Issue of Equity and Total Voting Rights and Capital

25 Marzo 2024 - 4:15AM

UK Regulatory

Issue of Equity and Total Voting Rights and Capital

ALBION DEVELOPMENT VCT PLC

Issue of Equity and Total Voting

Rights

LEI Code

213800FDDMBD9QLHLB38

The first allotment for the 2023/2024 tax year

of new ordinary shares of nominal value 1 penny per share ("New

Shares") in Albion Development VCT PLC (the “Company”) under the

Albion VCTs Prospectus Top Up Offers 2023/24 (the “Offers”), (which

opened for applications on 2 January 2024) took place on 22 March

2024.

Pursuant to the Prospectus, the Company offered

an early bird discount of 1% on issue costs to existing

shareholders and 0.5% on issue costs to new subscribers. These

early bird discounts were available to investors who subscribed for

New Shares for the first £10m across the five Albion VCTs

participating in the Offers. The cost of these discounts is being

borne by the Manager, Albion Capital Group LLP. The issue pricing

of the New Shares has been structured to avoid any capital dilution

to existing shareholders who do not participate in the Offers.

The Company has received valid applications for

1,922,293 New Shares which will be allotted at an issue price of

93.41 pence per share from existing shareholders and 371,463 New

Shares allotted at an issue price of 93.89 pence per share for new

subscribers, both of which qualified for the early bird discount. A

further 12,701,513 New Shares will be allotted at an issue price of

94.38 pence per share (which did not qualify for the early bird

discount). The total net proceeds receivable by the Company for

these allotments is approximately £13.7 million.

Application has been made to the Financial

Conduct Authority for 14,995,269 New Shares to be admitted to the

Official List and to the London Stock Exchange for the New Shares

to be admitted to trading on the London Stock Exchange's market for

listed securities. The New Shares rank pari passu with the existing

shares in issue.

It is expected that admission to the Official

List will become effective and that dealings in the New Shares will

commence on or around 25 March 2024.

The Offers which constitute separate offers have

been fully subscribed and all have been closed to further

applications. The total amount raised across the Albion VCTs under

the Offers is £60 million.

Following this allotment and in conformity with

the provisions of DTR 5.6, the Company makes the following

notifications in connection with the issued share capital of the

Company:

The Company's capital as at 22 March 2024

consists of 169,174,011 ordinary shares with a nominal value of 1

penny each. The Company holds 19,309,045 ordinary shares in

Treasury.

Therefore, the total number of voting rights in

the Company is 149,864,966 which may be used by shareholders and

other persons as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

For further information, please contact:

Vikash Hansrani

Operations Partner

Albion Capital Group LLP

Company Secretary

020 7601 1850

25 March 2024

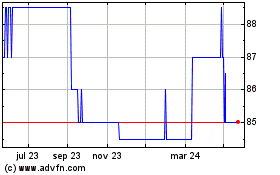

Albion Development Vct (LSE:AADV)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

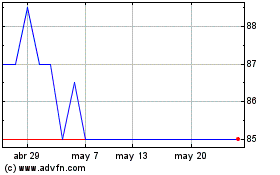

Albion Development Vct (LSE:AADV)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024