Bitcoin Short-Term Holder Profit Taking Reaches Levels Not Seen Since Nov. 2021

02 Febrero 2023 - 8:00AM

NEWSBTC

On-chain data shows the Bitcoin short-term holder profit-taking has

reached high levels not seen since the November of 2021. Bitcoin

Short-Term Holder SOPR Has Shot Up Recently As pointed out by an

analyst in a CryptoQuant post, a near-term top usually becomes more

probable when this trend forms for BTC. The relevant indicator here

is the “Spent Output Profit Ratio” (SOPR), which tells us whether

the average Bitcoin investor is selling at a loss or at a profit

right now. When the value of this metric is greater than 1, it

means the holders as a whole are realizing some profit on their

selling currently. On the other hand, values below the threshold

suggest the overall market is selling at some loss at the moment.

Naturally, the indicator having a value exactly equal to 1 would

suggest the average investor is just breaking even right now as the

total amount of profits being realized in the market is equal to

the losses currently. The SOPR here covers the entire market, but

the metric can also be modified to cover only certain segments of

the market. One major part of the sector is made up of the

“short-term holders” (STH) which is a cohort that includes all

investors that acquired their coins within the last 155 days. Now,

here is a chart that shows the trend in the 30-day moving average

(MA) Bitcoin SOPR specifically for these STHs over the last several

years: The 30-day MA value of the metric seems to have seen some

rise in recent days | Source: CryptoQuant As displayed in the above

graph, the 30-day MA Bitcoin STH SOPR had been below a value of 1

throughout the 2022 bear market, implying that these investors had

been selling at a loss during this period. Related Reading:

Stablecoin Supply Approaches Death Cross, Bad News For Bitcoin? The

quant has also marked previous instances of such a trend with the

green boxes in the BTC price chart. It looks like this trend was

also observed during bearish periods of the past cycles. Recently,

with the latest rally, the metric has sharply climbed and broken

out of this zone, as its value is above 1 now. This suggests that

there is more profit harvesting happening from this cohort than

loss realization currently. This makes sense as prices right now

are significantly higher than they were during the last 155 days

window, which is when the STHs would have bought their coins, so

these holders must be in some decent profits currently. As the

rally has continued, the STHs seem to have rapidly ramped up their

profit-taking as well, since the SOPR indicator for them has also

continued to shoot up. The level of their profit realization is now

comparable to that seen in November 2021, when Bitcoin set its

all-time high. Related Reading: FED To Put Off Interest Rate Hikes,

Bitcoin Rallies: Here’s Why As for what this current profit-taking

may imply for BTC, the analyst explains, “when retail starts to get

euphoric, the probability of a near-term price top starts to

increase.” BTC Price At the time of writing, Bitcoin is trading

around $23,800, up 3% in the last week. Looks like BTC has risen in

the past day | Source: BTCUSD on TradingView Featured image from

Kanchanara on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

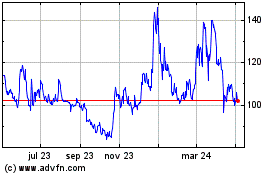

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

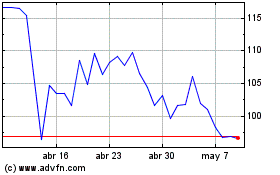

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024