Bitcoin Reclaims $66k But Retail Investors Lag—Is A Final FOMO Wave Coming?

14 Octubre 2024 - 10:30PM

NEWSBTC

Bitcoin has recently begun to see a major recovery in its price,

reclaiming the $66,000 mark earlier today. This sudden positivity

in price performance has prompted debates on whether retail

investors and newcomers have returned to the market. Although there

has so far been speculation about increased retail participation, a

detailed analysis reveals a more nuanced picture. Related Reading:

Bitcoin Price Braces For Volatility Ahead Of Chinese Stimulus

Speculations, Options Expiry A Closer Look At Retail Participation

According to a CryptoQuant analyst, BinhDang, in a recent post on

the CryptoQuant QuickTake platform, the trends among smaller retail

groups show growth and stagnation in different areas, reflecting a

complicated dynamic in the current market cycle. In the post titled

“1 Year Change – From Plankton to Fish Addresses,” BinhDang broke

down Bitcoin wallet activity into several categories of retail

investors, including plankton (addresses holding more than 0 but

less than or equal to 0.1 BTC), shrimp (holding more than 0.1 but

less than 1 BTC), and fish (holding between 10 and 100 BTC). These

smaller groups were analyzed because they better represent retail

investors than larger wallet categories like whales or humpbacks,

which tend to be dominated by institutional players or exchanges.

One of the key observations made by BinhDang is that the growth in

retail addresses is uneven, particularly among the smallest

investors. The plankton addresses, representing individuals holding

tiny amounts of Bitcoin, have shown almost negligible growth from

2023 to the present day. This starkly contrasts previous cycles,

where significant price increases were accompanied by a sharp rise

in the number of retail investors holding small amounts of Bitcoin.

The analyst explained that this slower growth could reflect broader

economic conditions, including the global decline in monetary flows

over the past few years, which may have discouraged new entrants

from investing in Bitcoin. Potential For Future FOMO In Bitcoin’s

Bull Cycle The uneven growth in retail addresses points to a

cautious return of retail investors to the Bitcoin market. However,

there are still positive signs that the current cycle has room to

expand. BinhDang highlighted the trend of retail investors,

particularly those in the “fish” category (holding between 10 and

100 BTC), who have continued accumulating Bitcoin, suggesting that

while smaller investors may be hesitant, more seasoned participants

are preparing for the next phase of the bull cycle. The data

indicates that while retail participation is not as strong as in

previous cycles, there remains the potential for a final wave of

FOMO (Fear of Missing Out) that could drive Bitcoin to new heights.

The analyst particularly wrote in the post: So, the data suggests

that future FOMO waves are still possible in this cycle. […] Based

on these observations, I conclude there is still a basis to look

forward to a final wave in this cycle. Featured image created with

DALL-E, Chart from TradingView

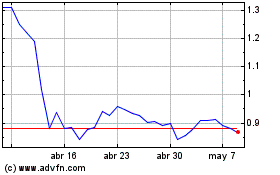

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024