TIDMBANK

RNS Number : 1078C

Fiinu PLC

08 June 2023

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of the

Market Abuse Regulation (EU) No 596/2014 ('MAR'), which is part of

UK law by virtue of the European Union (Withdrawal) Act 2018, until

the release of this announcement

8 June 2023

Fiinu Plc

("Fiinu", the "Company" or the "Group")

Final Results

Fiinu, a fintech group, creator of the Plugin Overdraft(R),

announces its results for the period ended 31 December 2022 ("2022

Annual Report").

Commenting, Chris Sweeney, Chief Executive Officer said:

"Fiinu has had a very encouraging year with significant progress

made despite the extremely difficult capital markets, the

increasingly challenging cost environment and the extremely tight

timetable in which to launch our business. Whilst the business has

focused on delivery against key milestones targets, we have also

built an exceptional team of motivated colleagues who want to build

something that will challenge the status quo in UK Retail Banking

by utilising technology to make a difference for hard-pressed

consumers. I am proud of what we have achieved together in such a

short space of time "

S

Enquiries:

Fiinu plc via Brazil London

Chris Sweeney, Chief Executive Officer (press office for

Philip Tansey, Chief Financial Officer Fiinu)

www.fiinu.com

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368

Mark Brady / Adam Dawes 3550

SP Angel Corporate Finance LLP (Joint Tel: +44 (0) 207 470

Broker) 0470

Matthew Johnson / Charlie Bouverat

(Corporate Finance)

Abigail Wayne / Rob Rees (Corporate

Broking)

Panmure Gordon (UK) Limited (Joint Tel: +44 (0)207 886

Broker) 2500

Stephen Jones / Atholl Tweedie (Corporate

Finance)

Hugh Rich (Corporate Broking)

Brazil London (press office for Fiinu) Tel: +44 (0) 207 785

Joshua Van Raalte / Christine Webb 7383

/ Jamie Lester Email: fiinu@agencybrazil.com

About Fiinu

Fiinu, founded in 2017, is a fintech group, that developed the

Plugin Overdraft(R) which is an unbundled overdraft solution

allowing customers to have an overdraft without changing their

existing bank. The underlying bank Independent Overdraft(R)

technology platform is bank agnostic, that therefore enables it to

serve all other banks' customers. Open Banking allows Fiinu's

Plugin Overdraft(R) to attach ("plugin") to the customer's existing

primary bank account, no matter which bank they may use. Fiinu's

vision is built around Open Banking, and it believes that it

increases competition and innovation in UK banking.

For more information, please visit

www.fiinu.com .

FOUNDER'S STATEMENT

We have come a long way and our mission is to revolutionise how

people manage their finances, creating better financial inclusion

and increasing financial flexibility for consumers.

We are currently focused on building a Bank Independent

Overdraft(R) platform, to promote our flagship product in the UK -

Plugin Overdraft(R), which will give consumers access to an

overdraft facility without the need to switch banks and current

accounts..

Evidence suggests that the current macroeconomic environment,

rising inflation, and cost-of-living crisis is resulting in more

demand for an overdraft, and that the gap between supply and demand

of overdraft credit is widening. In 2017, we presented a thematic

analysis and details on how to technically unbundle overdrafts from

current accounts without the need for customers to switch banks and

thereby extending access to a broader population and improving

financial inclusion. The Fiinu business model is based on this. It

is technology- led using Open Banking to improve consumer outcomes

in the lending sector.

Customers will be able to link multiple bank accounts to their

dedicated overdraft account through Open Banking application

programming interfaces (APIs). The underwriting process is also led

by Open Banking, as opposed to conventional underlying risk-based

underwriting methods.

Financial Inclusion

The presence of an arranged overdraft in a credit file can

improve the credit rating if consumers use it sensibly. The Open

Banking-led underwriting model is based on the principle that

overdraft limits will be provided to those who can demonstrate an

ability to make repayments within a reasonable time without

adversely impacting their overall nancial well-being or needing to

borrow more elsewhere to make repayment.

Over the past 12 months, only circa 10% of newly opened personal

current accounts in the UK include an agreed overdraft. Our model

is adopting a sophisticated approach to assess affordability and to

set credit limits, thereby potentially enabling it to extend its

overdraft credit to a substantially wider population than

traditional banks.

Outlook and the Year Ahead

We have achieved a sequence of critical milestones, including

the admission to the AIM public market coupled with raising GBP14m

of initial funding which has allowed us to move at pace in

developing our systems and control structures and now, most

recently, the conditional raising of up to GBP6.5m before costs to

support ongoing operations. The company is now focused on securing

GBP34-42m of capital and as is anticipated, a full unrestricted

banking licence in the second half of 2023.

MARKO SJOBLOM

Founder and Executive Director

CHAIR'S STATEMENT

Review and Outlook

I am delighted to present my first statement as Chairman at a

most exciting time in the UK banking market which Fiinu aims to

revolutionise with the provision of services to so many, to this

point in time, under-served people.

I am particularly pleased with the work effort, commitment and

achievements of the entire team ranging from the Board through the

management team and to all our employees who have worked with

diligence and speed and with a very clear focus on the goal of

obtaining an unrestricted banking licence and commencing the

provision of services to the UK public in, we anticipate, the

second half of 2023.

The building of a thorough governance framework across the group

has been particularly impressive and puts us in good shape in

advance of the anticipated commencement of business by providing a

robust platform upon which to build and develop.

I thank the Board for the huge progress we have made and in such

a challenging environment and want to also thank the previous

Immediate Acquisition PLC Board, for their stewardship up and until

the reverse takeover by Fiinu Holdings Limited in July 2022. This

takeover provided the ability for the group to access the capital

markets through its AIM listing to obtain capital to enable the

growth of the business.

I also thank our shareholders for their support. We would not

have been able to achieve what we have without their loyalty and

support.

We very much look forward to building upon these achievements

and a very exciting future.

DAVID HOPTON

Chair

CHIEF EXECUTIVE'S STATEMENT

Chief Executive's Statement Overview

Fiinu has had a significant year of progress despite the serious

challenges posed by the difficult capital markets, the ever

increasing cost environment and the extremely tight mobilisation

year timetable.

It has been a year of milestones achieved against targets set

and I thank all our employees and business partners for their

support. These targets included especially the retention of our

people, our control framework and the support of our shareholders

as we look to build on this first year.

The Year 2022

Through the reverse takeover (RTO) of Immediate Acquisition Plc,

which was subsequently re-named Fiinu Plc, the group concluded by

the re-admission in July of its shares to trading on the AIM

market. This provided the group with access to the capital markets

to seek the required investment required to support unrestricted

launch of banking services. Over the following 6 months the

achievements were exceptional;

September 2022 saw the contract signed and configuration

commenced on the core banking platform with Tuum along with

completion of the hiring of key management positions;

October 2022: Contract signed with TransUnion to provide open

banking and credit reference services along with the key decision

engine services provider;

November 2022: The critical Payment Initiation Service Provider

("PISP") was selected following a detailed process to provide

inbound and outbound secure payment services and Initial

microservices covering customer identification & validation and

messaging were delivered into internal test environments;

December 2022: Regulatory Senior Management Function ("SMF")

approval received for Chief Financial Officer, Chief Risk Officer

and Chair of Board Risk and Compliance Committee and the

development of the mobile application 'front end' was

completed.

Staff

We are blessed to have excellent people within the Group and we

continue to attract new individuals though I continue to monitor

the head count required by the our business plan. I thank all our

members of staff for their commitment and hard work in the past

year as they managed the uncertainty and challenges of the new

working model.

Shareholders

I am delighted with the support, both in terms of capital

investment and guidance, received from our major shareholders and

thank them and the new investors who have joined and supported

Fiinu in not only our reverse takeover of Immediate Acquisition Plc

to obtain access to the capital markets through its AIM listing and

GBP14million gross fund raise but also, following the end of this

financial year, the further conditional raise of up to GBP6.5m

before costs to support ongoing operations. The company is now

focused on securing GBP34-42m of capital to support its full

unrestricted banking licence in the second half of 2023.

Fiinu Technology

I am truly excited by the ground-breaking work being undertaken

by our team members in collaboration with our key external partners

as they build out the technology stack with some revolutionary

applications and processes that will lead to the provision of the

Plugin Overdraft. Whilst we focus on securing the future of banking

it is becoming clear how large an opportunity for future revenue

streams our proprietary technology will become.

Consumers, Fairness & Opportunity

We at Fiinu believe that we are on a mission which is to provide

on a far fairer and more open basis a good quality banking

overdraft facility to so many people who have been denied this

opportunity to help them in their well- managed day-to-day affairs

but also help them build up good credit histories that other

consumer lending products can not and do not.

Looking forward

The progress since the July 2022 RTO has been nothing short of

spectacular and has involved a deep level of commitment and

dedication from our Board and staff and our key suppliers and

shareholders all of whom can see the vision become reality in what

is a very short period of time.

I look forward to the rest of this calendar year when we aim to

move from development and into the serious business of serving the

UK consumer fair and accessible lending in a market that currently

underserves them.

CHRIS SWEENEY

Chief Executive Officer

CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

Period ended Year

31 December ended

31 March

2022 2022

GBP GBP

Administrative expenses (8,218,903) (973,965)

--------------------------- ---------------

Operating loss (8,218,903) (973,965)

Investment revenues 11,596 -

Finance costs (9,970) (1,222)

--------------------------- ---------------

Loss before taxation (8,217,277) (975,187)

Income tax income 377,879 -

--------------------------- ---------------

Loss and total comprehensive income

for the period (7,839,398) (975,187)

=========================== ===============

Profit for the financial period is all attributable to the

owners of the parent company.

Total comprehensive income for the period is all attributable to

the owners of the parent company.

Earnings per share

Basic (3.31) (0.52)

Diluted (3.31) (0.52)

================== ======

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 December 31 March

2022 2022

GBP GBP

ASSETS

Non-current assets

Intangible assets 878,639 29,563

Property, plant and equipment 276,524 5,412

------------------- --------------

1,155,163 34,975

------------------- --------------

Current assets

Trade and other receivables 660,078 45,964

Current tax recoverable 352,879 95,150

Cash and cash equivalents 7,045,161 275,370

------------------- --------------

8,058,118 416,484

------------------- --------------

Total assets 9,213,281 451,459

EQUITY

Called up share capital 26,513,186 3,758,184

Share premium account 9,194,313 5,189,313

Merger reserve (21,120,782) (5,090,626)

Retained earnings (7,293,795) (4,134,550)

------------------- --------------

Total equity 7,292,922 (277,679)

------------------- --------------

LIABILITIES

Non-current liabilities

Lease liabilities

93,425 -

------------------- --------------

Current liabilities

Trade and other payables 1,693,603 729,138

Lease liabilities 133,331 -

------------------- --------------

1,826,934 729,138

------------------- --------------

Total liabilities 1,920,359 729,138

------------------- --------------

Total equity and liabilities 9,213,281 451,459

------------------- --------------

COMPANY STATEMENT OF FINANCIAL POSITION

------------------------------- --------- ----------------------------------------------

2022 2021

GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 224,546 -

Investments 46,482,583 1,977,267

Other receivables - 56,482

46,707,129 2,033,749

------------------ --------------------------

Current assets

Trade and other receivables 1,801,269 1,050,267

Cash and cash equivalents 99,078 26,685

------------------ --------------------------

1,900,347 1,076,952

------------------ --------------------------

Total assets 48,607,476 3,110,701

------------------ --------------------------

EQUITY

Called up share capital 26,513,186 3,758,184

Share premium account 27,944,314 5,189,313

Revaluation reserve - 836,265

Shared based reserve 40,218 40,218

Retained earnings (7,093,177) (7,176,955)

------------------ --------------------------

Total equity 47,404,541 2,647,025

------------------ --------------------------

LIABILITIES

Non-current liabilities

Lease liabilities 93,425 -

------------------ --------------------------

Current liabilities

Trade and other payables 976,179 463,676

Lease liabilities 133,331 -

------------------ --------------------------

1,109,510 463,676

------------------ --------------------------

Total liabilities 1,202,935 463,676

------------------ --------------------------

Total equity and liabilities 48,607,476 3,110,701

================== ==========================

As permitted by s408 Companies Act 2006, the company has not

presented its own income statement and related notes. The company's

loss for the year was GBP752,487 (2021 - GBP649,784 loss).

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Retained Total

capital premium reserve earnings

account

GBP GBP GBP GBP GBP

As restated for the period ended 31 March 2022:

Balance at 1 April 2021 2,558,184 3,586,541 (2,687,835) (3,159,363) 297,527

---------- --------- ---------------- ------------- -------------

2,558,184 3,586,541 (2,687,835) (3,159,363) 297,527

Period ended 31 March

2022:

Loss and total comprehensive

income for the period (975,187) (975,187)

Issue of share capital 1,200,000 1,602,772 (2,402,791) - 399,981

---------- --------- ---------------- ------------- -------------

Balance at 31 March 2022 3,758,184 5,189,313 (5,090,626) (4,134,550) (277,679)

---------- --------- ---------------- ------------- -------------

Period ended 31 December

2022:

Loss and total comprehensive

income for the period - - - (7,839,398) (7,839,398)

Issue of share capital 4,005,000 4,005,000 - - 8,010,000

Share-based payment credit - - - 4,680,153 4,680,153

Effect of reverse take-over 18,750,002 - (16,030,156) 2,719,846

---------- --------- ---------------- ------------- -------------

Balance at 31 December

2022 26,513,186 9,194,313 (21,120,782) (7,293,795) 7,292,922

========== ========= ================ ============= =============

COMPANY STATEMENT OF CHANGES IN EQUITY

Share Share Merger Share-based Retained Total

capital premium reserve payment earnings

account reserve

GBP GBP GBP GBP GBP GBP

Balance at 1 January

2021 2,558,184 3,586,541 67,500 40,218 (6,527,171) (274,728)

Year ended 31

December 2021

Loss and total

comprehensive income

for

the year - - - - (649,784) (649,784)

Transactions with

owners in their

capacity

as owners:

Issue of share

capital 1,200,000 1,602,772 - - - 2,802,772

Other movements - - 768,765 - - 768,765

------------- ------------ ------------- -------------- ------------- ------------

Balance at 31

December 2021 3,758,184 5,189,313 836,265 40,218 (7,176,955) 2,647,025

------------- ------------ ------------- -------------- ------------- ------------

Period ended 31

December 2022:

Loss and total

comprehensive income

for

the year - - - - (752,487) (752,487)

Transactions with

owners in their

capacity

as owners:

Issue of share

capital 22,755,002 22,755,001 - - - 45,510,003

Transfer from

revaluation reserve - - (836,265) - 836,265 -

------------- ------------ ------------- -------------- ------------- ------------

Balance at 31

December 2022 26,513,186 27,944,314 - 40,218 (7,093,177) 47,404,541

============= ============ ============= ============== ============= ============

CONSOLIDATED STATEMENT OF CASH FLOWS

31 December 31 March

2022 2022

GBP GBP GBP GBP

Cash flows from operating

activities

Cash absorbed by operations (4,497,027) (692,240)

Interest paid - (1,222)

Income taxes refunded 120,150 -

------------ ------------- ------------- -------------

Net cash outflow from operating

activities (4,376,877) (693,462)

Investing activities

Purchase of intangible assets (849,076) (26,063)

Purchase of property, plant

and equipment (50,457) -

Interest received 11,596 -

------------ ------------- ------------- -------------

Net cash used in investing

activities (887,937) (26,063)

Financing activities

Proceeds from issue of shares 8,010,000 399,981

Net of cash acquired on reverse

takeover 3,577,275 -

Proceeds from borrowings 500,000 -

Payment of lease liabilities (47,533) -

Interest paid (5,137) -

------------ ------------- ------------- -------------

Net cash generated from financing

activities 12,034,605 399,981

------------ ------------- ------------- -------------

Net increase/(decrease) in

cash and cash equivalents 6,769,791 (319,544)

Cash and cash equivalents at

beginning of year 275,370 594,914

------------ ------------- ------------- -------------

Cash and cash equivalents at

end of year 7,045,161 275,370

============ ============= ============= =============

COMPANY STATEMENT OF CASH FLOWS

31 December 31 March

2022 2022

Notes GBP GBP GBP GBP

Cash flows from operating

activities

Cash absorbed by operations 34 (3,365,399) (1,549,239)

Interest paid - 47

--------------- ---------------- -------------- ----------------

Net cash outflow from operating

activities (3,365,399) (1,549,192)

Investing activities

Purchase of additional capital

in subsidiaries (8,982,580) -

Proceeds from disposal of subsidiaries 1,882,500 -

Loans made - (1,050,000)

Repayment of loans 1,050,000 -

Purchase of investments - (249,083)

Proceeds from disposal of investments 951,460 -

Interest received 69,111 72,188

--------------- ---------------- -------------- ----------------

Net cash used in investing

activities (5,029,509) (1,226,895)

Financing activities

Proceeds from issue of shares 8,010,000 3,000,000

Share issue costs - (197,228)

Proceeds from borrowings 500,000 -

Non-operating income treated

as financing activity (42,699) -

--------------- ---------------- -------------- ----------------

Net cash generated from financing

activities 8,467,301 2,802,772

--------------- ---------------- -------------- ----------------

Net increase in cash and cash

equivalents 72,393 26,685

Cash and cash equivalents at

beginning of year 26,685 -

--------------- ---------------- -------------- ----------------

Cash and cash equivalents at

end of year 99,078 26,685

=============== ================ ============== ================

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1 Accounting policies

Company information

Fiinu plc is a public company limited by shares incorporated in

England and Wales. The registered office is Meadows Business Park,

Station Approach, Blackwater, Camberley, GU17 9AB. The group's

principal activity is of banking services to provide overdrafts

through Open Banking to retail customers. The group is currently in

the mobilisation phase.

The group consists of Fiinu plc and all of its subsidiaries.

1.1 Accounting convention

The Group's consolidated and the Company's financial statements

are prepared in accordance with UK- adopted international

accounting standards and the Companies Act 2006 requirements,

except as otherwise stated. On publishing the parent company

financial statements here together with the consolidated financial

statements, the company is taking advantage of the exemption in

s408 of the Companies Act 2006 not to present its individual

statement of profit and loss. Profit and loss and other

comprehensive income and related notes that form a part of these

approved financial statements.

The AIM Rules require that the consolidated financial statements

of the group be prepared in accordance with International Financial

Reporting Standards.

During the period ended December 2022, Fiinu Holdings Ltd and

Fiinu Bank Ltd adopted International Financial Reporting Standards

(IFRS) having previously prepared financial statements in

accordance with United Kingdom Generally Accepted Accounting

Practice (UKGAAP). As such the group has applied the provisions of

IFRS1, First-time adoption of International Financial Reporting

Standards' (IFRS1) in the preparation of this annual report.

The reported financial position and financial performance for

the previous period are reconciled in note 25.

For the year ended 31 December 2022 the parent company has

continued to apply International Financial Reporting Standards

(IFRS) in line with previous accounting periods.

The financial statements are prepared in sterling, which is the

functional currency of the group. Monetary amounts in these

financial statements are rounded to the nearest GBP.

The financial statements have been prepared under the historical

cost convention. The principal accounting policies adopted are set

out below.

There are no new standards or amendments to standards which are

material to the financial statements and mandatory for the first

time for the financial year ended 31 December 2022.

1.2 Reverse takeover transactions

On 15 June 2022 The Directors of Immediate Acquisition Plc

announced that it had entered into a Sale and Purchase Agreement to

acquire Fiinu Holdings Ltd which, on account of the relative sizes

of the two entities, constituted a reverse takeover under the

London Stock Exchange AIM Rules. As a prelude to the acquisition,

which completed on 7 July 2023, Immediate Acquisition Plc raised

GBP8.01million in new equity capital. The shares in the enlarged

company were then readmitted to trading on the AIM market on 8 July

2023 under its new name of Fiinu plc.

Where there has been a reverse takeover, the coming together of

the entities does not constitute a business combination and as such

the transaction is accounted for as, in substance, a capital

reorganisation. The accounting acquirer is different from the legal

acquirer. As such, from an accounting perspective, the previous

comparatives and any results prior to the reverse takeover have not

been presented and the assets and liabilities of the accounting

acquirer are recorded in the consolidated financial statements at

their pre- combination amounts. The share capital in the

consolidated financial statements however, reflects that of the

legal acquirer.

Fiinu Holdings Ltd has been identified as the accounting

acquirer and Fiinu plc, the legal acquirer. The share capital in

the consolidated accounts reflects that of the legal acquirer,

being Fiinu plc. The comparatives, and any results prior to 8 July

2022 of Fiinu plc have not been presented and the assets and

liabilities of the Fiinu Holdings Limited group have been recorded

in the consolidated financial statements at their pre-combination

amounts.

1.3 Basis of consolidation

All financial statements are made up to 31 December 2022. Where

necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used into line with

those used by other members of the group.

All intra-group transactions, balances and unrealised gains on

transactions between group companies are eliminated on

consolidation. Unrealised losses are also eliminated unless the

transaction provides evidence of an impairment of the asset

transferred.

Subsidiaries are consolidated in the group's financial

statements from the date that control commences until the date that

control ceases.

Acquisitions are accounted for using the acquisition method. the

cost of an acquisition is measured at fair value at the date of

exchange of the consideration. Identifiable assets and liabilities

of the acquired business are recognised at their fair value at the

date of acquisition. To the extent that the cost of an acquisition

exceeds the fair value of the net assets acquired the difference is

recorded as goodwill. Where the fair value of the net assets

acquired exceeds the cost of an acquisition the difference is

recorded in profit and loss.

1.4 Going concern

The financial statements have been prepared on a going concern

basis. In assessing going concern, the Directors have considered

the current statement of financial position, the financial

projections, longer-term strategy of the business and the capital

and liquidity plans, including stress tests and plans for future

capital injections.

The circumstances in relation to the requirement to raise

capital to support year one of operations post approval from the

PRA and FCA to operate as a bank without restrictions, following

the re-submission of Fiinu Bank's banking application. This

represents a material uncertainty that may cast significant doubt

on the ability of the bank and therefore potentially the Group to

continue as a going concern.

1.5 Intangible assets other than goodwill

Intangible assets acquired separately from a business are

recognised at cost and are subsequently measured at cost less

accumulated amortisation and accumulated impairment losses.

Research and development expenditure

Expenditure on research is recognised as an expense in the

period in which it is incurred.

Cost that are directly attributable to the development phase of

new customised technologies are recognised as intangible assets

provided they meet the following recognition criteria:

-- completion of the intangible asset is technically feasible so

that it will be available for use or sale;

-- the group intends to complete the intangible asset and use or sell it;

-- the group has the ability to use or sell the tangible asset;

-- the intangible asset will generate probable future economic

benefits. Among other things, this requires that there is a market

for the output from the intangible asset or the intangible asset

itself, or, if it is to be used internally, the asset will be used

in generating such benefits;

-- there are adequate technical, financial and other resources

to complete the development and to use or sell the intangible

asset; and

-- the expenditure attributable to the intangible asset during

its development can be measured reliably. Development costs not

meeting the criteria for capitalisation are recognised as expenses

as incurred.

Amortisation is recognised as an administrative expense in

profit or loss on a straight line basis over the estimated useful

lives of intangible assets, other than goodwill, from the date that

they are available for use. The estimated useful lives for

intangible assets are as follows:

Research and development not yet in use

1.6 Property, plant and equipment

Property, plant and equipment are initially measured at cost and

subsequently measured at cost or valuation, net of depreciation and

any impairment losses.

Cost includes expenditures that are directly attributable to the

acquisition of the asset. Purchased software that is integral to

the functionality of the related equipment is capitalised as part

of that equipment.

Depreciation is recognised so as to write off the cost or

valuation of assets less their residual values over their useful

lives, leased assets are depreciated over the shorter of the lease

term and their useful lives. Depreciation is recognised on the

following bases:

Leasehold property Over the period of the lease

Office and IT equipment 3-10 years

Plant and equipment 3-7 years

Computers and network equipment 3-5 years or contract term if shorter

The gain or loss arising on the disposal of an asset is

determined as the difference between the sale proceeds and the

carrying value of the asset, and is recognised in the income

statement.

1.7 Non-current investments

Interests in subsidiaries, associates and jointly controlled

entities are initially measured at cost and subsequently measured

at cost less any accumulated impairment losses. The investments are

assessed for impairment at each reporting date and any impairment

losses or reversals of impairment losses are recognised immediately

in profit or loss.

A subsidiary is an entity controlled by the parent company.

Control is the power to govern the financial and operating policies

of the entity so as to obtain benefits from its activities.

1.8 Borrowing costs

Finance costs comprise interest expense on borrowings including

leases which are recognised in profit or loss in the period in

which they are incurred.

1.9 Impairment of tangible and intangible assets

At each reporting end date, the group reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an individual asset, the group

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

Intangible assets with indefinite useful lives and intangible

assets not yet available for use are tested for impairment

annually, and whenever there is an indication that the asset may be

impaired.

1.10 Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks, other short-term liquid investments with original

maturities of three months or less, and bank overdrafts. Bank

overdrafts are shown within borrowings in current liabilities.

1.11 Financial assets

Financial assets are recognised in the group's statement of

financial position when the group becomes party to the contractual

provisions of the instrument. Financial assets are classified into

specified categories, depending on the nature and purpose of the

financial assets.

At initial recognition, financial assets classified as fair

value through profit and loss are measured at fair value and any

transaction costs are recognised in profit or loss. Financial

assets not classified as fair value through profit and loss are

initially measured at fair value plus transaction costs.

Financial assets at fair value through profit or loss

When any of the above-mentioned conditions for classification of

financial assets is not met, a financial asset is classified as

measured at fair value through profit or loss. Financial assets

measured at fair value through profit or loss are recognised

initially at fair value and any transaction costs are recognised in

profit or loss when incurred. A gain or loss on a financial asset

measured at fair value through profit or loss is recognised in

profit or loss, and is included within finance income or finance

costs in the statement of income for the reporting period in which

it arises.

Financial assets held at amortised cost

Financial instruments are classified as financial assets

measured at amortised cost where the objective is to hold these

assets in order to collect contractual cash flows, and the

contractual cash flows are solely payments of principal and

interest. They arise principally from the provision of goods and

services to customers (eg trade receivables). They are initially

recognised at fair value plus transaction costs directly

attributable to their acquisition or issue, and are subsequently

carried at amortised cost using the effective interest rate method,

less provision for impairment where necessary.

Financial assets at fair value through other comprehensive

income

Debt instruments are classified as financial assets measured at

fair value through other comprehensive income where the financial

assets are held within the group's business model whose objective

is achieved by both collecting contractual cash flows and selling

financial assets, and the contractual terms of the financial asset

give rise on specified dates to cash flows that are solely payments

of principal and interest on the principal amount outstanding.

A debt instrument measured at fair value through other

comprehensive income is recognised initially at fair value plus

transaction costs directly attributable to the asset. After initial

recognition, each asset is measured at fair value, with changes in

fair value included in other comprehensive income. Accumulated

gains or losses recognised through other comprehensive income are

directly transferred to profit or loss when the debt instrument is

derecognised.

The parent company has made an irrevocable election to recognize

changes in fair value of investments in equity instruments through

other comprehensive income, not through profit or loss. A gain or

loss from fair value changes will be shown in other comprehensive

income and will not be reclassified subsequently to profit or loss.

Equity instruments measured at fair value through other

comprehensive income are recognized initially at fair value plus

transaction cost directly attributable to the asset. After initial

recognition, each asset is measured at fair value, with changes in

fair value included in other comprehensive income. Accumulated

gains or losses recognised through other comprehensive income are

directly transferred to retained earnings when the equity

instrument is derecognised or its fair value substantially

decreased. Dividends are recognized as finance income in profit or

loss.

Impairment of financial assets

Financial assets carried at amortised cost and FVOCI are

assessed for indicators of impairment at each reporting end

date.

The expected credit losses associated with these assets are

estimated on a forward-looking basis. A broad range of information

is considered when assessing credit risk and measuring expected

credit losses, including past events, current conditions, and

reasonable and supportable forecasts that affect the expected

collectability of the future cash flows of the instrument.

For trade receivables, the simplified approach permitted by IFRS

9 is applied, which requires expected lifetime losses to be

recognised from initial recognition of the receivables.

Derecognition of financial assets

Financial assets are derecognised only when the contractual

rights to the cash flows from the asset expire, or when it

transfers the financial asset and substantially all the risks and

rewards of ownership to another entity.

1.12 Financial liabilities

The group recognises financial debt when the group becomes a

party to the contractual provisions of the instruments. Financial

liabilities are classified as either 'financial liabilities at fair

value through profit or loss' or 'other financial liabilities'.

Other financial liabilities

Other financial liabilities, including borrowings, trade

payables and other short-term monetary liabilities, are initially

measured at fair value net of transaction costs directly

attributable to the issuance of the financial liability. They are

subsequently measured at amortised cost using the effective

interest method. For the purposes of each financial liability,

interest expense includes initial transaction costs and any premium

payable on redemption, as well as any interest or coupon payable

while the liability is outstanding.

Derecognition of financial liabilities

Financial liabilities are derecognised when, and only when, the

group's obligations are discharged, cancelled, or they expire.

1.13 Equity instruments

Equity instruments issued by the parent company are recorded at

the proceeds received, net of direct issue costs. Dividends payable

on equity instruments are recognised as liabilities once they are

no longer payable at the discretion of the company.

Share capital represents the nominal value of shares that have

been issued. Share premium includes any premium received on issue

of share capital.

The company also has warrants in issue following an equity fund

raising process. The warrants had a life of 1 year from grant date,

which was extended to 30 June 2022 and have since expired. The

grant date fair value of warrants granted to investors is

recognised as an expense against share premium, with a

corresponding increase in equity. The amount recognised as an

expense is adjusted to reflect the expected number of share

warrants that vest unless this adjustment is due to the share price

not achieving the exercise price threshold.

The investment revaluation reserve includes accumulated gains

and losses on financial assets.

Retained losses include retained profits and losses relating to

current and prior years and purchases and sales of own shares by

the Employee Benefit Trust.

All transactions with owners of the parent are recorded

separately within equity.

1.14 Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The group's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the reporting end

date.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from goodwill or from the initial recognition of other assets and

liabilities in a transaction that affects neither the tax profit

nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each

reporting end date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered. Deferred tax is

calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset is realised.

Deferred tax is charged or credited in the income statement, except

when it relates to items charged or credited directly to equity, in

which case the deferred tax is also dealt with in equity. Deferred

tax assets and liabilities are offset when the group has a legally

enforceable right to offset current tax assets and liabilities and

the deferred tax assets and liabilities relate to taxes levied by

the same tax authority.

1.15 Employee benefits

The costs of short-term employee benefits are recognised as a

liability and an expense, unless those costs are required to be

recognised as part of the cost of inventories or non-current

assets.

The cost of any unused holiday entitlement is recognised in the

period in which the employee's services are received.

Termination benefits are recognised immediately as an expense

when the group is demonstrably committed to terminate the

employment of an employee or to provide termination benefits.

For cash-settled share-based payments, a liability is recognised

for the goods and services acquired, measured initially at the fair

value of the liability. At the balance sheet date until the

liability is settled, and at the date of settlement, the fair value

of the liability is remeasured, with any changes in fair value

recognised in profit or loss for the year.

1.16 Retirement benefits

Payments to defined contribution retirement benefit schemes are

charged as an expense as they fall due.

1.17 Leases

At inception, the group assesses whether a contract is, or

contains, a lease within the scope of IFRS 16. A contract is, or

contains, a lease if the contract conveys the right to control the

use of an identified asset for a period of time in exchange for

consideration. Where a tangible asset is acquired through a lease,

the group recognises a right-of-use asset and a lease liability at

the lease commencement date. Right-of-use assets are included

within property, plant and equipment, apart from those that meet

the definition of investment property and are recognised for all

leases except those which are considered to have a fair value below

GBP4,500 and those with a duration of 12 months or less.

The right-of-use asset is initially measured at cost, which

comprises the initial amount of the lease liability adjusted for

any lease payments made at or before the commencement date plus any

initial direct costs and an estimate of the cost of obligations to

dismantle, remove, refurbish or restore the underlying asset and

the site on which it is located, less any lease incentives

received.

The right-of-use asset is subsequently depreciated using the

straight-line method from the commencement date to the earlier of

the end of the useful life of the right-of-use asset or the end of

the lease term. The estimated useful lives of right-of-use assets

are determined on the same basis as those of other property, plant

and equipment. The right-of-use asset is periodically reduced by

impairment losses, if any, and adjusted for certain remeasurements

of the lease liability.

The lease liability is initially measured at the present value

of the lease payments that are unpaid at the commencement date,

discounted using the interest rate implicit in the lease or, if

that rate cannot be readily determined, the group's incremental

borrowing rate. Lease payments included in the measurement of the

lease liability comprise fixed payments, variable lease payments

that depend on an index or a rate, amounts expected to be payable

under a residual value guarantee, and the cost of any options that

the group is reasonably certain to exercise, such as the exercise

price under a purchase option, lease payments in an optional

renewal period, or penalties for early termination of a lease.

1.18 Foreign exchange

Transactions in currencies other than pounds sterling are

recorded at the rates of exchange prevailing at the dates of the

transactions. At each reporting end date, monetary assets and

liabilities that are denominated in foreign currencies are

retranslated at the rates prevailing on the reporting end date.

Gains and losses arising on translation in the period are included

in profit or loss.

1.19 Earnings per share

The group presents basic and diluted earnings per share ("EPS")

data for its ordinary shares. Basic EPS is calculated by dividing

the profit or loss attributable to ordinary shareholders of the

company by the weighted average number of ordinary shares

outstanding during the period. Diluted EPS is determined by

adjusting the profit or loss attributable to ordinary shareholders

and the weighted average number of ordinary shares outstanding for

the effects of all dilutive potential ordinary shares, which

comprise share options granted to employees.

2. Earnings per share

31 December 31 March

2022 2022

Number Number

Number of shares

Weighted average number of ordinary shares in issue 237,184,397 187,500,017

Less weighted average number of own shares

------------- -------------

Weighted average number of ordinary shares for

basic earnings per share 237,184,397 187,500,017

Weighted average number of ordinary shares for

diluted earnings per share 237,184,397 187,500,017

31 December 31 March

2022 2022

Earnings GBP GBP

Continuing operations

Loss for the period from continued operations (7,839,398) (975,187)

2022 2022

Pence per Pence

share per

share

Basic and diluted earnings per share

From continuing operations (3.31) (0.52)

============= =============

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of shares outstanding during the year.

In accordance with IAS 33 the diluted earnings/(loss) per share

is stated at the same amount in both December 2022 and March 2022

as basic as there is no dilutive effect.

3. Events after the reporting date

On 15 March 2023, the Company announced that it had

conditionally raised up to GBP6.49 million before costs in new

equity funding.

The first quarter 2023 saw a series of banks, including but not

limited to Silicon Valley Bank ('SVB') and Credit Suisse, which

operate in the UK and globally enter into either bankruptcy or

merger leading to a widespread unrest in the financial markets. The

Group had no direct exposures to any of these failed entities. At

this stage, the Directors do not believe this would have a material

adverse effect on the Group and consider this to be a non-adjusting

post balance sheet event.

On 28 April 2023 Fiinu Plc announce through the London Stock

Exchange Regulatory News Service that continuing challenging

capital market conditions have impeded its fundraising process.

Whilst good progress has been made with regard to our operational

readiness for Fiinu's full banking activity, the lack of full

funding commitment at this stage has slowed the necessary

regulatory application processes such that Fiinu has determined a

preferential course of action is to make an application to withdraw

its licence aiming to re-apply after a short period of 2 - 3

months. This application was submitted to the PRA and FCA and is

awaiting completion of the process. This action will allow the

Company to focus on securing its exit funding requirement which is

estimated to be in the range of GBP34 - GBP42 million. Once this

funding has been secured it is intended for the application process

to be resumed and completed promptly, again subject to the

necessary PRA and FCA approval.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKFBBFBKKQAK

(END) Dow Jones Newswires

June 08, 2023 04:29 ET (08:29 GMT)

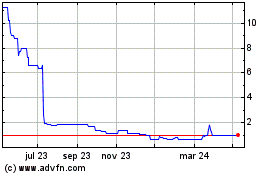

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

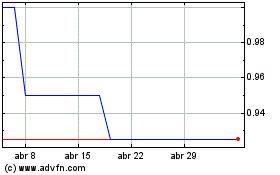

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024