Pound Rebounds On More-than-expected U.K. Inflation Data

17 Abril 2024 - 12:58AM

RTTF2

The British pound rebounded from early lows against other major

currencies in the European session on Wednesday, after data showed

that the nation's Consumer Price Index for March grew more than

what economists had expected, making it likely to push back market

expectations of an early rate cut.

Data from the Office for National Statistics showed that U.K.

consumer price inflation softened to 3.2 percent in March from 3.4

percent in February. However, this was slightly above the forecast

of 3.1 percent.

The March inflation was the lowest since September 2021, when it

was 3.1 percent.

At the same time, core inflation that excludes energy, food,

alcohol and tobacco, eased to 4.2 percent from 4.5 percent in

February. The rate was seen at 4.1 percent.

On a monthly basis, the consumer price index moved up 0.6

percent, the same as in February.

Another data from the ONS showed that input prices fell 2.5

percent in the year to March, worse than a revised fall of 2.2

percent in the year to February.

Meanwhile, factory gate inflation rose to 0.6 percent from 0.4

percent in the previous month.

On a monthly basis, input prices fell 0.1 percent, but output

prices rose 0.2 percent in March.

European stocks traded higher after reports that the United

States and the European Union are planning to impose new sanctions

on Iran, following its weekend attack on Israel.

Israel has vowed to retaliate against Iran, but officials

haven't said how or when they might strike.

Israel's Foreign Minister Israel Katz said a diplomatic

offensive against Iran would be carried out alongside Israel's

military response.

Federal Reserve Chair Jerome Powell cautioned that persistently

elevated inflation will likely delay any rate cuts until later this

year.

The International Monetary Fund said on Tuesday that a resilient

global economy is set for steady growth in the next two years, but

the growth will be uneven amid persistent risks.

In the Asian session today, the sterling traded lower against

its major rivals.

In the European trading now, the pound rose to a 2-day high of

1.2481 against the U.S. dollar, from an early low of 1.2417. The

pound may test resistance near the 1.27 region.

Against the euro, the pound advanced to more than a 5-week high

of 0.8520 from an early 2-day low of 0.8554. The next possible

upside target for the pound is seen around 0.84 region.

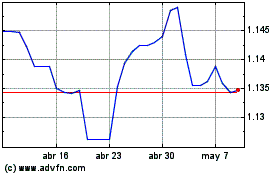

The pound edged up to 192.82 against the yen and 1.1373 against

the Swiss franc, from early lows of 192.01 and 1.1332,

respectively. If the pound extends its uptrend, it is likely to

find resistance around 194.00 against the yen and 1.15 against the

franc.

Looking ahead, U.S. MBA mortgage approvals data, U.S. EIA crude

oil data and U.S. Fed Beige book report are slated for release in

the New York session.

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024