Terra Classic (LUNC) Chances Of Revival Grow Slimmer, Here’s Why

10 Agosto 2023 - 6:00PM

NEWSBTC

Terra Classic (LUNC) has suffered persistent declines since the

network’s collapse back in 2022. These declines have ranged from

its price through to the network’s Total Value Locked (TVL). And

even while development abounds among its community members to try

to restore it to its past glory, the numbers point to a low

possibility of recovery. Terra Classic TVL Falls To All-Time Low

After Terra’s crash in 2022, the network lost a significant chunk

of its TVL due to investors pulling out their funds as well as

developers moving their decentralized applications and protocols to

other networks. Over time, there seemed to be a stable trend but

once again, the network has lost out against its better

counterparts. Related Reading: Cardano (ADA) Next In Line For A

Rally Following Shark And Whale Buying Spree Data from the on-chain

tracker DeFiLlama shows that as of Thursday, the total Terra

Classic (LUNC) TVL is sitting at $2.11 million. This is notable

because this is the lowest that the network’s TVL has ever been. It

is also a long way from the over $20 billion all-time high TVL of

the Terra blockchain before its tragic collapse. LUNC TVL falls to

new all-time low | Source: DeFiLlama The vast majority of its

meager TVL is spread across just two DeFi protocols: Terraswap and

Astroport Classic, with $1.07 million and $933,527 in TVL,

respectively. The highest that Terra’s TVL has been in 2023 is $12

million back in April 2023. Terra’s TVL has now declined by over

83% from its 2023 peaks. In the same vein, DeFiLlama shows $0

decentralized exchange (DEX) volumes over the last week, meaning

that trading activity on the network has grounded to a halt. The

Road To Recovery For LUNC Over the last year, the Terra community

has been consistent about trying to help the network recover.

However, the kind of decline that the cryptocurrency suffered as a

result of the crash is not easy and near impossible to recover

from. Related Reading: Crypto Analyst Says Bitcoin Could Reach

$180,000 Next Cycle If This Happens Throwing in the fact that the

network’s activities are almost non-existent, the chances of

recovery have become even slimmer. But perhaps the biggest

hindrance to its recovery is the fact that LUNC’s supply ballooned

to over 6 trillion coins. Given this, even a surge to the $1 mark

is out of reach for the token, unless there is a significant

reduction in its supply. LUNC’s price continues to struggle at this

time, trading at $0.00007746 at the time of writing. Its market cap

is currently sitting at $450 million, making it the 80th-largest

cryptocurrency by market cap. LUNC price trading over 99% below

all-time high | Source: LUNCUSDT on Tradingview.com Follow Best

Owie on Twitter for market insights, updates, and the occasional

funny tweet… Featured image from Finbold, chart from

TradingView.com

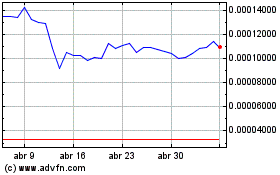

Terra Luna Classic (COIN:LUNCUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Terra Luna Classic (COIN:LUNCUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024