Solana Consolidates In A Bullish Pattern – A Breakout ‘Could Spark A 40% Move’

13 Enero 2025 - 5:00PM

NEWSBTC

Solana (SOL) finds itself at a critical juncture as the broader

crypto market weathers a bearish consolidation phase. Since January

6, Solana has shed over 20% of its value, with losses extending to

more than 33% since late November, reflecting the challenging

conditions across the sector. Related Reading: XRP Scores A Lower

High Break On Daily – ATH Next? This downturn has placed Solana

under the spotlight as both investors and analysts closely monitor

its next move. Top analyst Ali Martinez recently shared a technical

analysis on X, revealing that Solana is currently consolidating

within a symmetrical triangle pattern—a formation often seen during

periods of indecision in the market. This pattern suggests that

Solana could either break out and recover or break down and

continue its descent, depending on upcoming market catalysts. A

decisive move for Solana could set the tone for the weeks ahead.

While the bearish sentiment weighs heavily on the market, Solana’s

position as a leading altcoin keeps it in focus for investors

seeking potential opportunities. All eyes are now on the

symmetrical triangle as traders prepare for the volatility that a

breakout or breakdown could bring. Will Solana regain its momentum,

or is further downside in store? Solana Faces Critical

Consolidation As Market Awaits Next Move Solana, often hailed as a

market leader since 2023, has faced significant headwinds in recent

weeks. The altcoin has struggled to maintain crucial support

levels, with consistent losses placing it in a precarious position.

Once a beacon of strength, Solana now finds itself grappling with

bearish sentiment, testing investor patience and market resilience.

Top analyst Ali Martinez shared a technical analysis on X,

revealing that Solana is consolidating within a symmetrical

triangle—a formation known for signaling potential volatility.

According to Martinez, a breakout above $214 or a breakdown below

$183 could trigger a 40% move in either direction, making this a

critical moment for SOL. With the price currently hovering below

the bearish target, a close below today’s levels could confirm a

further correction and send Solana spiraling toward lower support

zones. Despite these challenges, not all hope is lost. Solana’s

robust fundamentals and its historical ability to recover could

pave the way for a quick bounce or a period of sideways

consolidation. A reversal in market sentiment, driven by macro or

ecosystem-specific catalysts, could propel Solana back into bullish

territory. However, the path forward depends heavily on how SOL

navigates the current triangle formation. Related Reading: Whales

Buy 470 Million Dogecoin In 48 Hours As Price Tests Crucial Demand

Level – Details As investors brace for potential volatility, the

coming days will likely determine whether Solana can reclaim its

leadership status or succumb to further selling pressure. A

decisive move is imminent, and market participants are keeping a

close eye on these critical price levels. Will Solana defy the

bears and stage a recovery, or is a deeper correction on the

horizon? The next steps will define Solana’s trajectory in this

uncertain market climate. SOL Tests Key Demand Level Solana

is currently trading at $177, testing the critical support provided

by the daily 200 exponential moving average (EMA). This level has

historically served as a stronghold for bullish reversals, making

it a pivotal area for SOL to defend in the face of broader market

declines. The ongoing market downturn has placed significant

pressure on Solana, highlighting the importance of maintaining the

$175 level. If the price can stabilize and hold above this mark, it

may signal a potential rebound or at least a pause in the bearish

momentum. However, failing to secure support here could result in

further downside, with the next significant support zone around

$155. Market participants are closely monitoring these levels as

Solana navigates this critical phase. The daily close will be

crucial in determining whether SOL can maintain its structure and

build a foundation for recovery or if it risks deeper corrections.

A breakdown below the $175 mark would likely intensify selling

pressure, potentially triggering additional losses as the market

searches for equilibrium. Related Reading: Chainlink Forms A Daily

Bullish Pattern – Top Analyst Eyes Breakout To $30 For now, the

$175-$177 range remains a decisive battleground, with bulls aiming

to prevent a drop below this level while eyeing a potential

recovery from these crucial supports. Featured image from Dall-E,

chart from TradingView

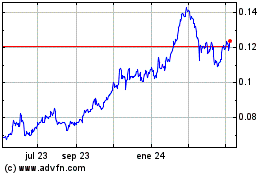

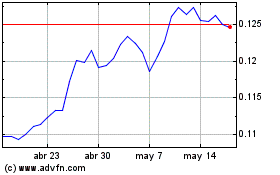

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025