Is It A Good Idea To Buy Curve Now? Here’s What This Founder Thinks

31 Julio 2023 - 10:00AM

NEWSBTC

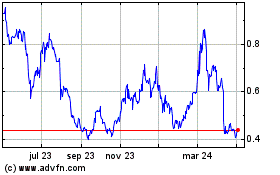

In the wake of a massive exploit, the price of the Curve (CRV)

token has declined drastically, recording double-digit losses in

the last day. This has led to what some would call an opportunity

to buy cheap coins and Matrixport and Bitdeer founder Jihan Wu is

one of the believers. A Good Time To Buy Curve (CRV)? Jihan Wu

recently tweeted that he bought the CRV dip. According to Wu, he

remains a strong believer in the token because of its future

applications. Wu’s tweet comes at a time when Decentralized Finance

(DeFi) platform Curve DAO’s native token CRV has been down by more

than 12% in the last 24 hours. This dip came following an exploit

in some of Curve’s stablecoin pools. Related Reading: Here’s

How Long The Majority Of New Ethereum Wallets Are Used Before

They’re Dumped The exploit on the protocol reportedly occurred due

to a bug in the Vyper programming language, which is used to power

part of the DEX’s ecosystem. Despite this occurrence, Wu

believes that this is a good time to invest in the CRV tokens as

these tokens will play a significant role in the coming RWA (Real

World Assets) wave in reference to the tokenization of physical

assets. “In the coming RWA wave, $crv is one of the most important

infrastructures. I have BTFD. NFA,” the founder said in the tweet.

Without a doubt, the tokenized industry is growing and boasts

immense potential. Last year, a World Economic Forum survey

projected the tokenized assets industry to account for almost 10%

of the global GDP by 2027. The tokenization of real-world

assets will involve bringing physical assets like houses, arts, and

precious metals on-chain. This will undoubtedly provide easier

access and promote fractional ownership of these assets. CRV

price declines over 14% following exploit | Source: CRVUSD on

Tradingview.com As Wu has highlighted, DeFi protocols like Curve

and tokens like CRV will play an integral role in facilitating

transactions involving the transfer and trade of these tokenized

assets. DeFi Security Remains A Stumbling Block The several

exploits on DeFi protocols continue to remain a huge problem in the

DeFi ecosystem and something which many consider a stumbling block

to the wider adoption of DEXs over CEXs by many crypto users.

Recently, Curve Finance’s Omnipool platform, Conic Finance,

suffered an exploit that resulted in the hacker stealing over $3

million in Ether. Related Reading: Ahead Of The Pack: Binance Moves

Forward With New License in Dubai A report from Web3 portfolio app

De.Fi found that over $204 million was lost to hacks and exploits

in the DeFi ecosystem in Q2 of 2023 alone. The number of incidents

(117) in Q2 this year translated to an “almost 7 times” increase in

comparison with Q2 of 2022 (17 incidents). According to the

report, over $665 million have been lost to such exploits this

year. And these breaches further highlight the need for DeFi

protocols to implement enhanced security mechanisms on their

platforms. Featured image from The Coin Republic, chart from

Tradingview.com

Curve DAO Token (COIN:CRVUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Curve DAO Token (COIN:CRVUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024