- Continued acceleration in quarterly revenue growth since Q2

2024, with Q4 2024 reaching nearly €3.0 million, up 81% versus

2023

- Strong full-year performance in the medical equipment

distribution business, generating €2.3 million in revenue

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible

for PEA-PME equity savings plans), a medical technology company

specializing in implants for orthopedic surgery and the

distribution of technological medical equipment, today announces

its full-year 2024 revenue and cash position as of December 31,

2024.

Ludovic Lastennet, IMPLANET’s Chief Executive Officer,

stated: “The strong commercial performance achieved in the second

half of 2024, with 66% growth compared to the same period last

year, underscores the effectiveness of the development model

implemented at the start of 2024. Building on our expertise in

spine surgery and the synergy between our product ranges, the

combination of implant sales with the distribution of high-value

medical equipment has significantly increased our sales across

strategic markets. While the first half of 2024 was impacted by a

slowdown in international activity, we are now reaping the benefits

of our investments in the United States and are more convinced than

ever of the strong growth potential of our solutions in this

region. With the support of our key shareholder, Sanyou Medical, we

intend to sustain this growth momentum by expanding our product

offerings and continuing our innovation strategy.”

Fourth quarter 2024 growth of

+81%

Revenue by Activity (in € thousands

- IFRS Standards1)

2024

2023

Change %

Spine Implants

1,871

1,608

+16%

Medical Equipment (SMTP)

1,110

24

-

Services (MADISON)

1

11

-

Total Revenue for the fourth

quarter

2,982

1,643

+81%

The Spine Implants activity achieved Q4 2024 revenue of €1.87

million, an increase of +16% compared to €1.61 million in Q4

2023.

The medical equipment distribution activity continued its

growth, supported by the ongoing deployment of the Olea ultrasonic

scalpel in France, internationally, and in the U.S. under the

exclusive partnership with elliquence for the spinal endoscopy

market. Revenue from this activity for Q4 2024 was €1.11 million,

compared to €0.02 million in Q4 2023.

Activity in France grew by +8%, with revenue of €1.04 million

for Q4 2024, compared to €0.96 million in Q4 2023. In the U.S., Q4

2024 revenue reached €1.13 million, up from €0.33 million in Q4

2023. Export activity in the rest of the world recorded €0.82

million in Q4 2024, compared to €0.36 million in the same period

last year, representing growth of +132%, mainly driven by a

recovery in orders from Europe and South America.

Revenue by Region (in € thousands -

IFRS Standards1)

2024

2023

Change %

France

1,035

956

+8%

United States

1,125

333

+237%

Rest of World

822

354

+132%

Total Revenue for the fourth

quarter

2,982

1,643

+81%

2024 Full-Year Revenue Growth of

+26%

Revenue by Activity (in € thousands

- IFRS Standards 1)

2024

2023

Change %

Revenue for the first quarter

2,223

2,208

+1%

Revenue for the second quarter

1,894

2,060

-8%

Revenue for the third quarter

2,308

1,537

+50%

Revenue for the fourth quarter

2,982

1,643

+81%

Full-Year revenue

Full-Year Spine Implants Revenue

7,034

7,067

0%

Full-Year Medical Equipment (SMTP)

Revenue

2,351

303

+676%

Full-Year Services (MADISON) Revenue

20

79

-75%

Total Full-Year Revenue

9,406

7,448

+26%

IMPLANET recorded full year revenue of €9.41 million in 2024,

compared to €7.45 million in 2023.

Spine Implants activity generated €7.03 million in 2024,

compared to €7.07 million in 2023. Meanwhile, the medical equipment

distribution activity delivered €2.35 million in 2024, representing

a growth of +676% compared to 2023.

Revenue in France grew by 17%, totaling €4.12 million. Revenue

in the United States reached €2.57 million in 2024, up +86% from

€1.38 million in 2023. Export activity in the rest of the world

also increased by 6% to €2.72 million in 2024, compared to €2.56

million in 2023.

Revenue by Region (in € thousands –

IFRS Standards1)

2024

2023

Variation %

France

4,120

3,510

+17%

United States

2,570

1,379

+86%

Rest of the World

2,716

2,560

+6%

Total Full-Year Revenue

9,406

7,448

+26%

Cash Position

As of December 31, 2024, the Company had a cash position of

€1.60 million.

As a reminder, the Company received €0.68 million related to the

sale of the MADISONTM activity, with the remaining balance of €0.17

million expected to be collected during the first half of 2025.

Additionally, on December 5, 2024, IMPLANET announced the

implementation of financing with Shanghai Pudong Development Bank

(“SPD Bank”). This financing arrangement consists of a short-term

working capital loan from SPD Bank, totaling RMB 15.2 million

(around €2 million), for a 12-month term, repayable in full at

maturity, without requiring collateral. The loan is intended for

supplier payments and other operational expenses, with repayment

guaranteed by Sanyou Medical.

Given this recent financing and cash flow projections based on

current activity assumptions and anticipated commercial

developments with Sanyou Medical for the 2024 and 2025 fiscal

years, the Company believes it will be able to meet its operational

financing needs for the next twelve months. Additionally, the

Company continues to explore various financing options to

accelerate the development of its activities and medium-term

growth, as well as the implementation of payment facilities with

the Sanyou Medical group.

Reminder of 2024

highlights

- Successful completion of the capital increase announced on

January 4, 2024, raising €5.5 million through the issuance of

83,924,897 new shares;

- Appointment of Max W. Painter as Vice President and General

Manager of IMPLANET’s US subsidiary;

- FDA clearance of the new Jazz Spinal SystemTM hybrid posterior

fixation range in the United States;

- Exclusive partnership signed for the distribution of the

ultrasonic scalpel Olea for endoscopic spine surgery in the U.S.

market.

- Financing of around €2 million with Shanghai Pudong Development

Bank.

Upcoming financial event:

- 2024 Full-Year Results: March 4, 2025, after market

close.

About IMPLANET Founded in 2007, IMPLANET is a medical

technology company that manufactures high-quality implants for

orthopedic surgery and distributing medical technology equipment.

Its activity revolves around a comprehensive innovative solution

for improving the treatment of spinal pathologies (JAZZ®)

complemented by the product range offered by Orthopaedic &

Spine Development (OSD), acquired in May 2021 (thoraco-lumbar

screws, cages and cervical plates). Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. In 2022, IMPLANET entered into a

commercial, technological and financial partnership with SANYOU

MEDICAL, China's second largest medical device manufacturer.

IMPLANET employs 43 staff and recorded a consolidated revenue of

€9.4 million in 2024. Based near Bordeaux in France, IMPLANET

opened a US subsidiary in Boston in 2013. IMPLANET is listed on the

Euronext Growth market in Paris. For further information, please

visit www.Implanet.com.

Disclaimer This press release contains forward-looking

statements relating to IMPLANET and its activities. IMPLANET

believes these forward-looking statements are based on reasonable

assumptions. However, no assurance can be given that the forecasts

expressed in these forward-looking statements will be realized, as

they are subject to risks, including those described in IMPLANET’s

registration document filed with the French Financial Markets

Authority (Autorité des marchés financiers – AMF) on April 16,

2018, under number D.18-0337, as well as in the annual financial

report as of December 31, 2023, both available on the Company’s

website (www.implanet-invest.com). These statements are also

subject to changes in economic conditions, financial markets, and

the markets in which IMPLANET operates. The forward-looking

statements in this press release are also subject to risks that are

unknown to IMPLANET or not currently considered material. The

occurrence of some or all of these risks could cause IMPLANET’s

actual results, financial condition, performance, or achievements

to differ significantly from those expressed in these

forward-looking statements.

This press release is for informational purposes only and does

not constitute, and should not be considered as constituting, an

offer to sell or subscribe to, or a solicitation of an offer to

purchase or subscribe to, IMPLANET’s securities in any country.

1 Unaudited figures

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114330809/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Nicolas Fossiez Tél.: +33 (0)1

44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

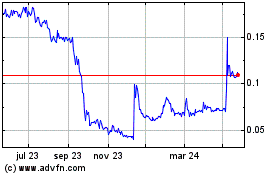

Implanet (EU:ALIMP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

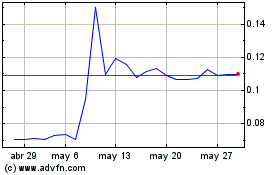

Implanet (EU:ALIMP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025