Aave Protocol Unfazed By Market Jitters, Surges 21%

06 Agosto 2024 - 4:30PM

NEWSBTC

Crypto lending protocol Aave restarts its bullishness as the market

resets. AAVE, the namesake token of the platform, surged to nearly

20% in the past 24 hours, capturing the momentum of the broader

market which is still up by over 5% since yesterday. Related

Reading: Binance Coin In Turmoil: Nearly 10% Value Erased In Market

Shake-Up Aave’s recent developments also contributed to this rally.

However, the broader crypto-finance market might be in disagreement

with the platform’s current performance. $200 Million In Market

Size Unlocked On Aave Lido Finance, a crypto staking platform,

recently onboarded the platform’s Lido V3 market instance,

custom-made for Aave which is tailored to Lido’s staked Ethereum

(stETH) and wrapped staked Ethereum (wstETH). This will

significantly improve user experience in lending and borrowing

stETH and wstETH as it can be fine-tuned to maximize profitability

for Aave users. The Lido V3 market on @aave has been live for

48 hours and just surpassed $200m in market size 👻 Here’s what you

need to know 👇 pic.twitter.com/aNSGxsq2fy — Lido (@LidoFinance)

July 31, 2024 This helped AAVE recover in price. The platform also

experienced a significant bump in the total value locked (TVL) with

a near 10% increase since yesterday. However, the broader market

seems to be at odds with Aave’s recent bullishness. The 2nd quarter

revealed some cracks within the lending portion of the

decentralized finance (DeFi) space. According to CoinGecko’s 2nd

Quarter research, over $31.87 billion in TVL is dedicated to

lending, marking a significant cut of the pie on DeFi. However, the

main functions of DeFi such as staking, lending, and cross-chain

bridges saw a huge decrease in TVL, totaling over $8 billion.

The value that left these sectors returned in the form of restaking

in other platforms or to basis trading protocols that saw a

whopping 154% increase in TVL in Q2. This decrease in lending

activity also translated to the assets on the platform.

Blockanalitica reveals that a majority of the wallets that hold

collateral on Aave are either medium or high risk. If the market

drops by 25%, majority of the wallets are in the red which

represents liquidation. This shows that lending on DeFi remains to

be dangerous, especially with the current market volatility

experienced this week. A Short Squeeze? AAVE is currently

occupying the range between $93 and $102. This position, although a

big downgrade from its return from June price levels, is a solid

support for a possible breakthrough in the near future. Related

Reading: Bloody Monday: Cardano Not Spared From Bloodbath, Suffers

30% Loss However, as it moves independent of the market, this

current bullishness might just be a short squeeze or a sudden

increase in price before a sharp fall. With the current

market environment reflecting this volatility, AAVE will have a

hard time securing its June price level bringing in the possibility

of further downturns. Featured image from Zerion, chart from

TradingView

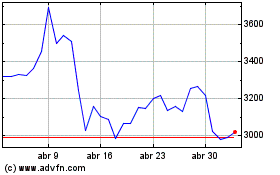

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024