Yen Falls Amid Risk Appetite

12 Agosto 2024 - 12:15AM

RTTF2

The Japanese yen weakened against other major currencies in the

European session on Monday, as the European markets are expected to

start the new week on an optimistic note even amidst anxiety ahead

of crucial inflation updates due from Europe, U.K and the U.S. over

the course of the week. Overwhelming expectations of a Fed rate cut

in September is supporting market sentiment. The unfolding

geopolitical situation in the Middle East is also seen swaying

market mood.

Markets continued to recover from recent sell-off sparked by

concerns about the world's largest economy slipping into a

recession. Traders may also be reluctant to make more significant

ahead of key U.S. inflation data later in the week

Wall Street had closed on a mildly positive note on Friday,

marking the end of a turbulent week that witnessed whipsawing

prices amidst U.S. economic growth concerns.

In the European trading now, the yen fell to 160.93 against the

euro and 188.20 against the pound, from an early high of 160.20 and

187.16, respectively. If the yen extends its downtrend, it is

likely to find support around 170.00 against the euro and 200.00

against the pound.

Against the U.S. dollar and the Swiss franc, the yen dropped to

147.32 and 169.88 from early highs of 146.70 and 169.46,

respectively. The yen may test support near 154.00 against the

greenback and 174.00 against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

yen edged down to 97.10, 88.70 and 107.33 from early highs of

96.51, 88.07 and 106.80, respectively. On the downside, 102.00

against the aussie, 93.00 against the kiwi and 112.00 against the

loonie are seen as the next support levels for the yen.

Looking ahead, Canada building permits for June, U.S. consumer

inflation expectations for July, U.S. Federal monthly budget

statement for July and U.S. WASDE report are slated for release in

the New York session.

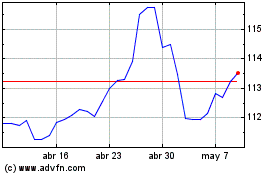

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2024 a Oct 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Oct 2023 a Oct 2024