Pound Rises As European Shares Traded Higher

14 Marzo 2024 - 11:46PM

RTTF2

The British pound strengthened against other major currencies in

the European session on Thursday, as investors await the key U.S.

data due later in the day that could shed additional light on the

outlook for interest rates.

Investors look for more clarity on whether the Fed will make its

first rate cut this year in either June or July.

Elsewhere, the U.S. Federal Reserve is likely to hold rates

steady at its policy meeting next week, but the 'dot plot'

projections may signal future interest rate moves.

The U.S. producer price inflation data for February due out

later in the day along with other reports on weekly jobless claims

and retail sales may shed additional light on the outlook for

interest rates.

Remarks by several European Central Bank officials may also sway

sentiment as the day progresses.

In the Asian session today, the pound held steady against its

major rivals.

In the European trading now, the pound rose to a 3-day high of

1.1275 against the Swiss franc and a 2-day high of 1.2816 against

the U.S. dollar, from early lows of 1.1242 and 1.2787,

respectively. If the pound extends its uptrend, it is likely to

find resistance around 1.14 against the franc and 1.29 against the

greenback.

Against the euro and the yen, the pound edged up to 0.8537 and

189.46 from early lows of 0.8558 and 188.82, respectively. On the

downside, 0.84 against the euro and 191.00 against the yen are seen

as the next support levels for the pound.

Looking ahead, Canada manufacturing sales data for January, U.S.

PPI and retail sales, both for February, U.S. weekly jobless claims

and U.S. business inventories for January, are slated for release

in the New York session.

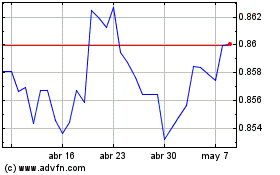

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

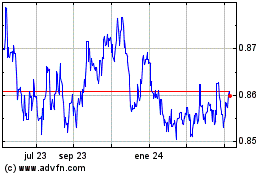

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024