Strong growth in business and gross profit despite a fall in

unit margins* * At constant scope

Regulatory News:

Clasquin (Paris:ALCLA):

Q1 2024

Q1 2023

Change at current scope &

exch. rates

Change lfl***

CONSOLIDATED (unaudited)

Number of shipments**

86,066

77,770

+10.7%

+10.7%

Sales (€m)*

149.3

139.2

+7.3%

-3.5%

Gross profit (€m)

34.7

30.1

+15.4%

+2.0%

* Sales is not a relevant indicator of business in our sector,

as it is greatly impacted by changing air and sea freight rates,

fuel surcharges, exchange rates (particularly versus USD), etc.

Changes in the number of shipments, volumes shipped and, in

financial terms, gross profit are relevant indicators. **: The

number of shipments does not include the TIMAR acquisition. ***:

Excluding Timar acquisition (28/03/2023) and at constant exchange

rates.

MARKET AND BUSINESS REVIEW

The sea freight market was severely disrupted in Q1 2024

by the events in the Red Sea, which led to a sharp rise in sea

freight rates in January and February. At the end of the period,

the market resumed a less turbulent rhythm, reflected in the fall

in rates, which nevertheless remained significantly higher than in

2023.

The air freight market benefited both from the transfer

of certain sea freight shipments to air due to the disruption in

the Red Sea and from the boom in e-commerce exports from China (70

to 80% of airline load capacity), masking the sluggish demand for

general cargo.

Against this backdrop, the Group saw strong growth in its

business (up 10.7% in the number of shipments on a

like-for-like basis) and in volumes shipped, particularly by

air (tonnage: up 26.5%).

Gross profit rose by 15.4%, benefiting from the

acquisition of the Timar group on 01/04/23 (Impact +14.9%) and from

the development of the Group’s key accounts.

Despite sustained growth in the sea freight business

(number of shipments up 9.0%), Q1 was marked by a fall in the unit

margin (down 15.3%), which nonetheless remained well above the

level of the pre-Covid period (> +50%). Overall, gross profit

for sea freight was down 7.7%.

The extremely buoyant air freight business in Q1 2024

(number of shipments up 15.9%) also saw a fall in unit margins

(down 7.0%), which, as with sea freight, remained well above the

pre-Covid period (>30%), leading to a 10.3% increase in gross

profit for air freight.

At constant scope, the road brokerage business grew by

5.3% in Q1 2024 in terms of number of shipments, with gross profit

remaining stable. The contribution from the Timar group acquisition

boosted gross profit in this business line by 79.9%.

BREAKDOWN BY BUSINESS LINE

NUMBER OF SHIPMENTS

GROSS PROFIT (€m)

At current scope

and exchange rates

Q1 2024

Q1 2023

Change Q1 2024/

Q1 2023

Q1 2024

Q1 2023

Change Q1 2024/

Q1 2023

Sea freight

33,917

31,125

+9.0%

15.5

16.6

-6.6%

Air freight

23,096

19,932

+15.9%

9.5

8.6

+10.3%

Road Brokerage

19,391

18,416

+5.3%

7.0

3.9

+79.9%

Other*

9,662

8,297

+16.5%

2.7

1.0

+168.8%

TOTAL CONSOLIDATED

86,066

77,770

+10.7%

34.7

30.1

+15.4%

*: Other businesses: Rail/Customs/Logistics

VOLUMES

At current scope and exchange

rates

Q1 2024

Q1 2023

Q1 2024/ Q1 2023

Sea freight

59,087 TEUs*

58,925 TEUs*

+0.3%

Air freight

20,217T**

15,986T**

+26.5%

*: Twenty-foot equivalent units **: Tons

Q1 2024 HIGHLIGHTS

Signing of the sale agreement for the acquisition of 42.06%

of the share capital of Clasquin by SAS Shipping Agencies Services

Sàrl (“SAS”)

Following the press releases dated 4 December 2023 and 21 March

2024 and after completion of the information and consultation

procedures with the relevant employee representative bodies of

Clasquin, which issued a favourable opinion, on 28 March 2024, Yves

Revol, OLYMP and SAS Shipping Agencies Services Sàrl (“SAS”), a

subsidiary of MSC Mediterranean Shipping Company SA, signed a sale

agreement for the acquisition of 42.06% of the share capital of

Clasquin by SAS, at a price of EUR 142.03 per share.

Note that:

- completion of the transaction, which will be subject to

obtaining clearances from the competent regulatory authorities, is

expected to happen by year end.

- Upon completion of the transaction, SAS will file a tender

offer with the Autorité des Marchés Financiers (AMF) for the

remaining shares in the capital of Clasquin, at the same price of

EUR 142.03 per share. This draft offer will be submitted to the AMF

for approval.

- The transaction is supported by the Chief Executive Officer of

Clasquin and other key management team members, who have committed

to tender all of their Clasquin shares into SAS’ tender offer,

representing in aggregate c.8.5% of the share capital.

- The name of the independent expert tasked with preparing a

report on the financial terms of the offer will be communicated

immediately after their appointment by the Clasquin Board of

Directors, on the recommendation of the ad hoc committee comprising

a majority of independent directors. The CLASQUIN SA Board of

Directors will meet again to issue a substantiated opinion on the

offer, after having reviewed the independent expert’s report, the

ad hoc committee’s recommendation and the opinion of the CLASQUIN

SA Social and Economic Committee (see Clasquin press release of 21

March 2024).

The CLASQUIN Group would retain its head office in Lyon and

would continue to operate together with its teams and under the

Group’s brands (CLASQUIN, Timar, LCI-Clasquin Cargolution, CVL,

Exaciel, Art Shipping International and Transports Petit in

particular).

TIMAR SA

A Mandatory Squeeze-Out Offer for the TIMAR shares was

filed by Financière CLASQUIN Euromed on 7 November 2023 with the

Moroccan Capital Market Authority (AMMC), and closed on 27/03/24.

As a result, the Group now holds 99% of the shares in Timar SA. The

delisting of Timar SA shares is scheduled for 10/06/24.

2024 OUTLOOK

2024 market

- International trade by volume: up 3.3% (WTO – October

2023)

- Air freight by volume: up 4.5% (IATA – December 2023)

- Sea freight by volume: up 3-4%

CLASQUIN 2024

Business (volumes): outperform market growth

UPCOMING EVENTS (publication after market closure)

- Wednesday 05 June 2024: Combined Annual General Meeting

- Thursday 25 July 2024: Q2 2024 business report

- Tuesday 17 September 2024: H1 2024 results

- Tuesday 29 October 2024: Q3 2024 business report

CLASQUIN is an air and sea freight forwarding

and overseas logistics specialist. The Group designs and manages

the entire overseas transport and logistics chain, organising and

coordinating the flow of client shipments between France and the

rest of the world and, more specifically, to and from Asia-Pacific,

North America, North Africa and sub-Saharan Africa. Its shares are

listed on EURONEXT GROWTH, ISIN FR0004152882, Reuters ALCLA.PA,

Bloomberg ALCLA FP. Read more at www.clasquin.com. CLASQUIN

confirms its eligibility for the share savings plan for MSCs

(medium-sized companies) in accordance with Article D. 221-113-5 of

the French Monetary and Financial Code established by decree number

2014-283 of 4 March 2014 and with Article L. 221-32-2 of the French

Monetary and Financial Code, which set the conditions for

eligibility (less than 5,000 employees and annual sales of less

than €1,500m or balance sheet total of less than €2,000m). CLASQUIN

is listed on the Enternext© PEA-PME 150 index. LEI:

9695004FF6FA43KC4764

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425099755/en/

CLASQUIN

Philippe LONS – Deputy Managing Director/Group CFO Domitille

CHATELAIN – Group Head of Communication & Marketing

CLASQUIN Group – 235 cours Lafayette – 69006 Lyon Tel.: +33 (0)4

72 83 17 00

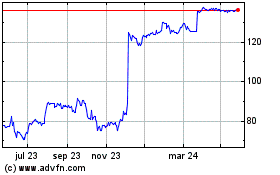

Clasquin (EU:ALCLA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

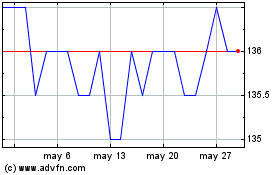

Clasquin (EU:ALCLA)

Gráfica de Acción Histórica

De May 2023 a May 2024