Bitcoin Breaches Halfway Mark To $31,000 – How High Can BTC Go This Week?

23 Octubre 2023 - 12:19AM

NEWSBTC

The price of Bitcoin is maintaining an upward trajectory, catching

many off guard this weekend. As of now, BTC has surged by 3.0% in

the last 24 hours, and sustaining a 12% rally in the last week. At

$30,780, according to data by Coingecko, the top crypto is just

inches away from reaching the vaunted $31K, a territory it briefly

crossed in April 10 this year. The $30,000 mark holds considerable

significance for Bitcoin, functioning as both a psychological

milestone and a technical resistance point. Psychologically, it

represents a round number that influences investor sentiment,

inspiring confidence when surpassed and raising concerns when it

becomes a barrier. Technically, $30,000 historically acts as a

level where selling pressure tends to intensify, impacting

short-term and long-term price movements. As a result, this price

level is closely monitored by traders and investors, making it a

critical reference point in the cryptocurrency market. Related

Reading: Solana On Fire With Over 34% Rally Within A Week – Details

The Anticipated Boost: Bitcoin ETF’s Impact On The Crypto Market

There’s a lot of excitement about the possibility of the U.S.

Securities and Exchange Commission allowing a Bitcoin

exchange-traded fund (ETF). This could be a big boost for the

struggling cryptocurrency market. Mike Novogratz, the CEO of Galaxy

Digital, thinks it’s very likely that the U.S. will approve this

kind of investment fund for Bitcoin soon. This news could be a

major reason for Bitcoin’s price to go up. Bitcoin may soon break

over its overhead resistance and begin a rapid surge, according to

trading group Stockmoney Lizards. They anticipate widespread

participation in the ETF and a subsequent surge in the run-up to

the halving in April 2024. BTCUSD inching closer to the key $31K

territory. Chart: TradingView.com The financial industry is

currently witnessing the active participation of major players such

as BlackRock, which manages assets above $10 trillion. These firms

are also actively pursuing the approval of their applications for

exchange-traded funds (ETFs), thereby creating an environment

filled with eager expectation. As a result of Bitcoin’s steady

ascent, tokens formed by the forking of the alpha coin, namely

Bitcoin Cash (BCH) and Bitcoin SV (BSV), had a significant surge of

up to 26%, surpassing other altcoins in terms of gains. This

surge may indicate a potential manifestation of enthusiasm. BTC

price action in the last 24 hours. Source: Coingecko Prospects Of A

Bitcoin ETF In Late 2023 Or Early 2024 Several industry experts are

suggesting that the long-anticipated approval of a spot Bitcoin

exchange-traded fund (ETF) could materialize sometime between late

2023 and early 2024. This revelation has sent ripples of excitement

throughout the cryptocurrency community and the broader financial

world. If BlackRock’s spot Bitcoin ETF is approved, Matrixport, a

provider of cryptocurrency services, projects that the price of

Bitcoin would rise to between $42,000 and $56,000. The community of

U.S. registered investment advisors and prospective investment

inflows from gold ETF investors form the basis of the extremely

optimistic forecast. Related Reading: Stacks (STX) Rockets 26%

Higher In A Single Week: The Factors At Play A Bitcoin ETF is a big

deal because it makes it easy for regular folks to invest in

Bitcoin without needing to deal with all the complicated stuff that

comes with digital currencies. It’s like a bridge that connects the

regular money world with the wild world of cryptocurrencies, which

could help more people get into Bitcoin. (This site’s content

should not be construed as investment advice. Investing involves

risk. When you invest, your capital is subject to risk). Featured

image from Collection FRAC Lorraine

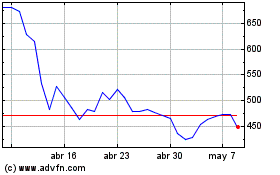

Bitcoin Cash (COIN:BCHUSD)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Bitcoin Cash (COIN:BCHUSD)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024