TIDMACIC

RNS Number : 8329U

abrdn China Investment Company Ltd.

28 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART) IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THE JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATON FOR THE PURPOSES OF

ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT FORMS

PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMENDED. FOLLOWING PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For immediate release

28 November 2023

Abrdn China Investment Company Limited (the "Company" or

"ACIC")

Proposal for the Reconstruction and Voluntary Winding-up of the

Company

The Board of ACIC (the "Board") is pleased to announce that

heads of terms have been agreed in principle for a proposed

combination of the Company with the assets of Fidelity China

Special Situations PLC ("Fidelity China") (the "Proposals"). It

believes the Proposals will benefit shareholders in the Company

("Shareholders") going forward. Fidelity China is the top

performing as well as the largest and most liquid UK investment

trust investing in China. The combination, if approved by each

company's shareholders, will be implemented through a Guernsey

scheme of reconstruction under which the Company will be placed

into voluntary liquidation and part of its cash, assets and

undertaking will be transferred to Fidelity China in exchange for

the issue of new ordinary shares in Fidelity China to

Shareholders.

Commenting on the Proposals, Helen Green, Chair of the Company,

said:

"After a very thorough review process, including consultation

with the Company's major shareholders, the Board has concluded that

the best practicable option to address the Company's

over-concentrated register and to provide significantly improved

liquidity to our shareholders is to merge with Fidelity China,

which is both sizeable and the clear leader in the China investment

company sector."

Key benefits of the Proposals:

-- Fidelity China is the top performing UK listed investment

company specialising in China over 1, 3, 5 and 10 years by NAV

total return.

-- Fidelity China, which was launched in 2010, is also the

largest UK listed investment company specialising in China with net

assets as at 31 October 2023 of GBP1.1 billion.

-- ACIC shareholders rolling over into Fidelity China are likely

to benefit from the far greater liquidity available in the market

for Fidelity China shares, should they subsequently wish to realise

their investment.

-- The Proposals include a cash exit opportunity of up to 33 per

cent of ACIC's shares in issue, at a 2 per cent discount to formula

asset value ("FAV") per ordinary share.

-- Fidelity China's manager, FIL Investment Services (UK)

Limited, has demonstrated its support for the Proposals by offering

to underwrite a portion of the costs of implementing the

Proposals.

Background to the Proposals

The Board has long been working on ways to address the

concentration of the Company's share register and the consequent

lack of liquidity and persistent discount at which its shares

trade. This concentration and lack of liquidity has been a subject

of significant and increasing dissatisfaction for a number of the

Company's major shareholders. Up until its change to a China

investment mandate in October 2021, the Company had invested on a

fund of funds basis. Whilst this had helped generate attractive

returns for investors, the fund of funds structure had clearly

moved out of favour and the Company's register became increasingly

narrow with a free float at the time of the change of mandate of

only 16 per cent. It was believed that a change to a more appealing

direct investment into China mandate, and a merger with Aberdeen

New Thai Investment Trust PLC helping to broaden the share

register, would pave the way for improved appeal to a wider range

of investors. However, the Company's share register continues to be

excessively concentrated, with just three shareholders accounting

for over 70 per cent of the Company's issued share capital and,

despite an active share buyback campaign, the discount at which the

Company's shares trade remains disappointing.

The Board has considered alternatives for improving the

situation, including potentially liquidating or merging with

another trust. The Board has consulted with the Company's major

shareholders and it has become clear that the consensus is for a

merger with Fidelity China with the option of a partial cash exit

at a small discount to FAV

The Proposals

The Board has in principle agreed heads of terms for a

combination of the Company with Fidelity China. Fidelity China's

investment objective is to achieve long-term capital growth from an

actively managed portfolio made up primarily of securities issued

by companies in China, both listed and unlisted, as well as Chinese

companies listed elsewhere. Fidelity China may also invest in

companies with significant interests in China. The combination, if

approved by each company's shareholders at the requisite general

meetings, will be implemented through a Guernsey scheme of

reconstruction pursuant to which the Company will be placed into

voluntary liquidation and part of its cash, assets and undertaking

will be transferred to Fidelity China in exchange for the issue of

new Fidelity China shares to Shareholders (the "Scheme").

New Fidelity China shares that are issued to Shareholders will

be issued on a FAV-to-FAV basis. FAVs will be calculated using the

respective net asset values of each company, adjusted for the costs

of the Proposals.

The Board believes that whilst many Shareholders may wish to

continue to be invested, it is appropriate as part of the Proposals

to offer those Shareholders wishing to realise at least part of

their investment in the Company the opportunity to do so via a cash

exit for up to 33 per cent of the Company's shares in issue, at a 2

per cent. discount to FAV per share of the Company (the "Cash

Option Discount"). Consequently, each Shareholder will have a basic

entitlement to elect to receive cash in respect of 33 per cent of

their shares in the Company. Shareholders will also be able to

elect to receive cash in respect of a larger proportion of their

shares, with elections in excess of the basic entitlement being

accepted pro rata to the extent that any Shareholders choose not to

elect for the cash exit. The benefit of the Cash Option Discount

will be credited to the interests of the Shareholders rolling over

their shareholdings in ACIC into the enlarged Fidelity China.

The combination with Fidelity China is expected to greatly

improve share trading liquidity for shareholders as well as

spreading the fixed costs of Fidelity China, as the continuing

entity, over a larger pool of assets.

City Code

In accordance with customary practice for a Guernsey scheme of

reconstruction, the City Code on Takeovers and Mergers is not

expected to apply to the combination of the Company and Fidelity

China.

Approvals

Implementation of the Proposals is subject to the approval,

inter alia, of Shareholders as well as regulatory and tax approvals

and approval by the shareholders of Fidelity China. A circular

providing further details of the Proposals and convening the

general meeting to seek the necessary Shareholder approvals will be

published by the Company as soon as practicable. It is anticipated

that the Proposals will be implemented by the end of Q1 2024.

The Company has consulted with a number of its major

shareholders who have indicated support for the Proposals. These

comprise approximately 73 per cent of the Company's share

register.

Enquiries:

Shore Capital (Financial adviser and joint corporate broker) Tel: +44 (0)20 7408 4050

Robert Finlay /Angus Murphy (Corporate Advisory)

Fiona Conroy (Corporate Broking)

Deutsche Numis (Joint corporate broker) Tel: +44 (0)20 7260 1000

Nathan Brown / George Shiel

Legal Entity Identifier: 213800R1A1NX8DP4P938

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

REPEAAFXALDDFAA

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

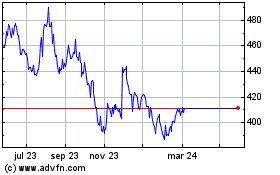

Abrdn China Investment (LSE:ACIC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Abrdn China Investment (LSE:ACIC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024