SAFE - Bond financing agreement in a minimum amount of €850,000 to support the Group’s turnaround strategy

11 Marzo 2024 - 1:00AM

SAFE - Bond financing agreement in a minimum amount of €850,000 to

support the Group’s turnaround strategy

Bond financing agreement in a minimum

amount of €850,000 to support the Group’s

turnaround strategy

Eragny-sur-Oise –

France – March 11, 2024, 8.00 a.m. Safe SA

(the “Company”) announces that it has arranged

flexible bond financing with the Global Corporate Finance

Opportunities 20 (GCFO 20) fund, a member of the Alpha Blue

Ocean (ABO) group, through the issuance of warrants giving access

to bonds convertible or exchangeable into new and/or existing

shares with warrants attached in a minimum net amount of

approximately €850,000. At a time when the Group is under

observation, this financing will facilitate the implementation of

the restructuring plan initiated by the new management team.

Under the terms of a convertible or exchangeable

bond financing agreement signed on March 14, 2023 between Safe SA

and the GCFO 20 fund, the GCFO 20 fund has undertaken to

finance the Group’s observation period in a minimum net amount of

approximately €850,000.

ABO Participation undertakes to ensure that this

financing is carried out through the drawdown, by Safe SA, of three

tranches (the “Authorized Tranches”) of bonds convertible or

exchangeable into new and/or existing shares (the “OCEANE bonds”)

with warrants attached (the “warrants”) to be subscribed for by

GCFO 20 under the terms of the Subscription Agreement

(excluding any commitment fee due), as follows:

|

Authorized Tranche |

Number of OCEANE bonds issued |

Nominal amount (in euros) |

Subscription price (97% of the nominal amount) (in

euros) |

Drawdown date of the relevant Authorized

Tranche |

|

1 |

310 |

310,000 |

300,700 |

Within 5 trading days of delivery of the order issued by the

juge-commissaire (official receiver) |

|

2 |

310 |

310,000 |

300,700 |

After a period of 20 trading days following the issue of the

previous Authorized Tranche |

|

3 |

260 |

260,000 |

252,200 |

After a period of 20 trading days following the issue of the

previous Authorized Tranche |

|

Total |

880 |

880,000 |

853,600 |

|

Within this framework, ABO Participation

declares in advance that it waives all the conditions precedent

provided for in the Subscription Agreement in connection with the

drawing down of the Authorized Tranches, it being specified that

this waiver applies only to the Authorized Tranches, to the

exclusion of any other tranche issued under the Subscription

Agreement.

ABO Participation further undertakes not to

convert the OCEANE bonds issued under the Authorized Tranches into

new shares until the Pontoise Commercial Court adopts a

continuation plan for Safe SA at the end of the observation period

and, if the observation period has not ended by that date, not

before June 30, 2024.

As subscription for the Authorized Tranches by

GCFO 20 has the characteristics of a new contribution granted

with a view to ensuring the continuation of the business for the

duration of the proceedings, it is subject to the authorization of

the juge-commissaire (official receiver) (in accordance with

paragraph 2 of Article L. 622-17 III 4° of the French

Commercial Code and must benefit from the preferential right

provided for in III 2° of that Article. Consequently, the first

Authorized Tranche will be drawn down within 5 trading days of the

order being issued by the official receiver, in accordance with the

above-mentioned table, and must be followed by the issuance of a

press release from Safe SA announcing the schedule for drawing down

the Authorized Tranches in accordance with the terms of the

Subscription Agreement.

The Company undertakes to keep an up-to-date

table on its website showing the number of OCEANE bonds and shares

outstanding.

Financial calendar:2023 annual

results and 2023 annual financial report, April 30

About Safe Group

Safe Group is a French medical technology group

that brings together Safe Orthopaedics, a pioneer in ready-to-use

technologies for spine pathologies, and Safe Medical (formerly LCI

Medical), a medical device subcontractor for orthopedic surgeries.

The group employs approximately 100 people.Safe Orthopaedics

develops and manufactures kits combining sterile implants and

ready-to-use instruments, available at any time to the surgeon.

These technologies are part of a minimally invasive approach aimed

at reducing the risks of contamination and infection, in the

interest of the patient and with a positive impact on

hospitalization times and costs. Protected by 15 patent families,

SteriSpineTM kits are CE marked and FDA approved. Safe Orthopaedics

has subsidiaries in the United Kingdom, Germany, the United

States.For more information: www.safeorthopaedics.com

Safe Medical produces implantable medical

devices and ready-to-use instruments. It has an innovation center

and two production sites in France and in Tunisia, offering

numerous industrial services: industrialization, machining,

finishing and sterile packaging.For more information:

www.safemedical.fr

Contacts

SAFE

GROUP AELYON

ADVISORSinvestors@safeorthopaedics.com safe@aelyonadvisors.fr

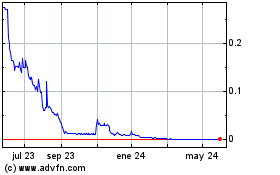

SAFE (EU:ALSAF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

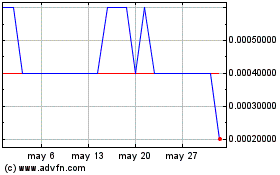

SAFE (EU:ALSAF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024