Ethereum Sends Red Signals, But Should You Worry About The Long Term?

19 Agosto 2022 - 3:08PM

NEWSBTC

The crypto market is experiencing a correction with Bitcoin and

Ethereum giving back their gains from previous weeks. The general

sentiment in the sector was optimistic but could take a blow if

main cryptocurrencies lose their current levels. Related Reading:

USDC Exchange Reserve Spikes – Can This Help Push Bitcoin Back Up?

At the time of writing, Ethereum (ETH) trades at $1,690 with a 10%

loss in the last 24 hours and 7 days, respectively. The

cryptocurrency has preserved a critical support zone at $1,700 that

was turned from major resistance into support. In a market update,

BitMEX Founder Arthur Hayes called the short-term price action

across the crypto market “ugly” as he sees potential for further

losses. Hayes said via Twitter: The short-term price action is

ugly. Assuming you are long, it could mean you read the market

wrong. Is it time to cover, sit tight, or add more? That all

depends on your nerve and how well you can read the chart. In the

short term, a trader might experience losses, but if the trader is

playing the long run on Ethereum, Hayes believes nothing has

“fundamentally change” for the second cryptocurrency by market cap.

In less than a month, Ethereum is set to deploy “The Merge” on

mainnet. This event will signal ETH’s full transition into a

Proof-of-Stake (PoS) blockchain. In what is one of the most

expected events in the history of the crypto market, Ethereum will

set the stage for a less energy-consuming, more scalable, and

accessible network. In the past, Hayes has said that “The Merge”

will be a transcendental event for ETH’s price as the

cryptocurrency will manage to attract fresh capital. The BitMEX

founder believes that once the blockchain reduces its energy

consumption, sidelined money will flow and potentially push ETH’s

price higher. Hayes said: If you tell me the $ETH merge ain’t

happening, or something occurred which severely diminishes it’s

probability of success then I would be worried about my long

position. Time To Increase Your Ethereum Holdings? In that sense,

traders should keep an eye on “The Merge” and any potential hurdles

as they can negatively affect the price of Ethereum. At the time of

writing, the update is on track, but ETH’s price must maintain its

current levels to prevent further downside. Related Reading: TA-

Trezor (TRB) Holds Strong Above $40, Will The Crypto Pullback

Affect It? If bears take control of the market, analyst Justin

Bennet believes that the price of Ethereum might find a bottom at

$300. Bennett said: Unpopular opinion: The $ETH bottom is probably

closer to $300 than $1,000. “That’ll never happen,” they’ll say. It

already did during the last #crypto bear market. And that was

without a global recession, a bear market for stocks, and inflation

ripping to new highs in many developed countries.

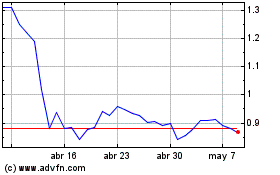

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024