LEXIBOOK: GROWTH CONTINUES. Q2 2023-24 FISCAL UP 12.91% THANKS TO

DIGITAL, INTERNATIONAL BUSINESS AND THE SUCCESS OF ITS NEW SMART

TOYS.

Les Ulis, November 15, 2023 at 7:00 a.m.

LEXIBOOK: GROWTH CONTINUES. Q2 2023-24

FISCAL UP 12.91% THANKS TO DIGITAL, INTERNATIONAL BUSINESS AND THE

SUCCESS OF ITS NEW SMART TOYS.

- Sales

growth reached 12.91% in Q2 2023-24, compared with Q2 2022-2023,

which was already up 36.46%.

- This

quarter follows 17 quarters of growth, once again validating the

Group's strategic choices to position itself in buoyant segments.

Growth was driven by electronic and musical toys, alarm clocks,

educational products, and cameras, with the other families

remaining broadly stable. Lexibook thus consolidates its position

as European leader in its major segments.

- Sales

in the USA/Canada and Asia are well on track, with respective

growth rates of 60% and 151% vs N-1. Europe continued to grow by

3.4% despite a high base effect.

- The

communications campaign in Europe continued to bear fruit over the

half-year and began in the USA with the arrival of the first

licensed products.

-

Tensions on component supplies and freight have

disappeared. As a result, the Group can deliver orders under

optimum conditions.

- Q3

2023-24, is expected to be slightly higher than 2022-23 despite a

high base effect and augurs another year of profitable growth over

the full fiscal year.

Lexibook (ISIN FR0000033599) today announced its sales

(unaudited) for the period ending September 30, 2023 (period from

April 1er to September 30).

|

Consolidated sales (M€) |

2021/2022 |

2022/2023 |

Var |

2023/2024 |

Var |

|

1er quarter |

5,08 |

6,93 |

36,42% |

7,01 |

1,15% |

|

Of which FOB |

1,31 |

2,22 |

69,47% |

2,21 |

-0,45% |

|

Of which Non FOB |

3,77 |

4,71 |

24,93% |

4,80 |

1,91% |

|

2éme

quarter |

9,82 |

13,40 |

36,46% |

15,13 |

12,91% |

|

Of which FOB |

2,96 |

4,32 |

45,95% |

2,85 |

-34,03% |

|

Of which Non FOB |

6,86 |

9,08 |

32,36% |

12,28 |

35,24% |

|

|

|

|

|

|

|

|

Total 6 months |

14,90 |

20,33 |

36,44% |

22,14 |

8,90% |

|

|

|

|

|

|

|

Sales growth reached 12.91% in Q1 2023-24

compared with Q1 2022-23, which was already up 36.46%. The Group

has favored domestic sales from the European central warehouse over

FOB sales from HK to lower its inventory levels. This explains the

increase in domestic sales compared with FOB sales.

This quarter follows 17 quarters of growth, once

again validating the Group's strategic choices to position itself

in buoyant segments. Consumption of the Group's products continues

to grow, particularly in electronic toys, children's alarm clocks,

educational products, musical toys, karaoke, and cameras. Lexibook

consolidates its position as European leader in its major

segments.

In geographical terms, Europe, which saw very

strong growth rates in H1 S2022-23, continues to see its business

develop, with growth of 3.4% over the half-year. The Group has

launched development plans in new territories, particularly in the

USA and Asia. Sales in these regions are beginning to accelerate,

with respective growth rates of 60% and 151% vs N-1.

The Group continued its digital communication

campaign in Europe at a level slightly below 2022 and began a

digital campaign in the USA. This will be amplified in H2.

Tensions on component supplies and freight have

disappeared. As a result, the Group can deliver orders under

optimum conditions.

Outlook :

Q3 2021-22 and 2022-23 were up 58.8% and 7.1%

respectively. The base effect is therefore high for Q3 2023-24,

which is also the highest contributor to annual sales.

Nevertheless, this quarter is expected to show slight growth in

2022-23 and augurs a new fiscal year of profitable growth for the

Lexibook Group.

Financial calendar

2022/2023

- Half-year results to September 30,

2023: December 22, 2023

- Q3 2023-24 sales : February 15,

2023

- Q4 2023-24 sales : May 15,

2023

- Annual results to March 31, 2024:

June 30, 2024

- Availability of the Universal

Registration Document on March 31, 2024: June 30, 2024

About Lexibook

Lexibook®, owner of over 40 registered brands

such as Powerman®, Decotech®, Karaoke Micro Star®, Chessman®, Cyber

Arcade®, Lexitab®, iParty®, FlashBoom®, etc., is the leader in

intelligent electronic leisure products for children. This success

is based on a proven strategy of combining strong international

licenses with high value-added consumer electronics products. This

strategy, complemented by a policy of constant innovation, enables

the Group to flourish internationally and to constantly develop new

product ranges under the Group's brands. With over 35 million

products on the market, the company now sells a product every 10

seconds worldwide! Lexibook's share capital is made up of 7,763,319

shares listed on the Alternext market in Paris (Euronext). ISIN:

FR0000033599 - ALLEX; ICB: 3743 - Consumer electronics. For further

information: www.lexibook.com and www.decotech-lights.com.

Contact

LEXIBOOK David Martins - DAF -

01 73 23 23 45 / davidmartins@lexibook.com

Les Ulis, November 15, 2023 at 7:00 a.m.

LEXIBOOK: GROWTH CONTINUES. Q2 2023-24

FISCAL UP 12.91% THANKS TO DIGITAL, INTERNATIONAL BUSINESS AND THE

SUCCESS OF ITS NEW SMART TOYS.

- Sales growth reached 12.91% in Q2 2023-24, compared

with Q2 2022-2023, which was already up 36.46%.

- This quarter follows 17 quarters of growth, once again

validating the Group's strategic choices to position itself in

buoyant segments. Growth was driven by electronic and musical toys,

alarm clocks, educational products, and cameras, with the other

families remaining broadly stable. Lexibook thus consolidates its

position as European leader in its major segments.

- Sales in the USA/Canada and Asia are well on track,

with respective growth rates of 60% and 151% vs N-1. Europe

continued to grow by 3.4% despite a high base effect.

- The communications campaign in Europe continued to bear

fruit over the half-year and began in the USA with the arrival of

the first licensed products.

- Tensions on component supplies and freight have

disappeared. As a result, the Group can deliver orders under

optimum conditions.

- Q3 2023-24, is expected to be slightly higher than

2022-23 despite a high base effect and augurs another year of

profitable growth over the full fiscal year.

Lexibook (ISIN FR0000033599) today announced its sales

(unaudited) for the period ending September 30, 2023 (period from

April 1er to September 30).

|

Consolidated sales (M€) |

2021/2022 |

2022/2023 |

Var |

2023/2024 |

Var |

|

1er quarter |

5,08 |

6,93 |

36,42% |

7,01 |

1,15% |

| Of which

FOB |

1,31 |

2,22 |

69,47% |

2,21 |

-0,45% |

| Of which

Non FOB |

3,77 |

4,71 |

24,93% |

4,80 |

1,91% |

|

2éme quarter |

9,82 |

13,40 |

36,46% |

15,13 |

12,91% |

| Of which

FOB |

2,96 |

4,32 |

45,95% |

2,85 |

-34,03% |

|

Of which Non FOB |

6,86 |

9,08 |

32,36% |

12,28 |

35,24% |

|

|

|

|

|

|

|

|

Total 6 months |

14,90 |

20,33 |

36,44% |

22,14 |

8,90% |

|

|

|

|

|

|

|

Sales growth reached 12.91% in Q1 2023-24

compared with Q1 2022-23, which was already up 36.46%. The Group

has favored domestic sales from the European central warehouse over

FOB sales from HK to lower its inventory levels. This explains the

increase in domestic sales compared with FOB sales.This quarter

follows 17 quarters of growth, once again validating the Group's

strategic choices to position itself in buoyant segments.

Consumption of the Group's products continues to grow, particularly

in electronic toys, children's alarm clocks, educational products,

musical toys, karaoke, and cameras. Lexibook consolidates its

position as European leader in its major segments. In geographical

terms, Europe, which saw very strong growth rates in H1 S2022-23,

continues to see its business develop, with growth of 3.4% over the

half-year. The Group has launched development plans in new

territories, particularly in the USA and Asia. Sales in these

regions are beginning to accelerate, with respective growth rates

of 60% and 151% vs N-1.

The Group continued its digital communication

campaign in Europe at a level slightly below 2022 and began a

digital campaign in the USA. This will be amplified in H2.

Tensions on component supplies and freight have

disappeared. As a result, the Group can deliver orders under

optimum conditions.

Outlook :Q3 2021-22 and 2022-23

were up 58.8% and 7.1% respectively. The base effect is therefore

high for Q3 2023-24, which is also the highest contributor to

annual sales. Nevertheless, this quarter is expected to show slight

growth in 2022-23 and augurs a new fiscal year of profitable growth

for the Lexibook Group.

Financial calendar

2022/2023

- Half-year results to September 30, 2023: December 22, 2023

- Q3 2023-24 sales : February 15, 2023

- Q4 2023-24 sales : May 15, 2023

- Annual results to March 31, 2024: June 30, 2024

- Availability of the Universal Registration Document on March

31, 2024: June 30, 2024

About Lexibook

Lexibook®, owner of over 40 registered brands

such as Powerman®, Decotech®, Karaoke Micro Star®, Chessman®, Cyber

Arcade®, Lexitab®, iParty®, FlashBoom®, etc., is the leader in

intelligent electronic leisure products for children. This success

is based on a proven strategy of combining strong international

licenses with high value-added consumer electronics products. This

strategy, complemented by a policy of constant innovation, enables

the Group to flourish internationally and to constantly develop new

product ranges under the Group's brands. With over 35 million

products on the market, the company now sells a product every 10

seconds worldwide! Lexibook's share capital is made up of 7,763,319

shares listed on the Alternext market in Paris (Euronext). ISIN:

FR0000033599 - ALLEX; ICB: 3743 - Consumer electronics. For further

information: www.lexibook.com and www.decotech-lights.com.

Contact

LEXIBOOK David Martins - DAF -

01 73 23 23 45 / davidmartins@lexibook.com

- Communique CA T2 2023-2024 en

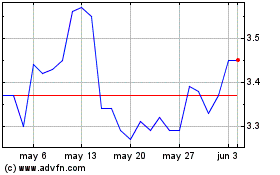

Lexibook Linguistic Elec... (EU:ALLEX)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Lexibook Linguistic Elec... (EU:ALLEX)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025