Bitcoin Supply Structure Very Similar To Early 2019, Bull Run Ahead?

18 Abril 2023 - 8:00AM

NEWSBTC

Bitcoin (BTC), the largest cryptocurrency in the market, reached a

new yearly high last week. However, since then, it has been trading

within a new range between $29,500 and $30,000, failing to

consolidate above this key level and continue its rally towards

higher territories. According to new data analyzed by Satoshi Club,

a leading cryptocurrency platform, Bitcoin has built a strong

foundation below $30,000, with the current supply structure

resembling that of early 2016 and 2019. This news comes as a

promising sign for bulls, suggesting that Bitcoin’s future may be

brighter than previously thought. Is Bitcoin Poised For New Highs?

According to Satoshi Club, the supply distribution of Bitcoin has

been split into two: pre-FTX collapse for long-term holders (LTH)

supply and post-collapse for short-term holders (STH)

supply. This has resulted in LTH supply near all-time highs

for several months or even a year. Furthermore, according to

Satoshi Club, BTC’s Long-Term Holder supply has reached a new

all-time high of 14.161 million BTC. Meanwhile, the Short-Term

Holder supply remains steady at 2.914 million BTC. Related

Reading: Binance Coin (BNB) Rallies 8% Ahead Of Hard Fork Upgrade

The most recent bull runs in 2016 and 2019 took 18-24 months to

start, and during those times, Bitcoin saw a quick spike in

long-term holdings in profit, followed by profit-taking. Currently,

Bitcoin is experiencing strength in its price, with year-to-date

(YTD) gains backed by an “explosive uptick” in coins held at a

profit. This means that more and more investors are holding onto

their BTC, as they are currently in profit. This is a positive sign

for the market as it indicates that investors have faith in the

long-term potential of Bitcoin. Additionally, Satoshi Club

highlights that in the current market environment, the foundation

of Bitcoin appears to be much stronger than in previous bear

markets. In 2023, 6.2 million Bitcoin returned to profit, which

represents 32.3% of the total supply. This indicates a strong cost

basis foundation below $30,000, which is a positive sign for the

long-term prospects of BTC. Moreover, according to Satoshi Club,

Bitcoin is unlikely to visit prices below $15,500 in the short

term. This prediction is based on the current supply structure of

Bitcoin, which indicates that there is significant support for the

cryptocurrency at this price point. BTC Bulls Rejoice CryptoQuant,

a leading crypto market data analytics platform, has released an

analysis on the use of the “net volume” movement in predicting

Bitcoin price fluctuations in the futures market. The analysis

suggests that using a 72-day moving average to analyze the

difference between long and short position volumes can help to some

extent in predicting BTC price fluctuations. According to

CryptoQuant’s analysis, the current Bitcoin position in the futures

market is similar to what was observed in November and December

2020. From a sentiment perspective, the potential for Bitcoin’s

price to rise is greater as increasing short positions are being

liquidated. Related Reading: Shiba Inu (SHIB) Breakout Fails, But A

Huge Rally Is Still Possible At the time of writing, the largest

cryptocurrency in the market is trading at $30,000 and has been

trading sideways for the past 24 hours. However, if BTC can

maintain its current trading zone, there is potential for it to

bounce from the support level and reach new yearly highs. Featured

image from Unsplash, chart from TradingView.com

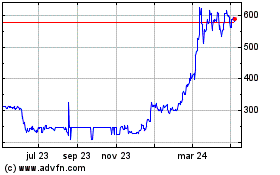

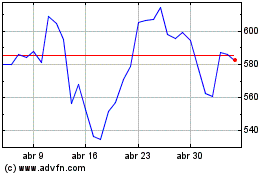

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024