Sachem Capital Corp. Announces Appointment of Jeffery C. Walraven to the Board of Directors

26 Agosto 2024 - 6:00AM

Sachem Capital Corp. (the “Company” or “Sachem Capital”), announced

today that its Board of Directors (the “Board”) has appointed

Jeffery C. Walraven to the Board, effective August 21, 2024. Mr.

Walraven will also stand for election at the Company’s 2024 Annual

Meeting of Shareholders.

“We are pleased to welcome Jeffery Walraven to our

Board,” said John L. Villano, CEO and Chairman of the Board of

Sachem Capital. “Jeff’s deep experience in the real estate

industry, especially in public company leadership, accounting and

capital markets, will be invaluable to Sachem Capital as we grow

our business and pursue value creation for our shareholders.”

Mr. Walraven is Co-Founder and Chief Operating

Officer of Freehold Properties, Inc., a real estate investment

trust (REIT), since its formation in 2019. He has also served as an

independent director and member of the audit committee of Broad

Street Realty, Inc. (OTCQX: BRST), a real estate company that owns,

operates, develops, and redevelops primarily essential

grocery-anchored shopping centers and mixed-use properties, since

2023. From 2014 to 2019, Mr. Walraven served as Executive Vice

President and Chief Financial Officer of MedEquities Realty Trust,

Inc. (formerly NYSE: MRT) and previously served in various

leadership roles at BDO USA, LLP, an international accounting firm,

from 2007 to 2014.

“Jeff’s appointment is a meaningful step in Sachem

Capital’s efforts to refresh the Board,” added Brian Prinz,

independent director and Chair of the Nominating and Corporate

Governance Committee. “Jeff’s public company accounting and

corporate finance expertise as well as his leadership experience

align with the qualities we have been searching for in a new

independent Board member.”

For further information, please refer to the

Company’s Current Report on Form 8-K filed with the SEC on August

26, 2024.

About Sachem Capital Corp.

Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e. three years or less) secured,

nonbanking loans to real estate investors to fund their

acquisition, renovation, development, rehabilitation, or

improvement of properties. The Company’s primary underwriting

criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or

commercial real estate and, typically, are held for resale or

investment. Each loan is secured by a first mortgage lien on real

estate and is personally guaranteed by the principal(s) of the

borrower. The Company also makes opportunistic real estate

purchases apart from its lending activities.

Forward Looking StatementsThis

press release may contain forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding our future

results of operations and financial position, strategy and plans,

and our expectations for future operations, are forward-looking

statements. Such forward-looking statements are subject to several

risks, uncertainties and assumptions as described in the Annual

Report on Form 10-K for 2023 filed with the U.S. Securities and

Exchange Commission (the “SEC”) on April 1, 2024. Because of these

risks, uncertainties and assumptions, any forward-looking events

and circumstances discussed in this press release may not occur.

You should not rely upon forward-looking statements as predictions

of future events. Neither the Company nor any other person assumes

responsibility for the accuracy and completeness of any of these

forward-looking statements. The Company disclaims any duty to

update any of these forward-looking statements. All forward-looking

statements attributable to the Company are expressly qualified in

their entirety by these cautionary statements as well as others

made in this press release. You should evaluate all forward-looking

statements made by the Company in the context of these risks and

uncertainties.

Important Additional Information and Where

to Find ItThe Company intends to file a proxy statement on

Schedule 14A, an accompanying proxy card, and other relevant

documents with the SEC in connection with its solicitation of

proxies from the Company’s shareholders for the Company’s 2024

Annual Meeting of Shareholders. THE COMPANY’S SHAREHOLDERS ARE

STRONGLY ENCOURAGED TO READ THE COMPANY’S DEFINITIVE PROXY

STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE

ACCOMPANYING PROXY CARD, AND ALL OTHER DOCUMENTS FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders

may obtain a copy of the definitive proxy statement, an

accompanying proxy card, any amendments or supplements to the

definitive proxy statement and other documents filed by the Company

with the SEC at no charge at the SEC’s website at www.sec.gov.

Copies will also be available at no charge by clicking the “SEC

Filings” link in the “Investor” section of the Company’s website,

http:// sachemcapitalcorp.com, or by contacting

investors@sachemcapitalcorp.com as soon as reasonably practicable

after such materials are electronically filed with, or furnished

to, the SEC.

Participants in the

SolicitationThe Company, its directors, certain of its

officers, and other employees may be deemed to be “participants”

(as defined in Section 14(a) of the Securities Exchange Act of

1934, as amended) in the solicitation of proxies from the Company’s

shareholders in connection with matters to be considered at the

Company’s 2024 Annual Meeting of Shareholders.

Information about the names of the Company’s

directors and officers, their respective interests in the Company

by security holdings or otherwise, and their respective

compensation is set forth in the sections entitled “Election of

Directors,” “Compensation of Directors,” “Executive Compensation,”

and “Security Ownership of Certain Beneficial Owners” of the

Company’s Proxy Statement on Schedule 14A in connection with the

2023 Annual Meeting of Shareholders, filed with the SEC on August

4, 2023 (available here) and the Company’s Annual Report on Form

10-K, filed with the SEC on April 1, 2024 (available here). To the

extent the security holdings of directors and executive officers

have changed since the amounts described in these filings, such

changes are set forth on Initial Statements of Beneficial Ownership

on Form 3 or Statements of Change in Ownership on Form 4

filed with the SEC, which can be found at no charge at the SEC’s

website at www.sec.gov. Updated information regarding the identity

of potential participants and their direct or indirect interests,

by security holdings or otherwise, in the Company will be set forth

in the Company’s Proxy Statement on Schedule 14A for the 2024

Annual Meeting of Shareholders and other relevant documents to be

filed with the SEC, if and when they become available. These

documents will be available free of charge as described above.

Investor & Media Contact:

Email: investors@sachemcapitalcorp.com

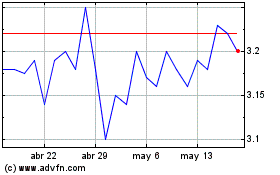

Sachem Capital (AMEX:SACH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

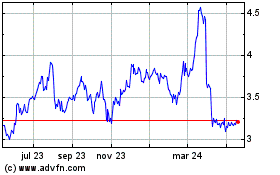

Sachem Capital (AMEX:SACH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024