Hedera (HBAR) Soars By 13%, Analyst Predicts Doubling Soon

20 Febrero 2024 - 2:40AM

NEWSBTC

Hedera (HBAR) has surged by 13.7% in the past 24 hours and a

notable 31.5% over the last week. This uptick is part of a broader

“altcoin season,” where select altcoins are experiencing

significant gains. Scott Melker, a prominent figure in the crypto

analysis space, today shared his insights into the altcoin market

and specifically on HBAR’s potential for growth. Altcoin Market

Overview Melker, also known as the “Wolf of all Streets,” has

highlighted the significance of the Total 3 market cap, which

excludes Bitcoin (BTC) and Ethereum (ETH), to gauge the health of

the altcoin market. According to Melker, Total 3 reaching a new

cycle high of approximately $550 billion on a weekly close is a

clear indicator of a robust altcoin market poised for further

expansion. Related Reading: Hedera (HBAR) Soars 50% To Mark New

20-Month High, Fuels Bullish Price Targets He stated, “Looking at

it generally gives us a clearer picture of what is happening with

altcoins. […] With that in mind, it is important to note that TOTAL

3 just made a new cycle high on the weekly close, around $550B.

This indicates that the altcoin market remains healthy and likely

to continue to grow.” Technical Analysis Of Hedera (HBAR) This

dynamic is the basis for HBAR (1-week chart, HBAR/USDT), for which

Melker’s analysis shows a very optimistic scenario. Currently, the

Hedera price is challenging a significant resistance zone. Melker

has identified the $0.10 level as pivotal for HBAR’s potential

uptrend. This resistance zone, highlighted by Melker in red, is

crucial because a consistent close above this level on the daily

and weekly charts would signal a shift in momentum favoring the

bulls. At press time, HBAR was trading just above this key

resistance zone, with yesterday’s daily candle closing above $0.10

for the first time since May 2022. The price closed at

approximately $0.1117. Melker states: HBAR is pushing hard into the

key resistance zone that I discussed many months ago. To keep it

more simple, a push above 10 cents should do the trick. Bulls want

to see daily and weekly closes above the red zone. A retest of that

zone as support would be an ideal entry. Two Simple Moving Averages

(SMAs) are plotted on the chart: the 50-day SMA at around $0.0615,

which HBAR is currently well above, and the 200-day SMA at

approximately $0.1241, which is slightly above the current price

action. The price positioning between the two SMAs can be

interpreted as a consolidation zone where the price needs to

establish a firm direction. Related Reading: Hedera (HBAR) Shines:

Record-Breaking 164 Million Daily Transactions, Market Cap Reaches

$2.9 Billion Melker points out that past the $0.10 resistance zone,

there appears to be minimal historical resistance until nearly a 2x

increase around the $0.186 level. This lack of resistance suggests

that if HBAR can maintain its position above the red zone, there is

potential for a relatively unobstructed upward trajectory. “As you

can see on the left of the charts, there is almost NO RESISTANCE

until nearly 2x, around .186. This coin dropped hard, leaving a

vacuum. It should do well if it can push through here,” Melker

remarks. However, if HBAR manages to break through the $0.186

resistance zone, Melker’s final target is the blue zone around

$0.25. This would net investors more than a 2x on their investment.

At press time, HBAR traded at $0.10647. Featured image from

Disruption Banking, chart from TradingView.com

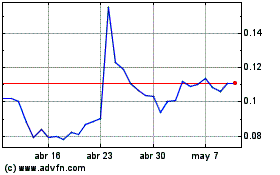

Hedera Hashgraph (COIN:HBARUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Hedera Hashgraph (COIN:HBARUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024