Kraken Surges Ahead In Altcoin Liquidity To Overtake Coinbase In US: Kaiko

11 Agosto 2023 - 10:00AM

NEWSBTC

The world of cryptocurrency exchanges, often clouded with

volatility and competition, has recently been witnessing a distinct

shift in dynamics, particularly as a Kraken is taking the lead in

the US altcoin trading space. The latest data reveals Kraken, the

California-based crypto exchange, is now dominating its rivals,

specifically Coinbase, in the altcoin market. Dominating The

Altcoin Trading Landscape Data analytics from crypto research firm

Kaiko has highlighted Kraken’s emergence as the premier US crypto

exchange for altcoin trading. With significant shifts in market

depth percentages and a notable increase in market share, Kraken

appears to be carving out a niche for itself in an otherwise

volatile industry. 📈🤔In July, Kraken emerged as the most liquid

platform for alts in the US. 👉 Its claiming almost half of the

market depth for the top 10 alts. pic.twitter.com/2fumt7yi9a —

Dessislava Ianeva (@DessislavaIane2) August 9, 2023 Related

Reading: Gateway Issues Cause Withdrawal And Deposit Delays For

Kraken Exchange Market depth is a crucial metric for crypto

exchanges as it represents an exchange’s capability to manage large

buy or sell orders without causing drastic price changes. And

according to recent data from Kaiko, Kraken now commands roughly

47% of the market depth for the top 10 altcoins. This dominance,

especially in the wake of the previous year’s price drop and the

unfortunate collapse of FTX, underscores the resilience Kraken has

brought to the altcoin trading sector. While the entire crypto

trading industry has been grappling with declining trading volumes,

Kraken has managed to hold its own. A steady uptick in its market

share is evident as it jumped from 8.3% in August 2022 to 21.1% in

July, according to data from The Block’s dashboard. Behind

Kraken Ascendancy Kraken reportedly attributes this upward

trajectory to a few specific improvements in its offerings.

Notably, the introduction of Kraken Pro, their advanced trading

platform which rolled out in December, is believed to be a pivotal

move. A spokesperson for the crypto exchange elaborated on the

exchange’s recent performance, pointing out that their “share of

total volumes has hit an 18-month high.” Furthermore, there’s been

a significant surge in their share of EUR spot markets, rising from

35% to 53%, and the AUD spot markets have seen exponential growth,

multiplying sixfold over the past year. Related Reading: Regulators

Are To Blame For All The Crisis In Crypto, Says Kraken CEO Despite

the laudable progress, it’s crucial to note that Kraken, like many

others in the industry, has felt the effects of the industry-wide

decline in trading volumes. Their monthly trading volumes have seen

a dip from a high of $28.07 billion in March to $13.6 billion in

the previous month. Featured image from Unsplash, Chart from

TradingView

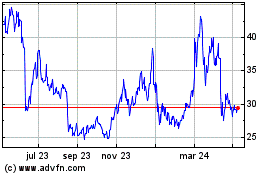

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dash (COIN:DASHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024