operating costs and expenses for the

quarter ended June 30, 2024 were $18.5 million compared to $10.3

million for the same 2023 period. The increase is primarily

attributable to a $8.5 million provision for credit losses compared

to $94,000 for the quarter ended June 30, 2023. This increase was

partially offset by a decrease in compensation and employee

benefits of $0.2 million because of a decrease in headcount between

periods.

Net loss attributable to common shares for the

three months ended June 30, 2024 was $4.1 million, or $0.09 per

share, compared to net income attributable to common shares of $4.8

million, or $0.11 per share, for the three months ended June 30,

2023. The change is mainly attributable to the larger provision for

credit losses reserves as mentioned above.

Balance Sheet

Total assets were $586.3 million at June 30,

2024 compared to $625.5 million at December 31, 2023. At June 30,

2024, cash and cash equivalents were $10.6 million and investments

in partnerships were $47.0 million. Net mortgages receivable for

the quarter were $485.7 million. Total liabilities at June 30, 2024

were $356.2 million compared to $395.5 million at December 31,

2023.

Total indebtedness at June 30, 2024 was $338.9

million. This includes: $259.9 million of unsecured notes payable

(net of $4.8 million of deferred financing costs), $55.0 million

outstanding on the Needham Bank revolving credit facility, $23.0

million outstanding on the Churchill master repurchase financing

facility and $1.0 million outstanding on a New Haven Bank mortgage

loan. We intend to repay $34.5 million of unsecured unsubordinated

notes due in December 2024 either by refinancing them or with a

combination of drawdowns on its existing credit facilities, current

cash on hand and principal repayments of its mortgage loans.

Total shareholders’ equity at June 30, 2024 rose

$0.1 million to $230.2 million compared to $230.1 million at

December 31, 2023. The change was primarily due to additional

paid-in capital of $6.1 million and a partly-offsetting increase in

accumulated deficit of $5.7 million and a decrease in accumulated

other comprehensive income of $0.3 million.

Dividends

On August 6, 2024, we paid a quarterly dividend

of $0.08 per share to shareholders of record on July 29, 2024.

Sachem currently operates and qualifies as a

Real Estate Investment Trust (REIT) for federal income taxes and

intends to continue to qualify and operate as a REIT. Under federal

income tax rules, a REIT is required to distribute a minimum of 90%

of taxable income each year to its shareholders, and the Company

intends to comply with this requirement for the current year.

Investor Conference Webcast and

Call

The Company is hosting a webcast and conference

call Wednesday, August 14, 2024 at 8:00 a.m. Eastern Time, to

discuss in greater detail its financial results for the quarter

ended June 30, 2024. A webcast of the call may be accessed on the

Company’s website at

https://ir.sachemcapitalcorp.com/ir-calendar.

Interested parties can access the conference

call via telephone by dialing toll free 877-704-4453 for U.S.

callers or +1-201-389-0920 for international callers.

Replay

The webcast will also be archived on the

Company’s website and a telephone replay of the call will be

available through Wednesday, August 28, 2024 and can be accessed by

dialing 1-844-512-2921 for U.S. callers or +1 412-317-6671 for

international callers and by entering replay passcode:

13746956.

About Sachem Capital Corp

Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e., three years or less) secured,

nonbanking loans to real estate investors to fund their

acquisition, renovation, development, rehabilitation, or

improvement of properties. The Company’s primary underwriting

criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or

commercial real estate and, typically, are held for resale or

investment. Each loan is secured by a first mortgage lien on real

estate and is personally guaranteed by the principal(s) of the

borrower. The Company also makes opportunistic real estate

purchases apart from its lending activities.

Forward Looking Statements

This press release may contain forward-looking

statements. All statements other than statements of historical

facts contained in this press release, including statements

regarding our future results of operations and financial position,

strategy and plans, and our expectations for future operations, are

forward-looking statements. The words “anticipate,” “estimate,”

“expect,” “project,” “plan,” “seek,” “intend,” “believe,” “may,”

“might,” “will,” “should,” “could,” “likely,” “continue,” “design,”

and the negative of such terms and other words and terms of similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based primarily on

management’s current expectations and projections about future

events and trends that management believes may affect the Company’s

financial condition, results of operations, strategy, short-term

and long-term business operations and objectives and financial

needs. These forward-looking statements are subject to several

risks, uncertainties and assumptions as described in the Annual

Report on Form 10-K for 2023 filed with the U.S. Securities and

Exchange Commission on April 1, 2024. Because of these risks,

uncertainties and assumptions, the forward-looking events and

circumstances discussed in this press release may not occur, and

actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. You

should not rely upon forward-looking statements as predictions of

future events. Although the Company believes that the expectations

reflected in the forward-looking statements are reasonable, the

Company cannot guarantee future results, level of activity,

performance, or achievements. In addition, neither the Company nor

any other person assumes responsibility for the accuracy and

completeness of any of these forward-looking statements. The

Company disclaims any duty to update any of these forward-looking

statements. All forward-looking statements attributable to the

Company are expressly qualified in their entirety by these

cautionary statements as well as others made in this press release.

You should evaluate all forward-looking statements made by the

Company in the context of these risks and uncertainties.

Investor & Media Contact:Email:

investors@sachemcapitalcorp.com

| |

|

SACHEM CAPITAL CORP.CONSOLIDATED BALANCE

SHEETS(dollars in thousands, except share

data)(unaudited) |

| |

| |

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

(audited) |

| Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

10,577 |

|

|

$ |

12,598 |

|

|

Investment securities (at fair value) |

|

|

1,798 |

|

|

|

37,776 |

|

|

Mortgages receivable |

|

|

500,133 |

|

|

|

499,235 |

|

|

Less: Allowance for credit losses |

|

|

(14,405 |

) |

|

|

(7,523 |

) |

|

Mortgages receivable, net of allowance for credit losses |

|

|

485,728 |

|

|

|

491,712 |

|

|

Interest and fees receivable, net |

|

|

7,769 |

|

|

|

8,475 |

|

|

Due from borrowers, net |

|

|

5,636 |

|

|

|

5,597 |

|

|

Real estate owned |

|

|

3,872 |

|

|

|

3,462 |

|

|

Investments in partnerships |

|

|

46,952 |

|

|

|

43,036 |

|

|

Investments in rental real estate, net |

|

|

11,904 |

|

|

|

10,554 |

|

|

Property and equipment, net |

|

|

3,277 |

|

|

|

3,373 |

|

|

Other assets |

|

|

8,808 |

|

|

|

8,956 |

|

|

Total assets |

|

$ |

586,321 |

|

|

$ |

625,539 |

|

| |

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

Notes payable (net of deferred financing costs of $4,826 and

$6,048) |

|

$ |

259,913 |

|

|

$ |

282,353 |

|

|

Repurchase facility |

|

|

22,993 |

|

|

|

26,461 |

|

|

Mortgage payable |

|

|

1,042 |

|

|

|

1,081 |

|

|

Lines of credit |

|

|

55,000 |

|

|

|

61,792 |

|

|

Accrued dividends payable |

|

|

— |

|

|

|

5,144 |

|

|

Accounts payable and accrued liabilities |

|

|

2,800 |

|

|

|

2,322 |

|

|

Advances from borrowers |

|

|

8,893 |

|

|

|

10,998 |

|

|

Below market lease intangible |

|

|

665 |

|

|

|

665 |

|

|

Deferred revenue |

|

|

4,847 |

|

|

|

4,647 |

|

|

Total liabilities |

|

|

356,153 |

|

|

|

395,463 |

|

| |

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

| Preferred shares - $.001 par

value; 5,000,000 shares authorized; 2,903,000 shares designated as

Series A Preferred Stock; 2,206,128 and 2,029,923 shares of Series

A Preferred Stock issued and outstanding at June 30, 2024 and

December 31, 2023, respectively |

|

$ |

2 |

|

|

$ |

2 |

|

| Common shares - $.001 par

value; 200,000,000 shares authorized; 47,547,051 and 46,765,483

issued and outstanding at June 30, 2024 and December 31, 2023 |

|

|

48 |

|

|

|

47 |

|

| Additional paid-in

capital |

|

|

255,928 |

|

|

|

249,826 |

|

| Accumulated other

comprehensive income |

|

|

— |

|

|

|

316 |

|

| Accumulated deficit |

|

|

(25,810 |

) |

|

|

(20,115 |

) |

|

Total shareholders’ equity |

|

|

230,168 |

|

|

|

230,076 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

586,321 |

|

|

$ |

625,539 |

|

|

|

| |

|

SACHEM CAPITAL CORP.CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)(dollars in

thousands, except share and per share data) |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income from loans |

|

$ |

11,754 |

|

|

$ |

11,898 |

|

|

$ |

24,395 |

|

|

$ |

22,882 |

|

| Fee income from loans |

|

|

2,083 |

|

|

|

3,319 |

|

|

|

4,699 |

|

|

|

5,489 |

|

| Income from partnership

investments |

|

|

1,217 |

|

|

|

1,006 |

|

|

|

2,413 |

|

|

|

1,556 |

|

| Other investment income |

|

|

70 |

|

|

|

34 |

|

|

|

386 |

|

|

|

633 |

|

| Other income |

|

|

22 |

|

|

|

16 |

|

|

|

57 |

|

|

|

30 |

|

|

Total revenues |

|

|

15,146 |

|

|

|

16,273 |

|

|

|

31,950 |

|

|

|

30,590 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and amortization of

deferred financing costs |

|

|

6,973 |

|

|

|

7,139 |

|

|

|

14,442 |

|

|

|

14,012 |

|

| Compensation and employee

benefits |

|

|

1,365 |

|

|

|

1,562 |

|

|

|

3,308 |

|

|

|

3,342 |

|

| General and administrative

expenses |

|

|

1,258 |

|

|

|

1,317 |

|

|

|

2,496 |

|

|

|

2,215 |

|

| Provision for credit losses

related to loans |

|

|

8,503 |

|

|

|

94 |

|

|

|

9,868 |

|

|

|

197 |

|

| Other expenses |

|

|

362 |

|

|

|

213 |

|

|

|

866 |

|

|

|

297 |

|

|

Total operating expenses |

|

|

18,461 |

|

|

|

10,325 |

|

|

|

30,980 |

|

|

|

20,063 |

|

|

Income before other income (loss) |

|

|

(3,315 |

) |

|

|

5,948 |

|

|

|

970 |

|

|

|

10,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment loss |

|

|

(77 |

) |

|

|

(413 |

) |

|

|

(77 |

) |

|

|

(413 |

) |

| Gain (loss) on sale of real

estate and property and equipment, net |

|

|

275 |

|

|

|

(21 |

) |

|

|

264 |

|

|

|

127 |

|

| Gain on equity securities |

|

|

61 |

|

|

|

184 |

|

|

|

458 |

|

|

|

577 |

|

|

Total other income (loss), net |

|

|

259 |

|

|

|

(250 |

) |

|

|

645 |

|

|

|

291 |

|

|

Net income (loss) |

|

|

(3,056 |

) |

|

|

5,698 |

|

|

|

1,615 |

|

|

|

10,818 |

|

| Preferred stock dividend |

|

|

(1,068 |

) |

|

|

(925 |

) |

|

|

(2,091 |

) |

|

|

(1,850 |

) |

|

Net income (loss) attributable to common shareholders |

|

$ |

(4,124 |

) |

|

$ |

4,773 |

|

|

$ |

(476 |

) |

|

$ |

8,968 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per

common share |

|

$ |

(0.09 |

) |

|

$ |

0.11 |

|

|

$ |

(0.01 |

) |

|

$ |

0.21 |

|

| Diluted earnings (loss) per

common share |

|

$ |

(0.09 |

) |

|

$ |

0.11 |

|

|

$ |

(0.01 |

) |

|

$ |

0.21 |

|

| Basic weighted average common

shares outstanding |

|

|

47,504,875 |

|

|

|

43,844,285 |

|

|

|

47,415,630 |

|

|

|

43,321,303 |

|

| Diluted weighted average

common shares outstanding |

|

|

47,504,875 |

|

|

|

43,844,285 |

|

|

|

47,415,630 |

|

|

|

43,321,303 |

|

|

|

| |

|

SACHEM CAPITAL CORP.CONSOLIDATED

STATEMENTS OF CASH FLOWS (unaudited)(dollars in

thousands) |

| |

| |

|

|

|

|

|

|

| |

|

Six Months Ended |

| |

|

June 30, |

| |

|

2024 |

|

2023 |

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

|

|

|

Net income |

|

$ |

1,615 |

|

|

$ |

10,818 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

Amortization of deferred financing costs and bond discount |

|

|

1,275 |

|

|

|

1,225 |

|

|

Depreciation expense |

|

|

189 |

|

|

|

109 |

|

|

Stock-based compensation |

|

|

437 |

|

|

|

396 |

|

|

Provision for credit losses related to loans |

|

|

9,868 |

|

|

|

197 |

|

|

Impairment Loss |

|

|

77 |

|

|

|

413 |

|

|

(Gain) on sale of real estate and property and equipment, net |

|

|

(264 |

) |

|

|

(127 |

) |

|

(Gain) on equity securities |

|

|

(458 |

) |

|

|

(577 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Interest and fees receivable, net |

|

|

411 |

|

|

|

(1,456 |

) |

|

Other assets |

|

|

80 |

|

|

|

(700 |

) |

|

Due from borrowers, net |

|

|

(624 |

) |

|

|

(1,521 |

) |

|

Accounts payable and accrued liabilities |

|

|

478 |

|

|

|

153 |

|

|

Deferred revenue |

|

|

200 |

|

|

|

455 |

|

|

Advances from borrowers |

|

|

(2,105 |

) |

|

|

2,694 |

|

|

Total adjustments |

|

|

9,564 |

|

|

|

1,261 |

|

| NET CASH PROVIDED BY OPERATING

ACTIVITIES |

|

|

11,179 |

|

|

|

12,079 |

|

| |

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

Purchase of investment securities |

|

|

(7,767 |

) |

|

|

(18,347 |

) |

|

Proceeds from the sale of investment securities |

|

|

43,964 |

|

|

|

6,560 |

|

|

Purchase of interests in investment partnerships, net |

|

|

(3,916 |

) |

|

|

(4,568 |

) |

|

Proceeds from sale of real estate owned |

|

|

1,403 |

|

|

|

191 |

|

|

Acquisitions of and improvements to real estate owned, net |

|

|

— |

|

|

|

(180 |

) |

|

Purchases of property and equipment |

|

|

(26 |

) |

|

|

(722 |

) |

|

Improvements in investment in rental real estate |

|

|

(1,424 |

) |

|

|

— |

|

|

Principal disbursements for mortgages receivable |

|

|

(84,328 |

) |

|

|

(114,468 |

) |

|

Principal collections on mortgages receivable |

|

|

79,628 |

|

|

|

66,356 |

|

|

Other assets – pre-offering costs |

|

|

— |

|

|

|

19 |

|

| NET CASH PROVIDED BY (USED IN)

INVESTING ACTIVITIES |

|

|

27,534 |

|

|

|

(65,159 |

) |

| |

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

Net proceeds from (repayment of) lines of credit |

|

|

(6,792 |

) |

|

|

32,313 |

|

|

Net proceeds from (repayment of) repurchase facility |

|

|

(3,468 |

) |

|

|

7,976 |

|

|

Proceeds from (repayment of) mortgage payable |

|

|

(39 |

) |

|

|

899 |

|

|

Dividends paid on common shares |

|

|

(10,363 |

) |

|

|

(11,048 |

) |

|

Dividends paid on Series A Preferred Stock |

|

|

(2,091 |

) |

|

|

(1,850 |

) |

|

Proceeds from issuance of common shares, net of expenses |

|

|

2,050 |

|

|

|

9,689 |

|

|

Repurchase of common shares |

|

|

— |

|

|

|

(225 |

) |

|

Proceeds from issuance of Series A Preferred Stock, net of

expenses |

|

|

3,616 |

|

|

|

517 |

|

|

Gross proceeds from (repayment of) notes payable |

|

|

(23,647 |

) |

|

|

6,225 |

|

| NET CASH (USED IN) PROVIDED BY

FINANCING ACTIVITIES |

|

|

(40,734 |

) |

|

|

44,496 |

|

| |

|

|

|

|

|

|

| NET DECREASE IN CASH AND CASH

EQUIVALENTS |

|

|

(2,021 |

) |

|

|

(8,584 |

) |

| |

|

|

|

|

|

|

| CASH

AND CASH EQUIVALENTS – BEGINNING OF PERIOD |

|

|

12,598 |

|

|

|

23,713 |

|

| |

|

|

|

|

|

|

| CASH

AND CASH EQUIVALENTS – END OF PERIOD |

|

$ |

10,577 |

|

|

$ |

15,129 |

|

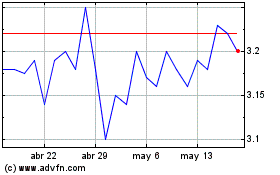

Sachem Capital (AMEX:SACH)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

Sachem Capital (AMEX:SACH)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024