American Express Co - 4th Qtr. & Final Results Pt.2

04 Febrero 1998 - 7:08AM

UK Regulatory

RNS No 5724c

AMERICAN EXPRESS CO

30th January 1998

PART 2

CONTACT: Susan D. Miller

212-640-4953

Michael J. O'Neill

212-640-5951

(Preliminary) American Express Bank

Statement of Income

(Unaudited)

(Dollars in millions) Quarter Ended

December 31 September 30 June 30 March 31 December 31

1997 1997 1997 1997 1996

Net Revenues:

Interest Income $ 223 $ 230 $ 226 $ 218 $ 223

Interest Expense 148 148 148 136 140

Net Interest Income 75 82 78 82 83

Commissions, Fees

and Other Revenues 54 57 54 52 57

Foreign Exchange

Income 38 23 21 19 16

Total Net Revenues 167 162 153 153 156

Provision for

Credit Losses 10 7 1 2 10

Expenses:

Human Resources 64 60 58 58 56

Other Operating

Expenses 63 61 61 61 64

Total Expenses 127 121 119 119 120

Pretax Income 30 34 33 32 26

Income Tax

Provision 11 13 12 12 9

Net Income $ 19 21 $ 21 $ 20 $ 17

(Preliminary) American Express Bank

Selected Statistical Information

(Unaudited)

(Dollars in millions,

except where indicated) Quarter Ended

December 31 September 30 June 30 March 31 December 31

1997 1997 1997 1997 1996

Investments

(billions) $ 2.3 $ 2.6 $ 2.9 $ 2.8 $ 2.8

Total Loans

(billions) $ 6.2 $ 6.5 $ 6.4 $ 6.1 $ 5.9

Reserve for

Credit Losses $ 131 $ 127 $ 130 $ 131 $ 117

Total Non-

Performing Loans $ 47 $ 60 $ 80 $ 46 $ 35

Other Real

Estate Owned $ 4 $ 5 $ 4 $ 35 $ 36

Deposits (billions) $ 8.5 $ 9.0 $ 9.0 $ 9.1 $ 8.7

Shareholder's

Equity $ 830 $ 819 $ 814 $ 787 $ 799

Return on

Average Assets* 0.58% 0.65% 0.65% 0.69% 0.55%

Return on Average

Common Equity * 9.98% 11.16% 11.05% 11.14% 8.89%

Risk-Based

Capital Ratios:

Tier 1 8.8% 8.6% 8.4% 8.7% 8.8%

Total 12.3% 11.6% 11.3% 11.8% 12.5%

Leverage Ratio 5.3% 5.4% 5.5% 5.6% 5.6%

* Excluding the effect of SFAS No.115

(Preliminary)

American Express Bank

Selected Statistical Information

(Unaudited)

(Dollars in millions, except where indicated)

Quarter Ended

December 31,

1997 1996

Investments (billions) $ 2.3 $ 2.8

Total Loans (billions) $ 6.2 $ 5.9

Reserve for Credit Losses $ 131 $ 117

Total Nonperforming Loans $ 47 $ 35

Other Real Estate Owned $ 4 $ 36

Deposits (billions) $ 8.5 $ 8.7

Shareholder's Equity $ 830 $ 799

Return on Average Assets* 0.58% 0.55%

Return on Average

Common Equity* 9.98% 8.89%

Risk-Based Captal Ratios:

Tier 1 8.8% 8.8%

Total 12.3% 12.5%

Leverage Ratio 5.3% 5.6%

Year Ended

December 31,

1997 1996

Investments (billions) $ 2.3 $ 2.8

Total Loans (billions) $ 6.2 $ 5.9

Reserve for Credit Losses $ 131 $ 117

Total Nonperforming Loans $ 47 $ 35

Other Real Estate Owned $ 4 $ 36

Deposits (billions) $ 8.5 $ 8.7

Shareholder's Equity $ 830 $ 799

Return on Average Assets* 0.64% 0.57%

Return on Average

Common Equity* 10.83% 9.22%

Risk-Based Captal Ratios:

Tier 1 8.8% 8.8%

Total 12.3% 12.5%

Leverage Ratio 5.3% 5.6%

*Excluding the effect of SFAS 115.

END

QRRWBUAGGBGRGGU

x

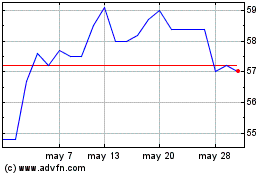

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024