Analyst Predicts Bitcoin Could Plunge Back To $51,000 On Wedge Pattern Breakdown

07 Agosto 2024 - 3:00AM

NEWSBTC

Bitcoin may be experiencing a price recovery towards the $57,000

level after a sharp 20% drop on Monday that sent the largest

cryptocurrency on the market to a low of $49,000 not seen since

February. Still, BTC is not out of the woods yet, as a concerning

pattern has emerged on its 10-day chart. Analysts Spot

Bearish Signals According to technical analyst Ali Martinez,

Bitcoin is forming a rising wedge pattern, a bearish continuation

pattern often linked to further downtrends. While BTC may

climb as high as $57,000 at the upper boundary of the wedge,

Martinez warns that investors should look for a potential breakdown

that could pull the cryptocurrency back down to around $51,000.

Related Reading: UNI Price Bounces Back 13% Above $5.6, Can Bulls

Maintain Control? Martinez also highlighted that one of Bitcoin’s

key support levels, based on its market value to realized value

(MVRV) pricing bands, is currently at the $54,000 mark. This level

is crucial in preventing a more substantial drop towards the

$40,000 region. Conversely, if the $54,000 support holds, the

analyst sees the key resistance on the upside at $67,000. Another

analyst, Rekt Capital, has also observed that Bitcoin is showing

signs of attempting to recover and fill the new CME gap above with

the currency’s current price recovery of 4.5% recorded in the last

hours, which ranges from $59,400 to $62,550. However, the

analyst noted that a smaller CME gap has formed at a slightly lower

level, between $53,700 and $54,600, which any short-term dip in the

market could potentially fill. Reasons For Optimism In Bitcoin

Market Amidst these bearish technical indicators, there is a

glimmer of optimism, as according to Ki Young Ju, the founder and

CEO of market analysis firm CryptoQuant, several key metrics

suggest that the bull market remains intact despite the recent

pullback. According to Ju, one of the key signs is the recovery in

Bitcoin’s hashrate, a measure of the computing power dedicated to

the network. Ju contends that miner capitulation is nearly over,

with the hashrate nearing all-time highs. This is

significant, as US mining costs are approximately $43,000 per BTC,

indicating that the hashrate will likely remain stable unless

prices dip below this level. Additionally, Ju has observed

significant inflows of Bitcoin into custody wallets, indicating

that large institutional investors, or “whales,” are actively

accumulating digital assets. The analyst noted that Permanent

Holder addresses, which hold their Bitcoin for over 3 years, have

increased by 404,000 BTC, including 40,000 BTC in US spot Bitcoin

exchange-traded funds (ETFs) over the past 30 days. Related

Reading: XRP Whales Take Advantage Of 20% Drop To Buy Millions

Worth Of Tokens In contrast to the increased whale activity, Ju has

observed a relative absence of retail investors, similar to the

market conditions in mid-2020. This could be interpreted as a

positive sign, as it indicates that the current price movements are

not driven by speculative froth but rather by institutional

investors’ strategic accumulation of Bitcoin. Lastly, Ju noted a

reduction in the selling pressure from long-term Bitcoin holders,

or “old whales,” who sold their holdings to new whales between

March and June. The analyst believes that the lack of

significant selling pressure from these experienced investors is a

bullish signal, as it suggests that a new generation of

institutional players is now shaping the market with a more

long-term outlook. At the time of writing, BTC is struggling to

break above its current price level of $56,670 while trimming

losses in larger time frames, which amounted to 13% last

week. Featured image from DALL-E, chart from TradingView.com

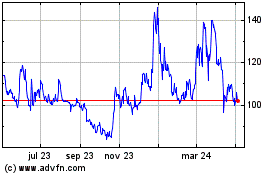

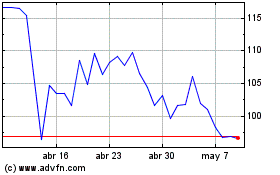

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024