Unifiedpost demonstrates continued resilience and flexibility

Press release – Regulated information - Inside

inforrmation

Unifiedpost demonstrates continued

resilience and flexibilityNavigating regulatory

changes and expanding digital solutions

La Hulpe, Belgium – 27 February, 2023,

7:00 a.m. CET – [INSIDE INFORMATION] Unifiedpost Group (Euronext:

UPG), a leading provider of integrated business communications

solutions, announces its 2023 results today. With a notable 13,2%

organic growth y/y in recurring digital processing revenue, the

Company demonstrates continued resilience and adaptability in a

rapidly evolving market. In the transition towards comprehensive

digital invoicing, Unifiedpost maintains its commitment to

prioritising further cash flow improvements, while fully preparing

for the future digital invoicing market.

Highlights

- Unifiedpost showed resilience in light of the delays of the

implementation directive in several countries

- Unifiedpost Group achieved 13,2% y/y organic growth in its

recurring digital processing revenue in FY 2023

- The customer base grew to 1.234.098 by year-end, a 16,0%

increase in 2023

- Unifiedpost based government portal in Serbia is handling over

10 million invoices monthly

- Financial stability and adaptability, enabling us to navigate

market challenges with resilience and flexibility

- With a dedicated R&D team of 380 full-time employees we

remain committed to targeted investments that drive LT value

- Digital processing gross margin improved to 43,2%, up 1,3%pts

y/y

- EBITDA continues to develop positively quarter by quarter,

EBITDA improved during FY 2023 to -€0,1 million compared to -€6,4

million in 2022

- The Group achieved its cash objective in the fourth quarter of

2023, with cash at the end of 2023 of €26,3 million

- Identified impairment attributed to external factors: increased

cost of capital and delays in regulatory requirements, representing

a non-cash event with no further impact

Commenting on the FY 2023 results, Hans

Leybaert, CEO and founder, remarked: “We're pleased with our

achievements in 2023, showcasing resilience and adaptability amidst

external challenges. Our success is a testament to the dedication

of our team, the trust of our clients, and the collaboration of our

partners. Together, we've achieved remarkable growth in recurring

digital processing revenue and expanded our customer base,

highlighting our collective strength and unwavering commitment to

excellence.”

| Key revenue figures (EUR

million) |

FY 2023 |

FY 2022 |

Change (%) |

|

Recurring digital processing revenue (core revenue) |

124,8 |

112,7 |

+10,7% |

|

Non-recurring digital processing revenue |

11,8 |

14,3 |

-17,5% |

|

Postage & Parcel Optimisation revenue |

54,8 |

64,0 |

-14,4% |

|

Group revenue |

191,4 |

191,0 |

+0,2% |

| Key revenue growth figures FY

2023 vs. FY 2022 |

Organic(local currency) |

Currency |

Acquisitions/ divestments |

Total growth |

|

Recurring digital processing revenue (core revenue) |

+13,2% |

-2,5% |

0,0% |

+10,7% |

|

Non-recurring digital processing revenue |

-17,0% |

-0,5% |

0,0% |

-17,5% |

|

Postage & Parcel Optimisation revenue |

-7,4% |

-7,0% |

0,0% |

-14,4% |

| Key financial figures (EUR

million) |

FY 2023 |

FY 2022 |

Change (%) |

| Recurring revenue (in % of total

revenue) |

93,8% |

92,5% |

+1,3%pts |

| Gross margin digital processing |

43,2% |

41,9% |

+1,3%pts |

| EBITDA margin |

-0,1% |

-3,4% |

+3,3%pts |

| Loss for the period from operations

excl. impairment |

-26,9 |

-29,9 |

+10,0% |

| Impairment losses |

-39,0 |

- |

- |

| Cash and cash equivalents |

26,3 |

40,0 |

-34,2% |

Steady recurring digital processing

revenue growth

Unifiedpost's recurring digital processing, its

core revenue, in 2023 grew by 13,2% to €124,8 million based on

constant exchange rates and by 10,7% based on current rates. The

Company continues to experience consistent double-digit expansion.

Strong growth was observed in key markets such as Benelux, the

Baltics and the Balkans in 2023, with other countries also showing

promising growth trends.

93,8% of Unifiedpost Group's total year-to-date

revenue is recurring, highlighting the Company's strong and

consistent revenue stream.

The non-recurring digital processing revenue

decreased by 17,5% y/y. Projects for corporates in this segment

performed well in 2023, achieving a growth rate of 7,9% compared to

the previous year. The revenue from licenses was lower due to

delayed decisions coming from postponed legislations. However, this

revenue is anticipated to materialise in the future.

Improved contributions and operational

challenges

In 2023, the digital business segment showed an

improvement in contribution, with a €6 million increase compared to

2022. This growth was achieved through a combination of revenue

expansion and effective cost management practices. The contribution

from the Postage & Parcel Optimisation segment remained

relatively stable, experiencing only a marginal decrease of €0,1

million.

During 2022 and 2023, the Company diligently

pursued cost reduction initiatives, yielding favourable results.

These efforts were impacted by inflation and wage indexation.

Additionally, two one-time elements influenced the outcome:

firstly, the Company decided to put all non-core applications in

maintenance and expense all Research and Development (R&D) of

those, resulting in a negative impact on costs in 2023 without any

cash implications. Secondly, there were one-time costs totalling €2

million, primarily attributed to lay-offs and consulting fees

related to divestment activities.

Impairment result

[INSIDE INFORMATION] It was determined that an

impairment of €39 million is necessary, this is a non-cash event.

This impairment test was influenced by two key factors. Firstly,

there was a rise in the cost of capital due to increased interest

rates, impacting our financial calculations. Secondly, the future

business plans faced setbacks due to delays in the legal

requirement for e-invoicing, which forced the Company to make

changes to our anticipated plans and forecasts.

Group’s operating and financial

result

The Group's loss from operations excluding the

impairment improved by €3 million, from a loss of €29,9 million in

2022 to €26,9 million in 2023. In total, with the impairment of €39

million, the total loss from operations for 2023 amounted to €65,9

million. The financial costs, income tax and loss on equity method

of the Group, which amounted to €17,2 million in 2023, resulted in

a total loss of €83,1 million. Within these financial costs lies a

non-cash expense related to Francisco Partners amounting to €10,8

million.

Unifiedpost continues investment in

R&D for future growth

Unifiedpost recognises the importance of staying

ahead in our dynamic market. To ensure our solutions remain

innovative and competitive, we continue to invest in the

development of our offerings. With a dedicated R&D team of 380

full-time employees at YE, Unifiedpost remains at the forefront of

technological advancements. These investments not only keep our

solutions cutting-edge but also position the Company for future

growth.

Unifiedpost Group achieves positive cash

flow momentum in 2023

Our focus on cash flow has yielded significant

improvement in 2023. In 2022, the combined operational and

investing cash flow resulted in a negative balance of €43,7

million. This has improved substantially in 2023, with just a €2,1

million negative result. Our financing activities resulted in a

negative cash flow of €11,6 million during 2023. Overall, the

Group realised a negative cash flow of €13,7 million for the year,

excluding any divestments.

Starting the year with €40 million in cash,

after accounting for cash flow results, we ended the year with

€26,3 million in cash.

The Group successfully met its cash objective in

the fourth quarter of 2023. The overall result for H2 still

revealed a modest negative balance of €1,7 million (adjusted for

restructuring costs). Thanks to the cost-cutting measures

implemented over the past two years, we have positioned ourselves

with a cost base that provides a solid foundation for future cash

flow generation.

Streamlining operations for continued

profitable and cash-flow positive growth

Throughout 2023, we have successfully reduced

our workforce by 189 full-time equivalents (FTEs) through careful

evaluation and optimisation of our organisational structure. The

R&D team remains at the core with 380 FTE’s at YE, securing the

future growth. Workforce reductions have been implemented without

compromising the core development of our future-oriented services

or the support we provide to our valued customers. Moving forward,

we remain committed to optimising our workforce to better align

with our strategic objectives.

The divestment of FitekIn/Onea, announced on

August 1st, is still pending completion. However, we anticipate the

closing to occur in the very near term. This transaction involves

€7,2 million in cash. Additionally, we are actively exploring or

working on other divestments to streamline the Group's operations

and refocus on core business activities. This initiative aims to

enhance our strategic focus and drive sustainable growth.

Changes in Unifiedpost Group's Board of

Directors

Mr. Joost Uwents resigned from all his mandates

within the Company, effective December 31, 2023, due to commitments

arising from his other professional activities. Mr. Uwents served

as a director on the Board of Directors, and his resignation has

resulted in the cessation of his mandate, which will not be

replaced at this point in time.

Additionally, Mr. Uwents held the position of

Chairman of the Audit Committee. In light of his departure,

Unifiedpost Group is pleased to announce the appointment of Mr.

Philippe De Backer as a member of the Audit Committee.

Unifiedpost: pioneering digital

transformation in the European market

The European market is rapidly digitising due to

stringent regulatory frameworks like ViDa, driving adoption of

digital invoicing, payments, and reporting systems. Unifiedpost

leveraged IPO proceeds to acquire key companies, expanding its

market presence and product suite. Integration efforts culminated

in a cohesive platform, addressing diverse regulatory requirements.

Operational efficiencies were attained through centralised

structures, reducing costs while prioritising core business areas.

Unifiedpost is well-positioned for growth, with a modular framework

enabling integration of emerging technologies. Actively engaging

with partners, Unifiedpost supports clients' digital

transformation. Positioned as a leader in digital solutions,

Unifiedpost aims for sustained growth, fully realising market

potential in the coming years.

Growing the network: robust customer

growth

| Key business

KPI’s |

End Q4 2023 |

End Q3 2023 |

End Q2 2023 |

End Q1 2023 |

End Q4 2022 |

| Customers |

1.234.098 |

1.212.508 |

1.172.197 |

1.133.706 |

1.063.776 |

| Paying

customers |

520.058 |

505.636 |

490.936 |

473.679 |

468.128 |

| Customers paid

by 3rd parties |

714.040 |

706.872 |

681.261 |

660.027 |

595.648 |

| Companies in business network |

2.404.891 |

2.320.065 |

2.254.762 |

2.186.270 |

2.109.297 |

| Banqup

customers

|

161.936 |

156.450 |

151.931 |

143.902 |

124.333 |

| Billtobox

customers Belgium

|

53.257 |

50.528 |

48.651 |

45.359 |

40.363 |

| JeFacture

customers France

|

17.013 |

15.699 |

14.291 |

11.973 |

5.428 |

Unifiedpost Group closely monitors several key

metrics to gauge its performance and market reach. The total number

of companies utilising Unifiedpost's services reached 1.234.098 by

the end of 2023, reflecting steady growth and market penetration.

The count of businesses in the network even grew to 2.404.891,

underscoring our efforts to interconnect with other digital

networks. Banqup, Unifiedpost's premium solution, saw a significant

increase in customers, also in France with the uptake of

JeFacture.

First proof points of regulatory

tailwind

The regulatory landscape in Europe is rapidly

evolving, particularly with Belgium mandating e-invoicing from

January 1, 2026. This development underscores the importance of

preparing for upcoming changes in 2024 and 2025. Following

Belgium's implementation, France will implement e-invoicing

requirements starting from 2026, with other countries like Germany

and Spain to follow. These regulatory shifts are reshaping the

business landscape, emphasising the need for digitalisation and

compliance with evolving standards across European markets. The

full EU-market had approximately 50 million SME’s and self-employed

people that need to adapt the new way of working.

<End>

Statement from the external

auditor

We are currently finalising the financial

statements for the year ended 31 December 2023. Our independent

auditor has confirmed that its audit procedures in relation to the

financial information for the year ended 31 December 2023 as

included in this press release are substantially completed and have

not revealed any material corrections required to be made to the

financial information included in this press release. Should any

material changes arise during the audit’s finalisation, an

additional press release will be issued.

The issuance of our annual report is scheduled

for April 19, 2024.

Investors

& Media webcast

Management will host a

live video webcast for analysts, investors and media today at 10:00

a.m. CET.

A recording will be available shortly

after the event. To attend, please register with the link below.

Participants can also join via telephone. They can obtain their

personal dial-in details by registering with this link.

To register and attend the webcast,

please click here:

https://onlinexperiences.com/Launch/QReg/ShowUUID=798552DF-257F-4554-B0C7-8D61CC1DB6B8

A full replay be

available after the webcast at:

https://investors.unifiedpostgroup.com/

Financial Calendar 2024

| Apr 19, 2024 |

Publication of the annual report for

2023 |

| May 20, 2024 |

Publication of the Q1 2024 business

update |

| May 21, 2024 |

General Shareholder Meeting |

| Aug 27, 2024 |

Publication of H1 2024 results |

| Nov 14, 2024 |

Publication of the Q3 2024 business

update |

Contact

Laurent Marcelis

+32 477 61 81 37

Laurent.marcelis@unifiedpost.com

Interim consolidated statement of profit or loss and other

comprehensive income (unaudited)

|

Thousands of Euro, except per share data |

For the period ended 31 December |

|

|

2023 |

2022 |

| |

|

|

| Digital processing

revenues |

136.615 |

126.916 |

| Digital processing

cost of services |

-77.572 |

-73.770 |

| |

|

|

|

Digital processing gross profit |

59.043 |

53.146 |

| |

|

|

| Postage &

Parcel optimisation revenues |

54.770 |

64.047 |

| Postage &

Parcel optimisation cost of services |

-47.851 |

-57.040 |

| |

|

|

|

Postage & Parcel optimisation gross

profit |

6.919 |

7.007 |

| |

|

|

| Research and

development expenses |

-23.662 |

-14.133 |

| General and

administrative expenses |

-41.895 |

-45.788 |

| Selling and

marketing expenses |

-26.705 |

-29.190 |

| Other income /

expenses (-) |

-607 |

-942 |

| Impairment gains /

losses (-) |

-39.000 |

- |

| |

|

|

|

Profit / loss (-) from operations |

-65.907 |

-29.900 |

| |

|

|

| Financial

income |

175 |

308 |

| Financial

expenses |

-15.910 |

-9.367 |

| Change in fair

value of financial liabilities |

- |

-4.295 |

| Share of profit /

loss (-) of associates |

-573 |

-1.875 |

| |

|

|

|

Profit / loss (-) before tax |

-82.215 |

-45.129 |

| |

|

|

| Current income

tax |

-2.318 |

-1.178 |

| Deferred tax |

1.387 |

2.763 |

|

|

|

|

|

PROFIT / LOSS (-) FOR THE YEAR |

-83.146 |

-43.544 |

| |

|

|

| Other

comprehensive income / loss (-): |

-15 |

-3.286 |

| |

|

|

| Items that will not

be reclassified to profit or loss (-), net of tax: |

|

|

| Remeasurements of

defined benefit pension obligations |

123 |

50 |

| Items that will or

may be reclassified to profit or loss (-), net of tax: |

|

|

| Exchange gains /

losses (-) arising on translation of foreign operations |

-138 |

-3.336 |

|

|

|

|

|

TOTAL COMPREHENSIVE INCOME / LOSS (-) FOR THE

YEAR |

-83.161 |

-46.830 |

| |

|

|

| Profit /

loss (-) is attributable to: |

|

|

| Owners of the

parent |

-83.899 |

-43.550 |

| Non-controlling

interests |

753 |

6 |

| |

|

|

| Total

comprehensive income / loss (-) is attributable to: |

|

|

| Owners of the

parent |

-83.914 |

-46.836 |

| Non-controlling

interests |

753 |

6 |

| |

|

|

| Earnings

per share attributable to the equity holders of the

parent: |

|

|

| Basic |

-2,32 |

-1,26 |

| Diluted |

-2,32 |

-1,26 |

Interim consolidated statement of financial position

(unaudited)

|

Thousands of Euro |

As at 31

December

As

at 31 December |

|

|

2023 |

2022 |

|

|

|

|

|

ASSETS |

|

|

| Goodwill |

113.069 |

153.429 |

| Other intangible

assets |

82.856 |

85.516 |

| Property and

equipment |

7.420 |

8.231 |

| Right-of-use

assets |

9.734 |

10.214 |

| Investments in

associates |

1.493 |

1.875 |

| Non-current

contract costs |

475 |

872 |

| Deferred tax

assets |

776 |

462 |

| Other

non-current assets |

2.086 |

1.728 |

|

Non-current assets |

217.909 |

262.327 |

| Inventories |

612 |

822 |

| Trade and other

receivables |

23.420 |

29.629 (*) |

| Contract

assets |

617 |

426 |

| Contract costs |

1.281 |

1.859 |

| Current tax assets |

770 |

705 |

| Prepaid expenses |

1.901 |

2.275 |

| Cash and cash equivalents |

26.323 |

40.033 |

|

Current assets from continuing operations |

54.924 |

75.749 |

|

Assets classified as held for sale |

5.145 |

- |

|

Current assets |

60.069 |

75.749 |

|

TOTAL ASSETS |

277.978 |

338.076 |

| |

|

|

|

SHAREHOLDERS’ EQUITY AND LIABILITIES |

|

|

| Share capital |

326.806 |

326.806 |

| Costs related to

equity issuance |

-16.029 |

-16.029 |

| Share premium

reserve |

492 |

492 |

| Accumulated

deficit |

-232.257 |

-148.497 |

| Reserve for

share-based payments |

1.831 |

1.813 |

| Other reserve |

-1.581 |

-2.863 |

| Cumulative

translation adjustment reserve |

-3.851 |

-3.713 |

|

Equity attributable to equity holders of the

parent |

75.411 |

158.009 |

| Non-controlling

interests |

499 |

281 |

|

Total shareholders’ equity |

75.910 |

158.290 |

| Non-current loans

and borrowings |

110.517 |

97.408 |

| Liabilities

associated with puttable non-controlling interests |

200 |

840 |

| Non-current lease

liabilities |

6.193 |

6.438 |

| Non-current

contract liabilities |

4.430 |

4.039 |

| Retirement benefit

obligations |

- |

83 |

| Deferred tax

liabilities |

4.636 |

5.720 |

|

Non-current liabilities |

125.976 |

114.528 |

| Current loans and

borrowings |

5.059 |

4.706 (*) |

| Current liabilities

associated with puttable non-controlling interests |

7.560 |

7.670 |

| Current lease

liabilities |

3.547 |

3.800 |

| Trade and other

payables |

43.930 |

34.853 |

| Contract

liabilities |

13.487 |

12.701 |

| Current income tax

liabilities |

1.845 |

1.528 |

|

Current liabilities from continuing

operations |

75.428 |

65.258 |

|

Liabilities directly associated with assets classified as held for

sale |

664 |

- |

|

Current liabilities |

76.092 |

65.258 |

|

TOTAL EQUITY AND LIABILITIES |

277.978 |

338.076 |

(*) The comparative figures 2022 have been restated following

IAS 8 regarding the factoring debt. The factoring agreement with

Belfius/BNP is a non-recourse agreement, hence the debt may be

matched with the outstanding trade receivables.

Interim consolidated statement of changes in equity

(unaudited)

|

Thousands of Euro |

Share capital |

Costs related to equity issuance |

Share premium reserve |

Accumulated deficit |

Share based payments |

Other reserves |

Cumulative translation adjustment reserve |

Non-controlling interests |

Total equity |

|

Balance as at 1 January 2022 |

309.220 |

-15.926 |

492 |

-101.332 |

1.545 |

2.529 |

-376 |

277 |

196.429 |

| |

|

|

|

|

|

|

|

|

|

| Result for the

period |

- |

- |

- |

-43.550 |

- |

- |

- |

6 |

-43.544 |

|

Other comprehensive income / loss (-) |

- |

- |

- |

50 |

- |

- |

-3.336 |

- |

-3.286 |

| Total

comprehensive income / loss (-) for the period |

- |

- |

- |

-43.500 |

- |

- |

-3.336 |

6 |

-46.830 |

| |

|

|

|

|

|

|

|

|

|

| Issuance of new

shares |

17.586 |

-103 |

- |

- |

- |

-3.801 |

- |

- |

13.682 |

| Share-based

payments |

- |

- |

- |

- |

74 |

- |

- |

- |

74 |

| Own shares |

- |

- |

- |

- |

194 |

- |

- |

- |

194 |

| Current year profit

AND OCI of NCI with put option |

- |

- |

- |

- |

- |

3 |

- |

-3 |

- |

| Changes in carrying

value of liabilities associated with puttable NCI |

- |

- |

- |

- |

- |

-5.230 |

- |

- |

-5.230 |

| True up of

liabilities associated with puttable NCI and unwind of other

reserve due to exercise of linked call option (JV UP Balkan) |

- |

- |

- |

-3.637 |

- |

3.637 |

- |

- |

- |

| Other |

- |

- |

- |

-28 |

- |

-1 |

-1 |

1 |

-29 |

|

Balance as at 31 December 2022 |

326.806 |

-16.029 |

492 |

-148.497 |

1.813 |

-2.863 |

-3.713 |

281 |

158.290 |

| |

|

|

|

|

|

|

|

|

|

|

|

Thousands of Euro |

Share capital |

Costs related to equity issuance |

Share premium reserve |

Accumulated deficit |

Share based payments |

Other reserves |

Cumulative translation adjustment reserve |

Non-controlling interests |

Total equity |

|

Balance as at 1 January 2023 |

326.806 |

-16.029 |

492 |

-148.497 |

1.813 |

-2.863 |

-3.713 |

281 |

158.290 |

| Result for

the period |

- |

- |

- |

-83.899 |

- |

- |

- |

753 |

-83.146 |

|

Other comprehensive income / loss (-) |

- |

- |

- |

123 |

- |

- |

-138 |

- |

-15 |

| Total

comprehensive income / loss (-) for the period |

- |

- |

- |

-83.776 |

- |

- |

-138 |

753 |

-83.161 |

| |

|

|

|

|

|

|

|

|

|

| Share-based

payments |

- |

- |

- |

- |

18 |

- |

- |

- |

18 |

| Current year profit

AND OCI of NCI with put option |

- |

- |

- |

- |

- |

535 |

- |

-535 |

- |

| Changes in carrying

value of liabilities associated with puttable NCI |

- |

- |

- |

- |

- |

750 |

- |

- |

750 |

| Other |

- |

- |

- |

16 |

- |

-3 |

- |

- |

13 |

|

Balance as at 31 December 2023 |

326.806 |

-16.029 |

492 |

-232.257 |

1.831 |

-1.581 |

-3.851 |

499 |

75.910 |

| |

|

|

|

|

|

|

|

|

|

|

Interim consolidated statement of cash flows (unaudited)

|

Thousands of Euro |

For

the year ended 31 December |

|

|

2023 |

2022 |

| |

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

| |

Profit / loss (-) for the year |

|

-83.146 |

-43.544 |

| |

Adjustments for: |

|

|

|

| |

§ Amortisation and impairment of intangible fixed assets |

|

59.907 |

17.891 |

| |

§ Depreciation and impairment of property, plant &

equipment |

|

1.489 |

1.452 |

| |

§ Depreciation of right-of-use assets |

|

4.429 |

4.168 |

| |

§ Impairment of trade receivables |

|

335 |

35 |

| |

§ Gain on disposal of fixed assets |

|

-33 |

-18 |

| |

§ Financial income |

|

-174 |

-308 |

| |

§ Financial expenses

- Change fair value contingent consideration

|

|

15.910- |

9.3674.830 |

| |

§ Change fair value of derivative

- Share of profit / loss (-) of associate

|

|

-573 |

-5351.875 |

| |

§ Income tax expense / income (-) |

|

931 |

-1.585 |

| |

§ Share-based payment expense / own shares |

|

18 |

269 |

| |

|

|

|

|

| |

Subtotal |

|

239 |

-6.103 |

| |

Changes in Working Capital |

|

|

|

| |

§ Increase (-) / decrease in trade receivables and contract

assets & costs |

|

6.145 |

4.410 (*) |

| |

§ Increase (-) / decrease in other current and non-current

receivables |

|

-61 |

-616 |

| |

§ Increase (-) / decrease in inventories |

|

209 |

-261 |

| |

§ Increase / decrease (-) in trade and other liabilities |

|

11.753 |

-7.416 |

| |

|

|

|

|

| |

Cash generated from / used in (-) operations |

|

18.285 |

-9.986 |

| |

Income

taxes paid |

|

-3.222 |

-1.563 |

| |

Net cash provided by / used in (-) operating

activities |

|

15.063 |

-11.550 |

| |

|

|

|

|

| |

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

| |

Payments made for purchase of associate |

|

- |

-3.750 |

| |

Exercise of the JV UP Balkan put option |

|

- |

-5.000 |

| |

Payments made for purchase of intangibles and development

expenses |

|

-16.439 |

-22.242 |

| |

Proceeds from the disposals of intangibles and development

expenses |

|

81 |

316 |

| |

Payments made for purchase of property, plant & equipment |

|

-974 |

-1.778 |

| |

Proceeds from the disposals of property, plant & equipment |

|

17 |

119 |

| |

Interest received |

|

175 |

136 |

| |

|

|

|

|

| |

Net cash provided by / used in (-) investing

activities |

|

-17.140 |

-32.199 |

| |

|

|

|

|

| |

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

| |

Issue

of ordinary shares |

|

- |

12.756 |

| |

Costs

related to equity issuance |

|

- |

-103 |

| |

Proceeds from loans and borrowings |

|

3.913 |

83.981 (*) |

| |

Repayments of loans and borrowings |

|

-6.367 |

-22.538 (*) |

| |

Repayment of lease liabilities |

|

-4.524 |

-4.326 |

| |

Interest paid on loans, borrowings and leasings |

|

-4.581 |

-2.958 |

| |

|

|

|

|

| |

Net cash provided by / used in (-) financing

activities |

|

-11.559 |

66.812 |

| |

FX

impact cash |

|

- |

- |

| |

Net increase / decrease (-) in cash &

cash equivalents |

|

-13.636 |

23.063 |

| |

Cash

classified within current assets held for sale |

|

-74 |

- |

| |

Net increase / decrease (-) in cash &

cash equivalents, including cash classified within current assets

held for sale |

|

-13.710 |

23.063 |

| |

(*) The

comparative figures 2022 have been restated following IAS 8

regarding the factoring debt. |

|

|

|

| |

Cash

and cash equivalents at beginning of period |

|

40.033 |

16.970 |

| |

Cash

and cash equivalents at end of period |

|

26.323 |

40.033 |

| |

|

|

|

|

|

|

Appendix: regulatory developments in Q4

2023

In the past quarter Q4 2023, significant regulatory developments

have unfolded across key European markets, including:

- Belgium: mandatory e-invoicing effective from January 1, 2026,

marking a pivotal step towards digitalisation in the country's

business landscape.

- Germany: additional details regarding their plans for B2B

e-invoicing have been provided, emphasising the use of XRechnung

and ZUGFeRD formats. Implementation is expected to commence in

January 2025, with mandatory e-invoicing for large companies

starting from 2026.

- Croatia: plans are underway to implement mandatory B2B

e-invoicing by 2026.

- France: updated timelines have been announced for the upcoming

mandatory e-invoicing regulations. While the French Senate has

approved a revised timetable for the implementation with a gradual

roll-out starting from 1 July 2025, an amendment has been

introduced by the government to restore the 2026 timing.

- Poland: the mandatory rollout of e-invoicing has been

indefinitely postponed.

- The implementation of EU 'ViDa' e-invoicing and e-reporting has

been delayed until at least 2030, allowing more time for

preparations and adjustments.

These regulatory updates underscore the dynamic nature of the

European market and highlight the importance of staying informed

about changes to ensure compliance and strategic alignment.

Unifiedpost remains committed to leveraging these developments to

drive growth and innovation, while simultaneously prioritising

short-term objectives such as further improving its cash flow and

optimising business operations.

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform

for SME business services built on “Documents”, “Identity” and

“Payments”. Unifiedpost operates and develops a 100% cloud-based

platform for administrative and financial services that allows

real-time and seamless connections between Unifiedpost’s customers,

their suppliers, their customers, and other parties along the

financial value chain. With its one-stop-shop solutions,

Unifiedpost’s mission is to make administrative and financial

processes simple and smart for its customers. Since its founding in

2001, Unifiedpost has grown significantly, expanding to offices in

33countries, with more than 500 million documents processed in

2021, reaching over 2.100.000 SMEs and more than 2.500 Corporates

across its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2023 turnover €191 million

- 1.200+ employees

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

Warning about future statements: The statements

contained herein may contain forecasts, future expectations,

opinions and other future-oriented statements concerning the

expected further performance of Unifiedpost Group on the markets in

which it is active. Such future-oriented statements are based

on the current insights and assumptions of management concerning

future events. They naturally include known and unknown

risks, uncertainties and other factors, which seem justified at the

time that the statements are made but may possibly turn out to be

inaccurate. The actual results, performance or events may

differ essentially from the results, performance or events which

are expressed or implied in such future-oriented statements.

Except where required by the applicable legislation, Unifiedpost

Group shall assume no obligation to update, elucidate or improve

future-oriented statements in this press release in the light of

new information, future events or other elements and shall not be

held liable on that account. The reader is warned not to rely

unduly on future-oriented statements.

- Press release FY2023 FR

- Press release FY2023 ENG

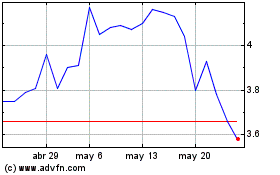

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025